- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

PSX Ends Flat Mid-Week!

The Pakistan Stock Exchange (PSX) witnessed dull trading session on Wednesday. Indices traded in red for most part of the day until finally closing flat, while volumes appreciated from previous close. Analyst attributed the downtrend to delay in signing the staff-level agreement with the International Monetary Fund (IMF), as well as, the impending rate hike.

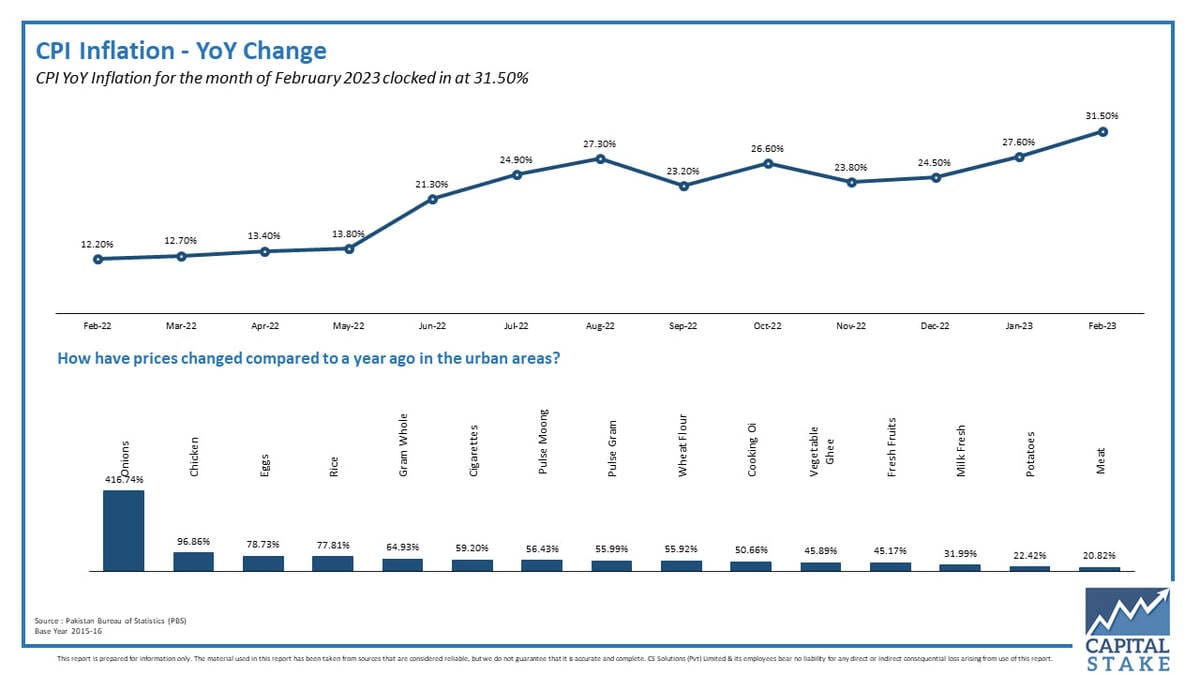

On the economic front, as per data released by the Pakistan Bureau of Statistics (PBS), CPI inflation increased to 31.5% on YoY basis in Feb'23 as compared to an increase of 27.6% in Jan'23 & 12.2% in SPLY. On MoM basis, it increased to 4.3% in Feb'23 as compared to an increase of 2.9% in Jan'23 and an increase of 1.2% in SPLY.

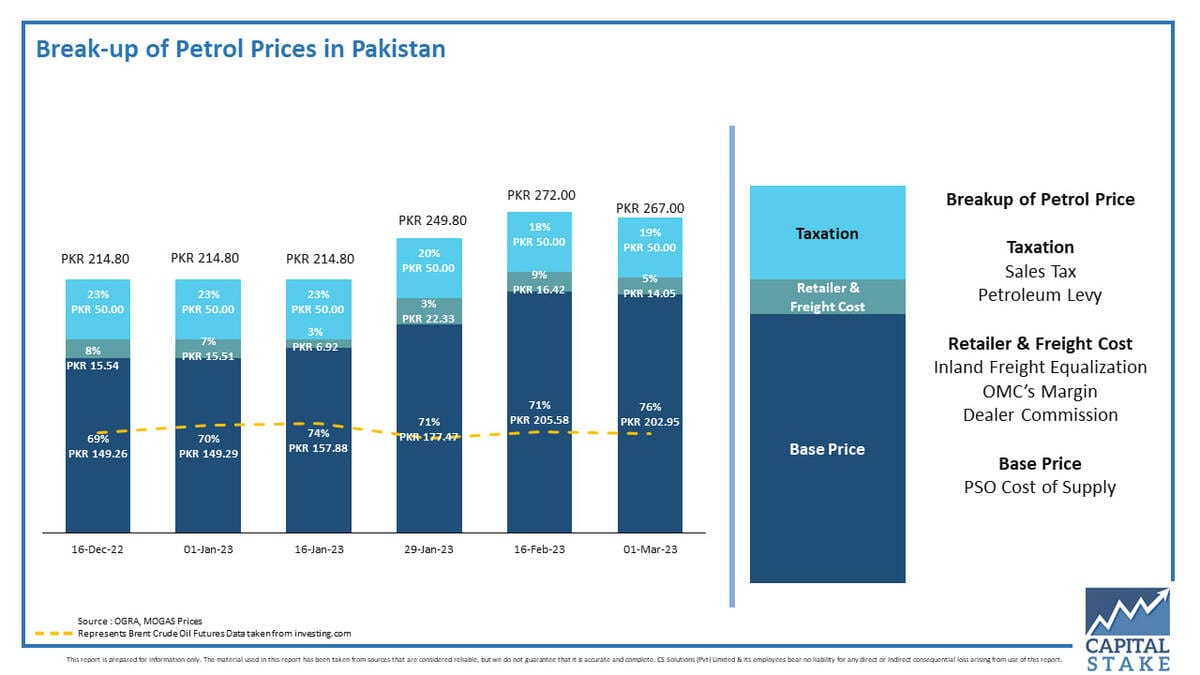

Moreover, as per data released by Oil and Gas Regulatory Authority (OGRA), the Government of Pakistan has decided to slash petrol prices by Rs.5.00 from PKR 272.00 to PKR 267.00. Base price declined by Rs.2.63 to Rs.202.95 (76% of total cost). Retailer and freight cost fell by Rs2.37 to Rs 14.05. While petroleum levy and sales tax remained unchanged at Rs 50.00 and zero, respectively.

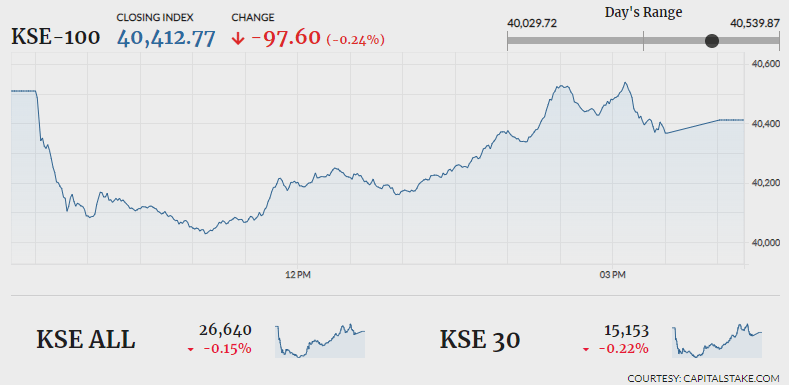

Gaining 29.50 pts the benchmark KSE 100 index recorded intraday high of 40,539.87. Failing to carry forward the positive momentum the index fell to day’s low of 40,029.72 losing 480.65 pts. It settled flat by negative 97.60 pts at 40,412.77. The KMI 30 index dropped by 355.67 pts closing at 68,406.74. While the KSE All Share index lost 40.03 pts settling at 26,639.72.

Overall market volumes went up from 126.25 mn shares in the previous session to 167.01 mn shares. Maintaining first position on the volume chart for the third day in a row was Worldcall Telecom Limited (WTL +1.55%) with 20.21 mn shares traded. Followed by the Hub Power Company Limited (HUBC +0.11%) and Maple Leaf Cement Factory limited (MLCF -2.54%). The scrips had 7.96 m shares and 7.50 mn shares traded, respectively.

Sectors driving the benchmark KSE 100 index south included, Oil and Gas Exploration sector (57.22 pts), Cement sector (36.54 pts) and Banking sector (13.70 pts). Company-wise, Oil and Gas Development Company Limited (OGDC 29.35 pts), Pakistan Petroleum Limited (PPL 17.85 pts) and Lucky Cement Limited (LUCK 16.70 pts), were top negative contributors.

The Cement sector lost 1.36% in its cumulative market capitalization. Lucky Cement Limited (LUCK 1.39%), Kohat Cement Company Limited (KOHC 0.93%), Fauji Cement Company Limited (FCCL 1.20%) and Maple Leaf Cement Factory Limited (MLCF 2.54%), all closed in red.

Values as at 04:13 PM PST