- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Volatile Session Ends Flat!

The Pakistan Stock Exchange (PSX) witnessed a day of ups and downs on Wednesday. Indices swung high and low before finally closing flat. Market volumes witnessed a slight uptick from previous close. Analysts attributed the dull trend to lack of fresh triggers.

Equity markets around the globe showed negative trend. Crude oil prices moved south with WTI crude oil price falling by 0.94% to $89.63. While Brent crude oil price was down by 0.94% to $93.45. (As at 3:53 PM PST, Source: Investing.com).

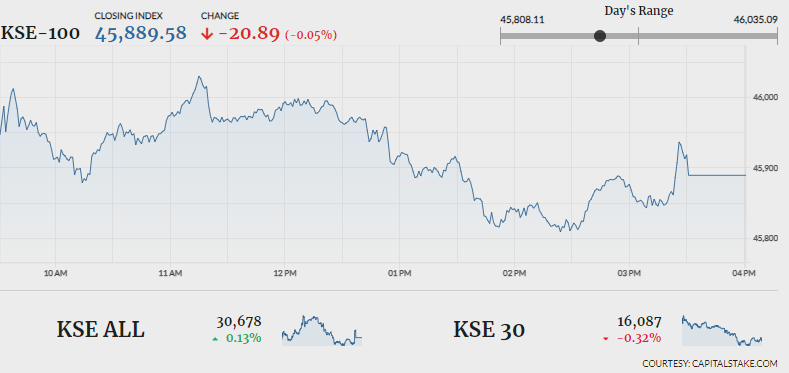

The benchmark KSE 100 index oscillated between intraday high of 46,035.09 (+124.62 pts) and intraday low of 45,808.11 (-102.36 pts). It settled flat by negative 20.89 pts at 45,889.58. The KMI 30 index shed 185.74 pts ending at 77,386.33. While the KSE All share index was up by 38.78 pts closing at 30,678.12.

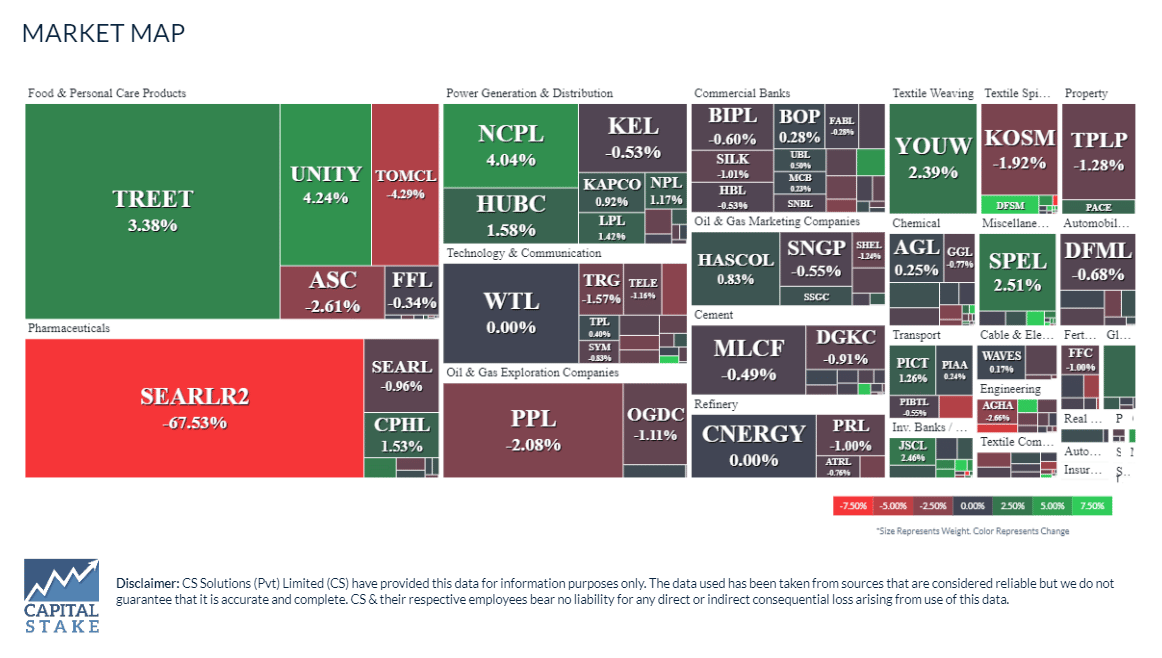

Volumes increased from 117.00 m shares in the previous session to 129.00 mn shares. Highest ranking players on the volume chart were Treet Corporation Limited (TREET +3.38%), Pakistan Petroleum Limited (PPL -2.08%) and Worldcall Telecom Limited (WTL +0.00%). The scrips had 17.80 mn shares, 6.15 mn shares and 4.86 mn shares exchanged, respectively.

Sectors driving the benchmark KSE 100 index south included, Oil and Gas Exploration sector (-51.07 pts), Technology and Communication sector (-38.66 pts) and Fertilizer sector (-32.42 pts). Company-wise, Pakistan Petroleum Limited (PPLP -29.30 pts), Oil and Gas Development Company Limited (HUBC -19.92 pts) and Systems Limited (SYS -19.55 pts), were top negative contributors.

The Oil and Gas Exploration sector fell by 0.85% in its cumulative market capitalization. Oil and Gas Development Company Limited (OGDC -1.12%), Mari Petroleum Company Limited (MARI -0.63%) and Pakistan Petroleum Limited (PPL -1.97%), all closed in red.

Pakistan Petroleum Limited (PPL -1.97%) announced its financials for FY23. The company reported a profit of Rs 97.94 bn in FY23. Sales appreciated 41.68% YoY. Other income surged by 24% YoY. EPS improved from Rs 19.68 in FY22 to Rs 35.99.

Values as at 04:05 PM PST