- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Volatile Session Ends Flat!

The Pakistan Stock Exchange (PSX) concluded a volatile trading session with marginal fluctuations on Thursday. Initially, indices showed promise with a positive start, but profit-taking later dominated, leading to a largely unchanged closure. Trading volume saw a significant surge compared to previous session.

Global equity markets showed a mixed trend. Crude oil prices moved north, with WTI crude oil rising by 0.10% to $82.89 while Brent crude oil was up by 0.12% to $88.13 (as of 3:47 PM PST, Source: Investing.com).

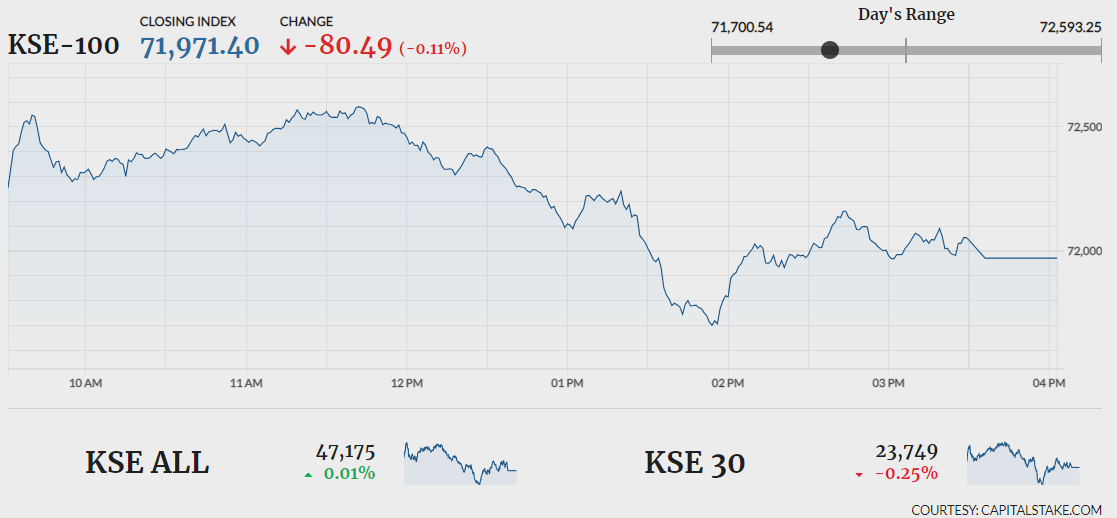

Clenching 541.36 pts, the benchmark KSE 100 index jumped to day’s high of 72,593.25. It then lost momentum falling to day’s low of 71,700.54 losing 351.36 pts. The index closed flat by negative 80.49 pts at 71,971.40. The KMI 30 index lost 259.50 pts ending the day at 120,902.96. While the KSE All share index witnessed a minor increase of 2.14 pts closing the day at 47,174.95.

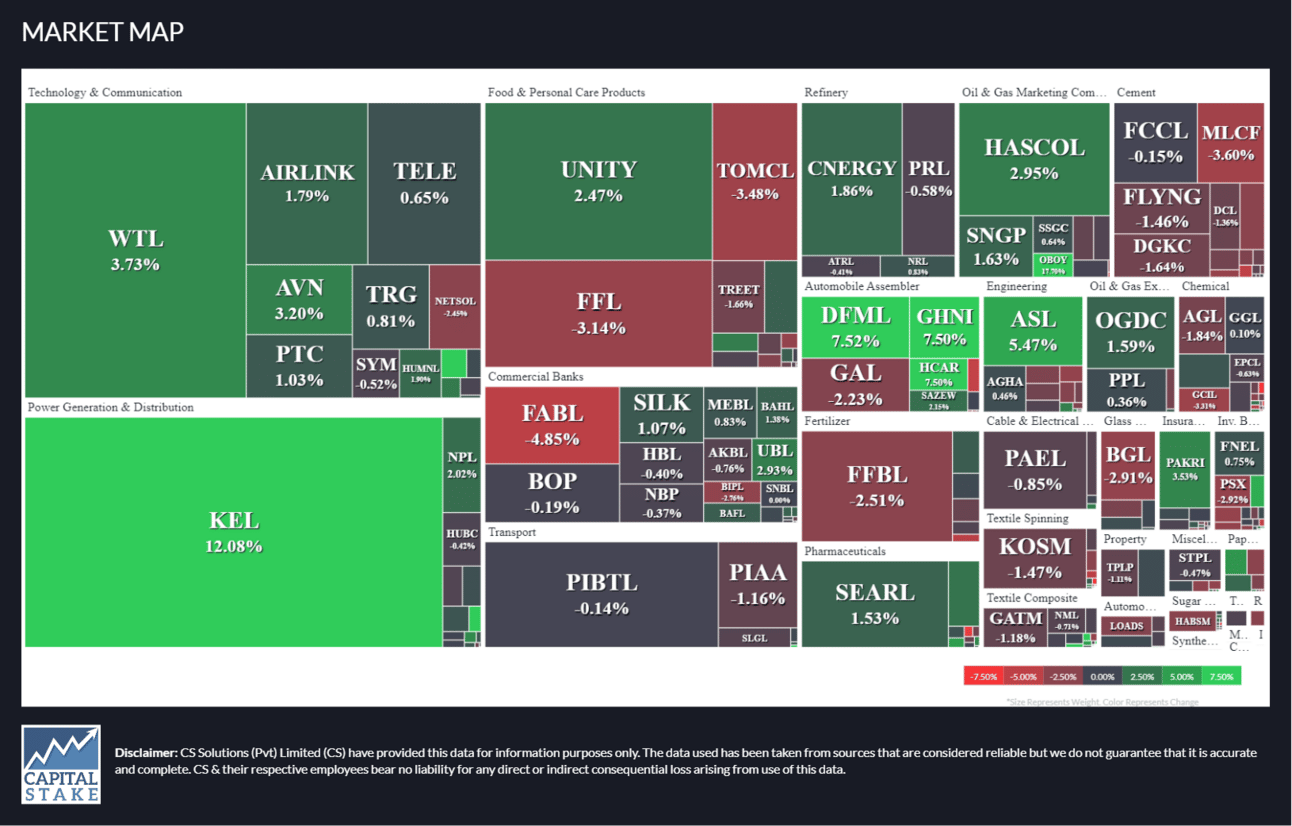

Investor participation swelled from 599.30 mn shares in the previous session to 798.23 mn shares. K-Electric Limited (KEL +12.08%), Worldcall Telecom Limited (WTL +3.73%) and Unity Foods Limited (UNITY +2.47%) dominated the volume chart. The scrips had 119.65 mn shares, 79.96 mn shares, and 44.28 mn shares traded, respectively.

Sectors dragging the benchmark KSE 100 index lower included Automobile Assembler sector (-94.35 pts), Cement sector (-85.26 pts) and Miscellaneous sector (-50.42 pts). Companies that drove the index south included Millat Tractors Limited (MTL -94.62 pts), Dawood Hercules Corporation Limited (DAWH -43.96 pts) and Pakistan Services Limited (PSEL -43.38 pts).

The Oil and Gas Marketing sector lost 0.12% in its cumulative market capitalization. Pakistan State Oil Company Limited (PSO -0.19%), Attock Petroleum Limited (APL -2.35%) and Shell Pakistan Limited (SHELL -1.13%), all closed in red.

Pakistan Oilfields Limited (POL -1.84%) announced its financials for 3QFY24. The company reported net sales of Rs.16.29 bn compared to Rs.15.87 bn in SPLY. Finance cost decreased from Rs.5.44 bn in 3QFY23 to Rs.0.66 bn. EPS decreased to Rs.43.55 in March 2024 compared to Rs.57.19 in March 2023.

Values as at 04:15 PM