- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

PSX Continues to Move South!

The Pakistan Stock Exchange (PSX) continued to move south on Wednesday. Indices swung high and low before closing in red while volumes improved compared to previous session. Analysts attributed the bearish market trend to uncertainty surrounding the timing of upcoming elections.

Worldwide equity markets displayed mixed trend. Crude oil prices moved south with WTI crude oil price falling by 0.08% to $72.30. While Brent crude oil price was down by 0.04% to $77.62. (As at 3:54 PM PST, Source: Investing.com).

During the day, Bulls drove the benchmark KSE 100 index to day’s high of 64,550.94 (gaining 380.37 pts). Bears then took over driving the index to day’s low of 63,873.63 (losing 296.94 pts). It closed the session lower by 250.73 pts at 63,919.85. The KMI 30 index went down 566.95 pts ending at 107,681.07. Whereas the KSE All share index accumulated 57.74 pts ending at 43,192.37.

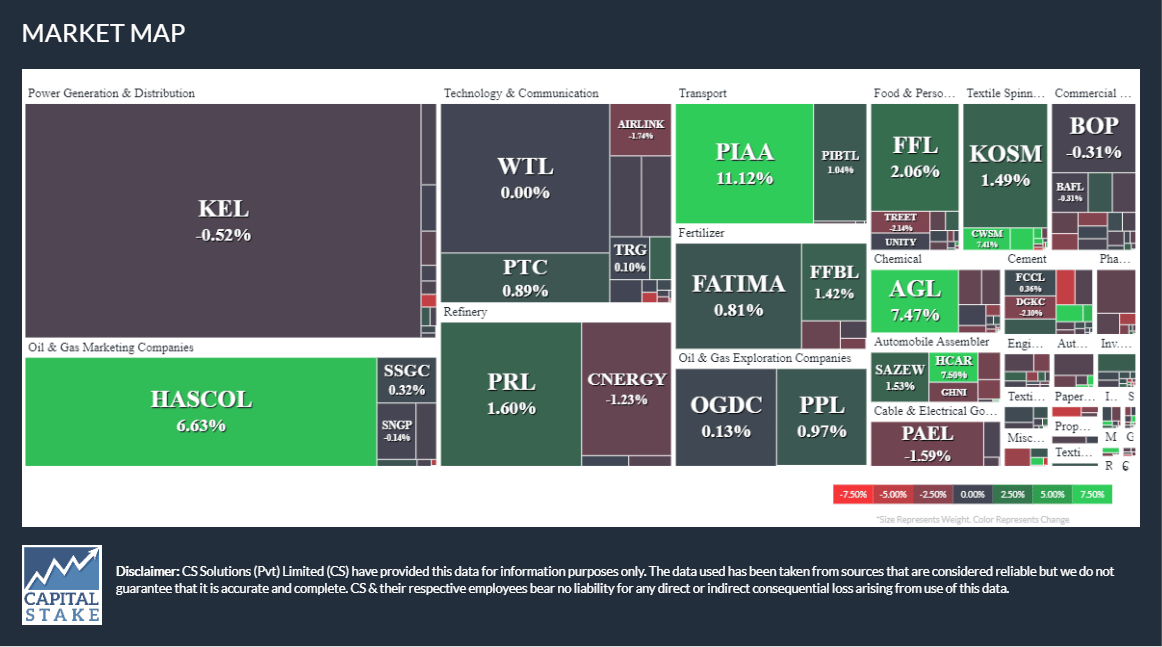

Market activity witnessed a substantial expansion, as the overall trading volume surged from 447.79 mn shares in the last session to 635.05 mn shares. K-Electric Limited (KEL -0.52%) claimed top position on the volume chart with 151.25 mn shares traded. Following closely behind were Hascol Petroleum Limited (HASCOL +6.63%) and Worldcall Telecom Limited (WTL +0.00%). The scrips had 67.98 mn shares and 42.07 mn shares traded, respectively.

Sectors exerting a downward pressure on the benchmark KSE 100 index included, Banking sector (-123.23 pts), Fertilizer sector (-78.83 pts) and Cement sector (-29.24 pts). Companies that contributed to the adverse performance of the index included Meezan Bank Limited (MEBL -49.29 pts), Engro Corporation Limited (ENGRO -45.20 pts), Bank AL Habib Limited (BAHL -42.39 pts).

The Fertilizer sector lost 0.97% in its cumulative market capitalization. Engro Corporation Limited (ENGRO -1.94%), Engro Fertilizers Limited (EFERT -1.47%), Fauji Fertilizer Company Limited (FFC -0.53%), all closed negative.

Values as at 04:15 PM