- Pulse by Capital Stake

- Posts

- Budget 💵, Performance 📊 & Outlook 🔮

Budget 💵, Performance 📊 & Outlook 🔮

Another Week, Another Pulse!

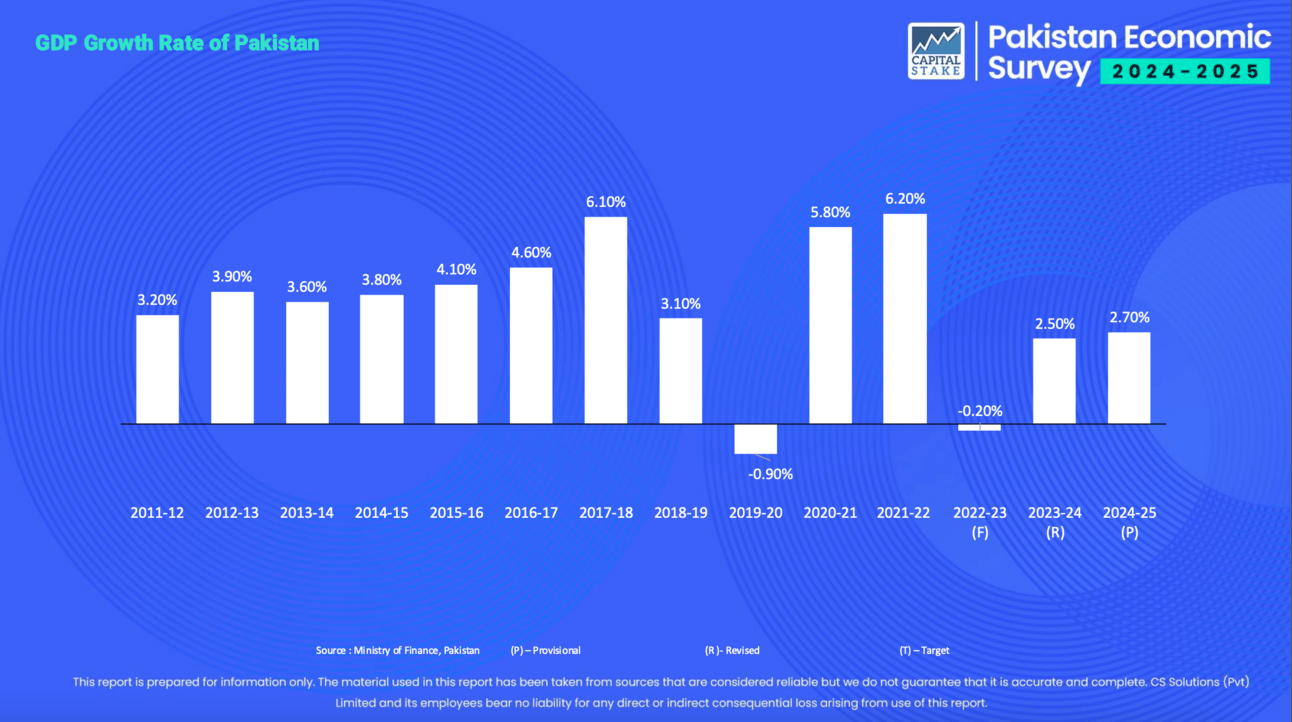

As the last fragrant plates of Eid ul Adha biryani are savored and the country slowly settles back into its daily rhythm, all attention now turns to the Federal Budget for FY26. The Economic Survey delayed over the holidays has finally been released and the numbers are far from appetizing. GDP growth clocked in at 2.7 percent falling short of the 3.6 percent target once again. Just as budget talks started to heat up another story grabbed the spotlight. Chinese defence stocks surged after reports that Pakistan is set to acquire the advanced J-35 stealth jets. Meanwhile Khyber Pakhtunkhwa’s cement sector braces for a royalty hike from 250 to 350 rupees per ton. On the global front oil prices bounced back amid renewed US-China talks. Back home the State Bank is preparing for a massive 4.35 trillion rupee auction as part of its liquidity management, while with the foreign exchange reserves slipped slightly by 7 million dollars.

Here is your quick 5-minute recap of last week to help you plan ahead.

Prefer listening instead?

Subscribe to our podcast for the latest business and economic news, anytime, anywhere.

🎧 Listen now on your favorite platform:

Youtube - https://rb.gy/ws1arm

SoundCloud - https://rb.gy/4xtr3x

Spotify- https://rb.gy/x8juim

📅 Key Events to Watch This Week

📌 June 10, 2025

🏛️ Budget 2026

📌 June 11, 2025

💸 T-Bill Auction

🌐 Worker Remittances

📌 June 12, 2025

💰 Foreign Exchange Reserves

📌 June 13, 2025

🛒 Weekly SPI

🚗 Auto Sales Data

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

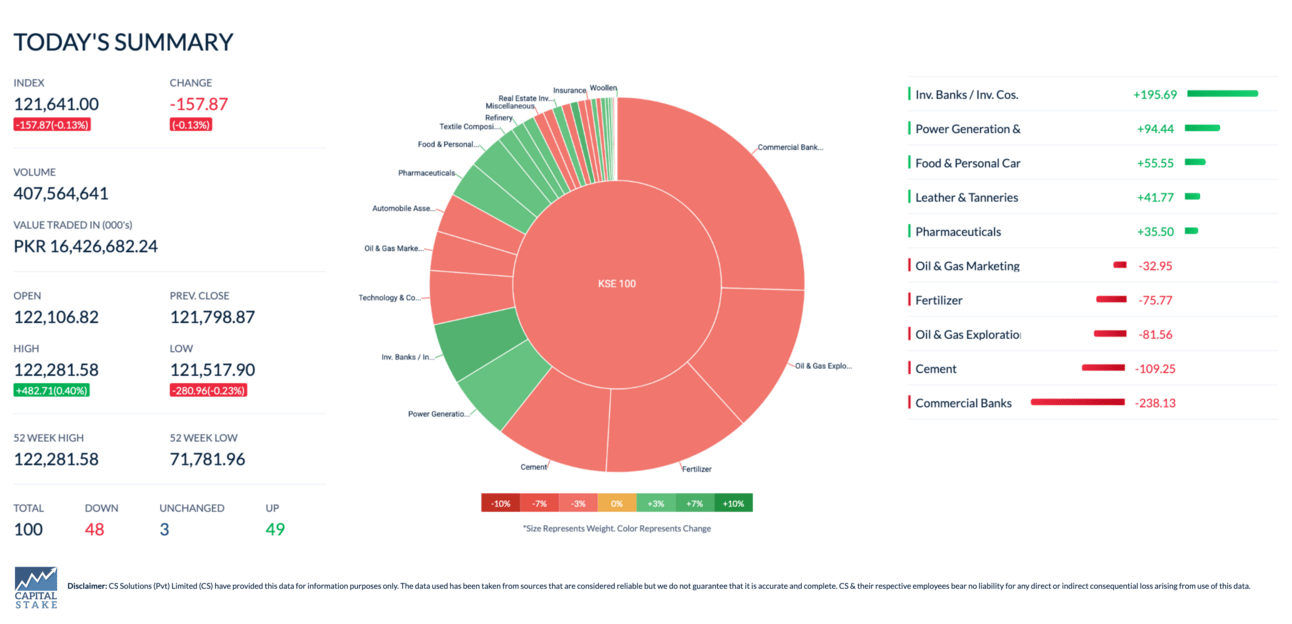

The Pakistan Stock Exchange (PSX) closed the final session of the week down by 157.87 points, or 0.13%. However, the benchmark KSE 100 index finished the four-day trading week with a gain of 2.24%.

Big Bird Foods signs export agreement with Alibaba

Big Bird Foods (BBFL), Pakistan’s only company specializing in making and selling processed and ready-to-cook chicken products, has signed a major deal with Alibaba, the world’s biggest online marketplace. This deal allows Big Bird to sell its chicken and food products directly to buyers in over 190 countries, opening up huge new markets for the company. This is important because it helps Big Bird grow internationally, boosting its sales and brand recognition worldwide. Going forward, Big Bird will use Alibaba’s global platform, trade events, and shipping support to reach more customers and increase exports, which should create more value for its shareholders and help the company expand beyond Pakistan.

ADB approves $800m to boost Pakistan’s public finance

The Asian Development Bank has approved $800 million to help Pakistan improve its public finances by supporting key reforms in tax collection, government spending, and financial management. This includes a $300 million loan and a $500 million guarantee aimed at attracting additional funding from commercial banks. These measures come as part of Pakistan’s efforts to stabilize its economy and promote sustainable growth. Moving forward, the government will implement these reforms to strengthen its financial system and boost investor confidence.

Fertiliser makers, association fined Rs375m

The Competition Commission of Pakistan has fined six leading urea manufacturers—Engro, Fauji Fertiliser, FFBL, Fatima Fertiliser, Fatima Ltd, and Agritech—and their trade association FMPAC, Rs375 million for collusive price-fixing, violating competition laws by setting uniform fertiliser prices despite varying costs. This ruling is important because such cartel behavior reduces competition, leading to higher prices for farmers and affecting the agriculture sector’s efficiency. For farmers and consumers, this crackdown aims to restore fair pricing, which could lower fertiliser costs, reduce financial burdens on farmers, and ultimately contribute to more affordable food prices.

NEC nods to record Rs4.2tr development outlay for next fiscal

The National Economic Council has approved a record Rs4.2 trillion ($15.1 billion) development programme for the fiscal year 2025–2026, with Rs1 trillion allocated for federal projects and Rs2.87 trillion for provincial initiatives. The plan prioritizes key sectors such as health, education, infrastructure, water, and housing. The council also endorsed a six-point agenda, the macroeconomic framework, and targets for the year, calling for close coordination between ministries, provinces, and the Planning Ministry to ensure successful implementation. Additionally, the 13th Five-Year Plan (2024–2029), aligned with the “Uraan Pakistan Framework,” was approved, outlining a strategic vision for the country’s development over the next five years.

Tracking Pakistan’s GDP: Targets vs. Reality

The chart below shows Pakistan’s GDP growth over recent years, highlighting the gap between the government’s target and the actual numbers reported in the latest Economic Survey. The shortfall underscores the economic challenges currently faced.

Credits: Capital Stake

Explore the full analysis and key insights in our detailed Economic Survey Report.

Are Investors Prioritizing Safety Over Returns?

With Pakistan’s national savings rate standing at 14% (Pakistan Economic Survey 2024-25), it’s clear that more individuals are choosing to park their money instead of spending it. But where is this money going — and is it working hard enough?

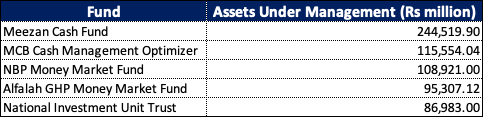

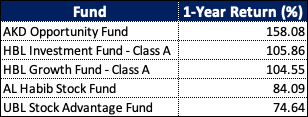

We analyzed the top 5 mutual funds by Assets Under Management (AUM) as of May 2025:

These funds have attracted the most investor money — largely due to their low risk profiles, liquidity, and perceived safety. But are they delivering the best returns?

Let’s look at the top 5 performers by 1-year return

The contrast is striking. None of the highest AUM funds appear in the top 1-year performers list. This raises a compelling question for investors: Are you prioritizing familiarity and liquidity at the expense of higher potential returns?

💡 Want to explore high-performing funds based on your goals and risk appetite?

Download Behtari and make your money work smarter.

🍏 IOS Download | 🤖 Android Download

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan