- Pulse by Capital Stake

- Posts

- Economy 🌍 Energy ⚡ Equity 📊

Economy 🌍 Energy ⚡ Equity 📊

Another Week, Another Pulse!

It’s been a week of big headlines, with money flowing in, policies shifting, and new targets shaping Pakistan’s future. The State Bank of Pakistan kept interest rates steady at 11 percent for 4th meeting in a row but injected nearly ₨12 trillion into banks to ensure there’s enough cash in the financial system. This was one of the biggest cash infusions seen this year.

The federal government announced bold goals for the next three years, aiming to raise economic growth to around 5 percent, expand the economy to over ₨162 trillion, increase exports by 10 billion dollars, and boost remittances to a record 44.8 billion dollars.

Pakistan also received strong international support. The Green Climate Fund approved 250 million dollars to help Pakistan tackle climate change through the Glaciers to Farms program. Kuwait signed a 7 billion rupee loan for the Mohmand Dam, and Saudi Arabia extended a one billion dollar oil facility, rolled over five billion dollars in deposits, and launched a new Economic Cooperation Framework to strengthen trade and investment ties.

At home, challenges remain. The food sector is struggling with unpaid dues and interest costs that have reached 325 billion rupees. The government raised petrol prices again, now 265.45 rupees per liter. The Pakistan Airports Authority announced that all airports will soon become fully cashless, a step toward a more digital economy.

Pakistan also partially reopened the Torkham border to allow Afghan refugees to return home. The Finance Ministry shared a cautious outlook, saying that the country’s debt situation could improve over the next few years, but warned that slow growth, a weaker rupee, and high interest costs could still cause problems.

Here’s your five-minute recap of everything you need to know.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/4tt8sb2h

SoundCloud - https://tinyurl.com/bdw92w94

Spotify- https://tinyurl.com/2mb4y76s

📅 Key Events This Week!

📌 3rd November 2025

📈 CPI Inflation Data Release

📌 4th November 2025

🏗️ Cement Sales Report

📌 6th November 2025

💱 Foreign Exchange Reserves Update

📌 7th November 2025

🛒 Weekly SPI (Sensitive Price Index) Release

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

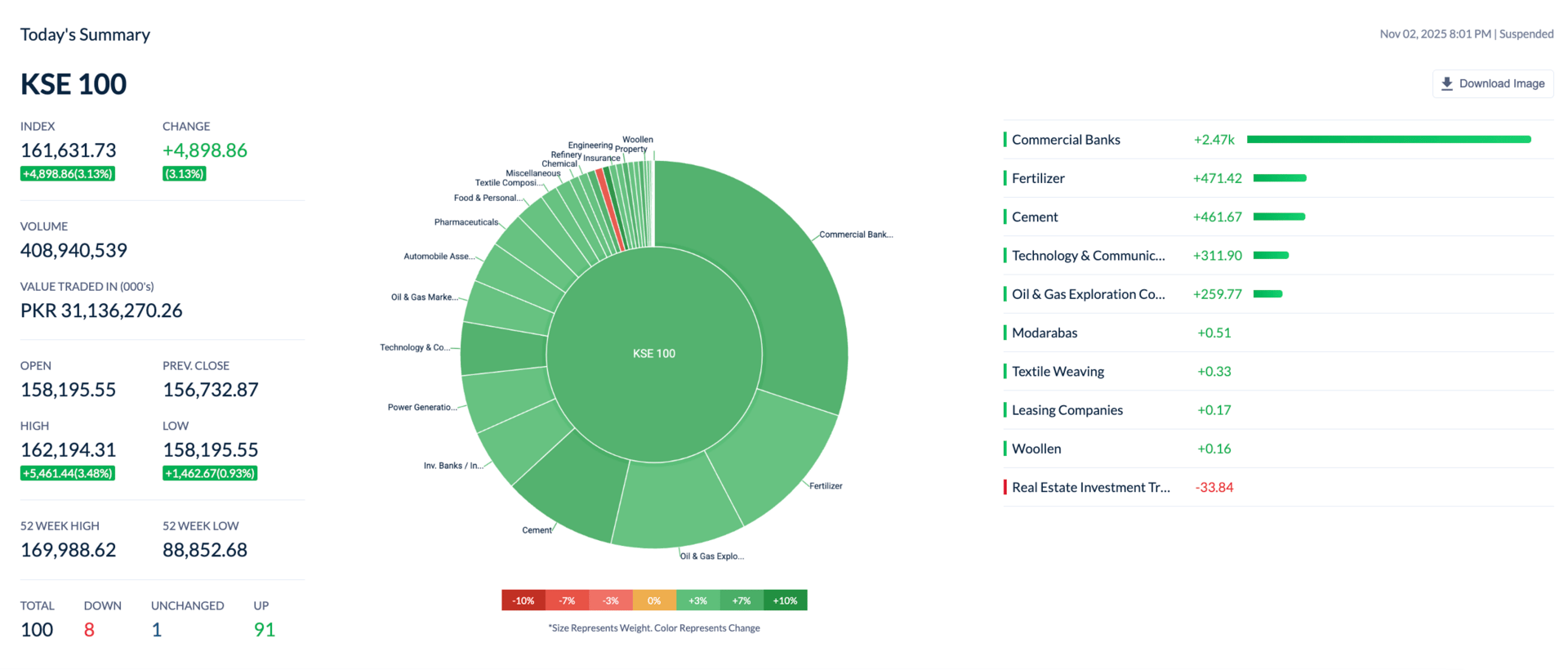

The Pakistan Stock Exchange (PSX) staged a powerful recovery at the end of the outgoing week, with the benchmark KSE-100 index surging 4,899 points, or 3.13%, on Friday to close at 161,632, marking one of its strongest single-day rebounds in recent sessions. On a week-on-week (WoW) basis, the index registered a decline of 1,672 points/ 1.02%.

Cherat, Shirazi withdraw bids of intention to acquire Attock Cement

Cherat Cement (CHCC) and Shirazi Investments have withdrawn their plan to buy an 84 percent stake in Attock Cement, ending months of merger talks that could have created one of Pakistan’s biggest cement groups. The deal’s collapse suggests that the parties could not agree on key terms, likely related to pricing or control. This development means both companies will now continue independently, while investors watch whether Attock Cement attracts a new buyer or remains under its current ownership.

Pakistan Set to Gain Stronger Position in MSCI Frontier Markets Index

Pakistan is expected to strengthen its presence in the MSCI Frontier Markets Index, with Fatima Fertilizer, Askari Bank, and Bank of Punjab likely to be added in the upcoming November 2025 review. If included, Pakistan’s total listed companies in the index will rise to 30, giving the country a slightly higher overall weight. Currently, Pakistan has 27 stocks in the index with a combined share of about 5.4 percent, led by Fauji Fertilizer Company. MSCI will announce the final review on November 5, with changes taking effect on November 25, 2025.

Saudi Arabia to Roll Over $5 Billion Deposits, Extend $1 Billion Oil Facility to Pakistan

Saudi Arabia has reaffirmed its financial support to Pakistan by extending a one billion dollar oil financing facility and rolling over five billion dollars in deposits with the State Bank of Pakistan for another year. The move will help ease Pakistan’s external payment pressures and ensure steady fuel imports. Under the arrangement, Saudi Arabia is already providing oil worth around 100 million dollars each month, while the rolled-over deposits, valued at about 1.45 trillion rupees, will continue to strengthen Pakistan’s foreign exchange reserves and support economic stability.

Govt Planning to Increase Taxes on Mobile Calls, Solar and Cash Withdrawal

The government is preparing a plan to raise taxes on mobile calls, solar panels, and cash withdrawals if revenue targets are missed or expenses exceed limits in the first half of the fiscal year. The move is part of Pakistan’s commitment to the IMF under its $7 billion bailout program. Possible measures include higher income tax on landline and mobile calls, increased withholding tax on bank withdrawals, and a sales tax hike on solar panels from 10 to 18 percent. The government may also extend excise duty to items like biscuits and confectionery. These steps, worth around ₨200 billion, would only be implemented if needed to keep the IMF program on track.

Is Your Fund Manager Playing It Safe or Waiting to Strike? 🧐

We compared the cash positions of all active equity Mutual Funds for September to see how managers are positioning themselves.

A higher cash holding can mean two things:

⚠️ Caution — they believe the market might be overvalued.

💡 Opportunity — they’re waiting to invest when prices pull back.

Viewed alongside returns and AUM, it gives a glimpse into each manager’s sentiment and strategy.

💭 What do you think this shift in cash holdings says about where the market is headed next?

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan