- Pulse by Capital Stake

- Posts

- DAILY MARKET WRAP

DAILY MARKET WRAP

Winning Streak Snaps!

Bears of the Pakistan Stock Exchange (PSX) put an end to the bull run on first trading session of the week. After an initial surge, indices slipped lower and lower all day long. Volumes decreased slightly compared to previous session. As per analysts, investors yielded to profit-taking, resulting in downward movement of the market.

Global equity markets showed negative trend. Crude oil prices moved south with WTI crude oil price falling by 0.80% to $70.66. While Brent crude oil price was down by 0.69% to $75.32. (As at 3:47 PM PST, Source: Invetsing.com).

Initially, the benchmark KSE 100 index stretched to day’s high of 66,564.04, gaining 340.41 pts. It later plummeted, falling to day’s low of 65,129.00 losing 1,094.63 pts. The settled in the red zone with a loss of 211.31 pts at 66,012.33. The KMI 30 index lost 390.67 pts ending at 110,803.90. While the KSE All share index was down by 165.04 pts closing at 43,716.49.

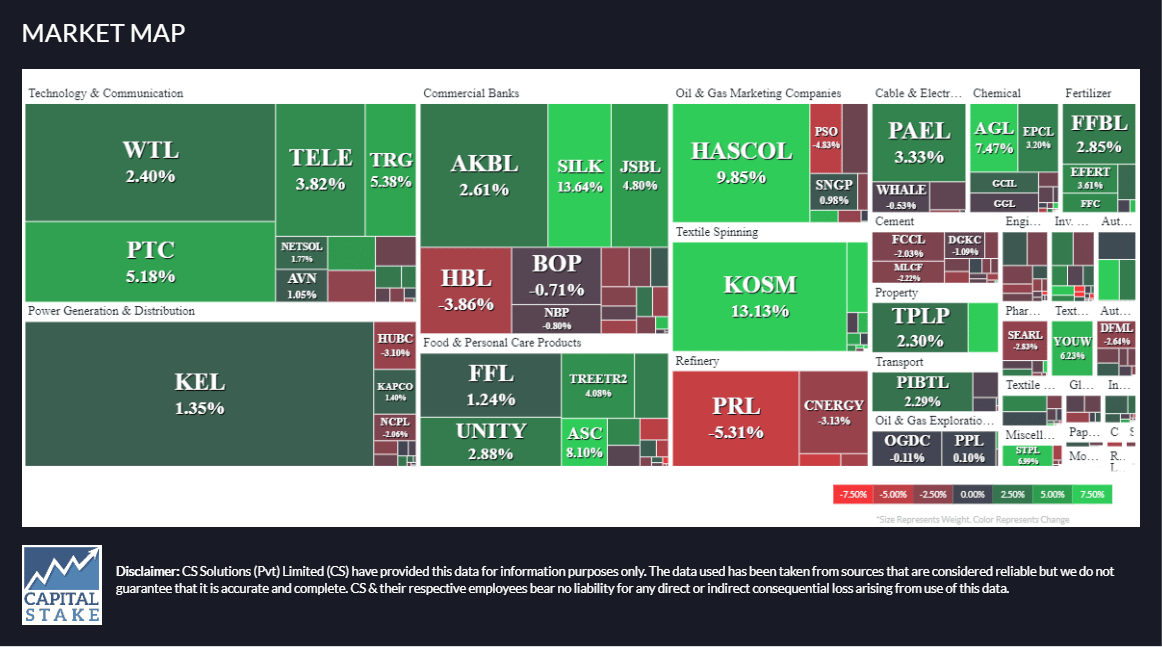

Total volume clocked in at 1.21 bn compared to 1.33 bn shares in the previous session. Total traded value stood at Rs.33.39 bn on Monday. K-Electric Limited (KEL +1.35%), Worldcall Telecom Limited (WTL +2.40%) and Kohinoor Spinning Mills Limited (KOSM +13.13%), were volume leaders of the session. The scrips had 164.64 mn shares, 93.20 mn shares and 65.18 mn shares exchanged, respectively.

Sectors driving the benchmark KSE 100 index south included Banking sector (-254.08 pts), Power Generation and Distribution sector (-100.29 pts) and Oil and Gas Marketing sector (-69.72 pts). Company-wise, The Hub Power Company Limited (HUBC -113.01 pts), Habib Bank Limited (HBL -88.98 pts) and Meezan Bank Limited (MEBL -72.12 pts), were top negative contributors.

The Power Generation and Distribution sector lost 2.10% in its cumulative market capitalization. The Hub Power Company Limited (HUBC -3.23%), Nishat Power Limited (NPL -2.21%), Engro Powergen Qadirpur Limited (EPQL -0.53%) and Nishat Chunain Power Limited (NCPL -2.25%), all closed in red.

Values as at 04:15 PM PST