- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Upward Trend Continues at PSX!

The Pakistan Stock Exchange (PSX) endured a volatile session on Tuesday. Indices oscillated between both zones until finally choosing green, while investor activity showed a decline compared to preceding session.

Equity markets around the globe showed mixed trend. Crude oil prices moved north with WTI crude oil prices rising by 0.18% to $78.40. While Brent crude oil price rose by 0.22% to $82.70. (As at 3:46 PM PST, Source: Investing.com).

The benchmark KSE 100 index initially lost momentum as it slipped to day’s low of 56,118.18 losing 405.40 pts. Recovering losses, it then climbed to day’s high of 56,873.99 gaining 350.41 pts. The index settled in the green zone with an addition of 142.35 pts at 56,665.93. The KMI 30 index inched up by 741.96 pts ending the session at 97,087.93. While the KSE All share index grew by 153.09 pts closing at 37,542.85.

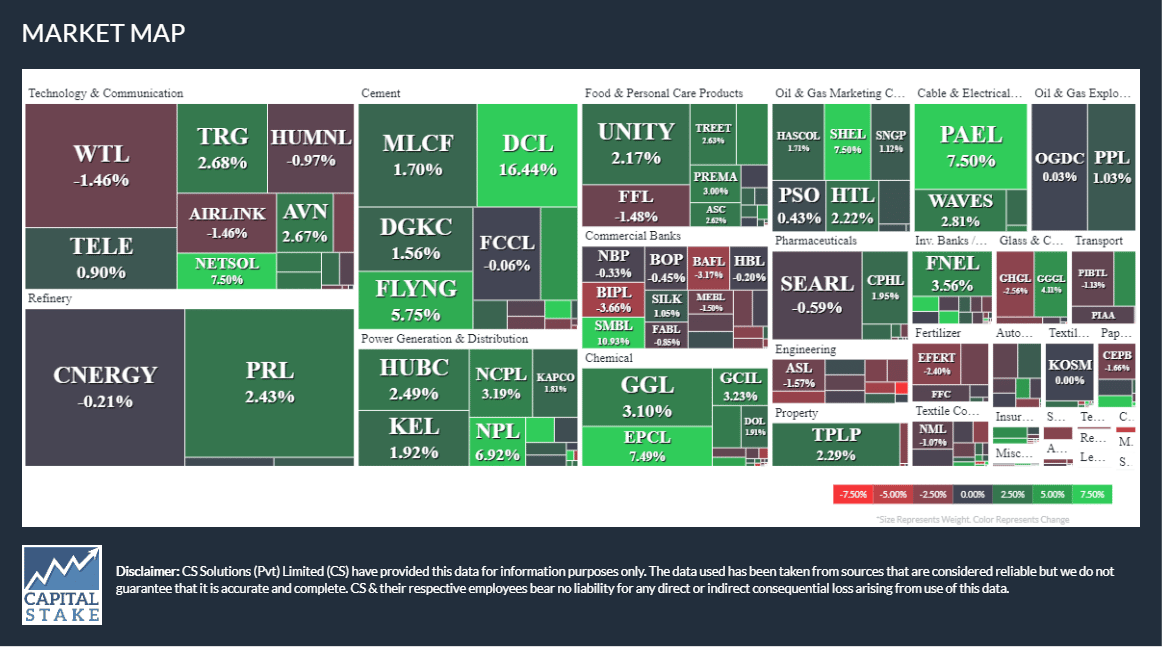

Total market volume dropped from 656.05 mn shares in the previous session to 523.52 mn shares. Total traded value was recorded at Rs. 19.51 bn on Tuesday. Cynergyico PK Limited (CNERGY -0.21%), Pakistan Refinery Limited (PRL +2.43%) and Worldcall Telecom Limited (WTL -1.46%) dominated the volume chart. The scrips had 35.19 mn shares, 35.15 mn shares and 25.93 mn shares, exchanged, respectively.

Sectors adding to the positive momentum to the benchmark KSE 100 index included, Power Generation and Distribution sector (114.78 pts), Technology and Communication sector (+81.11 pts) and Automobile Assembler sector (+64.27 pts). Company-wise, The Hub Power Company Limited (HUBC +87.93 pts), Millat Tractors Limited (MTL +63.74 pts) and Systems Limited (SYS +53.67 pts), drove the index north.

The Power Generation and Distribution sector gained 4.86% in its cumulative market capitalization. The Hub Power Company Limited (HUBC +5.85%), K-Electric Limited (KEL +7.49%), Kot Addu Power Company Limited (KAPCO +2.19%) and Pakgen Power Limited (PKGP +7.49%), all closed positive.

Values as at 04:11 PM PST