- Pulse by Capital Stake

- Posts

- Budget 📊 Tensions ⚔️ IMF 💸

Budget 📊 Tensions ⚔️ IMF 💸

This week was all about the upcoming budget. With a massive Rs 20 trillion outlay expected, everyone’s been waiting to see what’s in store. The suspense only grew when the government postponed the budget announcement from June 2 to June 10, keeping investors on edge. Another major headline this week was the promotion of Army Chief General Asim Munir to the rank of field marshal, the first in nearly 60 years. The announcement came soon after rising military tensions with India.

Amidst the wait, there was some movement on the IMF front. Pakistani authorities and the IMF reached a preliminary agreement on a financial framework, which will guide ongoing talks for the 2025–26 budget. The IMF also urged the government to bring inflation within the 5 to 7 percent target range. News of the IMF director visiting Pakistan this week to meet with the prime minister and finance minister added even more weight to the week’s developments.

Meanwhile, in global markets, oil prices inched up as US traders closed their positions ahead of the Memorial Day weekend. Uncertainty around the latest round of nuclear talks between the US and Iran also played a role in the price movement.

Here’s your quick 5-minute recap of what happened this week — and what to keep an eye on in the week ahead!

📅 Key Events to Watch This Week!

📅 27th May 2025

T-Bills Auction 🏦

📅 29th May 2025

Foreign Exchange Reserves 💱

📅 30th May 2025

Weekly SPI 📈

📅 31st May 2025

Branchless Banking Key Statistics 🏧

📅 1st June 2025

Petrol Prices ⛽

CPI Inflation 📊

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

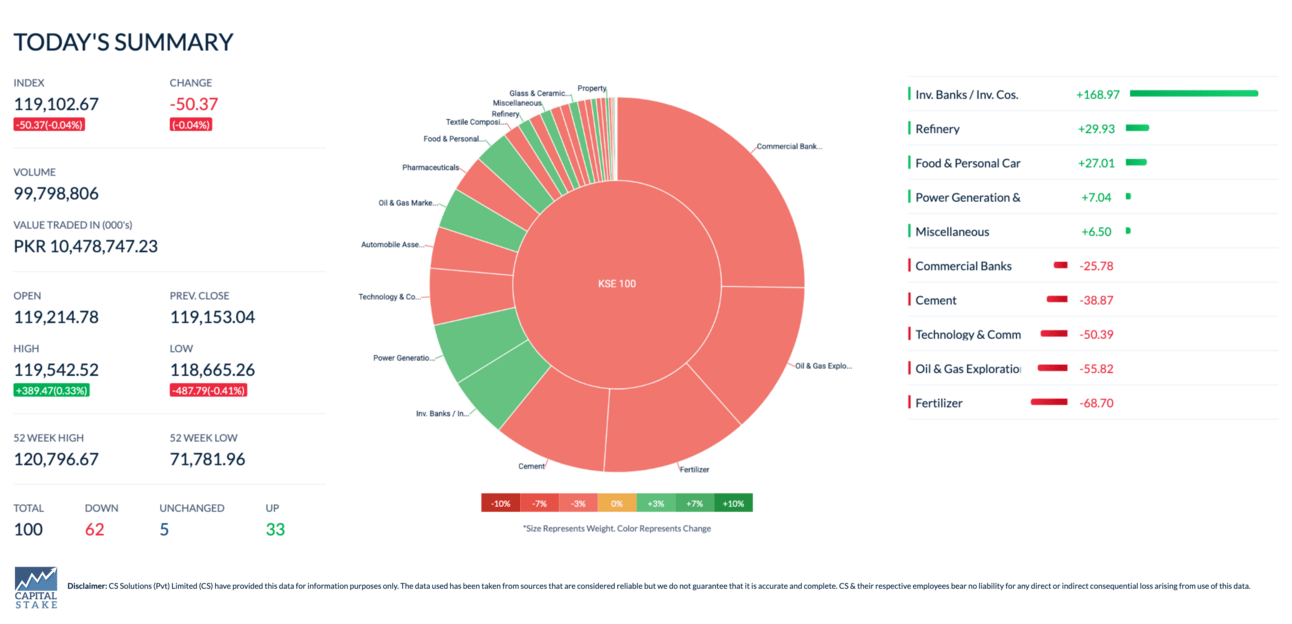

The Pakistan Stock Exchange (PSX) experienced a volatile week as the benchmark KSE 100 index declined by 0.46 percent week on week. The final session closed with a loss of 50.37 points, settling at 119,102.67, as investors took a cautious approach ahead of the federal budget for the fiscal year 2025-26.

ENGRO secures approvals for partnership with Jazz, VEON

Engro Corporation has secured approvals to partner with Jazz and its parent company VEON to combine their telecom infrastructure under Engro Connect. This will unite over 14,000 mobile towers, allowing all network operators to share resources. Sharing towers will help reduce costs, improve service, and make internet access more affordable for millions across Pakistan. This partnership marks a key step toward expanding connectivity, supporting new technologies, and driving economic growth. Engro plans to continue upgrading the network to meet future demands and unlock new opportunities for the country.

SBP Increases Foreign Reserves and Injects Liquidity into Market

The State Bank of Pakistan’s foreign exchange reserves rose by $71 million last week, reaching $10.4 billion. At the same time, SBP injected over Rs 12.8 trillion into the market through open market operations to ease liquidity pressure by providing banks with much-needed cash, helping them meet short-term funding needs and keep interest rates stable. These actions help stabilize the economy by managing cash flow and interest rates. Going forward, maintaining steady reserves and liquidity will be key as Pakistan faces upcoming economic challenges, including the budget and IMF talks.

SBP Pushes Digital Payments in Cattle Markets Nationwide

The State Bank of Pakistan has teamed up with 22 banks to promote digital payments in cattle markets from May 15 to June 6. Buyers and sellers are encouraged to use digital methods for purchasing animals and related services, building on last year’s campaign that onboarded thousands of merchants and processed hundreds of millions of rupees digitally. Digital payments increase safety and transparency while reducing the risks associated with handling cash. The campaign plans to expand further, supporting Pakistan’s ongoing efforts to boost digital financial inclusion and modernize payment systems across the country.

Pakistan Allocates 2,000MW for Bitcoin Mining and AI Data Centres

The government has allocated 2,000 megawatts of electricity to power Bitcoin mining and AI data centres as part of a national push to become a leader in digital innovation. This move follows the decision for legalization of cryptocurrency and the launch of the Pakistan Crypto Council, aimed at regulating blockchain technology and attracting foreign investment. By using surplus electricity for these high-tech industries, Pakistan aims to create jobs, boost foreign investment, and generate significant government revenue. Going forward, this initiative is expected to drive growth in the digital economy and position Pakistan as a hub for emerging technologies.

However, the announcement has sparked debate on X, with concerns over the economic viability of allocating surplus power, which costs around 7 cents per kWh after transmission, to crypto mining that is only viable at 3 to 4 cents per kWh. This could prompt demands for similar rates from energy-intensive industries and may breach IMF conditions on fair pricing. Check out the details on this tweet that sparked the conversation.

Budget 2026 – What to Expect: Key News Around the Table

📍👔 Salaried class likely to get tax relief as talks with IMF progress

📍🍪 Govt plans Rs. 150 billion extra taxes on snacks like biscuits, cakes, and chips

📍📦 Exporters to face 18% sales tax on imported raw materials, raising costs

📍🛡️ Defense budget may increase by 24% (Rs. 500 billion) to Rs. 2.6 trillion amid security concerns

📍💻 New taxes proposed on freelancers, vloggers, and YouTubers to raise Rs. 500-600 billion

📍💰 Benazir Income Support Program (BISP) budget expected to grow by 20% for social welfare

📍⛽ 3-5% GST likely on petroleum products to support domestic refineries and steady supply

📍🏛️ PM orders closure of inactive ministries to cut wasteful spending

📍🏠 Tax relief expected for real estate sector and salaried class

📍🌾 New loan scheme planned for 9 million small farmers to boost agriculture

📍💎 Luxury goods list expanding with 25% sales tax to increase government revenue

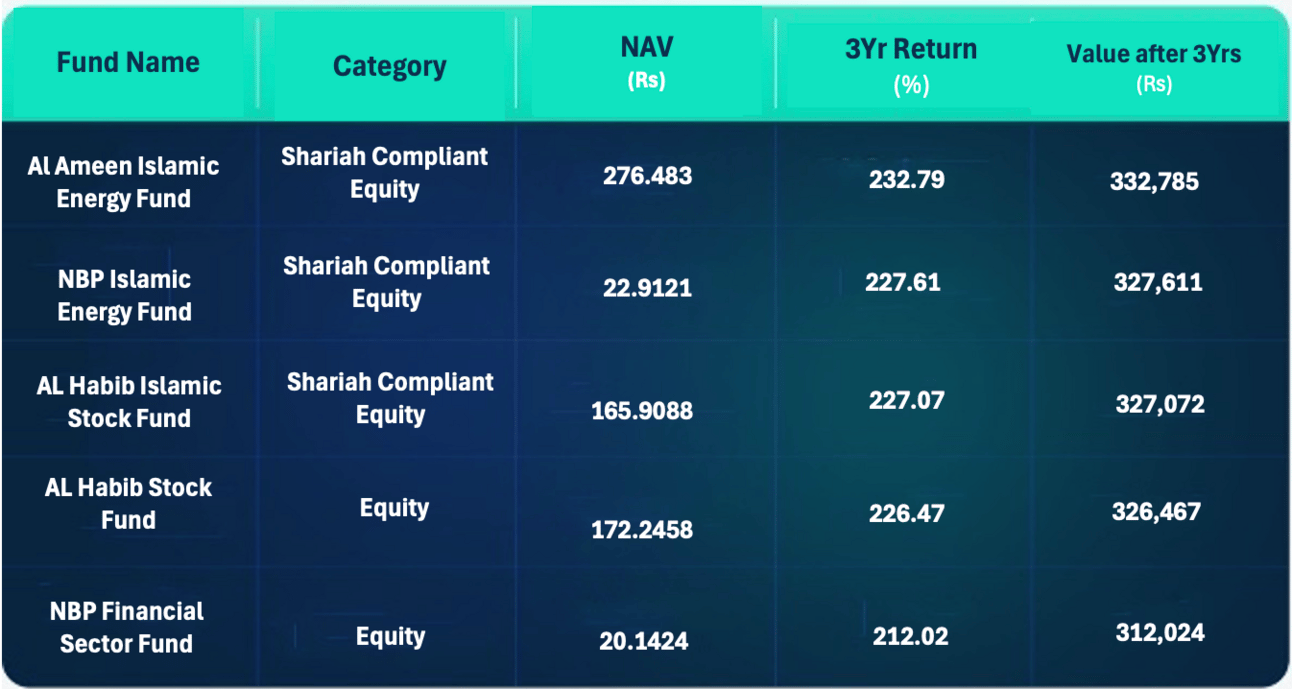

Investment is not a one-day game; it requires consistency and a long-term perspective. An analysis of the last three years’ performance reveals that Shariah Compliant Equity Funds, along with other equity funds, have delivered some of the highest returns in the market. Below is an illustration of how an initial investment of Rs 100,000 would have grown in select equity funds over the past three years:

Note: 3-Year Returns (%) represent total returns over 3 years. The final column shows the growth of an initial Rs 100,000 investment.

With the Behtari app, you can effortlessly monitor your mutual fund investments, initiate Systematic Investment Plans (SIPs), and compare various funds to make informed decisions. Whether you're new to investing or looking to optimize your portfolio, Behtari offers a user-friendly platform to help you achieve your financial goals.

Download the Behtari app today and take control of your investment journey.

🍏 IOS Download | 🤖 Android Download

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan