- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

DAILY MARKET WRAP

Bears Return to PSX!

Bears dominated the Pakistan Stock Exchange (PSX) reversing initial gains on Wednesday. Although the market began on a positive note, it gradually lost ground as the day went on ultimately ending in the red. Trading activity also dropped. As per analysts, investors engaged in panic selling ahead of the monetary policy meeting tomorrow.

Global equity markets exhibited mixed trends. Crude oil prices moved north, with WTI crude oil prices rising by 2.24% to $67.22. While Brent crude oil price went up by 2.02% to $70.59 (As at 3:48 PM PST, Source: Investing.com).

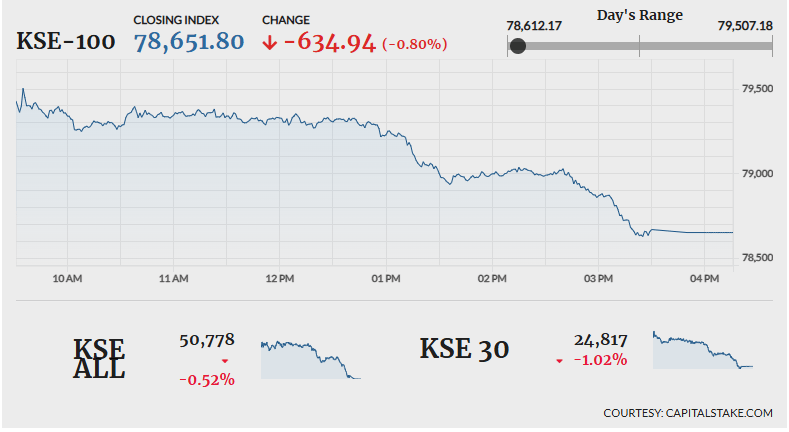

The benchmark KSE 100 index began the day strong, climbing to a high of 78,651.80 with an increase of 220.44 pts. However, the momentum didn’t last long as the index sharply declined to a low of 78,612.17 losing 674.57 pts. By the session’s end, the index closed in the red down 634.94 pts settling at 78,651.80. The KMI 30 index also saw a drop falling 1088.80 pts to close at 124,797.28. While the KSE All Share index lost 264.23 pts finishing at 50,777.65.

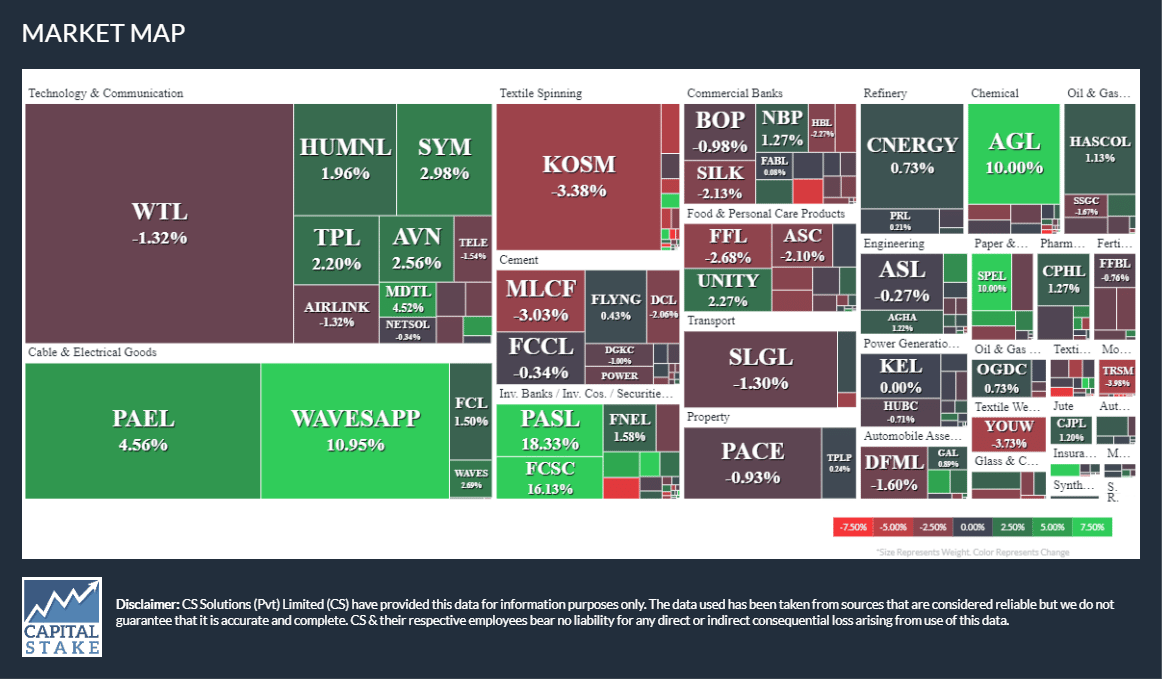

Market volume swelled from 509.38 mn shares in the previous session to 532.59 mn shares. Highest participation was witnessed in Worldcall Telecom Limited (WTL -1.32%), Pak Elektron Limited (PAEL +4.56%) and Waves Home Appliances Limited (WAVESAPP +10.95%). The scrips had 80.93 mn shares, 45.59 mn shares and 34.02 mn shares, traded respectively.

Sectors that pulled the KSE 100 index down included Banking sector (-293.42 pts), Fertilizer sector (-141.36 pts), and Oil and Gas Exploration sector (-72.77 pts). On a company level, Mari Petroleum Company Limited (MARI -71.05 pts), Bank Al Habib Limited (BAHL -64.01 pts), and MCB Bank Limited (MCB -62.39 points) all contributed to the index's downturn.

The Banking sector lost 1.36% in its cumulative market capitalization. Meezan Bank Limited (MEBL -1.92%), United Bank Limited (UBL -0.13%), MCB Bank Limited (MCB -2.11%) and Standard Chartered Bank (Pak) Limited (SCBPL -1.92%) were top negative contributors.

Values as at 04:15