- Pulse by Capital Stake

- Posts

- Deals 🤝, Tariffs ⚖️ & Power ⚡

Deals 🤝, Tariffs ⚖️ & Power ⚡

Another Week, Another Pulse!

As the pre-Eid holiday vibes set in, we’re bringing you an early Pulse Eidi! Here’s your five-minute rundown of the biggest stories in business, finance, and tech. Let’s dive in! 🚀

The good news keeps rolling in—Pakistan has secured a staff-level agreement with the IMF for a fresh $1.3 billion deal, along with the approval of the first review of its ongoing 37-month bailout program.

Meanwhile, global markets remain active, with Canada hitting back at Trump’s auto tariffs with its own trade measures. Closer to home, Pakistan’s corporate sector is making big moves as Engro Corporation receives approval from the Competition Commission of Pakistan to acquire Deodar (Pvt.) Ltd.—Jazz’s tower subsidiary—in a major $563 million deal.

In other positive developments, teachers across the country can breathe a sigh of relief as the Federal Government reinstates a 25% income tax rebate, easing their financial burden. On the investment front, the Pakistan Stock Exchange (PSX) is strengthening regional ties by signing an MoU with the Colombo and Dhaka stock exchanges. This collaboration aims to enhance market development and foster greater regional cooperation.

Enjoying your reading? We'd love to hear your thoughts! Take just 2 minutes to share your feedback by clicking the link: Pulse Feedback Form.

📅 Key Events to Watch This Week!

🌙 March 31, 2025 – Eid Ul Fitr

Pakistan celebrates Eid Ul Fitr with nationwide holidays, marking the end of Ramadan.

📊 April 1, 2025 – Trade Data Release

Pakistan’s export and import figures for March 2025 will be announced, highlighting trade performance.

📉 April 2, 2025 – T-Bills Auction Results

The State Bank of Pakistan (SBP) will conduct a Treasury Bills auction, indicating market liquidity trends.

📊 April 3, 2025 – Economic Indicators Update

Foreign Exchange Reserves 💰 – SBP will release the latest forex reserves data.

CPI Inflation Rate 📉 – Monthly inflation figures to assess price trends.

Petrol & Diesel Price Revision ⛽ – Government to review and update fuel prices.

📊 April 4, 2025 – Market & Economic Data

Weekly SPI Update 🛒 – Sensitive Price Index (SPI) to track commodity price changes.

Cement Sales Report 🏗️ – Data on cement dispatches, reflecting construction activity.

🏦 April 5, 2025 – Banking Sector Updates

SBP to release key banking indicators, including advances, deposits, and liquidity trends.

📱 April 6, 2025 – Telecom & Tech Insights

Pakistan Telecommunication Authority (PTA) to publish updates on mobile subscriptions and broadband penetration.

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

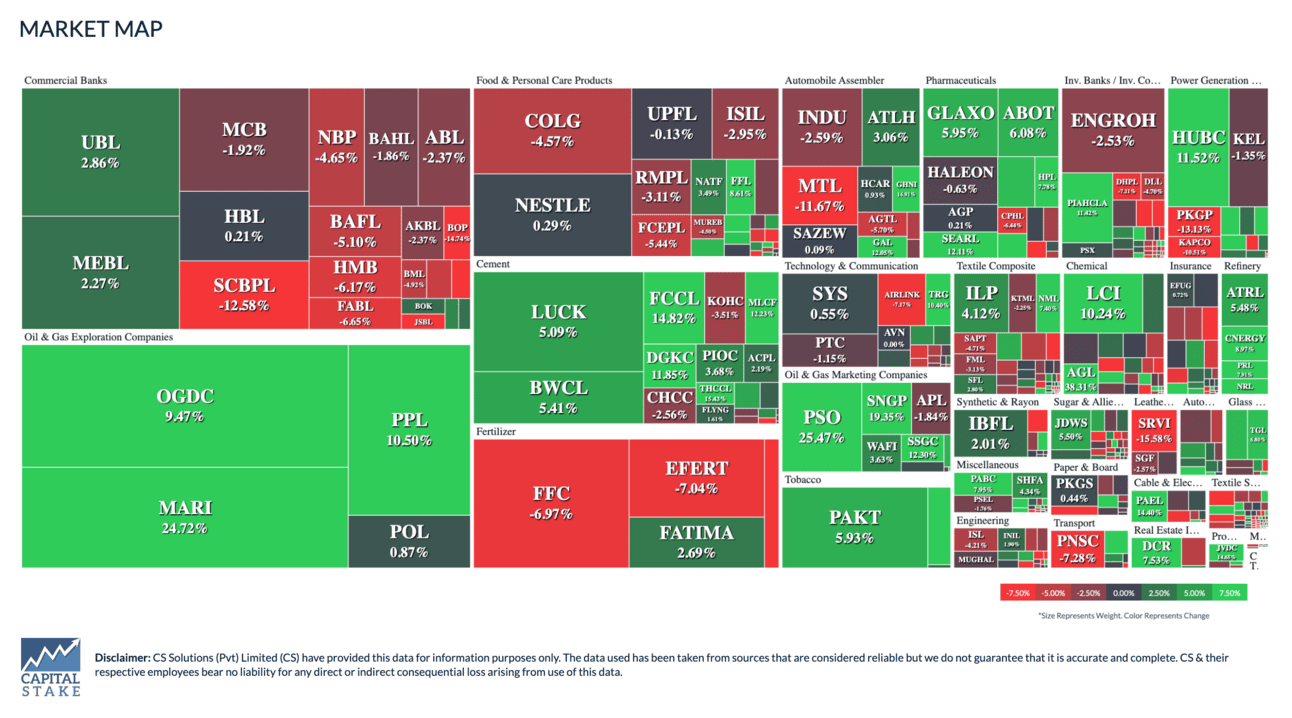

The Pakistan Stock Exchange delivered a strong performance in March 2025, with the benchmark KSE-100 Index closing the month up by 4.02%, gaining 4,555.08 points. The index also reached an all-time high of 118,769.77 during the month. However, on a week-on-week (WoW) basis, the index declined by 0.81% over the four-day trading week.

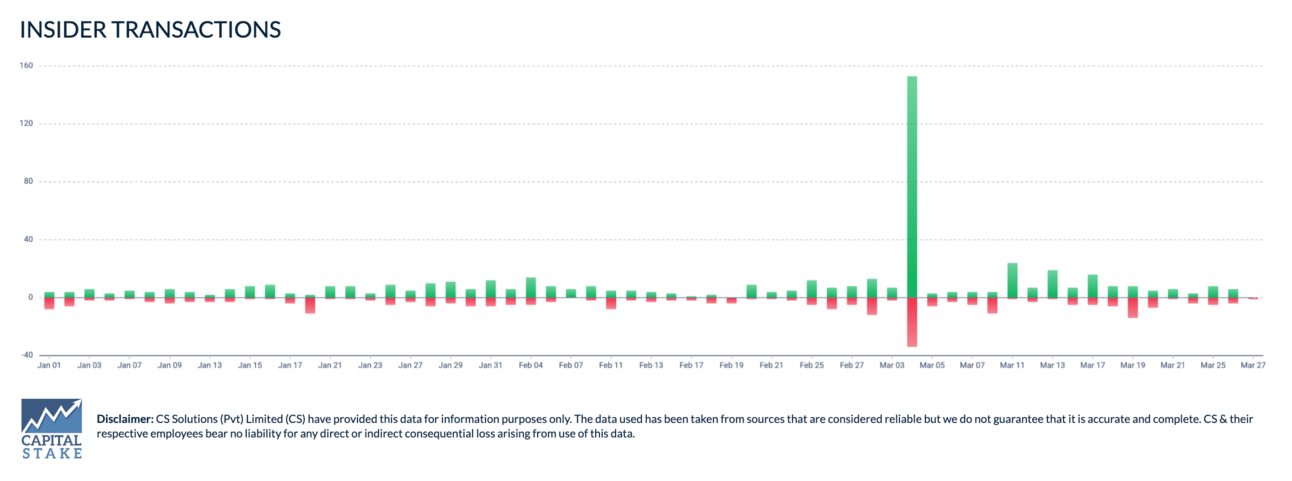

Stay Ahead with StockIntel’s Insider Transactions

Who is buying what, and what’s being sold in the market? Get real-time updates on all insider transactions with StockIntel’s Insider Transactions page. This feature provides a detailed breakdown of each trade, including the insider’s name, transaction type, number of shares, and total amount. Stay informed and gain an edge by tracking insider activity as it happens.

Philip Morris Pakistan to voluntarily delist from PSX, plans buyback

What Happened?

Philip Morris Pakistan, a cigarette manufacturer, has decided to remove itself from the Pakistan Stock Exchange (PSX). It will buy back shares from small investors so that its parent company, Philip Morris International, can take full control. The share price jumped 10% after the news.

Why It Matters

Small investors will get a chance to sell their shares at a good price.

Philip Morris will fully own the company and run it privately.

The stock market loses a big company, which may affect investor confidence.

This could signal a trend of multinational firms preferring private ownership in Pakistan.

Investors will closely watch the buyback price and regulatory approval process.

What’s Next?

Philip Morris will submit its official request to delist, and the price for the buyback will be set based on stock exchange rules. The process will take time as approvals from regulators and shareholders are required.

IMF Ties $1.3 Billion Climate Financing to Pakistan Completing Its Bailout Program

What Happened?

The IMF has tied $1.3 billion in climate financing for Pakistan to the successful completion of its $7 billion bailout program. This means Pakistan can only access the climate funds if it meets the conditions set under the Extended Fund Facility (EFF). The funds will be released in phases, with each six-monthly economic review unlocking both economic support and climate financing.

Why It Matters

Pakistan needs these climate funds to tackle environmental challenges, but it must first stick to strict IMF economic policies to qualify. The IMF Executive Board is expected to approve the funding within the next 4-6 weeks, though delays could occur due to upcoming IMF meetings.

What’s Next?

Pakistan must successfully complete each IMF review over the next 37 months to keep receiving both economic and climate funds. The climate financing program will last for 28 months, making it crucial for the government to maintain economic stability and meet IMF conditions.

IMF allows Rs1/unit cut in power tariff

What Happened?

The IMF has allowed Pakistan to reduce electricity prices by Rs1 per unit, but there’s a catch. The government will fund this relief by charging industries more for the gas they use to generate their own electricity. This means that while households and businesses connected to the national grid will see a slight drop in their electricity bills, industries relying on gas for power will have to pay 23% more for gas.

Why It Matters

This decision offers a small 1.5% reduction in electricity costs, which may provide some relief to consumers struggling with high bills. However, the industries affected by the higher gas charges could see an increase in their production costs. If this happens, they might pass on the extra cost to consumers by raising prices on goods and services, limiting the overall benefit of the electricity price cut. The move also highlights the government’s challenge in balancing IMF conditions while trying to ease inflation for the public.

What’s Next?

While this step slightly reduces electricity costs, it shifts the burden onto industries, which could impact jobs and business growth. The government may have to explore more sustainable solutions to lower energy prices without hurting industrial production. Businesses and consumers will now closely watch how this decision plays out in the coming months.

SBP Buys $5.5Bn from currency market

What Happened?

The State Bank of Pakistan (SBP) bought $5.5 billion from the banking market between June and December. Despite this, the country’s foreign exchange reserves still dropped by over $500 million last week (See Trend 📊) , showing that Pakistan’s dollar reserves remain weak.

Why It Matters

Pakistan is receiving a large amount of foreign currency, including over $35 billion in remittances from overseas Pakistanis this year, along with funds from the IMF, World Bank, and loan rollovers. However, despite this massive inflow, the SBP’s reserves are still not improving, raising concerns about poor management of foreign exchange.

What’s Next?

The government and economic managers will need to better handle these inflows to strengthen reserves. If not managed properly, it could lead to more economic instability despite the country receiving significant foreign currency.

Pakistan to issue 'panda bonds' this year

What Happened?

Pakistan plans to launch its first-ever Panda Bonds—bonds issued in Chinese Yuan—worth $200 million to $250 million this year. The funds raised will be used for climate-related projects. Finance Minister Muhammad Aurangzeb made this announcement while speaking at a forum in China.

Why It Matters

By issuing these bonds, Pakistan is looking to diversify its sources of funding instead of relying only on the US, Europe, and Islamic sukuks (Islamic bonds). This will give the country access to China’s large financial market, which could help raise funds more easily. Additionally, the government is working on a new budget that will increase taxes on real estate, retail, and agriculture to improve revenue collection.

What’s Next?

Pakistan is expected to officially announce the bond issuance soon. The finance minister also hinted at reducing electricity prices, which could bring some relief to businesses and consumers.

Pakistan’s upcoming budget to be shaped by IMF consultations

What Happened?

Pakistan’s 2025-26 budget will be shaped with input from the IMF, as the government holds ongoing discussions with the global lender. An IMF delegation is set to visit Pakistan soon for further talks, with both virtual and in-person meetings taking place until the budget is finalized. The budget will be presented in early June and will follow IMF-recommended economic policies.

Why It Matters

The IMF’s involvement means strict financial policies, which could include tax hikes and spending controls. However, some relief is expected for the real estate sector, as the federal excise duty on the first property sale will be removed, though other taxes will remain unchanged. Additionally, Pakistan’s access to climate-related financial aid depends on following IMF conditions, making compliance crucial for future funding.

What’s Next?

The IMF Executive Board will review and approve the budget’s key measures by late May or June. If Pakistan fails to meet IMF requirements, it could risk losing financial support, making this budget a critical one for the country’s economic future.

Govt Backtracks from Reducing Solar Buyback Rate After Cabinet Says No

What Happened?

The government has postponed its decision to reduce the solar net metering buyback rate after the federal cabinet, led by Prime Minister Shahbaz Sharif, rejected the proposal. The plan aimed to cut the buyback tariff from Rs. 27 per unit to Rs. 8-9 per unit, citing concerns that it was increasing costs for other electricity consumers. However, the cabinet sent the policy back for review, delaying any immediate changes.

Why It Matters

This decision is a relief for solar panel users, who would have earned much less for the electricity they supply to the grid under the new rates. The delay suggests that the government may revise the policy further before making a final decision.

What’s Next?

The Power Division will review the policy, but for now, solar users will continue to receive Rs. 27 per unit. Meanwhile, the cabinet approved lower electricity prices due to falling petroleum costs and sanctioned agreements with bagasse-fired power plants. Additionally, the government introduced the Whistleblower Protection and Vigilance Commission Act, 2025, to improve transparency and accountability, along with tax amendments for Islamabad under a reform program.

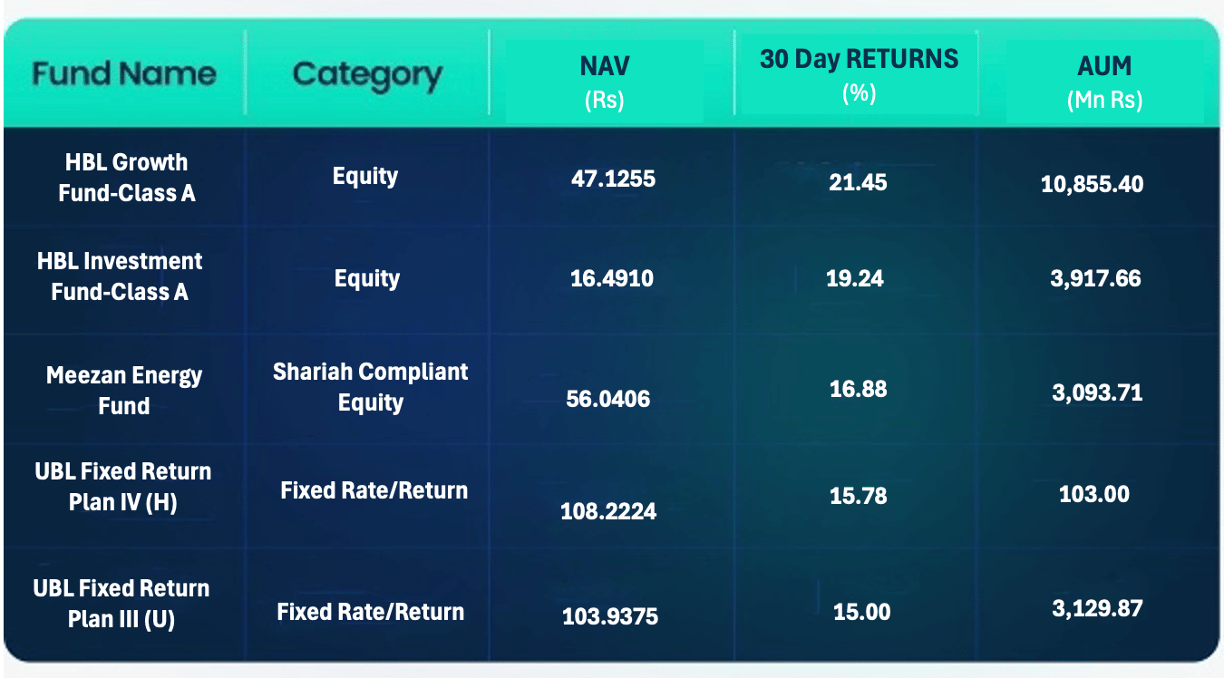

As Pakistani investors navigate the evolving economic landscape, some mutual funds have outperformed others, delivering strong returns over the past month. The following funds have recorded the highest 30-day returns, reflecting investor confidence and strategic asset allocation:

Looking to make the most of your investments? Explore top-performing mutual funds and start investing with ease on the Behtari app today!

🔹 Download for Android: https://shorturl.at/HSNfm

🔹 Download for iOS: https://shorturl.at/J0RUC

📈 Govt Raises Rs. 640 Billion Via T-Bills

The government secured Rs. 640 billion in the latest T-Bill auction, with yields rising by up to 34 basis points as investor participation reached Rs. 1,085 billion.

🚨 Facebook Tightens Monetization Policy in Pakistan

Pakistani content creators face widespread demonetization as Facebook silently updates its monetization policies, impacting earnings from in-stream ads, reels, and other revenue streams.

🥇 Gold Hits Record High in Local and Global Markets

Gold prices surged to historic levels, with per tola gold in Pakistan reaching Rs. 323,380 amid rising demand and international market trends.

There will be no Pulse Edition on Monday as we take a break for the Eid holidays. We’re sharing this edition on Saturday to keep you updated ahead of time. From all of us at Capital Stake, we wish you a joyous and blessed Eid filled with happiness, prosperity, and togetherness. Eid Mubarak! 🌙✨

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan