- Pulse by Capital Stake

- Posts

- 💸 Crypto, 💱 Currency, 🌐 Connectivity

💸 Crypto, 💱 Currency, 🌐 Connectivity

From rising climate worries to Pakistan going digital, here is your five-minute recap on everything that happened last week.

The government officially approved the Pakistan Virtual Assets Regulatory Authority and passed the Virtual Assets Act 2025, setting the stage for a regulated crypto space. The State Bank is also preparing to launch a pilot for a digital currency, moving the country closer to a modern and tech-driven financial system.

In a major boost for women-led businesses, the State Bank and Asian Development Bank launched a 500 million dollar loan initiative under the We Finance Code. Over in tech, Meta’s team met with officials to discuss advancements in artificial intelligence, including tools designed for local languages like Urdu.

Turns out the government is making big decisions using 10-year-old data. The Finance Minister called out the Pakistan Bureau of Statistics for not having updated figures on poverty, jobs, and economic growth due to delays in national surveys.

On the policy front, non-filers now face double the withholding tax on prize bond winnings and profits from savings. In other developments, Pakistan and Russia signed a deal to revive Pakistan Steel Mills. The government is reviewing the ban on new domestic gas connections to make use of surplus imported LNG. Meanwhile, PIA's privatization process is gaining momentum, with four shortlisted parties now moving to the next stage of the bidding process.

🎧 Listen now on your favorite platform:

Youtube - https://short-link.me/17pyb

SoundCloud - https://short-link.me/13a16

Spotify- https://short-link.me/13a0-

📅 Key Events to Watch This Week

15th July 2025 (Tuesday)

🚗 Petrol Price Announcement

🏦 Total Investments of Scheduled Banks

💰 Total Deposits of Scheduled Banks

📊 Total Advances of Scheduled Banks

17th July 2025 (Thursday)

🌍 Foreign Exchange Reserves (SBP)

📉 Loans to Private Sector Business

18th July 2025 (Friday)

📦 Weekly SPI (Inflation Tracker)

💼 Current Account Balance (June 2025)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

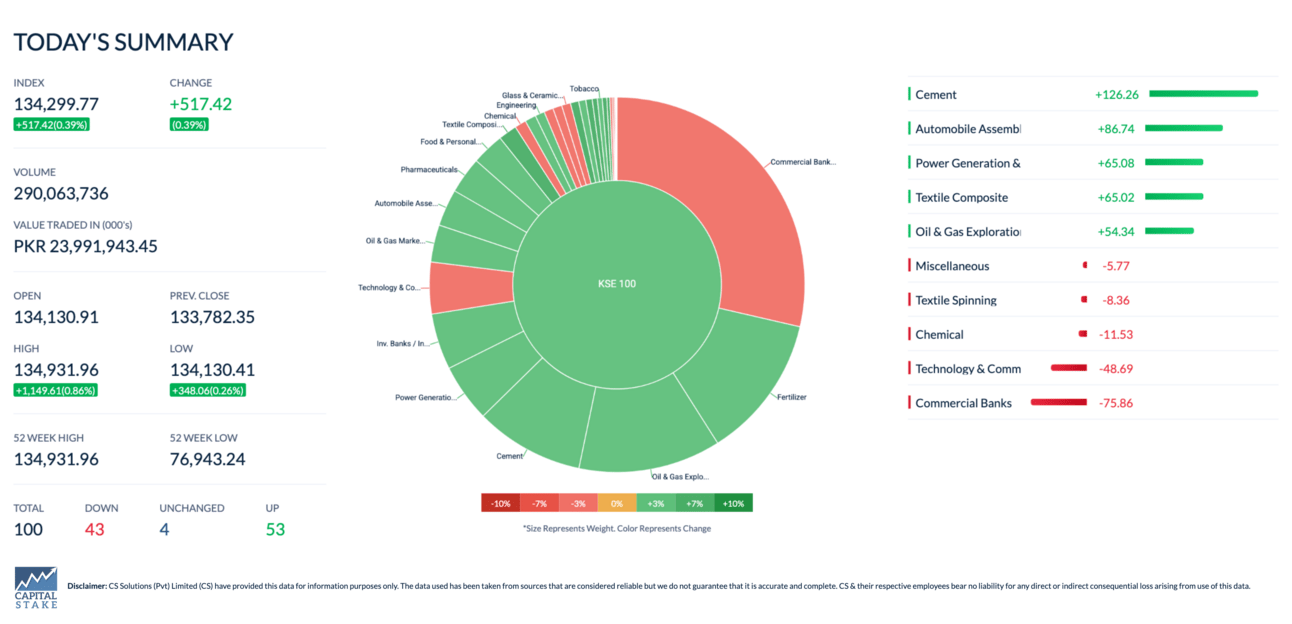

The KSE-100 index of the Pakistan Stock Exchange (PSX) gained 2,351 points this week, rising by 1.78% to close at 134,300. This marks the second consecutive week of growth, fueled by a strong corporate earnings outlook, record-high remittances (See Data 📈) , and positive macroeconomic developments.

Image Pakistan Ltd Wants to Buy London-Based Luxury Fragrance Brand

Image Pakistan Ltd (IMAGE), known for its fashion retail brand, is planning to expand into the luxury fragrance market by potentially acquiring Elegantes London, a premium brand sold at Harrods and established in both the UK and US. This move signals Image’s ambition to go global and diversify beyond clothing, tapping into a high-margin industry with strong growth potential. If the deal goes through, it could boost the company’s international presence and earnings, opening doors for Pakistani businesses in global luxury markets.

Pakistan Set to Produce Cheap Electricity Using Thar Coal

Pakistan is moving closer to producing cheaper electricity by using locally sourced Thar coal, as progress continues on a key railway project to connect Thar's coalfields with power plants nationwide. Once completed, this initiative will allow coal to be transported directly, slashing electricity costs to Rs. 4.7 per unit compared to Rs. 15 per unit for imported coal. This shift promises major relief for the country's energy sector and consumers alike. The project, expected to finish next year, is being fast-tracked with critical components already in place, marking a significant step toward energy independence and cost reduction.

Finance Ministry Initiates Non-Deal Roadshow in China for Inaugural Panda Bond

Pakistan has kicked off a non-deal roadshow in China to prepare for its first-ever Panda Bond issuance, aiming to raise funds from China’s domestic bond market. Finance Ministry officials are meeting investors, underwriters, and regulators in Beijing to present Pakistan’s economic outlook and debt reforms. The move signals Pakistan’s push to diversify its funding sources and tap into China’s deep capital markets with support from multilateral credit guarantees. Early investor response has been positive, showing confidence in Pakistan’s economic direction. The bond is expected to launch later this year, marking a major milestone in broadening the country’s financial partnerships.

Govt eyes $1bn valuation in Roosevelt Hotel redevelopment plan

Pakistan is aiming for a $1 billion valuation as it seeks a joint venture partner to redevelop the iconic Roosevelt Hotel in New York, one of its most prized foreign assets. Instead of selling the property outright, the government plans to retain partial ownership through an equity partnership, aligning with its broader $7 billion IMF-backed privatization drive. The hotel, shut since 2020 and briefly used as a migrant shelter, sits on prime Manhattan real estate and could be transformed into a residential and office complex. The process, managed by global real estate firm JLL, is set to move quickly, with completion expected in 6–9 months.

2nd phase of digitising oil supply chain begins

Ogra has launched the second phase of digitising Pakistan’s oil supply chain, aiming to boost transparency, safety, and efficiency in the sector. After successfully rolling out an online licensing system and the Raahguzar app for locating licensed fuel stations, this new phase introduces a full track-and-trace system across the petroleum supply chain. In partnership with the Punjab IT Board, the system will monitor the movement of fuel from refineries and import terminals to storage depots and retail outlets using GPS, ERP platforms, and real-time dashboards. This digital upgrade is expected to curb illegal activities like fuel smuggling and improve regulatory enforcement nationwide.

Audit Blames Govt for Creating Artificial Wheat Shortage

A recent audit report has raised serious concerns over the government's handling of wheat imports in FY2023/24. Despite record domestic production, more than 3.5 million metric tons of wheat were imported, significantly above initial approvals. The report highlights discrepancies in demand estimates, delays in policy decisions, and limited public sector procurement, which contributed to rising prices. It also questions the accuracy of official reserve figures and calls for greater transparency and accountability in future planning.

Starlink Satellite Internet Launch in Pakistan Confirmed

Pakistan is set to launch its first satellite-based internet service, with Elon Musk’s Starlink expected to begin operations by the end of this year. Starlink has formally applied for registration and agreed to operate within Pakistan’s legal and regulatory framework. The Pakistan Space Activities Regulatory Board is finalizing the satellite internet licensing process, after which the Pakistan Telecommunication Authority will issue Starlink’s operational license. Other global tech firms like Amazon and OneWeb have also shown interest, but Starlink is currently leading the way in bringing high-speed satellite internet to the country.

How to Choose the Right Fund for You

Every investor is different, the best fund for you depends on what you're saving for, how long you plan to invest, and how much risk you’re comfortable taking. Here’s a quick guide to help you invest with more clarity and confidence:

What’s your goal?

Short-term (up to 1 year): Choose money market or fixed return funds for capital safety and quick access.

Medium-term (1–3 years): Income or government securities funds offer better returns with moderate risk.

Long-term (3+ years): Equity or balanced funds offer higher growth but come with some market volatility.

What’s your risk level?

How much risk are you willing to take. All investments carry some risk. Lower risk means more stability, but usually lower returns. Higher returns often come with short-term fluctuations.Need urgent access to cash?

Keep a portion in cash for safety and liquidity, while investing the rest for growth.Are you diversified?

Don’t put all your money in one fund. A mix of low-risk and growth-oriented funds helps manage risk and returns better.

Not sure where to begin?

With Behtari’s new search option, you can filter funds by goal, return, and risk level to find the perfect fit for your needs.

📲 Download now on Google Play or Apple Store and start investing with confidence.

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan