- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Volatile Session Ends Flat!

Investors of the Pakistan Stock Exchange (PSX) witnessed a bumpy session on Thursday. Indices traded in both zones until finally closing flat, while volumes dropped from last close. Equity markets around the globe showed mixed trend. Crude oil prices moved south with WTI crude oil price falling by 0.69% to $67.62. While Brent crude oil price was down by 0.63% to $72.14. (As at 4:05 PM PST, Source: Investing.com).

On the economic front, as per news reports, the State Bank of Pakistan (SBP) allowed credit/debit card payments to be settled through banks, which resulted in decline in USD rate in the open-market.

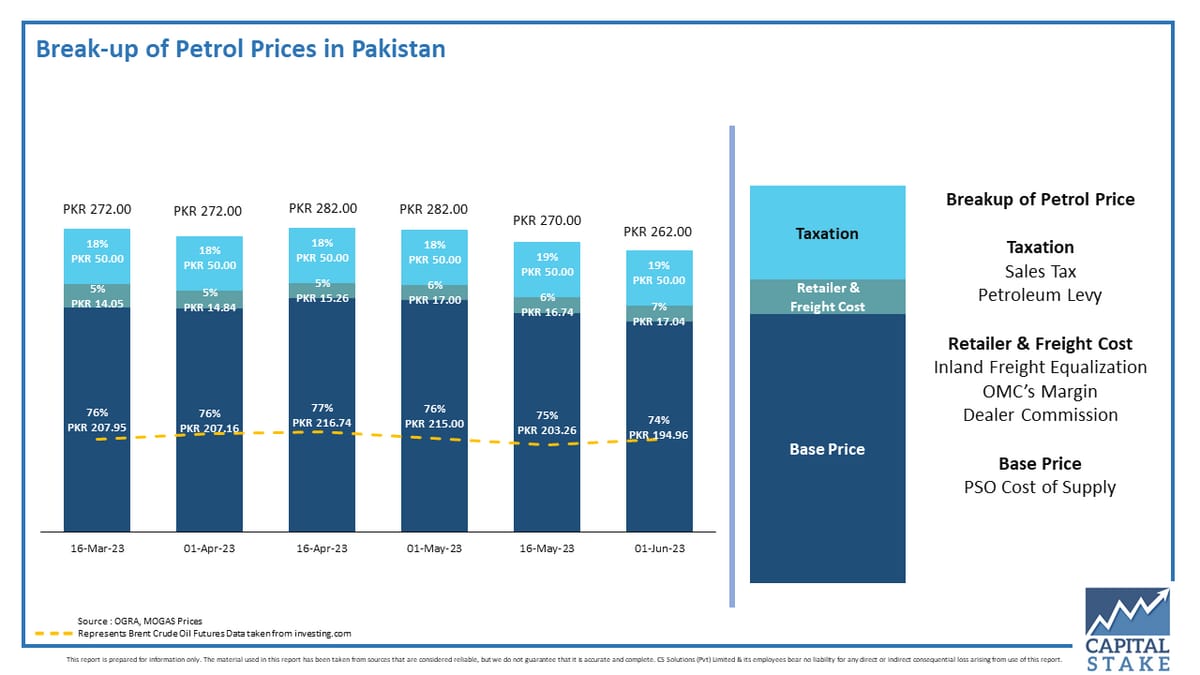

Furthermore, the government of Pakistan has decided to slash petrol prices by Rs 8.00 from PKR 270.00 to PKR 262.00. Base price declined by Rs8.30 to Rs194.96 (74% of total cost). Retailer & Freight Cost up by Rs0.30 to Rs 17.04. While Petroleum Levy & Sales tax remained unchanged at Rs 50.00 and zero, respectively.

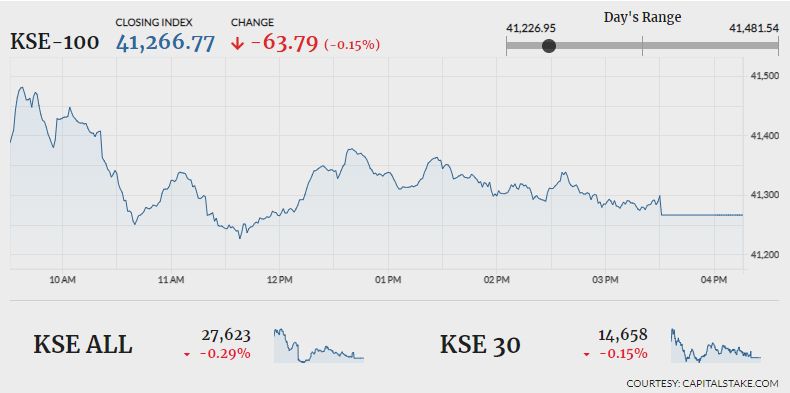

During the day, the benchmark KSE 100 index climbed to day’s high of 41,481.54 (gaining 150.98 pts). It then fell to day’s low of 41,226.95 (losing 103.61 pts). The index settled flat by negative 63.79 pts at 41,266.77. The KMI 30 index fell by 20.84 pts closing at 71,319.12. While the KSE All share index was down by 80.51 pts settling at 27,622.73.

Overall market volumes contracted from 158.09 mn shares in the previous session to 99.83 mn shares. Securing first position on the volume chart was Globe Residency REIT (GRR +0.10%) with 10.81 mn shares exchanged. Followed by Worldcall Telecom (WTL 0.00%) and Cynergyico PK Limited (CNERGY -1.57%). The scrips had 9.75 mn shares and 5.28 mn shares traded, respectively.

Sectors pushing the benchmark KSE 100 index towards the negative zone included, Banking sector (56.29 pts), Food and Personal Care Products sector (26.62 pts) and Textile Composite sector (10.00 pts). Company-wise, Nestle Pakistan Limited (NESTLE 24.86 pts), United Bank Limited (UBL 23.63 pts) and Mari Petroleum Company Limited (MARI 16.57 pts), were top negative contributors.

The Commercial Banks sector lost 0.60% in its cumulative market capitalization. Meezan Bank Limited (MEBL 1.04%), United Bank Limited (UBL 1.32%), MCB Bank Limited (MCB 0.11%) and Habib Bank Limited (HBL 0.94%), all closed in red.

Values as at 04:21 PM PST