- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Bloodbath Continues at PSX!

Continuing its decline from previous session, the Pakistan Stock Exchange (PSX) ended the day on Tuesday in red. Indices fluctuated significantly while investor participation dwindled compared to prior session. As per analysts, news regarding the IMF's release of $1.1bn loan tranche failed to excited investors as they were fixated on the unchanged policy rate.

Global equity markets showed a mixed trend. Crude oil prices moved north, with WTI crude oil rising by 0.45% to $83.00 while Brent crude oil was up by 0.46% to $87.60. (As at 3:58 PM PST, Source: Investing.com).

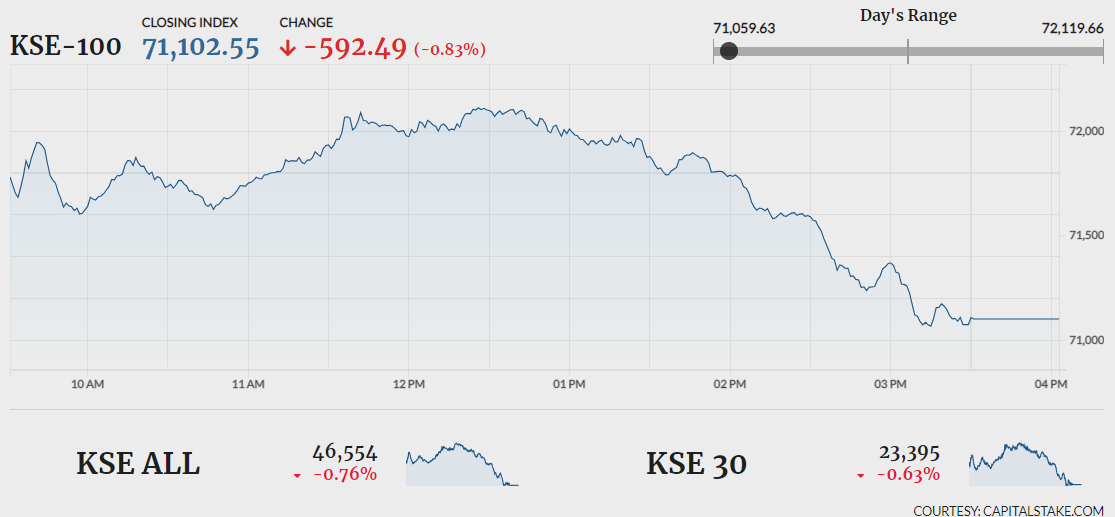

Initially, the benchmark KSE 100 index accumulated 424.62 pts jumping to day’s high of 72,119.66. It then lost 592.49 pts and dropped to day’s low of 71,102.55. It settled lower by 592.49 pts at 71,102.55. The KMI 30 index plunged by 817.83 pts ending the day at 119,444.80. While the KSE All share index shed 356.31 pts closing the day at 46,554.24.

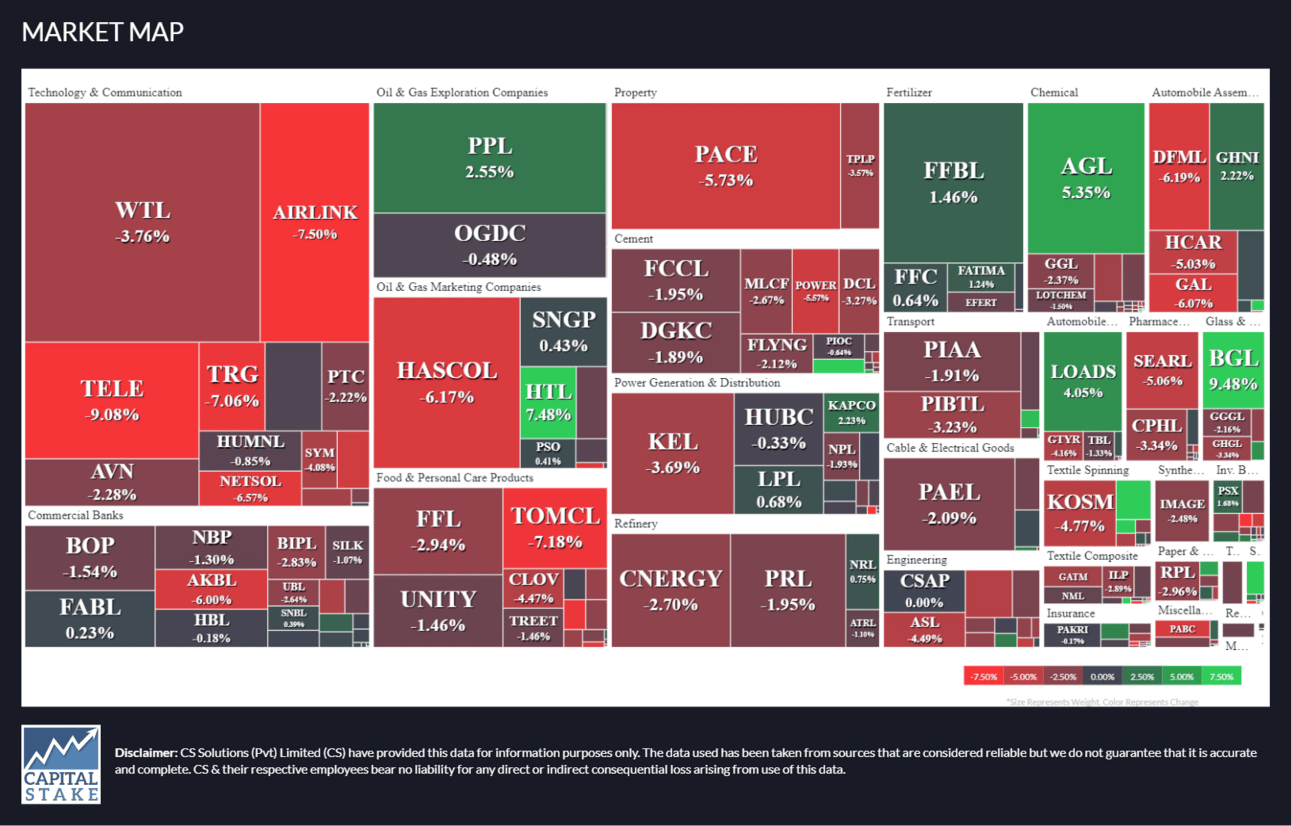

Investor participation witnessed a decrease from 612.85 mn shares in the previous session to 560.30 mn shares. Worldcall Telecom Limited (WTL -3.76%), Pace Pakistan Limited (PACE -5.73%) and Pakistan Petroleum Limited (PPL +2.55%), topped the volume chart. The scrips had 60.07 mn shares, 35.17 mn shares, and 32.65 mn shares traded, respectively.

Sectors contributing negatively to the benchmark KSE 100 index included, Technology and Communication sector (-152.59 pts), Banking sector (-109.43 pts) and Cement sector (-85.35 pts). Company-wise, Systems Limited (SYS -82.85 pts) United Bank Limited (UBL -80.87 pts) and TRG Pakistan Limited (TRG -58.36 pts), led the index south.

The Technology and Communication sector lost 4.30% in its cumulative market capitalization. Systems Limited (SYS -3.75%), Pakistan Telecommunication Company Limited (PTC -2.22%), TRG Pakistan Limited (TRG -7.06%) and Air Link Communication Limited (AIRLINK -7.50%) all closed in red.

NetSol Technologies Limited (NETSOL -7.50%) announced its financials for 3QFY24. The company reported net sales of Rs.2.25 bn compared to Rs.2.08 bn in SPLY. Finance cost increased from Rs.47.40 mn in 3QFY23 to Rs.78.05 mn. EPS decreased to Rs.0.73 March 2024 compared to Rs.15.98 in March 2023.

Values as at 04:12 PM