- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

PSX Ends Turbulent Session Flat!

The Pakistan Stock Exchange (PSX) closed last session of the week flat. Indices swung in both directions while volumes fell from previous close. Equity markets around the globe showed negative trend. Crude oil prices moved north with WTI crude oil price rising by 0.17% to $71.92. While Brent crude oil price was up by 0.08% to $76.58. (As at 5:06 PM PST, Source: Investing.com).

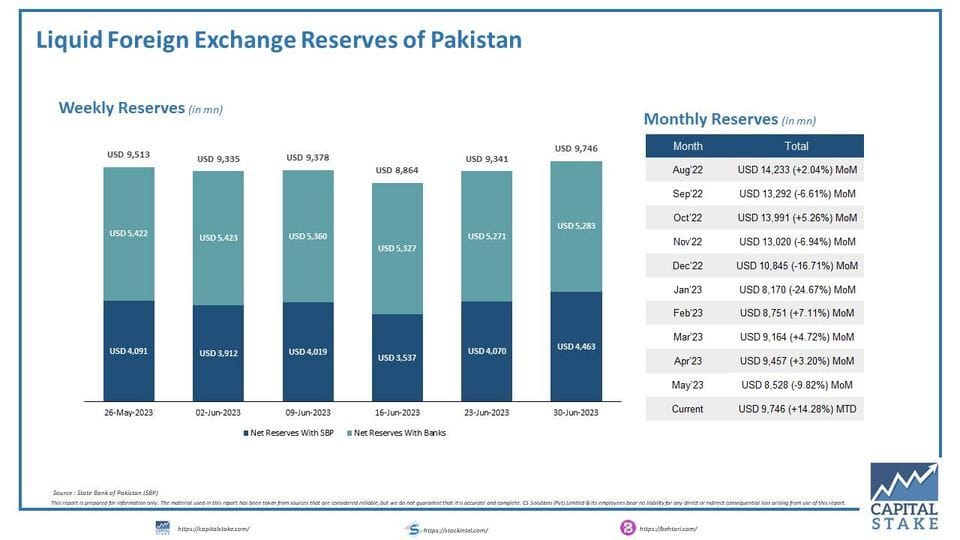

On the economic front, as per data released by the State Bank of Pakistan (SBP), the country’s liquid foreign exchange reserves appreciated by US$405 mn on WoW basis. Net reserves with State Bank of Pakistan up by US$393 mn on weekly basis. While net reserves with Banks increased by US$ 12 mn.

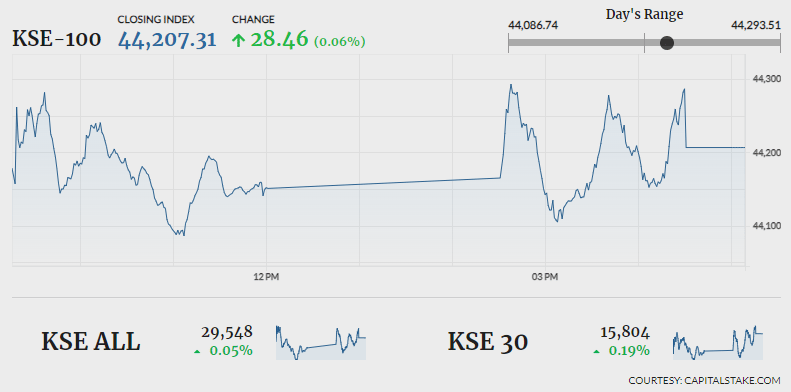

The benchmark KSE 100 index gained 6.65% on WoW basis. During the day, the index oscillated between intraday low of 44,086.74 (losing 92.11 pts) and intraday high of 44,293.51 (gaining 114.66 pts). It settled flat by positive 28.46 pts at 44,207.31. The KMI 30 index lost 190.96 pts closing at 75,592.88. While the KSE All share index climbed up by 15.42 pts ending at 29,547.62.

Overall market volumes reduced in size from 295.75 mn shares in the previous session to 246.16 mn shares. Worldcall Telecom Limited (WTL +3.31%) was the volume leader with 35.46 mn shares exchanged. Followed by Telecard Limited (TELE +5.61%) and TRG Pakistan Limited (TRG +7.50%). The scrips had 19.70 mn shares and 14.64 mn shares exchanged, respectively.

Sectors keeping the benchmark KSE 100 index in the green zone included, Technology and Communication sector (31.15 pts), Food and Personal Care Products sector (4.06 pts) and Miscellaneous sector (3.65 pts). Company-wise, TRG Pakistan Limited (TRG 20.93 pts), Pakistan Oilfields Limited (POL 6.46 pts) and Systems Limited (SYS 5.91 pts), were top positive contributors.

The Refinery sector went up by 1.73% in its cumulative market capitalization. Attock Refinery Limited (ATRL 2.03%), National Refinery Limited (NRL 3.62%) and Pakistan Refinery Limited (PRL 1.86%), all closed in green.

Values as at 05:09 PM PST