- Pulse by Capital Stake

- Posts

- Ceasefire ✌️, Interventions 🚨, Budget 📊

Ceasefire ✌️, Interventions 🚨, Budget 📊

Another Week, Another Pulse!

This past week felt straight out of a geopolitical thriller. As tensions between Pakistan and India escalated, the region held its breath — markets wavered, uncertainty loomed, and whispers of war grew louder. But just as quickly as the situation intensified, a swift and calculated response by the Pakistan Armed Forces, followed by timely diplomatic intervention by the US, brought the crisis to a halt with a ceasefire in place. Meanwhile, in a major financial development, the IMF approved the immediate release of nearly $1 billion to Pakistan under the Extended Fund Facility, brushing aside India’s objections. It also greenlit an additional $1.3 billion under the Resilience and Sustainability Facility (RSF). With stability gradually returning, attention now turns to the much-anticipated national budget 2025-26, set to be unveiled on June 12, 2025.

Here’s your 5-minute recap of all the important news from the past week — everything you need to know to plan ahead.

📅 Key Events to Watch This Week!

📌 May 12, 2025

🚗 Auto Sales

📌 May 14, 2025

💰 T-bills Auction Date

📌 May 15, 2025

💵 Foreign Exchange Reserves

🏦 Total Investments of Scheduled Banks

💼 Total Deposits of Scheduled Banks

💳 Total Advances of Scheduled Banks

📌 May 16, 2025

📊 Weekly SPI

⛽ Petrol Price

📌 May 19, 2025

🏢 Loans to Private Sector Business

🌍 Foreign Investment in Pakistan by Countries and Sectors

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

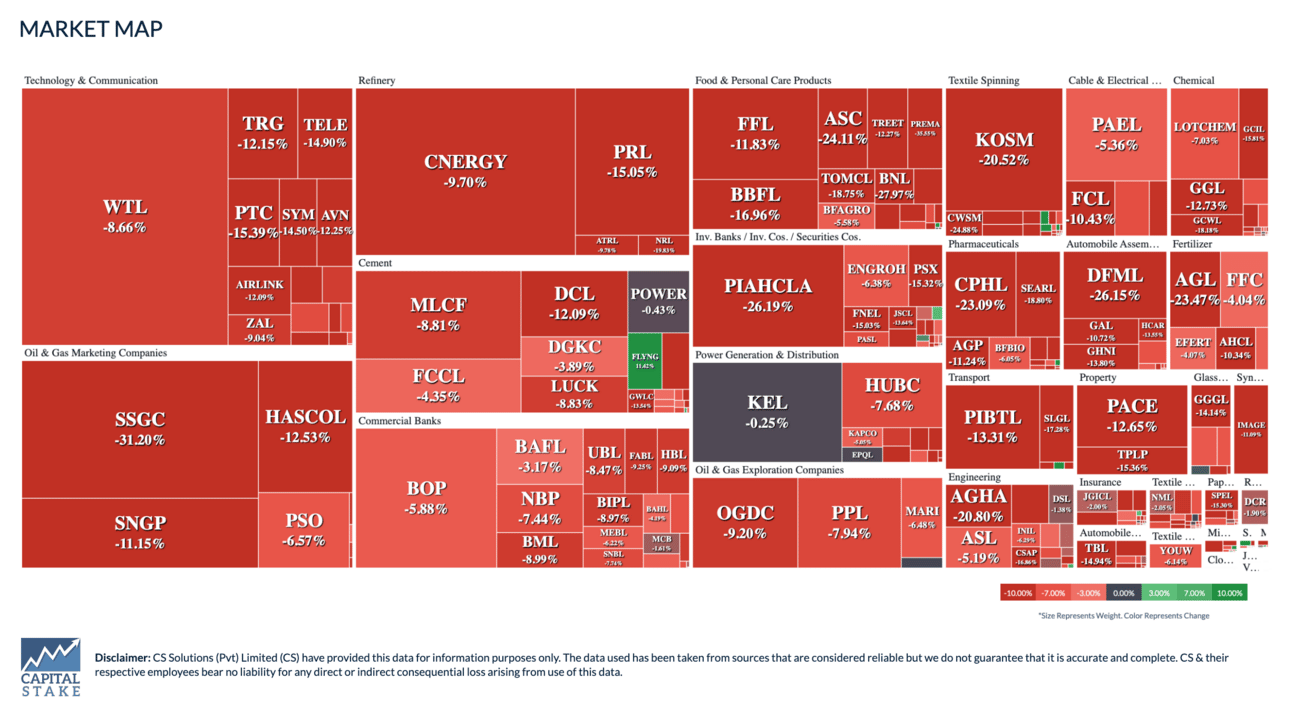

The volatile week at the Pakistan Stock Exchange ended on a positive note. Amid escalating tensions between Indo-Pak following India’s unlawful missile strikes against civilians the benchmark KSE-100 index lost 6,939 pts/6.08% WoW. The index manage to recover the losses by last session and ended the week on Friday up by +3,647.82 pts.

Mari Energies Ltd Discovers More Gas in Sindh

Mari Energies Limited (MARI) has discovered gas at the Soho-1 exploratory well in the Sujawal Block, Sindh—the first successful find in the Lower Goru (Massive Sand) Formation in this area. Initial testing showed strong flow rates of 30.01 MMSCFD and 18.84 MMSCFD at different choke sizes, indicating significant reservoir potential. This breakthrough opens new exploration prospects in a region previously marked by failures. With full ownership of the block, Mari Energies is well-positioned to capitalize on the discovery, which could boost domestic gas supply and support Pakistan’s energy needs. Further testing is ongoing.

SBP slashes interest rate to 11%, beating market expectations

In a surprise decision, the State Bank of Pakistan has cut the interest rate by 1%, bringing it down to 11% (See trend 📈). This move follows a sharp drop in inflation and early signs of economic recovery. The lower rate is expected to reduce borrowing costs, which can make things like home, car, and business loans more affordable, while also helping to support job creation and spending. The central bank believes inflation is now under better control and that the economy needs a gentle push to keep growing. However, global uncertainties and local challenges—like weak tax collection—remain, so while this decision offers some relief, the recovery is likely to be gradual and closely managed.

IMF Demands Pakistan to Cut Spending Instead of Raising Taxes in FY26 Budget

The IMF has asked Pakistan to focus on cutting government spending instead of raising taxes in the FY2026 budget, increasing the primary surplus target to 1.6% of GDP from 1% this year. Total revenue is expected to rise slightly, while spending will be reduced by 1.3% of GDP. The move aims to stabilize the economy without adding pressure on taxpayers, but it may result in tighter development budgets and limited subsidies. The IMF also wants better tax enforcement in under-taxed sectors like agriculture. Pakistan will need to balance fiscal discipline with growth to maintain support under the IMF program.

Remittances hit $31.2bn in Jul–Apr FY25, April inflows dip

Pakistan received $3.2 billion in remittances in April 2025, a 13% increase from the same month last year but a sharp 22% drop compared to March (See data 📈).. Despite the monthly dip, total remittances for July to April FY25 reached $31.2 billion — a strong 31% rise from $23.9 billion last year. This surge is a major boost for Pakistan’s foreign exchange reserves and household incomes. However, the April slowdown signals potential volatility ahead, making it crucial to sustain confidence among overseas Pakistanis and maintain stable inflow channels.

Govt Launches Pakistan’s First Green Sukuk

Pakistan has launched its first Green Sukuk, aiming to fund eco-friendly projects like renewable energy and green infrastructure. The sukuk, worth PKR 20 to 30 billion, will be auctioned and listed on the Pakistan Stock Exchange. This initiative aligns with Pakistan's Vision 2028 and supports the transition to an interest-free, sustainable economy. The launch is significant as it introduces a new Shariah-compliant investment opportunity, fostering sustainable development, creating jobs, and potentially attracting global investments focused on environmental responsibility.

Govt Likely to Double Tax on Fertilizers and Impose Duty on Pesticides in FY26 Budget

In the FY2025-26 budget, the Pakistani government plans to double the federal excise duty on fertilizers to 10% and introduce a new 5-10% duty on pesticides, aiming to raise Rs. 50 billion in additional taxes. The agriculture sector will also face higher income tax rates of up to 45% on earnings since January. These tax measures are part of Pakistan's latest agreement with the International Monetary Fund (IMF), which requires increased taxation on agricultural inputs and the removal of price interventions. The move is designed to help meet the new Rs. 14.3 trillion tax target for the next fiscal year. As a result, farmers and agriculture-related industries may face higher production costs, potentially leading to higher prices for fertilizers, pesticides, and agricultural products, which could affect food prices and inflation.

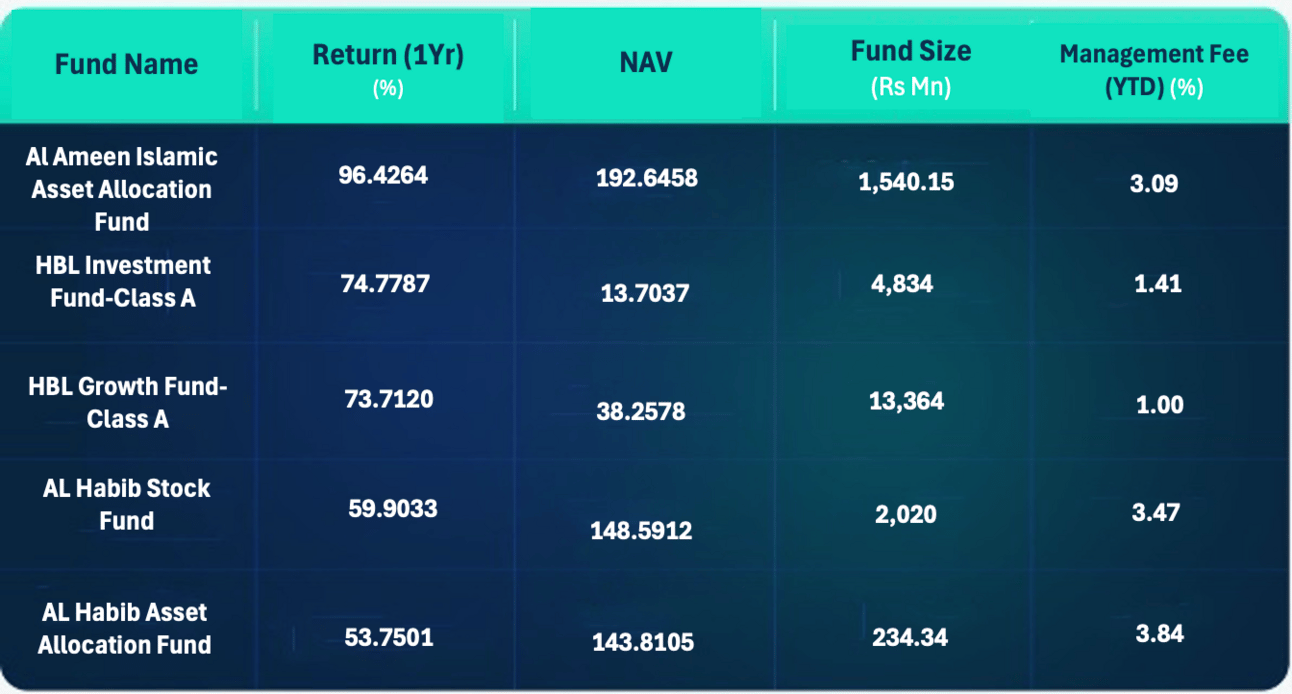

With so many investment options, choosing the right fund can feel overwhelming. Behtari’s upcoming search and filtering tools will make it easier than ever to compare funds based on returns, risk level, fees, and investor trust.

🔍 Why it matters:

📊 High-risk funds can deliver 15–20% higher returns—but with more volatility.

💸 A 1% lower expense ratio can significantly boost long-term gains.

🏅 78% of investors prefer funds trusted by others.

Top 5 Funds Based on Returns

These funds currently show the highest returns. Soon, you’ll be able to filter and sort funds based on your own criteria.

Download Now:

Google Play Store: https://shorturl.at/4AwQ0

Apple App Store: https://shorturl.at/wjzwh

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan