- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

DAILY MARKET WRAP

Bears Dominate PSX!

Bears of the Pakistan Stock Exchange (PSX) overthrew the bulls on Thursday. Indices slipped lower and lower for most of the day while volumes inched up compared to the previous session. As per analysts, the IMF approved EEF for the loan.

Equity markets around the globe showed mixed trends. Crude oil prices moved south with WTI crude oil price dropping by 2.20% to $68.16. While Brent crude oil price was depreciated by 2.03% to $71.42. (As at 3:54 PM PST, Source: Investing.com).

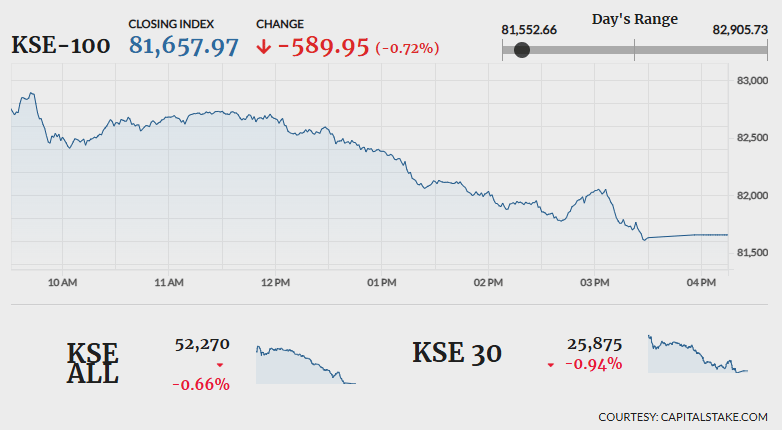

The KSE 100 index started the day with a gain of 657.81 pts hitting an intraday high of 82,905.73. However, the momentum shifted as bearish sentiment took hold causing a steep drop to 81,552.66 marking a loss of 695.25 pts. By the close, the index had settled at 81,657.97 down by 589.95 pts. Similarly, the KMI 30 index experienced a sharp decline of 1,460.46 pts closing at 125,893.32, while the KSE All Share index shed 348.44 pts finishing at 52,269.81.

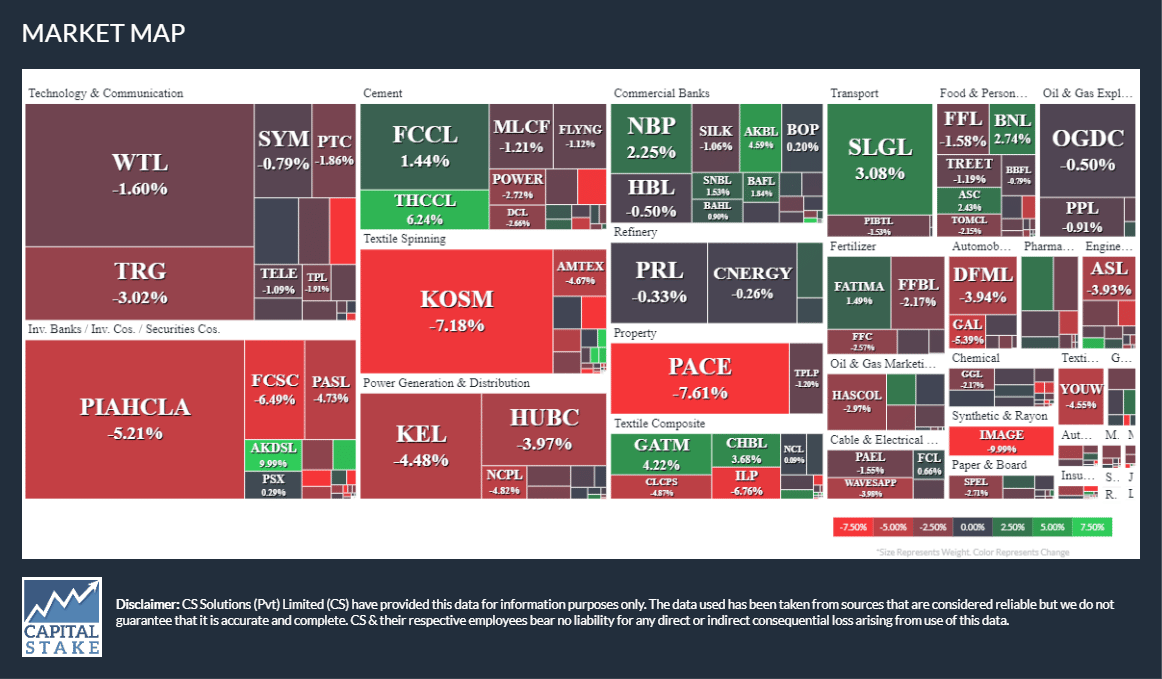

Market volumes rose from 421.75 mn shares in the previous session to 423.30 mn shares. PIA Holding Company Limited (PIAHCLA -5.21%) topped the volume leaderboard. It was followed by Worldcall Telecom Limited (WTL -1.60%) and Kohinoor Spinning Mills (KOSM -7.18%). The scrips had 36.33 mn, 33.11 mn, and 25.82 mn shares traded, respectively.

Sectors that dragged the benchmark KSE 100 index down included the Power Generation and Distribution sector (-213.23 pts), the Fertilizer sector (-182.63 pts) and the Technology and Communication sector (-53.37 pts). On a company level, The Hub Power Company Limited (HUBC -160.21 pts), Fauji Fertilizer Company Limited (FFC -125.64 pts), and United Bank Limited (UBL -63.53 pts) were the key contributors to the decline.

The Technology and Communication sector lost 1.22% in its cumulative market capitalization. Systems Limited (SYS -1.10%), Air Link Communication Limited (AIRLINK -0.01%), Pakistan Telecommunication Company Limited (PTC -1.86%) and TRG Pakistan Limited (TRG -3.02%), all closed negative.

Values as at 04:15