- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

DAILY MARKET WRAP

Bears Reappear at PSX!

The Pakistan Stock Exchange (PSX) experienced a mid-week shift as bearish sentiment reasserted its dominance. Initially, the market exhibited signs of optimism; however, the trend reversed in the final hour of trading, leading to a decline in the indices, which ultimately closed in negative territory. Notably, market volumes decreased compared to the previous session.

Worldwide equity markets displayed mixed trends. Crude oil prices moved north with WTI crude oil price rising by 1.62% to $74.43. While Brent crude oil price was up by 1.16% at $77.74. (As at 3:50 PM PST, Source: Investing.com).

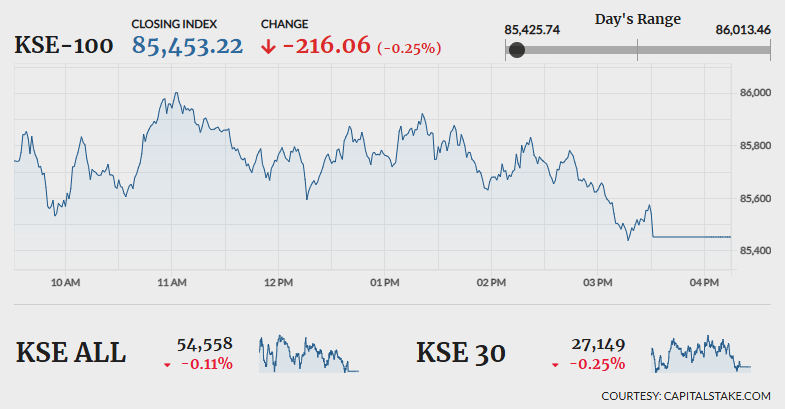

The benchmark KSE 100 index fluctuated between an intraday high of 86,013.46 an increase of 344.18 pts and an intraday low of 85,425.74 a decline of 243.54 pts. It ultimately closed lower by 216.06 pts settling at 85,453.22. The KMI 30 index experienced a significant drop of 41.82 pts closing at 129,780.37. Meanwhile, the KSE All Share index declined by 58.44 pts ending at 54,558.10.

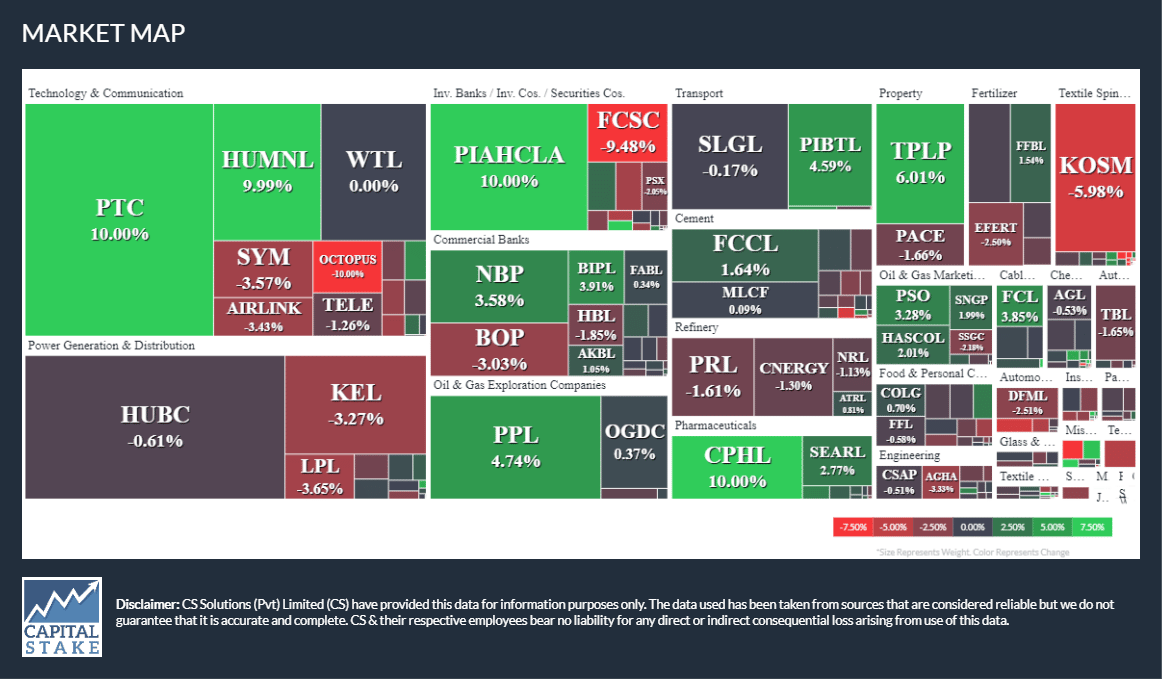

Overall market volume dropped from 595.73 mn shares in the previous session to 503.56 mn shares. The volume chart was led by Pakistan Telecommunication Company Limited (PTC +10.00%), The Hub Power Company Limited (HUBC -0.61%), and PIA Holding Company Limited (PIAHCLA +10.00%). The scrips had 52.24 mn shares, 46.57 mn shares and 25.51 mn shares traded, respectively.

The sectors that negatively impacted the benchmark KSE 100 index included the Fertilizer sector (-181.53 pts), the Banking sector (-76.74 pts) and the Power Generation and Distributor sector (-33.87 pts). On a company-specific basis, the largest detractors were Engro Fertilizers Limited (EFERT -96.38 pts), Fauji Fertilizer Company Limited (FFC -77.89 pts) and Habib Bank Limited (HBL -48.75 pts).

The Banking sector lost 0.16% in its cumulative market capitalization. Meezan Bank Limited (MEBL -0.12%), United Bank Limited (UBL -0.20%), MCB Bank Limited (MCB -0.70%) and Standard Chartered Bank (Pak) Limited (SCBPL -0.12%), all closed in red.

Values as at 04:15