- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

PSX Continues to Move North!

Extending gains from previous session, the Pakistan Stock Exchange (PSX) closed in the session on Thursday in green. Indices accumulated gains all day long while volume shrank compared to previous session. As per analysts, investors regained confidence in the market due to growing clarity seen on the political landscape.

Worldwide equity markets displayed negative trend. Crude oil prices moved north with WTI crude oil price rising by 0.23% to $78.09. While Brent crude oil price was up by 0.25% to $83.24. (As at 3:59 PM PST, Source: Investing.com).

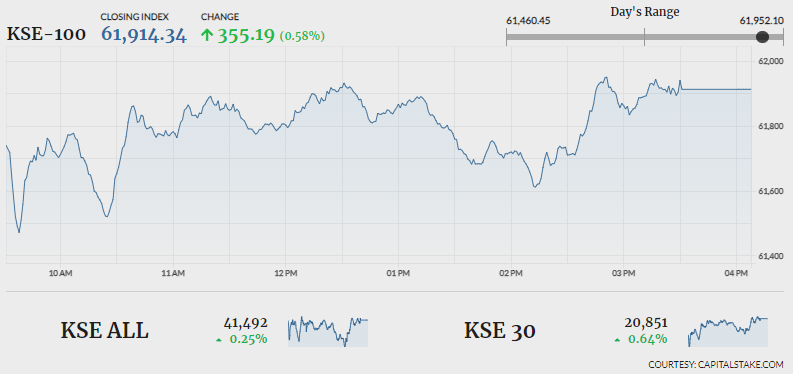

The benchmark KSE 100 index slipped to day’s low of 61,460.45 losing 98.71 pts. Bulls then drove the index to day’s high of 61,952.10 with an addition of 392.94 pts. The index settled higher by 355.19 pts at 61,914.34. The KMI 30 index grew by 844.48 pts ending the session at 103,509.96. While the KSE All share index was up by 101.39 pts ending the day at 41,491.88.

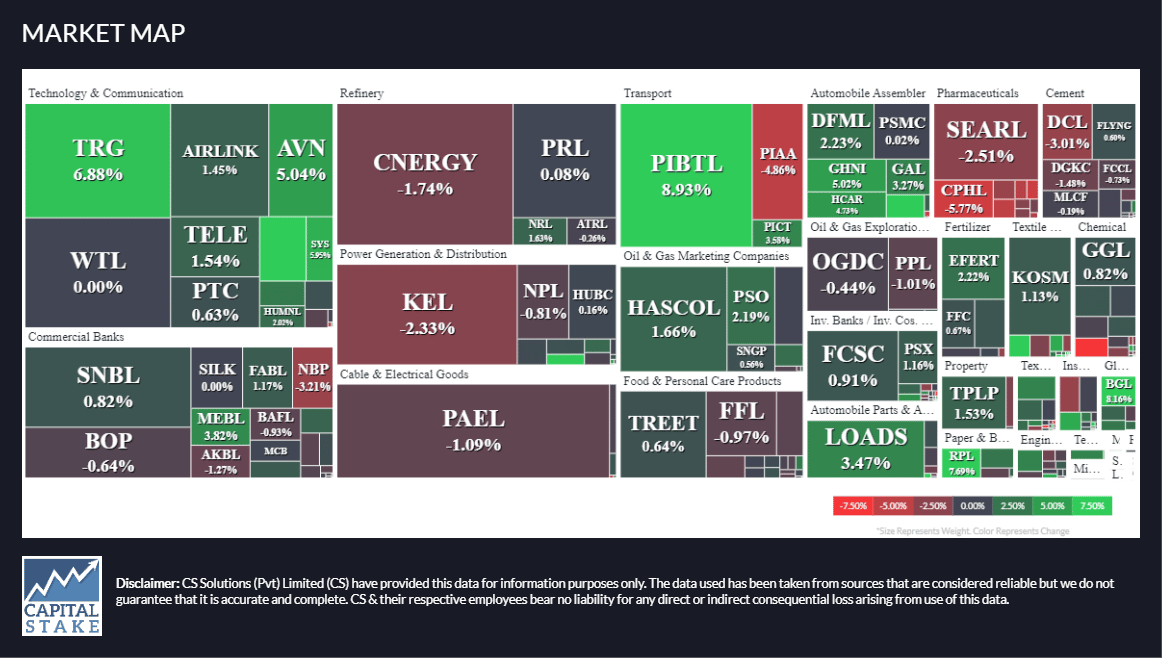

Market volume contracted from 362.67 mn shares in the last session to 324.61 mn shares. Highet participation was witnessed in Pak Elektron Limited (PAEL -1.09%), Cynergyico PK Limited (CNERGY -1.74%) and Pakistan International Bulk Terminal Limited (PIBTL +8.93%). The scrips had 23.11 mn shares, 21.25 mn shares and 26.26 mn shares exchanged, respectively. Out of the total scrips traded, 181 advanced, 143 declined and 219 remained unchanged.

Sectors adding gains to the benchmark KSE 100 index included, Technology and Communication sector (+191.04 pts), Banking sector (+114.38 pts) and Fertilizer sector (+75.66 pts). Company-wise, Systems Limited (SYS +122.93 pts), Meezan Bank Limited (MEBL +88.36 pts) and TRG Pakistan Limited (EFERT +57.95 pts), were top points contributors.

The Banking sector gained 0.76% in its cumulative market capitalization. Meezan Bank Limited (MEBL +4.12%), United Bank Limited (UBL +1.53%) MCB Bank Limited (MCB +0.01%) and Habib Bank Limited (HBL +0.66%), all closed in green.

Values as at 04:14 PM