- Pulse by Capital Stake

- Posts

- 🇵🇰 Economy 📈 Markets 🏦 Finance

🇵🇰 Economy 📈 Markets 🏦 Finance

Another Week, Another Pulse!

From ceasefires to extensions, it’s been another eventful week in Pakistan, full of twists, turns, and headlines that kept everyone talking.

The government extended the deadline for filing income tax returns once again, so if you still haven’t filed yours, consider this your lucky reminder! Meanwhile, gold prices continued to climb, but there was some relief at the petrol pump as fuel prices were slashed by Rs. 5.66 per litre for the next 15 days (See Trend).

Not all prices followed suit though. Tomato rates shot up sharply across the country, squeezing household budgets as rates soared well above normal levels (See Data).

On the inflation front, the IMF projected that prices could rise faster next year, expecting inflation to touch 6% compared to 4.5% this year. Adding to that, OGRA announced higher gas prices for both SNGPL and SSGCL consumers starting this month.

But it’s not all gloomy. There’s some good news too. Pakistan and the IMF have reached a staff-level agreement under two major financial programs, a step that signals continued support and stability for the economy. International confidence is also picking up, with Japan’s JBIC joining the Reko Diq financing group, a big boost for the country’s investment outlook.

And while another international airline prepares to launch flights to Pakistan, the country’s deposit levels have hit their lowest among peer economies, a reminder of the challenges that still need attention. Meanwhile, the government and the IMF are exploring new ways to raise revenue, possibly by taxing sectors like solar panels and internet services, after dropping earlier proposals on fertilizers and pesticides.

From prices that climb and fall to policies that shift and shape our economy, it’s been a week that reminds us how quickly things can change and how important it is to stay informed.

Here’s your five-minute reminder of everything you need to know.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/ms99u7c4

SoundCloud - https://tinyurl.com/2dur643e

Spotify- https://tinyurl.com/4kxr73up

📅 Key Events This Week

📌 20th October 2025

💰 Weighted Average Lending & Deposit Rates

🌍 Real Effective Exchange Rates

📈 Summary of Foreign Investment in Pakistan

🚢 Exports & Imports of Goods and Services

⚖️ Balance of Trade

📌 21st October 2025

💸 Repatriation of Profit

📌 23rd October 2025

💱 Foreign Exchange Reserves Update

📌 24th October 2025

🛒 Weekly SPI (Sensitive Price Index) Release

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

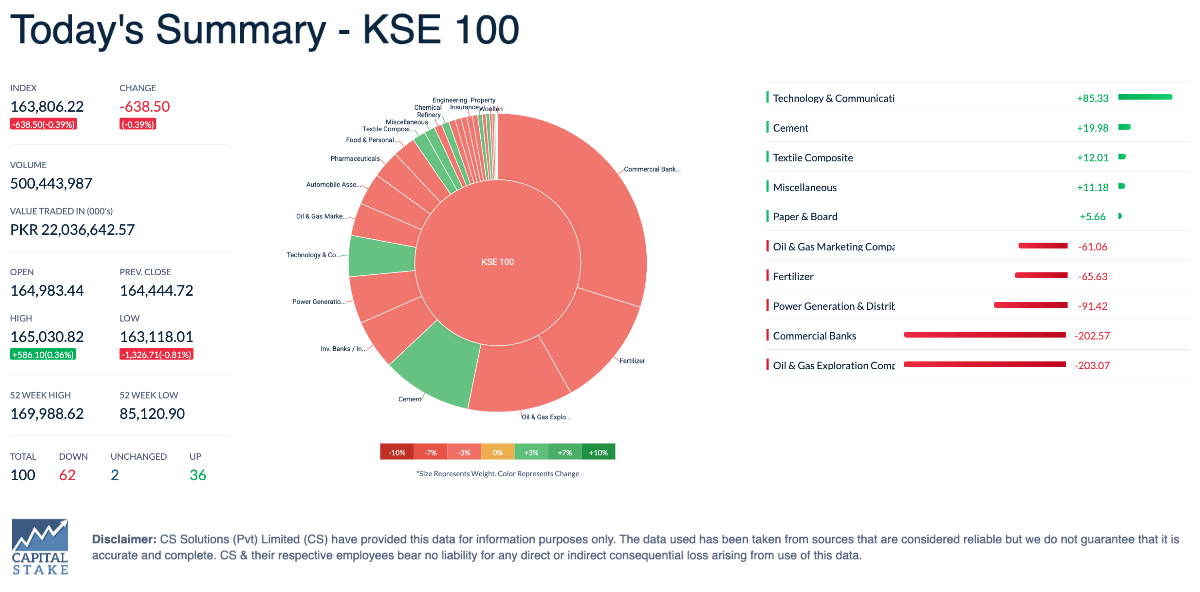

The Pakistan Stock Exchange (PSX) experienced a volatile yet positive week, with the KSE-100 Index rising 0.44% to close at 163,806 points, up 708 points overall. The market initially came under pressure due to profit-taking and geopolitical tensions with Afghanistan but regained strength toward the end of the week as political calm returned. Investor sentiment received a major boost after the IMF Executive Board approved Pakistan’s Staff-Level Agreement under the Extended Fund Facility (EFF) and Resilience and Sustainability Facility (RSF), unlocking around $1.2 billion in funding.

Samba Bank Receives SBP Approval to Become a Full Islamic Bank

Samba Bank (SBL) has received initial approval from the State Bank of Pakistan (SBP) to transition into a fully Shariah-compliant Islamic bank, marking an important milestone in its conversion plan shared earlier this year. The approval signals confidence from the regulator and aligns with Pakistan’s broader shift toward Islamic finance. The move positions Samba Bank to tap into the growing demand for Islamic banking services, with the final phase of conversion expected once all regulatory conditions are met.

Amreli Steels Signs Major Financial Restructuring Agreement with Banking Syndicate

Amreli Steels Limited (ASTL) has signed a Master Restructuring Agreement with a consortium of banks led by Bank Alfalah, with Pak Brunei Investment Company acting as the agent. The deal marks a key step in the company’s efforts to strengthen its financial health and streamline operations. The restructuring is expected to improve liquidity, cash flow, and capacity utilization, while reducing financial and operational costs. The agreement reflects renewed confidence from lenders and sets the stage for more sustainable growth for one of Pakistan’s leading steel manufacturers.

Thatta Cement Acquires 28% Stake in Pakistan Services Ltd, Owner of Pearl Continental Hotels

Thatta Cement Company Limited (THCCL) has acquired a 28% stake in Pakistan Services Limited (PSL), the operator of Pearl Continental Hotels, by purchasing over 9.1 million shares at Rs. 710 each. The move marks Thatta Cement’s entry into the hospitality sector, expanding beyond cement manufacturing and signaling growing corporate interest across industries.

SBP’s New Framework Aims to Protect Bank Customers Across Pakistan

The State Bank of Pakistan (SBP) has introduced the Business Conduct and Fair Treatment of Consumers Regulatory Framework (BC&FRF) to ensure banks and financial institutions deal with customers fairly and transparently. The framework promotes ethical conduct, data protection, and accountability across all stages of customer interaction—from product design to complaint handling. Aligned with SBP’s Vision 2028, the initiative aims to build trust, improve service quality, and create a more inclusive and responsible financial system in Pakistan.

NADRA Issues Landmark Digital ID and Data Exchange Regulations

NADRA has introduced the Digital Identity Regulations 2025 and National Data Exchange Layer (NDEL) Regulations 2025, creating a legal framework for secure digital IDs and data sharing between government and private entities. Supported by the World Bank, the move will enable citizens to verify their identity online and access key services like banking, healthcare, and education — a major step toward a trusted and modern digital ecosystem in Pakistan.

Pakistani Banks Lead the Way in 2024! 🥇

With banks like UBL, NBP, BAFL, BOP, ABL, and HMB ranking among the top 15 best-performing bank stocks of 2024, we took a deeper look to see which of these top performers your favourite equity funds are holding. 📊

Download the Behtari App to explore and invest in your favourite funds today!

👉 Google Play Store: https://tinyurl.com/2f3fdbcc

👉 Apple App Store: https://tinyurl.com/4mxarrb2

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan