- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Bloodbath at PSX!

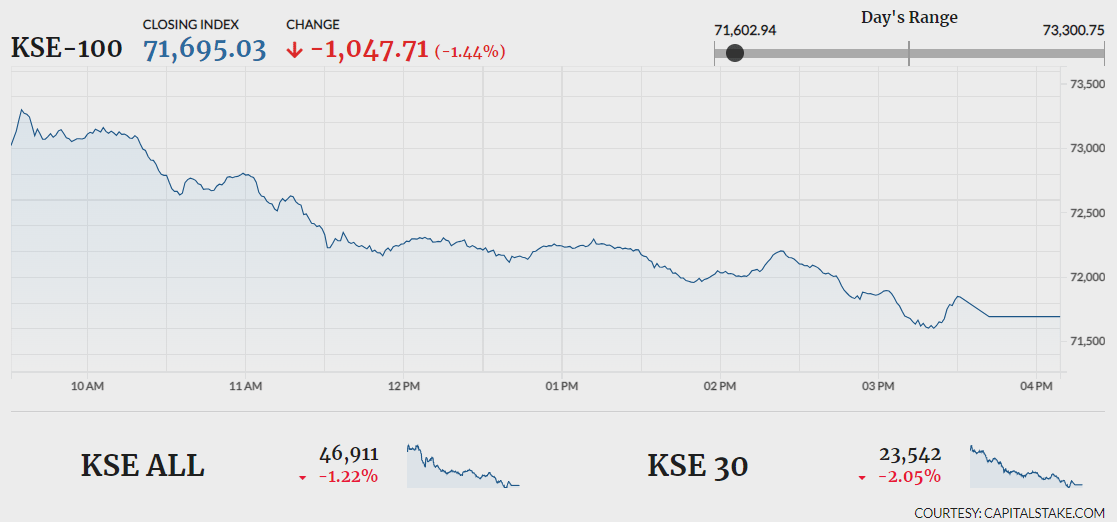

The Pakistan Stock Exchange (PSX) experienced a tumultuous start to the trading week. Following a surge that propelled the benchmark KSE 100 index beyond the 73,000-mark to reach a new all-time high, market momentum faltered significantly, leading to a close in the red. Analysts attributed the downturn to a loss of investor confidence, particularly in anticipation of today's monetary policy meeting.

Global equity markets showed a positive trend. Crude oil prices moved south, with WTI crude oil falling by 0.11% to $83.76 while Brent crude oil was down by 0.18% to $88.05. (As at 3:59 PM PST, Source: Investing.com).

The benchmark KSE 100 index gained 558.01 pts climbing to day’s high of 73,300.75 pts before plunging by 1,139.81 pts and falling to day’s low of 71,602.94. It settled lower by 1,047.71 pts at 71,695.03. The KMI 30 index lost 2,152.22 pts ending the day at 120,262.63. While the KSE All share index shrank by 578.92 pts closing the day at 46,910.55.

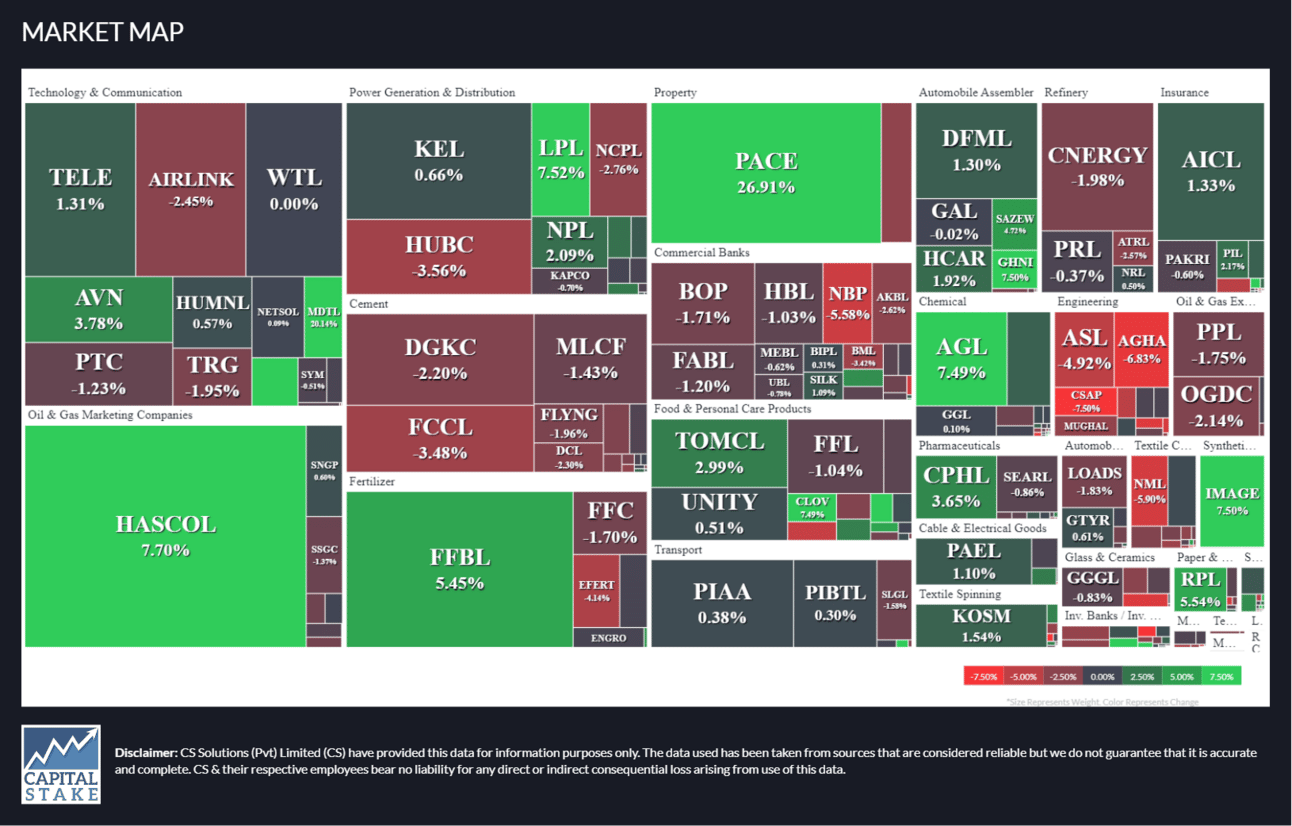

Investor participation grew from 540.78 mn shares in the previous session to 612.85 mn shares. Hascol Petroleum Limited (HASCOL +7.70%), Fauji Fertilizer Bin Qasim Limited (FFBL +5.45%), Pace Pakistan Limited (PACE +26.91%), led the volume chart. The scrips had 60.07 mn shares, 35.17 mn shares, and 32.65 mn shares traded, respectively.

Sectors dragging the benchmark KSE 100 index lower included, Banking sector (-217.41 pts), Fertilizer sector (-167.78 pts) and Power Generation and Distribution sector (-151.64 pts). Company-wise, The Hub Power Company Limited (HUBC -149.95 pts) Engro Fertilizers Limited (EFERT -130.80 pts) and Oil and Gas Development Company Limited (OGDC -59.46 pts), were top negative contributors.

The Cement sector lost 2.03% in its cumulative market capitalization. Lucky Cement Limited (LUCK -1.98%), Maple Leaf Cement Factory Limited (MLCF -1.43%), Kohat Cement Company Limited (KOHC -2.10%) and Fauji Cement Company Limited (FCCL -3.48%), all closed in red.

Oil and Gas Development Company Limited (OGDC -2.14%) announced its financials for 3QFY24. The company reported net sales of Rs.112.79 bn compared to Rs.105.91 bn in SPLY. Finance cost increased from Rs.1.20 bn in 3QFY23 to Rs.1.82 bn. EPS decreased to Rs.11.12 March 2024 compared to Rs.15.03 in March 2023.

Values as at 04:15 PM