- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

PSX Starts Week on Negative Note!

The Pakistan Stock Exchange (PSX) continued to witness turbulence during first trading session of the week. Indices swung between both zones until finally choosing red while volumes shrank compared to previous session. As per analysts, political uncertainty kept investors on the sidelines.

Worldwide equity markets displayed positive trend. Crude oil prices moved south with WTI crude oil price falling by 2.71% to $71.81. While Brent crude oil price was down by 2.46% to $76.82. (As at 3:58 PM PST, Source: Investing.com).

The benchmark KSE 100 index reached its peak for the day at 65,069.43, experiencing a gain of 554.54 pts. It later dipped to day's low of 64,183.53 witnessing a loss of 331.37 pts. The index concluded the session with a decrease of 277.87 pts at 64,237.03. The KMI 30 index dropped 138.82 pts settling at 108,370.31. Simultaneously, the KSE All Share index saw a reduction of 250.26 pts, concluding the day at 43,116.34.

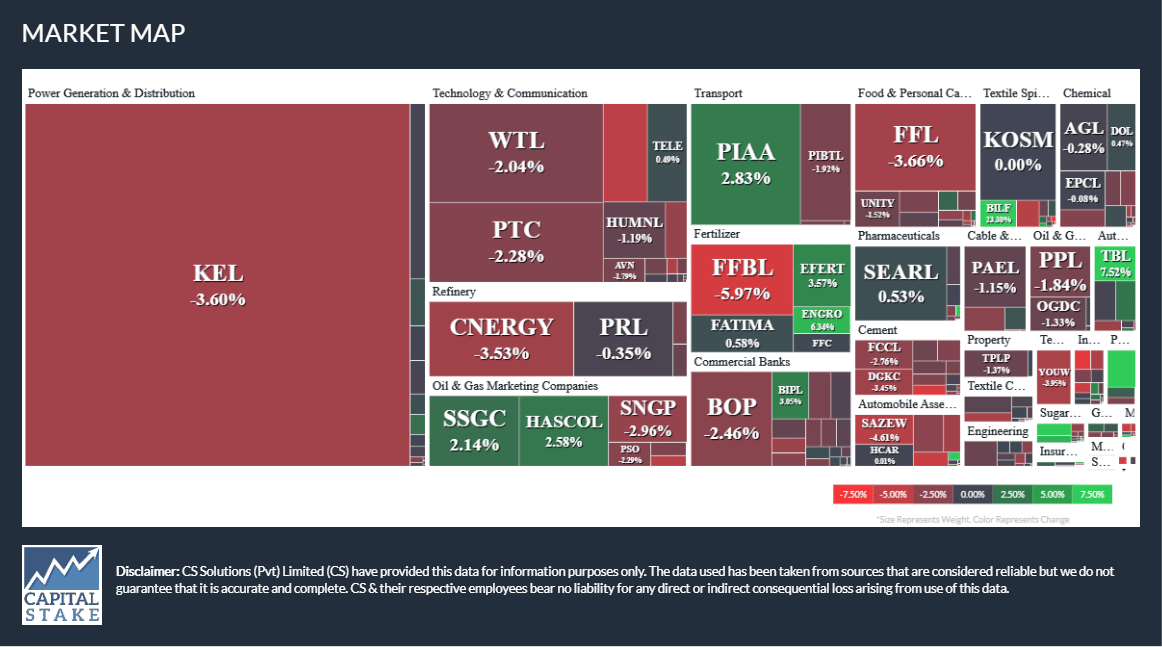

Total market activity diminished from 949.41 mn shares in the last session to 483.87 mn shares (down by 49%). Toppers of the volume chart were K-Electric Limited (KEL -3.60%), Worldcall Telecom Limited (WTL -2.04%) and Pakistan International Airlines Corp (PIAA +2.83%). The scrips had 168.81 mn shares, 21.98 mn shares and 17.94 mn shares exchanged, respectively.

Sectors driving the benchmark KSE 100 index south included, Banking sector (-139.28 pts), Oil and Gas Exploration sector (-93.42 pts) and Cement sector (-88.14 pts). Companies that played a significant role in pulling the index down included, United Bank Limited (UBL -62.98 pts), Pakistan Petroleum Limited (PPL -47.72 pts) and Oil and Gas Development Company Limited (OGDC -32.56 pts).

The Refinery sector lost 2.08% in its cumulative market capitalization. Attock Refinery Limited (ATRL -1.45%), Cynergyico PK Limited (CNERGY -3.33%), National Refinery Limited (NRL -2.59%) and Pakistan Refinery Limited (PRL -0.49%), all closed in red.

Values as at 04:13 PM