- Pulse by Capital Stake

- Posts

- 🥶 Hailstorms, 🏦 Investment Inflows & 💹 A Surplus Surprise

🥶 Hailstorms, 🏦 Investment Inflows & 💹 A Surplus Surprise

Another week, another Pulse!

This week, climate chaos took center stage. Hailstorms battered Islamabad and Rawalpindi, shattering car windshields and sending auto glass prices soaring. As the real impact of climate change hits home, the Society of Actuaries is calling for climate-focused insurance products. Meanwhile, Pakistan has agreed to the IMF’s push for greener project selection and is gearing up to introduce a carbon fee in the next budget. On the diplomatic front, after a 15-year pause, Pakistan and Bangladesh have resumed high-level talks to discuss key regional and international issues—marking a potential reset in ties.

Here’s your 5-minute recap on everything buzzing in business, finance, and tech.

A new debate has sparked over X! Following a recent podcast clip, an economic expert claimed Meezan Bank has outperformed Apple in dollar returns over the past 10 years. The bold statement ignited a flurry of reactions—while some celebrated the local success story, others ran the numbers and pushed back, pointing out Apple's staggering long-term performance.

📅 Key Events to Watch This Week!

📌 April 21, 2025

🏦 Roshan Digital Account Numbers

📊 Balance of Payments Data

📦 Balance of Trade

📤 Export Receipts

📥 Import Payments

📌 April 23, 2025

🏭 Large Scale Manufacturing Index (LSM)

🛠️ International Mechanical Engineering Conference (April 23–24)

💻 International Conference on Emerging Technologies in Electronics, Computing, and Communication (April 23–25)

📌 April 24, 2025

💵 Foreign Exchange Reserves

📌 April 25, 2025

🛒 Weekly Sensitive Price Index (SPI)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

