- Pulse by Capital Stake

- Posts

- Farewell 👋, Clashes ⚡, Relief 💰

Farewell 👋, Clashes ⚡, Relief 💰

Another Week, Another Pulse!

Good morning, folks! As we step into the holy month of Ramadan, a time of reflection and blessings, we bring you a quick five-minute roundup of the biggest stories in business, finance, and tech. This week, we bid farewell to an era—Skype, the once-revolutionary communication platform, is set to retire in May 2025. Meanwhile, political tensions flared as a clash between Trump and Zelensky shook the Oval Office. Closer to home, there's good news for consumers—fuel prices (See Trend 📊) have been slashed by Rs. 5 per litre, and the cost of flour has dropped by Rs. 25 per 10kg. Let’s dive into the details!

A $2.5 billion underground train project for Lahore has sparked debate on X. The cost is six times Saudi Arabia’s investment in Reko Diq and nearly half of Pakistan’s recent IMF loan. While some see it as a step toward modern infrastructure, others question if such spending is justified. Join the discussion on X!

In other news, Chinese AI startup DeepSeek claims its latest models, V3 and R1, could theoretically generate over five times their cost in profit every day. However, the company cautions that real earnings would be much lower. This bold claim has sparked discussions on how profitable AI models really are and whether such numbers reflect reality.

🔹 Key Events to Watch This Week! 🔥

📌 IMF Program Review Conclusion – 📅 March 3–5 💼

📌 FBR Tax Collection Update – 📅 March 4 📊

📌 SBP Monetary Policy Announcement – 📅 March 10 🏦 ((See Data 📊)

📌 Eurobond Repayment Deadline – 📅 March 6 💸

📌 Local Elections in Punjab – 📅 March 2 🗳️

📌 Pakistan-UAE Strategic Dialogue – 📅 March 5–6 🤝

📌 International Women’s Day Events – 📅 March 8 🌸

📌 Pakistan vs. Australia Cricket Series – 📅 March 2–8 🏏

📌 UN Environment Assembly Participation – 📅 March 3–5 🌱

Credits: Pulse by Capital Stake

Power Up Your Trades with Data & Insights!

With StockIntel’s Trading feature, you can harness real-time data, advanced analytics, and modern trading interface to trade with Confidence. Now, with the introduction of the Depth Chart, you get a visual representation of market demand and supply, helping you analyze buy and sell pressures instantly. Whether you're tracking market movements or making strategic investments, StockIntel equips you with the tools to stay ahead. Sign up now to see the depth chart in action!

📢 Pakistan’s Bisconni to Set Up $30M Biscuit Factory in Abu Dhabi

What Happened?

Pakistan’s Bisconni, a subsidiary of Ismail Industries, has announced plans to build a $30 million biscuit factory in Abu Dhabi’s KEZAD Al Ma’mourah. The company has signed a 50-year land lease agreement with KEZAD Group, which operates integrated economic zones in the UAE. The 37,000 square meter facility will focus on producing biscuits and confectionery products as part of Bisconni’s international expansion strategy.

Why It Matters:

This investment is a significant step for a Pakistani company looking to expand its global footprint. It strengthens trade and economic ties between Pakistan and the UAE, creating new business opportunities in the region. Additionally, the new factory is expected to generate employment opportunities, both directly in the UAE and indirectly through supply chain connections in Pakistan. By entering a competitive international market, Bisconni positions itself as a global brand, potentially opening doors for further regional expansion.

What’s Next?

With the lease agreement finalized, construction of the factory is expected to begin soon, with production likely to commence in the near future. If the venture proves successful, Bisconni may expand further in the Middle East, tapping into a larger consumer base. The move could also encourage other Pakistani companies to explore international investments, fostering greater economic growth and global recognition for Pakistani brands.

Pakistan’s wheat production to decline by 3.5mn metric tons, down 11% from last year: report

What Happened?

Pakistan’s wheat production is projected to decline by 3.5 million metric tons, an 11% drop from last year, bringing the total output down to 27.9 million metric tons (check wheat prices trend📊). According to the Ministry of Finance’s monthly economic outlook, this decline is primarily due to dry weather conditions affecting crop yields. Last year, Pakistan had a record wheat harvest of 31.4 million metric tons, but this year’s unfavorable weather has raised concerns about supply shortages.

Why It Matters:

Wheat is a staple food in Pakistan, and a production shortfall could lead to higher prices and potential shortages, affecting millions of people. The Pakistan Meteorological Department has warned that water stress in rain-fed areas has negatively impacted crops, which may further hurt future yields. Additionally, with domestic supply falling short of demand, Pakistan may need to import wheat, putting additional strain on the country’s foreign exchange reserves. The Ministry of Food had previously warned that delays in setting wheat support prices and procurement plans could discourage farmers from planting enough crop, worsening the situation.

What’s Next?

To fill the supply gap, Pakistan is likely to increase wheat imports, which could exceed $1 billion, adding pressure on the country’s already tight economic situation. Policymakers will need to act quickly to ensure food security, possibly by adjusting support prices, securing import deals, and improving irrigation strategies. If dry conditions persist, further challenges could arise for future crop cycles, making long-term agricultural planning even more critical.

Govt orders SOEs to disclose assets

What Happened?

The government has directed all state-owned enterprises (SOEs) to disclose their assets and beneficially owned investments after identifying serious transparency and accountability issues. This move comes after the Central Monitoring Unit, a special body overseeing public sector financial management, found that most SOE boards and management members were failing to declare their assets, violating an Act of Parliament. In response, the Ministry of Finance has issued strict instructions through the relevant ministries to ensure compliance.

Why It Matters:

SOEs play a critical role in Pakistan’s economy, managing key sectors such as energy, transportation, and finance. A lack of financial transparency in these entities can lead to mismanagement, corruption, and inefficient use of public funds. By enforcing full asset disclosure, the government aims to strengthen governance, restore public trust, and prevent financial misconduct. This move could also boost investor confidence and improve Pakistan’s creditworthiness in global financial markets.

What’s Next?

With new disclosure requirements in place, SOEs will need to comply or face consequences. The government may introduce penalties or stricter oversight for non-compliance. If implemented effectively, this initiative could pave the way for further governance reforms in the public sector. However, resistance from SOE management and boards could lead to delays or legal challenges, making enforcement a key challenge in the coming months.

Maritime minister for expanding Pakistan’s port capacities

What Happened?

The government is working on upgrading Pakistan’s National Maritime Policy, extending its scope until 2047. The Ministry of Maritime Affairs has begun consultations with relevant stakeholders, including provincial governments and key federal ministries, to formulate the updated policy. A major focus of National Maritime Policy (NMP) 2025 is to expand port capacities and tap into transit trade with Central Asia. However, coordination between Sindh and Balochistan governments—which oversee significant maritime functions—along with input from the Defence, Defence Production, and Commerce Ministries, is crucial for its successful implementation.

Why It Matters:

Pakistan’s strategic location presents a huge opportunity to become a regional trade hub, especially for landlocked Central Asian nations. Expanding port capacities and improving maritime infrastructure could boost economic growth, create jobs, and enhance regional connectivity. However, delays in policy enforcement due to bureaucratic hurdles and intergovernmental coordination issues could slow down progress. A well-executed policy could help modernize Pakistan’s ports, increase foreign investments, and strengthen its trade network.

What’s Next?

The government will continue policy consultations, but delays could arise due to differences between federal and provincial authorities. The success of NMP 2025 depends on effective coordination, streamlined decision-making, and timely execution. If implemented efficiently, the policy could significantly enhance Pakistan’s maritime sector, making it a key player in global trade and transit routes.

Govt rolls out relief plan for power consumers using up to 300 units

What Happened?

The federal government has announced a relief plan for electricity consumers using up to 300 units (See trend📊) and agricultural tube-wells, reinstating benefits of reduced fuel cost adjustments (FCA). Federal Minister for Energy Awais Leghari confirmed that monthly FCA charges will be lowered, helping households and farmers manage their electricity bills. This benefit was previously discontinued in June 2015, but the government has now decided to bring it back to ease financial pressure.

Why It Matters:

This decision is crucial for millions of middle- and lower-income households struggling with high electricity bills amid rising inflation. It also benefits farmers, as lower energy costs will help reduce agricultural expenses, making food production more sustainable. By cutting power costs, the government aims to provide economic relief, improve affordability, and reduce public dissatisfaction over soaring electricity prices.

What’s Next?

Consumers using up to 300 units and farmers with tube-wells will soon see a reduction in their electricity bills. However, the government needs to ensure proper implementation and prevent billing discrepancies. Additionally, there might be budgetary challenges in maintaining these subsidies in the long run. Future adjustments in fuel costs and economic conditions will determine whether this relief remains in place.

Tax shortfall reaches Rs606b

What Happened?

Pakistan’s tax revenue fell short by Rs606 billion in the first eight months of the fiscal year. The Federal Board of Revenue (FBR) was expected to collect Rs7.95 trillion between July and February, but it managed to collect only Rs7.342 trillion. While tax collection grew by 28% compared to last year, it still missed the target set under the IMF agreement, putting financial pressure on the government.

Why It Matters:

This tax shortfall makes it harder for the government to meet its budgetary needs and fulfill IMF conditions, which are crucial for securing loans and maintaining economic stability. If revenue collection doesn’t improve, Pakistan might have to introduce additional taxes or cut government spending, which could affect businesses and households.

What’s Next?

The government will need to increase tax collection in the coming months by expanding the tax base, improving enforcement, or introducing new tax measures. If the shortfall continues, it could lead to higher inflation, stricter financial conditions, and potential economic challenges.

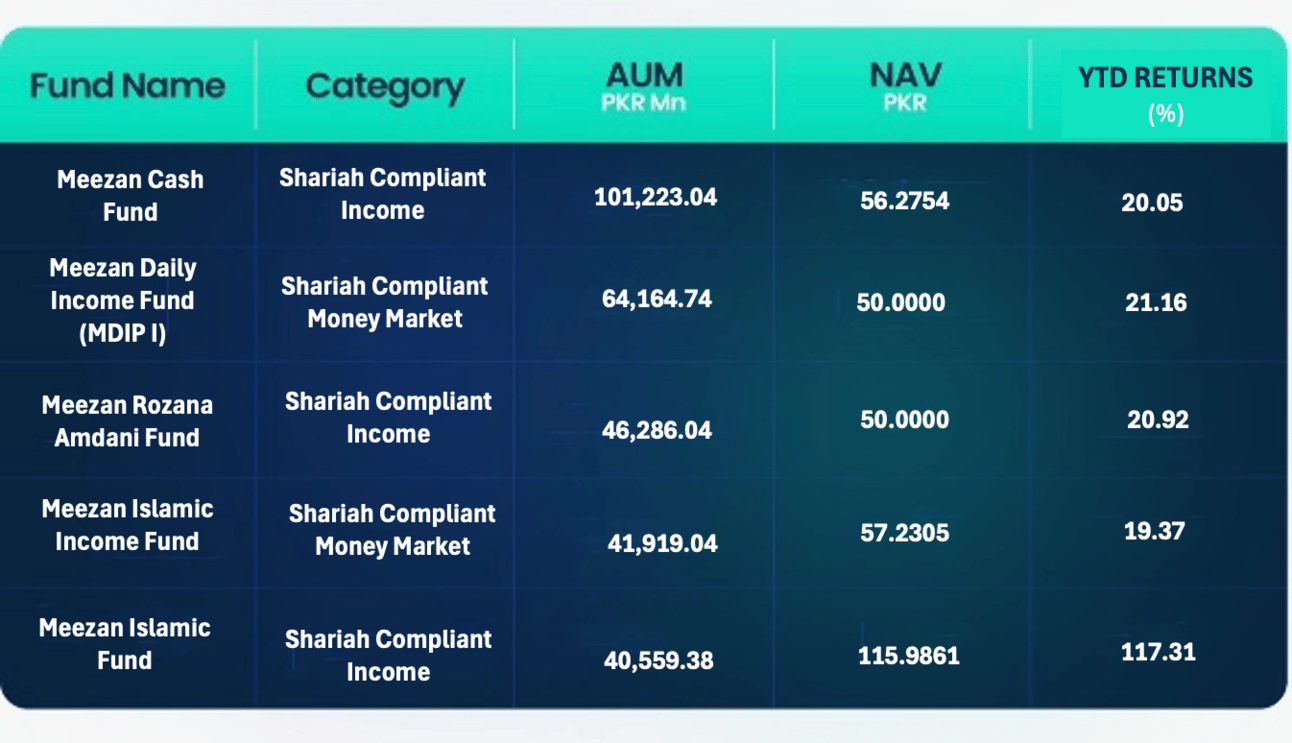

As part of our weekly strategy, we will feature a different Asset Management Company (AMC) each week, providing insights into their offerings and market position. This week, we spotlight Al Meezan Investments, the largest AMC in terms of Assets Under Management (AUM) in Pakistan. The following Meezan funds, mentioned in the table below, have the highest AUMs.

GAMES:

Riddle Answer! 🥁

Here for the answer to last week's riddle?

Drum roll, please... 🥁The answer to the riddle is "Budget".

A budget helps keep finances on track—if you overspend, you'll feel the consequences, but if you manage it well, you'll make wise financial decisions.

Riddle of the Week!

I’m borrowed and returned, sometimes with a fee. If you misuse me, you’ll be in misery. What am I?

Want to know the answer? Come back next week to find out!

In Other News:

🔹 Swiss Central Bank Rejects Bitcoin for Reserves

Switzerland’s central bank head, Martin Schlegel, ruled out bitcoin as a reserve currency, citing its volatility and lack of liquidity.

🔹 SBP Reserves Increase by $21 Million

The State Bank of Pakistan’s foreign currency reserves rose to $11.22 billion, up by $21 million in the week ending February 21, 2025.

🔹 Govt Reduces Interest Rates on National Savings Schemes

The Central Directorate of National Savings (CDNS) lowered returns on various National Savings Schemes (NSS) by up to 33 basis points, effective February 25, 2025.

🔹 Gold Prices Continue Downward Trend

Gold prices fell for the fifth consecutive day, with international rates dropping by $6 per ounce to $2,857.

Get to Know More About Our Products

Behtari – Your one-stop shop for mutual fund investments.

StockIntel – Make the most knowledgeable investing decisions.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan