- Pulse by Capital Stake

- Posts

- Budget 📊 Bulls 🐂 Floods ☔️

Budget 📊 Bulls 🐂 Floods ☔️

Another Week, Another Pulse!

This past week brought a mix of major decisions and serious climate concerns. The government officially approved the Rs. 17.6 trillion budget for 2025–26, confirming Rs. 463 billion in new taxes that had already been proposed. One of the more unusual items? A Rs. 10 tax on every day-old chick. In some good news for electricity users, the Rs. 35 PTV fee has been removed from power bills, offering a bit of relief. The Power Division also launched the Power Smart App, which lets people submit their own meter readings to avoid surprise charges. On a more worrying note, heavy rains caused flash floods in parts of Punjab and KP, resulting in several deaths. The World Bank also raised alarms in its latest report, warning that climate change could cost Pakistan up to 9% of its economy each year by 2050 if nothing is done.

Here’s your 5-minute recap of everything that happened last week.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/2s3bufa4

SoundCloud - https://tinyurl.com/5badt97s

Spotify- https://tinyurl.com/vmsnm8mk

📅 Key Events to Watch This Week

📅 July 1, 2025 (Tuesday)

📊 CPI Inflation

⛽ Petrol Price Update

📅 July 3, 2025 (Friday)

💵 Foreign Exchange Reserves

🧱 Cement Sales

📅 July 4th, 2025 (Saturday)

🛒 SPI (Sensitive Price Index)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

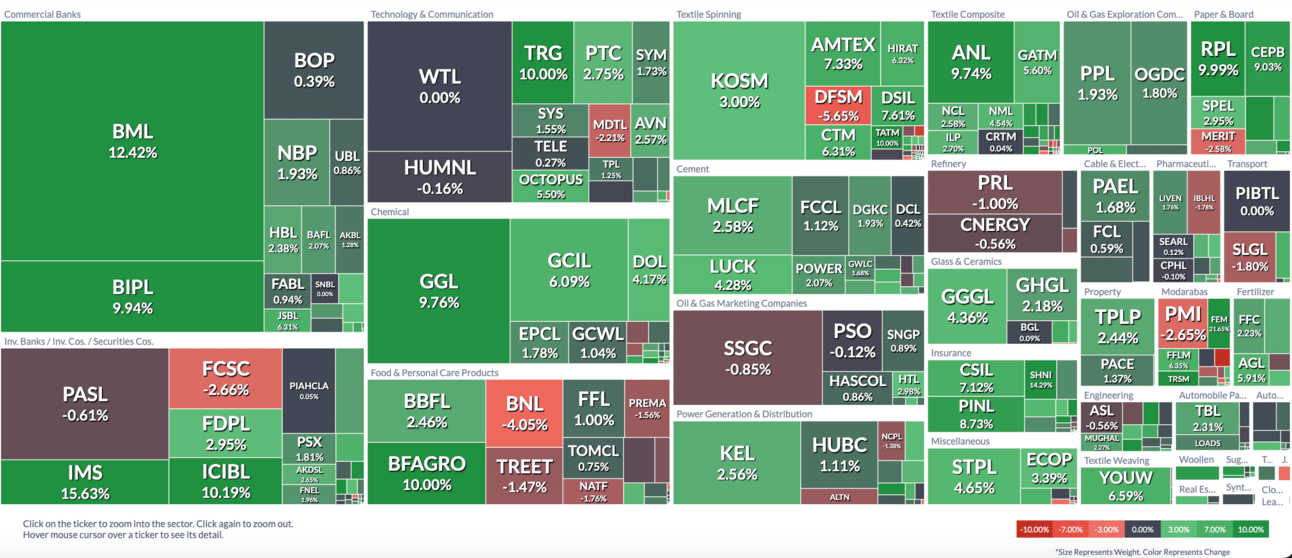

Pakistan’s stock market posted a strong recovery last week, with the KSE-100 index gaining 4,356 points or 3.63% WoW. It closed at 124,379.06 as investor confidence improved following a ceasefire in the Middle East, which helped ease geopolitical tensions and brought stability to global oil prices.

SNGPL to Set Up Wholly-Owned Subsidiary

SNGPL has decided to set up a new company that it will fully own, as part of its plans to grow and reorganize how it operates. This new company will start with Rs. 50 million and can raise up to Rs. 1 billion. The money spent by SNGPL to register it will be recovered later. This decision comes after a strong year for SNGPL, with its profits and earnings growing sharply. While the exact role of the new company hasn’t been shared yet, more information is expected soon.

PSX to Launch KSE-100 Price Return Index

Starting June 30, 2025, the Pakistan Stock Exchange will launch a new version of its main index called the KSE-100 Price Return Index. Unlike the existing KSE-100, which includes both price changes and dividend reinvestments, this new index will track only the price movement of stocks. It’s meant to give investors and analysts a clearer view of how share prices alone are performing. While the original KSE-100 remains the official benchmark, the new index will serve those specifically focused on pure price trends.

Organic Meat Company Ltd Becomes First Pakistani Firm to Export Beef Casings to Europe

The Organic Meat Company (TOMCL) has become the first Pakistani listed firm to export beef casings to Europe a major milestone for the country’s meat export industry. This breakthrough not only strengthens the company’s global footprint but also opens the door to new revenue streams in a high-potential market. By diversifying its product range, TOMCL is positioning itself for sustainable growth and expects this move to boost both sales and profitability in the near future.

Punjab’s Cement Manufacturers Get Temporary Reprieve from Supreme Court

The Supreme Court has granted a two-week stay to cement manufacturers in Punjab, halting the enforcement of a Lahore High Court ruling that required them to pay limestone royalties based on a percentage of the cement price instead of a fixed rate. The new formula, introduced by the Punjab government, would have significantly increased costs for the industry. The stay offers temporary relief to companies like Maple Leaf and Bestway as they face financial pressure from high energy costs, weak demand, and seasonal slowdowns. A final decision will be made after a full hearing.

Pakistan leads emerging markets in sovereign risk recovery, says Bloomberg Intelligence

Pakistan has recorded the biggest improvement in sovereign credit risk among emerging markets, according to Bloomberg Intelligence. The country's default probability has dropped from 59 percent to 47 percent over the past year, reflecting the strongest recovery worldwide. This improvement is driven by economic stabilization, structural reforms, ongoing IMF support, and timely debt repayments. The shift signals renewed investor confidence and a stronger financial outlook for Pakistan as it works to restore credibility and stability on the global stage.

Fixed gas charges increased by 50% for domestic consumers

Ogra has announced a 50 percent increase in fixed gas charges for domestic consumers, effective July 1, 2025, under the revised pricing plan for the new fiscal year. Households in the protected category, meaning those with low monthly gas usage who qualify for subsidised rates, will now pay Rs600 instead of Rs400. Non-protected consumers, who use more gas, will see their fixed charges rise from Rs1,000 to Rs1,500, and up to Rs3,000 for the highest usage bracket. While fixed charges have increased, gas tariffs for households remain unchanged. The change follows the ECC’s approval of a new pricing structure for bulk consumers.

Govt Aiming to Get $100 Million From Roosevelt Hotel Sale Next Fiscal Year

The government is aiming to raise at least $100 million from the sale of the Roosevelt Hotel in New York during the 2025–26 fiscal year, as part of its broader privatization plan to ease financial pressure and reduce reliance on borrowing or new taxes. The final sale value will depend on the structure approved by the Cabinet Committee on Privatization, with options like redevelopment or a joint venture potentially increasing returns over time. The hotel has remained closed since 2020, except for a temporary lease to New York City, and is currently generating no income. Its sale is a key part of the government’s Rs. 86 billion privatization target, which also includes PIA and three power distribution companies.

Banks to Remain Closed on July 1

All banks across Pakistan will remain closed on Monday, July 1, 2025, for the observance of Bank Holiday, as announced by the State Bank of Pakistan. Normal banking operations will resume on Wednesday.

Find the Right Fund, Faster

Discover funds that match your needs with Behtari’s new search, filter, and sort feature. Whether you're looking for low-risk options or top-performing funds, the right investment is now just a few taps away.

Set a Goal, Start a Plan

Behtari now lets you create monthly investment plans to help you save consistently for your goals, whether it’s an emergency fund, a vacation, or long-term growth. Small steps today can lead to big wins tomorrow.

Download the app today and find the fund that fits you best!

📱 Android: https://lnkd.in/dhAe2dEz

🍎 iOS: https://lnkd.in/dFQ2Jr3k

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan