- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Bears Take Charge of PSX!

Bears took control of the Pakistan Stock Exchange (PSX) on Thursday. Indices slipped lower and lower for most part of the day while volumes fell from last close. Equity markets around the world showed mixed trend. Crude oil prices moved north with WTI crude oil price rising by 1.30% to $69.16. While Brent crude oil price was up by 1.31% to $74.16. (As at 3:56 PM PST, Source: Investing.com).

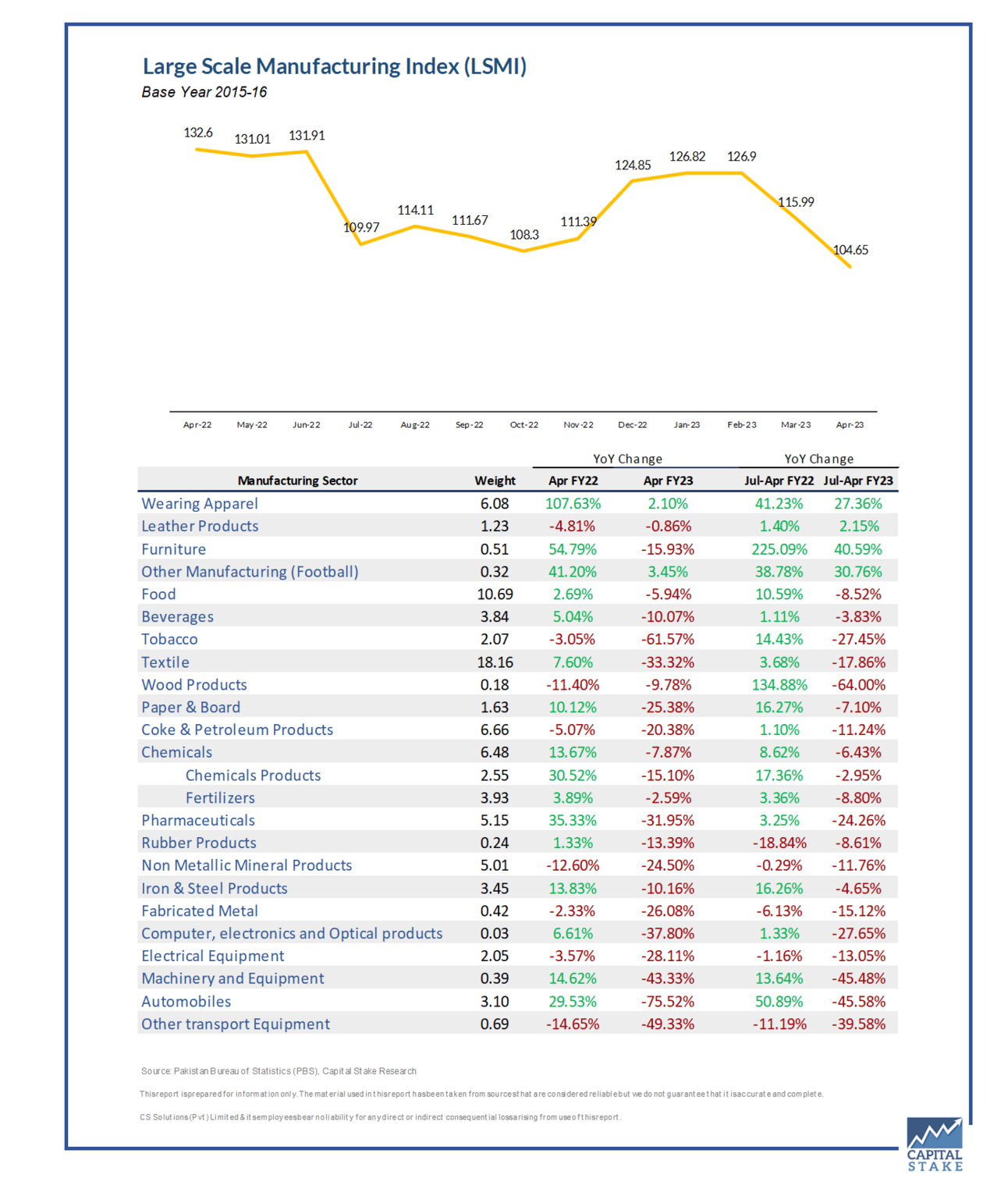

On the economic front, as per data released by the Pakistan Bureau of Statistics (PBS), the large-scale manufacturing index (LSMI) output decreased by 21.09% for Apr’23 compared to SPLY & 9.78% as compared to Mar’23. Overall LSMI declined by 9.39% during Jul-Apr 2023 compared with the SPLY.

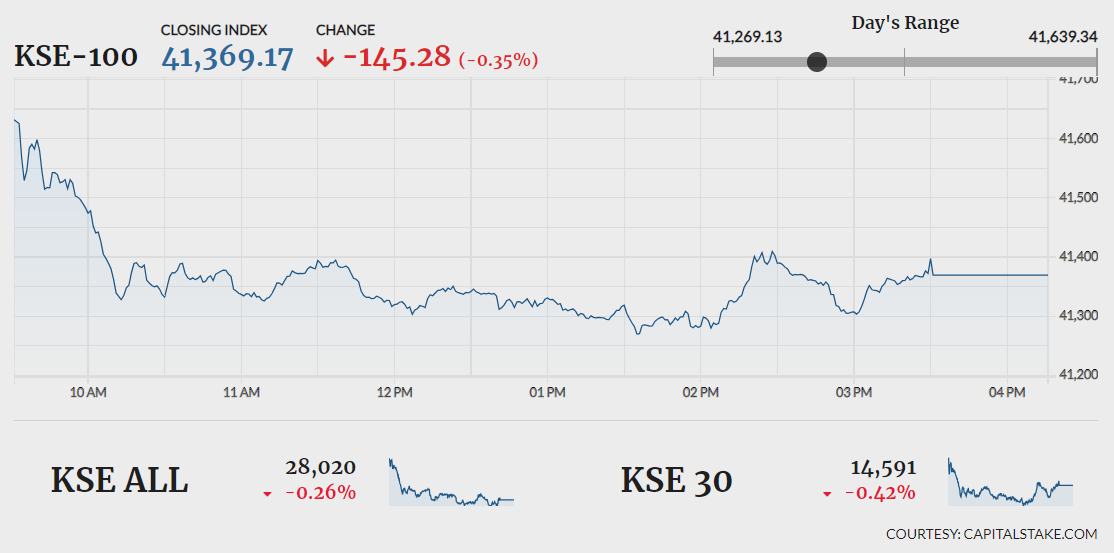

During the day, the benchmark KSE 100 index swayed between intraday high of 41,639.34 (gaining 124.89 pts) and intraday low of 41,269.13 (losing 245.32 pts). It settled lower by 145.28 pts at 41,369.17. The KMI 30 index lost 498.98 pts settling at 71,163.35. While the KSE All share index was down by 73.35 pts at 28,020.37.

Overall market volumes shrank from 179.22 mn shares in the previous session to 149.04 mn shares. Highest participation was witnessed in TPL Properties Limited (TPLP -3.37%), Worldcall Telecom Limited (WTL -0.86%) and Bank Islami Pakistan Limited (BIPL +4.22%). The scrips had 21.69 mn shares, 17.42 mn shares and 9.33 mn shares exchanged, respectively.

Sectors painting the benchmark KSE 100 index in red consisted of Fertilizer sector (58.99 pts), Oil and Gas Exploration sector (42.58 pts) and Cement sector (31.18 pts). Company-wise, Fauji Fertilizer Company Limited (FFC 26.50 pts), Oil and Gas Development Company Limited (OGDC 23.35), Pakistan Petroleum Limited (PPL 21.36 pts), were top negative contributors.

The Oil and Gas Exploration sector lost 0.82% in its cumulative market capitalization. Oil and Gas Development Company Limited (OGDC 1.66%), Pakistan Petroleum Limited (PPL 1.90%) and Pakistan Oilfields Limited (POL 0.08%), all closed in red.

Values as at 04:08 PM PST