- Pulse by Capital Stake

- Posts

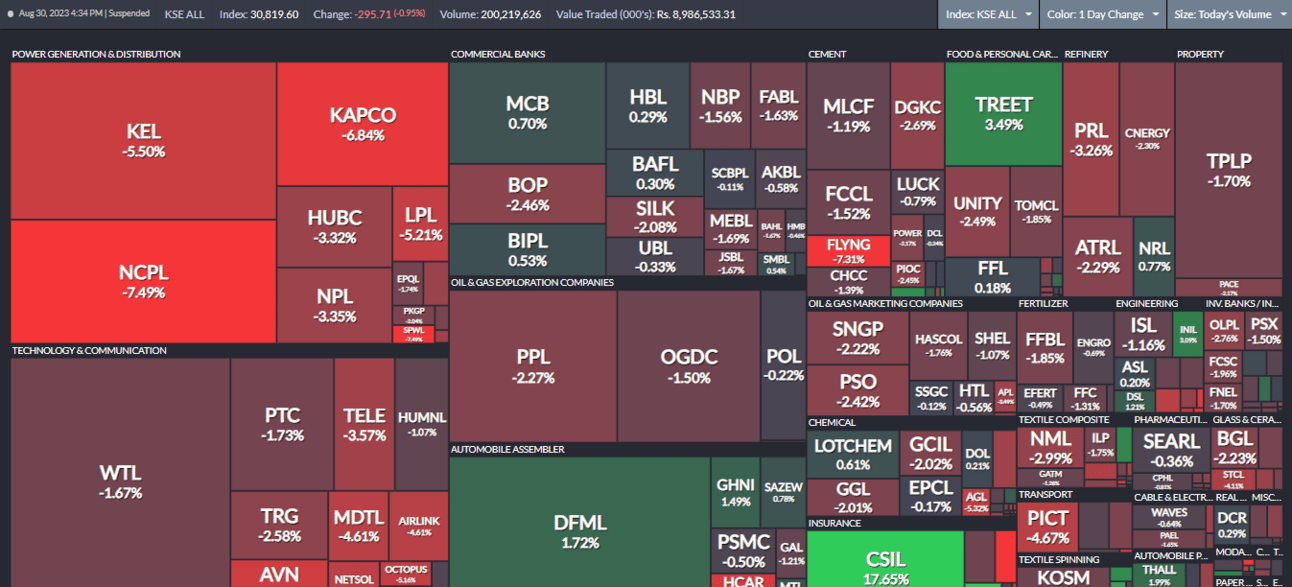

- DAILY MARKET WRAP

DAILY MARKET WRAP

Negative Trend Continues at PSX!

The Pakistan Stock Exchange (PSX) fell further into the red zone for the third consecutive session. Indices slipped lower and lower for most part of the day while volumes dried up from last close. As per analysts, bears ran amok as the Pakistani rupee reached new lows along with circulating rumors of an anticipated interest rate hike.

Equity markets around the globe showed mixed trend. Crude oil prices moved north with WTI crude oil price rising by 0.65% to $81.69. While Brent crude oil price was up by 0.53% to $85.36. (As at 3:59 PM PST, Source: Investing.com).

The benchmark KSE 100 index clenched 87.47 pts recording day’s high of 46,857.88. Losing grip of the minor gains, it dropped to day’s low of 46,101.34 with a loss of 669.08 pts. The index settled lower by 525.86 pts at 46,244.56. The KMI 30 index fell by 1,125.21 pts ending the session at 76,930.44. While the KSE All share index was down by 295.71 pts closing at 30,819.60.

Market volumes dwindled down to 200.14 mn shares from 216.31 mn shares in the previous session. Worldcall Telecom Limited (WTL -1.67%) continued to lead the volume chart with 16.26 mn shares exchanged. Followed by K-Electric Limited (KEL -5.50%) and Dewan Farooque Motors Limited (DFML +1.10%). The scrips had 12.42 mn shares, 12.10 mn shares exchanged, respectively.

Sectors contributing negatively to the benchmark KSE 100 index included, Power Generation and Distribution sector (-111.23 pts), Oil and Gas Exploration sector (-90.40 pts) and Fertilizer sector (-52.87 pts). Companies leading the index south included, The Hub Power Company Limited (HUBC -81.14 pts), Dawood Hercules Corporation (DAWH -37.96 pts) and Pakistan Petroleum Limited (PPL -34.43 pts).

The Power Generation and Distribution lost -4.73% in its cumulative market capitalization. The Hub Power Company Limited (HUBC -3.86%), K-Electric Limited (KEL -5.50%), Kot Addu Power Company Limited (KAPCO -7.39%) and Pakgen Power Limited (PKGP -1.78%), all closed negative.

Values as at 04:11 PM PST