- Pulse by Capital Stake

- Posts

- Eid 🌙 Markets 📊 Budget 💰

Eid 🌙 Markets 📊 Budget 💰

Another Week, Another Pulse!

Good morning everyone!

With the spirit of Hajj and Eid ul Adha in the air, Pakistan is gearing up for a festive break, as the government officially announces holidays from June 6th to 9th. While many look forward to the celebrations, the news cycle showed no signs of slowing down. US President Donald Trump announced that Pakistani officials will visit the US next week to negotiate tariffs, as Pakistan faces a possible 29% duty on exports due to a $3 billion trade surplus.

Crude oil prices continued to fall globally, yet the Government of Pakistan decided to increase petrol prices by Rs. 1. A curious move — is it pressure from the IMF, or is there more to the story?

Meanwhile, the Annual Plan Coordination Committee (APCC) is set to hold its pre-budget meeting tomorrow, building anticipation around upcoming economic decisions.

But perhaps the most surprising development came from the IMF. The lender is reportedly unhappy with Pakistan’s decision to allocate 2,000 megawatts of electricity for Bitcoin mining and AI data centers — all without prior consultation under its current bailout terms.

Plenty to reflect on, and even more to keep an eye on. Here’s your quick five-minute recap of the week that was, and what’s just around the corner.

📅 Key Events to Watch This Week!

📅 June 2–6, 2025

🤝 Trade Delegation Visit to the U.S.

⚖️ FATF Grey List Discussions

📅 June 3, 2025

📊 Balance of Trade

📅 June 4–6, 2025

🌐 International Conferences on Technology

📅 June 4, 2025

🏗️ Cement Sales

📅 June 5, 2025

💱 Foreign Exchange Reserves

📅 June 6, 2025

📈 Weekly SPI

📅 June 15, 2025

💸 Worker Remittances

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

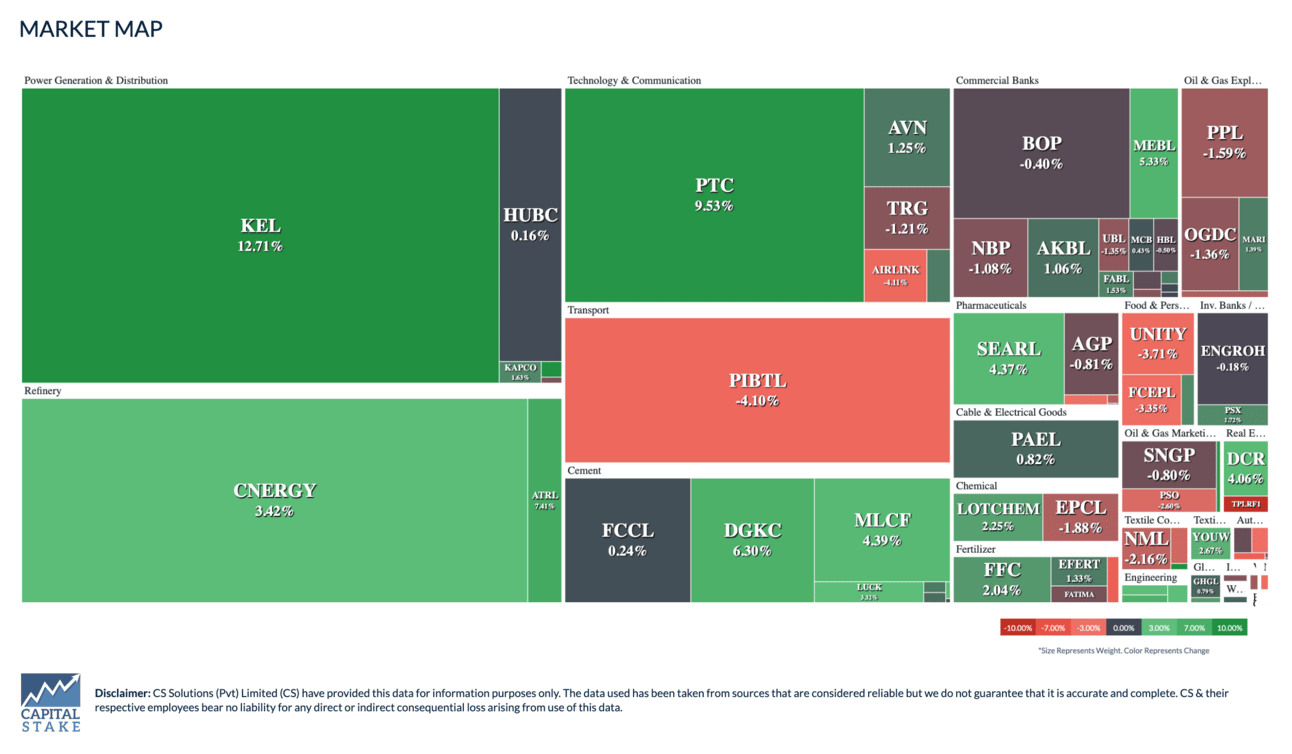

The Pakistan Stock Exchange (PSX) experienced a rollercoaster week as investors treaded carefully ahead of the upcoming 2026 budget announcement and ongoing IMF negotiations. Despite the cautious sentiment, the benchmark KSE-100 Index managed to post a modest gain of 0.49% week-on-week, closing the final trading session up by 717.69 points (+0.60%).

SECP Proposes Regulatory Framework for Algorithmic Trading in Pakistan

The Securities and Exchange Commission of Pakistan (SECP) has proposed a regulatory framework for algorithmic trading, which uses computer programs to automatically buy and sell stocks at high speed. While this technology improves efficiency, it also brings new risks. The SECP’s plan aims to promote innovation while protecting investors and market fairness. Exchanges will handle registration and testing, brokers will oversee controls, and algorithm providers must follow regulations. Initially, only institutional investors will be allowed, with retail investors included later. The public can review and comment on the proposal on the SECP’s website.

From Rock Bottom to Sky High: The Unbelievable Rise of PIA Holding-B

Something remarkable is unfolding with PIA Holding Company Limited-B. The stock’s 52-week range spans from a low of Rs. 470 to an astonishing high of Rs. 29,374.54, highlighting an exceptional rally that’s turned heads across the market. In just the past month alone, the share price surged from Rs. 967.10 on April 3rd, 2025, to Rs. 29,374.54, raising questions about what’s fueling this dramatic rise. Could it be the result of debt clearance, an ongoing restructuring plan, or the government’s privatization push? Whatever the catalyst, this movement has made PIA Holding Company a stock to watch.

For a deeper dive, check out the company’s details on stockintel.com.

SBP clarifies stance on virtual assets, denies declaring them illegal

The State Bank of Pakistan (SBP) recently clarified in a press release that it has never declared virtual assets like cryptocurrencies illegal. In 2018, the SBP advised banks and financial institutions to avoid dealing with these assets because there was no clear legal framework at the time. This clarification comes after some confusion from recent statements suggesting cryptocurrencies might be banned in Pakistan. While reassuring that virtual assets are not illegal, the SBP highlighted the need to develop clear regulations soon to protect consumers and the financial system.

China to Re-Lend $3.7 Billion to Pakistan in June

China plans to re-lend about $3.7 billion to Pakistan next month to help maintain the country’s foreign exchange reserves above $10 billion, according to news reports. The loan package includes both refinancing and new disbursements and is expected to be mostly in Chinese yuan, reflecting China’s shift away from dollar-denominated lending. The Industrial and Commercial Bank of China (ICBC) is reported to roll over a previously repaid $1.3 billion loan in yuan, which Pakistan had settled earlier this year.

India Convinces ADB to Delay $800 Million Loan Package for Pakistan

India has requested the Asian Development Bank (ADB) to delay an $800 million financing package for Pakistan by five days. The ADB board meeting, originally set for May 28, will now take place on June 3. This delay comes after India’s unsuccessful effort to block a $1 billion IMF tranche to Pakistan. The package includes a $300 million policy loan and a $500 million guarantee to help Pakistan secure up to $1.5 billion in foreign commercial loans, which is crucial given Pakistan’s low credit rating. Despite the delay, Pakistan’s external financing plans remain on track, with the government expecting to raise over $1 billion in commercial loans backed by the ADB guarantee.

Budget 2026 – What to Expect: Key News Around the Table

📍 🗓️ Federal Budget to be presented on June 10, confirms Finance Secretary

📍 🤝 Government to hold crucial pre-budget meeting tomorrow

📍 ✔️ IMF allows Pakistan to cut tax rates for salaried class in upcoming budget

📍 💰 Government plans to double withholding tax on cash withdrawals by non-filers

📍 📦 Possible excise duty on multiple imported goods in the new budget

📍 💵 Government may impose 1.5% tax on import payments

📍 🚗 Used cars expected to get cheaper after the budget

📍 📈 Salaried Class Alliance urges government to raise tax exemption limit

📍 🤝 IMF and Pakistan ‘near deal’ on salaried tax relief in upcoming budget

📍 ⚠️ Calls for the government to avoid surprises in Budget 2026-27

Credits: Pulse by Capital Stake

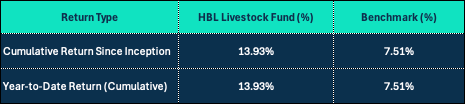

The HBL Livestock Fund focuses on cattle fattening and meat production businesses that serve the meat export market. By investing in this sector, the fund aims to generate returns while providing portfolio diversification. All fund assets are takaful covered, ensuring protection in accordance with Shariah principles. Additionally, the fund’s investments in real assets and commodities offer a potential hedge against inflation.

In today’s edition, we take a closer look at a mutual fund that offers investors exposure to the livestock sector. This fund is currently available through HBL Asset Management Company under the name HBL Livestock Fund.

Download the Behtari app to explore investment options:

🍏 IOS Download | 🤖 Android Download

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan