- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Slow Start to the Week - PSX Ends Day Flat!

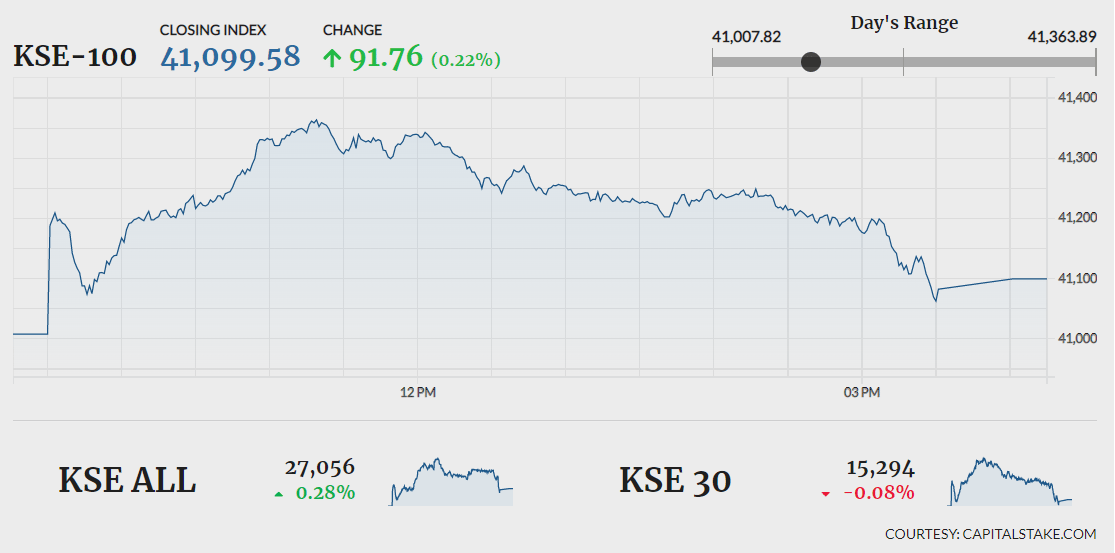

The Pakistan Stock Exchange (PSX) ended first session after the Eid holidays flat. Indices accumulated gains all day long but failed to hold on to gains at the end. While volumes rose from last close. Equity markets around the globe showed negative trend. WTI crude oil price rose by 0.13% to $77.17. While Brent crude oil price was down by 0.16% to $80.47. (As at 3:58 PM PST, Source: Investing.com).

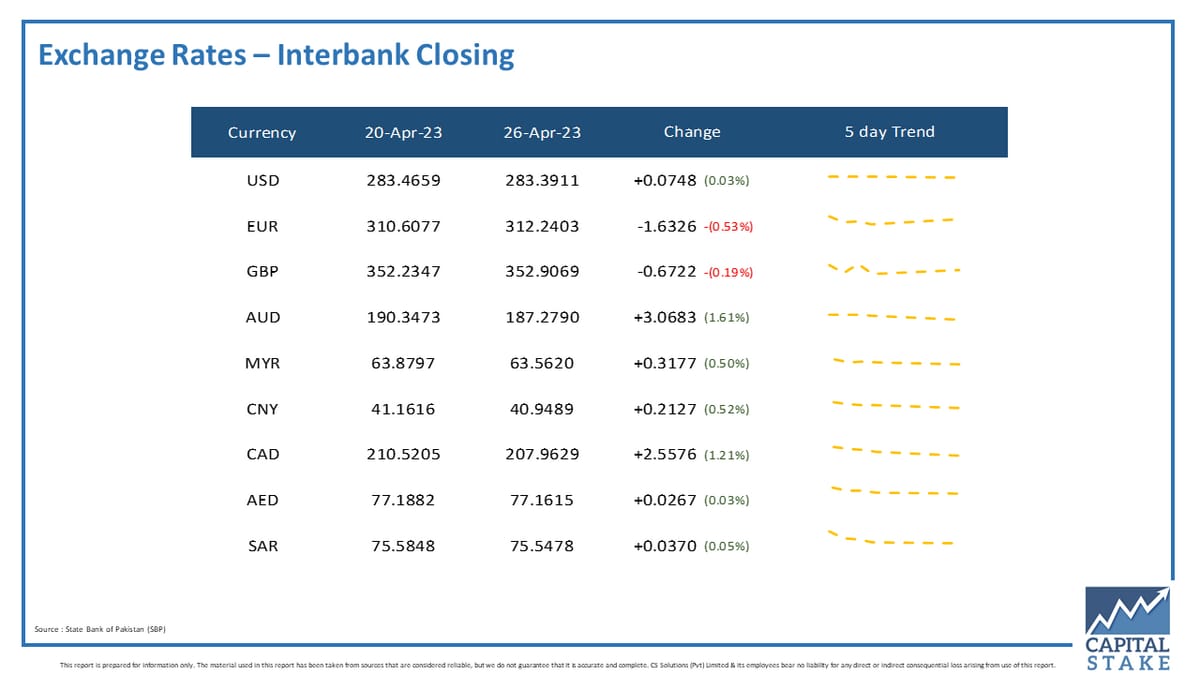

On the economic front, as per data released by the State Bank of Pakistan (SBP) the Pakistani Rupee gained PKR 0.0748/USD (+0.03%) against the US Dollar on DoD basis ending the session at PKR 283.3911/US$.

Trading shall remain suspended from April 21 till April 25, 2023 on account of Eid-ul-Fitr Holidays. From everyone at Capital Stake wishing you and your family a very happy Eid.

The benchmark KSE 100 index gathered 356.07 pts during the day recording intraday high of 41,363.89. Momentum eased particularly during the last half hour of trade and it settled flat by positive 91.76 pts at 41,099.58. The KMI 30 index lost 106.11 pts closing at 71,512.33. While the KSE All share index went up by 74.91 pts settling at 27,055.58.

Overall market volumes appreciated from 172.38 mn shares in the previous session to 186.56 mn shares. Pakistan Refinery Limited (PRL 5.18%), Fauji Foods Limited (FFL +0.32%) and Worldcall Telecom Limited (WTL +0.00%) topped the volume chart. The scrips had 16.01 mn shares, 13.69 mn shares and 10.38 mn shares exchanged respectively.

Sectors lifting the benchmark KSE 100 index higher included, Banking sector (55.98 pts), Investment Banking sector (42.43 pts) and Technology and Communication sector (13.92 pts). Company-wise, United Bank Limited (UBL 43.78 pts), Dawood Hercules Corporation Limited (DAWH 43.48 pts), and Bank Al Habib Limited (BAHL 31.60 pts), were top points contributors.

The Refinery sector gained 1.99% in its cumulative market capitalization. Cynergyico PK Limited (CNERGY 3.19%), Attock Refinery Limited (ATRL 1.79%), National Refinery Limited (NRL 0.73%) and Pakistan Refinery Limited (PRL 5.18%), all closed positive.

Indus Motor Company Limited (INDU +2.63%) released its financial results for 3Q2023. Sales declined by 29.35% YoY. Finance cost surged from Rs 17.12 mn in SPLY to Rs 40.81 mn. EPS fell from Rs 65.11 in SPLY to Rs 40.92.

Values as at 04:13 PM PST