- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Bears Reappear at PSX!

The Pakistan Stock Exchange (PSX) experienced a turnaround as bears made a comeback on Thursday. Indices initially showed positive momentum before succumbing to selling pressure and ultimately closing in red whereas volume shrank compared to previous session.

Worldwide equity markets displayed negative trend. Crude oil prices moved north with WTI crude oil price rising by 1.56% to $76.26. While Brent crude oil price was up by 1.42% to $81.18. (As at 3:51 PM PST, Source: Investing.com).

The benchmark KSE 100 index gathered 391.18 pts stretching to day’s high of 65,213.61. Bears then took over dragging the index to day’s low of 64,180.45 with a loss of 641.98 pts. The index closed lower by 524.43 pts at 64,298.01. The KMI 30 index slipped by 1,241.98 pts ending at 108,696.35. While the KSE All share index plunged by 407.38 pts closing at 43,382.43.

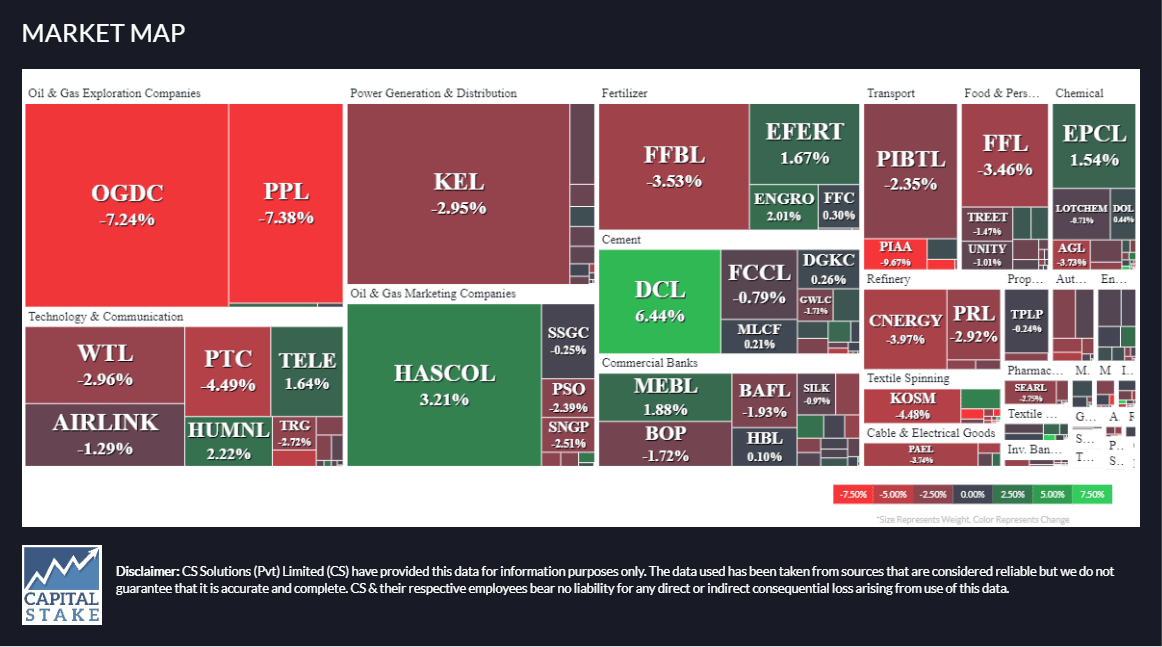

Overall market volume dropped from 479.76 mn shares in the last session to 460.17 mn shares. Out of the total scrips traded, 63.12% belonged to KSE 100 scrips. Top contributors in terms of volume traded were, Oil and Gas Development Company Limited (OGDC -7.24%), K-Electric Limited (KEL -2.95%) and Hascol Petroleum Limited (HASCOL +3.21%). The scrips had 49.68 mn shares, 48.97 mn shares 38.81 mn shares exchanged, respectively.

Sectors dragging the benchmark KSE 100 index downwards included, Oil and Gas Exploration sector (-367.27 pts), Technology and Communication sector (-61.07 pts) and Power Generation and Distribution sector (-56.78 pts). Company-wise, Oil and Gas Development Company Limited (OGDC -206.92 pts), Pakistan Petroleum Limited (PPL -191.13 pts), and Bank Al Habib Limited (BAHL -43.67 pts), were top point snatchers.

The Technology and Communication sector lost 1.74% in its cumulative market capitalization. Systems Limited (SYS -0.94%), Pakistan Telecommunication Company Limited (PTC -5.68%), TRG Pakistan Limited (TRG -2.54%) and Air Link Communication Limited (AIRLINK -1.61%), all closed in red.

Values as at 04:13 PM