- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Bears Dominate PSX!

Bears took control of the Pakistan Stock Exchange on Thursday. Indices slipped lower and lower all day long, while volumes fell from last close. As per analysts, a sharp increase in yields on yesterday’s treasury bill auction led to concerns of a similar upward move in the benchmark policy rate.

Equity markets around the globe showed mixed trend. Crude oil prices moved north with WTI crude oil price rising by 0.76% to $74.54. While Brent crude oil price was up by 0.65% to $ 81.14. (As at 3:53 PM PST, Source: Investing.com).

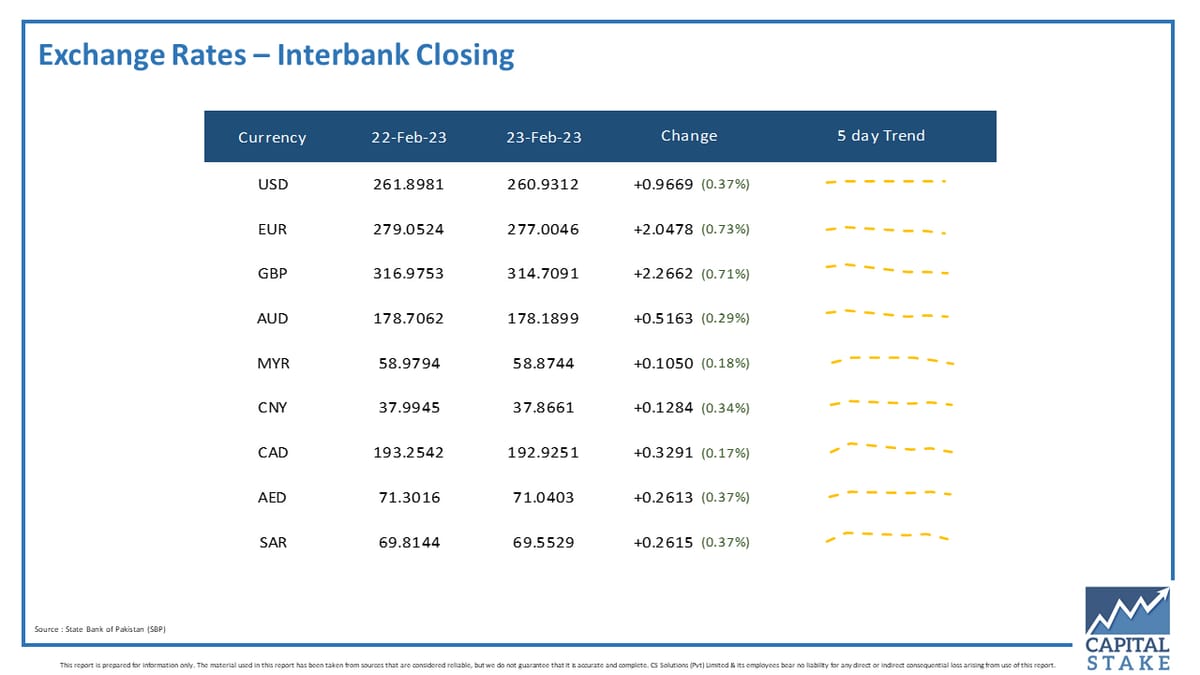

On the economic front, as per latest data released by the State Bank of Pakistan (SBP), the Pakistani Rupee gained PKR 0.9669/US$ (0.37%) against the US Dollar on DoD basis ending the session at PKR 260.9312/US$.

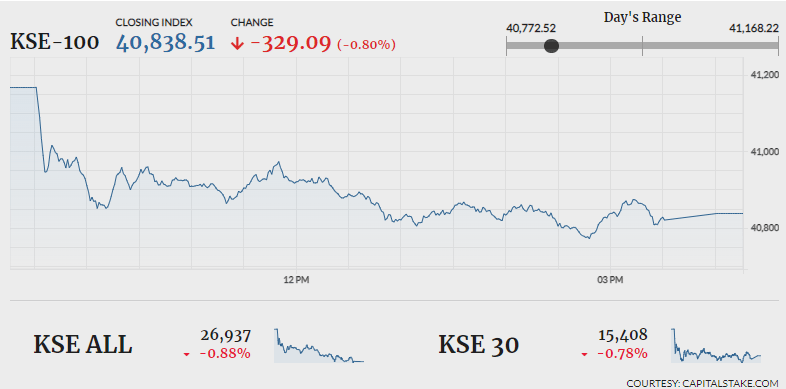

The benchmark KSE 100 index lost 395.08 pts recording intraday low of 40,772.52. It ended lower by 329.09 pts at 40,838.51. The KMI 30 index declined by 755.44 pts closing at 70,091.19. While the KSE All Share index plunged 238.29 pts settling at 26,936.83.

Overall market volumes dropped from 196.33 mn shares in last session to 149.95 mn shares. Worldcall Telecom Limited (WTL -0.79%), Maple Leaf Cement Factory Limited (MLCF -1.04%) and Kot Addu Power Company Limited (KAPCO +2.16%) recorded highest volumes. The scrips had 14.16 mn shares, 10.48 mn shares and 9.69 mn shares traded, respectively.

Sectors dragging the benchmark KSE 100 index lower included Banking sector (80.83 pts), Oil & Gas Exploration sector (79.06pts) and Technology & Communication sector (48.41 pts). Company-wise, Pak Petroleum Limited (PPL 47.87 pts), Oil and Gas Development Company Limited (OGDC 27.23pts) and Habib Bank Limited (HBL 23.92 pts), were top negative contributors.

The Refinery sector lost 1.54% in its cumulative market capitalization. Cynergyico PK Limited (CNERGY 1.36%), Attock Refinery Limited (ATRL 1.30%), National Refinery Limited (MCB 2.00%) and Pakistan Refinery Limited (PRL 1.81%) all closed in red.

Values as at 04:08 PM PST