- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

DAILY MARKET WRAP

PSX Continues to Shine - KSE 100 Gains 900 Pts!

The Pakistan Stock Exchange (PSX) continued its upward trajectory from the previous session, with the KSE-100 index reaching new peaks mid-week. The indices maintained positive momentum throughout the day, and trading volumes decreased from the prior session. As per analysts, this rise to the recent improvements in economic indicators.

Equity markets around the globe showed mixed trends. Crude oil prices declined, with WTI crude dropped by 1.37% to $69.00. While the Brent crude slipped 1.36% to $72.70. (As of 3:49 PM PST, Source: Investing.com).

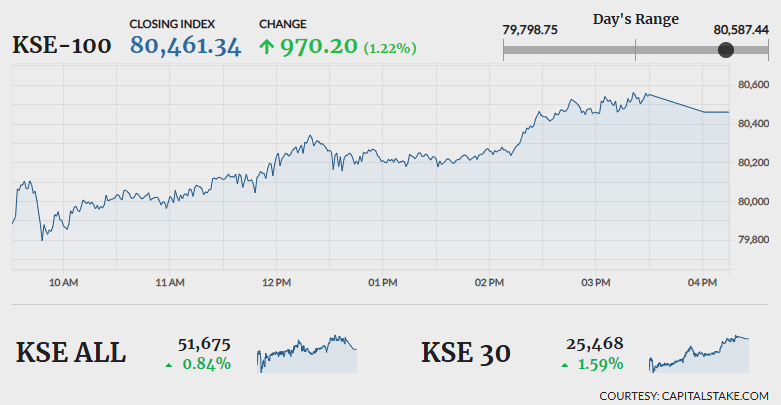

The KSE-100 index surged to a high of 80,587.44 achieving a notable increase of 1,096.30 pts, and concluded the day at 80,461.34 up by 970.20 pts. The KMI 30 index experienced a substantial gain climbing 2,201.71 pts to close at 128,473.48. Additionally, the KSE All Share index rose by 431.96 pts ending at 51,675.01.

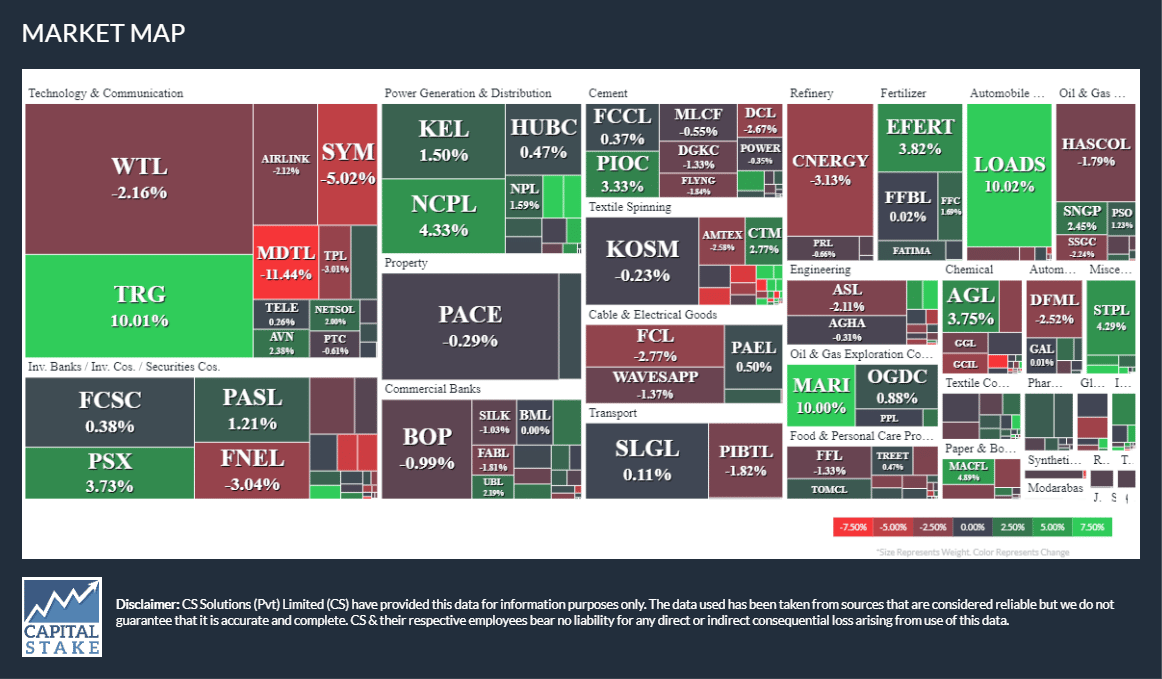

The total trading volume went down from 535.85 mn shares in the previous session to 396.42 mn shares. Worldcall Telecom Limited (WTL -2.16%) was the most traded stock, with 32.23 mn shares traded. It was followed by TRG Pakistan Limited (TRG +10.01%) and Pace Pakistan Limited (PACE -0.29%), which had 22.09 mn and 19.65 mn shares traded, respectively.

The benchmark KSE-100 index's gain was driven by strong performances in the Oil and Gas Exploration sector (+407.01 pts), the Fertilizer Sector (+207.77 pts) and the Banking Sector (+178.13 pts). At the company level, Mari Petroleum Company Limited (MARI +321.92 pts), Engro Fertilizer Limited (EFERT +127.65 pts), and United Bank Limited (UBL +90.60 pts) emerged as the leading contributors to the index's rise.

The Fertilizer sector gained 1.79% in its cumulative market capitalization. The Engro Fertilizers Limited (EFERT +3.82%), Fauji Fertilizer Company Limited (FFC +1.69%), Engro Corporation Limited (ENGRO +0.21%) and Fatima Fertilizer Company Limited (FATIMA +0.83%) all closed in green.

Values as at 04:15