- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Volatile Session Ends Flat!

The Pakistan Stock Exchange (PSX) closed a volatile session on Tuesday flat. Indices swayed both ways in search of a direction while volumes declined from last close. Global equity markets showed positive trend. Crude oil prices moved north with WTI crude oil price rising by 0.74% to $68.32. While Brent crude oil price was up by 0.60% to $74.22. (As at 4:13 PM PST, Source: Investing.com).

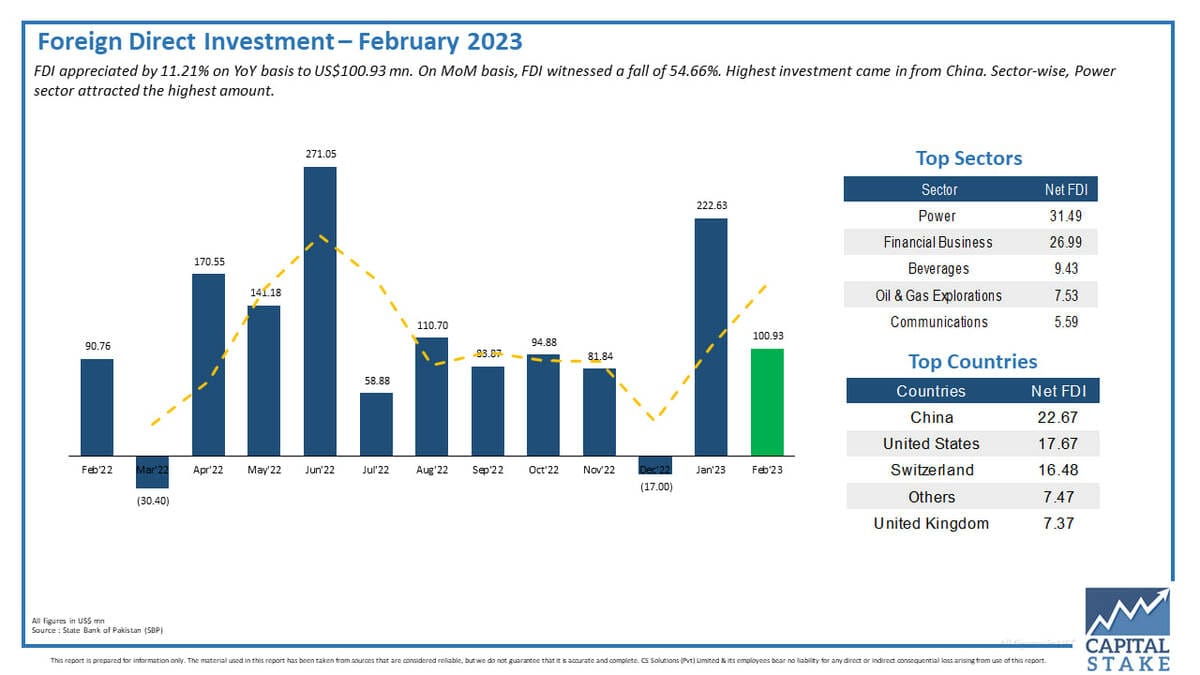

On economic front, according to latest data released by State Bank of Pakistan (SBP), foreign direct investment FDI appreciated by 11.21% on YoY basis to US$100.93 mn. On MoM basis, FDI witnessed a fall of 54.66%. Highest investment came in from China. Sector-wise, Power sector attracted the highest amount.

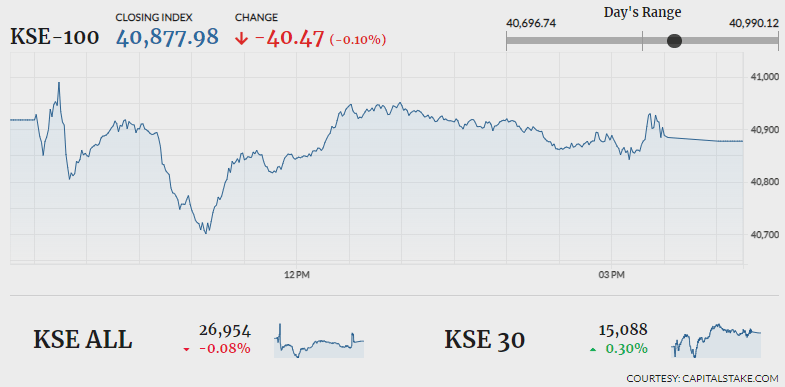

Accumulating 71.67 pts the benchmark KSE 100 index recorded intraday high of 40,990.12. Failing to sustain the gains, it fell to day’s low of 40,696.74 (down by 221.71 pts). The index settled flat by negative 40.47 pts at 40,877.98. The KMI 30 index was up by 214.10 pts closing at 70,588.99. While the KSE All Share index fell short by 21.60 pts ending at 26,953.58.

Overall market volumes fell from 195.35 mn shares in last session to 142.52 mn shares. Worldcall Telecom Limited (WTL +0.83%), Cynergyico PK Limited (CNERGY +2.76%) and Unity Foods limited (UNITY -0.28%) led the volume chart. The scrips had 5.97 mn shares, 4.72 mn shares and 4.69 mn shares traded, respectively.

Sectors driving the benchmark KSE 100 index lower included Miscellaneous sector (55.14 pts), Banking sector (27.37 pts) and Cement sector (18.67 pts). Company-wise, Pakistan Services Limited (PSEL 54.89 pts), Pakistan Tobacco Company Limited (PAKT 17.80 pts) and Packages Limited (PKGS 16.62 pts), were top negative contributors.

The Pharmaceuticals sector lost 0.65% in its total market capitalization. GlaxoSmithKline (Pakistan) Limited (GLAXO -0.97%), The Searle Company Limited (SEARL -1.66%), Haleon Pakistan Limited (HALEON -0.37%) and AGP Limited (AGP 1.39%) all closed in red.

Values as at 04:11 PM PST