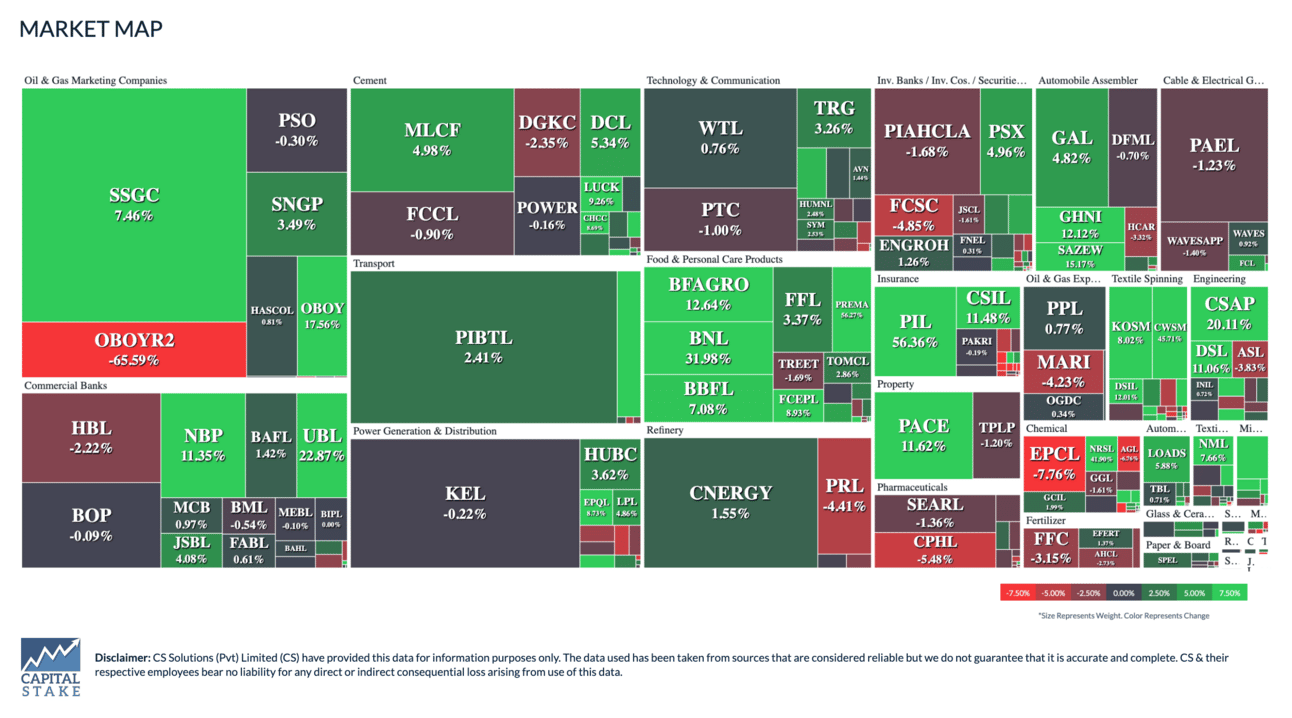

📊 PSX Snapshot of the Week!

The benchmark KSE-100 index closed the week on a positive note, gaining 414.45 points (+0.35%) in the final session. On a week-on-week basis, the index climbed 2.14%, reflecting continued investor optimism. The 5-day average trading volume stood at an impressive 400.26 million shares.

📈 Looking to stay ahead in the market?

Join the Battle of the Bull contest by PSX and gain complimentary access to the StockIntel platform! Get the latest market insights, powerful tools, and real-time data to make informed investment decisions and sharpen your skills in this exciting virtual trading challenge.

PSX, Malaysia to boost Islamic finance

A delegation of Malaysian Shariah scholars visited PSX to strengthen ties in Islamic finance. With over 50% of PSX-listed companies being Shariah-compliant and Rs6.5 trillion in Sukuk issued, Pakistan is emerging as a key player. The collaboration aims to boost cross-border initiatives and expand faith-based investment opportunities.

Pakistan Posts Record Current Account Surplus in March 2025

Pakistan’s current account posted a surplus of $1.2 billion in March 2025, the highest ever recorded in a single month, according to data from the State Bank of Pakistan. After deficits in January and February, the sharp turnaround was driven by record-high remittances of $4.1 billion, signaling improved external stability and a boost to the country’s economic outlook.

Fitch Upgrades Pakistan’s Credit Rating to ‘B-’ with Stable Outlook

Fitch Ratings has upgraded Pakistan’s sovereign credit rating from CCC+ to B-, citing stronger fiscal discipline, improved external stability, and progress under IMF-backed reforms. The stable outlook reflects growing confidence in Pakistan’s ability to manage its budget and sustain economic recovery. The move follows Pakistan’s recent agreements with the IMF on a $7 billion EFF review and a new $1.3 billion RSF, signaling continued commitment to reform.

Pakistan’s Remittances Cross $4.1 Billion in March 2025

Remittances to Pakistan reached $4.1 billion in March 2025, crossing the $4 billion mark for the first time, as per SBP data. This reflects a 37% year-on-year increase from $2.95 billion in March 2024 and a 30% rise from February 2025. Cumulatively, remittances for Jul–Mar FY25 stood at $28 billion, up 33.2% from $21.04 billion in the same period last year, strengthening the country’s external position. Check the trend of remittances on Karandaaz Portal.

Govt and Banks Sign Rs. 1.27 Trillion Deal to Resolve Energy Debt

Pakistan's government and banks have agreed on a deal worth Rs. 1.27 trillion to tackle the ongoing debt issue in the energy sector. As part of this agreement, banks will extend Rs. 658 billion worth of loans, while the government will provide an additional Rs. 617 billion in new funds to settle outstanding debts. This move is expected to help clear the country's energy sector debt of around Rs. 1.25 trillion, which has been affecting power supply and prices. The funds will be released by mid-May to help stabilize the sector.

Foreign Direct Investment in Pakistan Drops 91% in March 2025

Pakistan's Foreign Direct Investment (FDI) saw a significant decline of 91% in March 2025, with net FDI falling to $26 million compared to $294 million in the same month last year. Foreign inflows decreased by 49% to $177 million, while outflows rose by 200%, reaching $151 million. However, for the first nine months of FY25, net FDI increased by 14% year-on-year, totaling $1.64 billion, up from $1.44 billion in the same period last year.

Explore the monthly trend on Karandaaz's dataset.

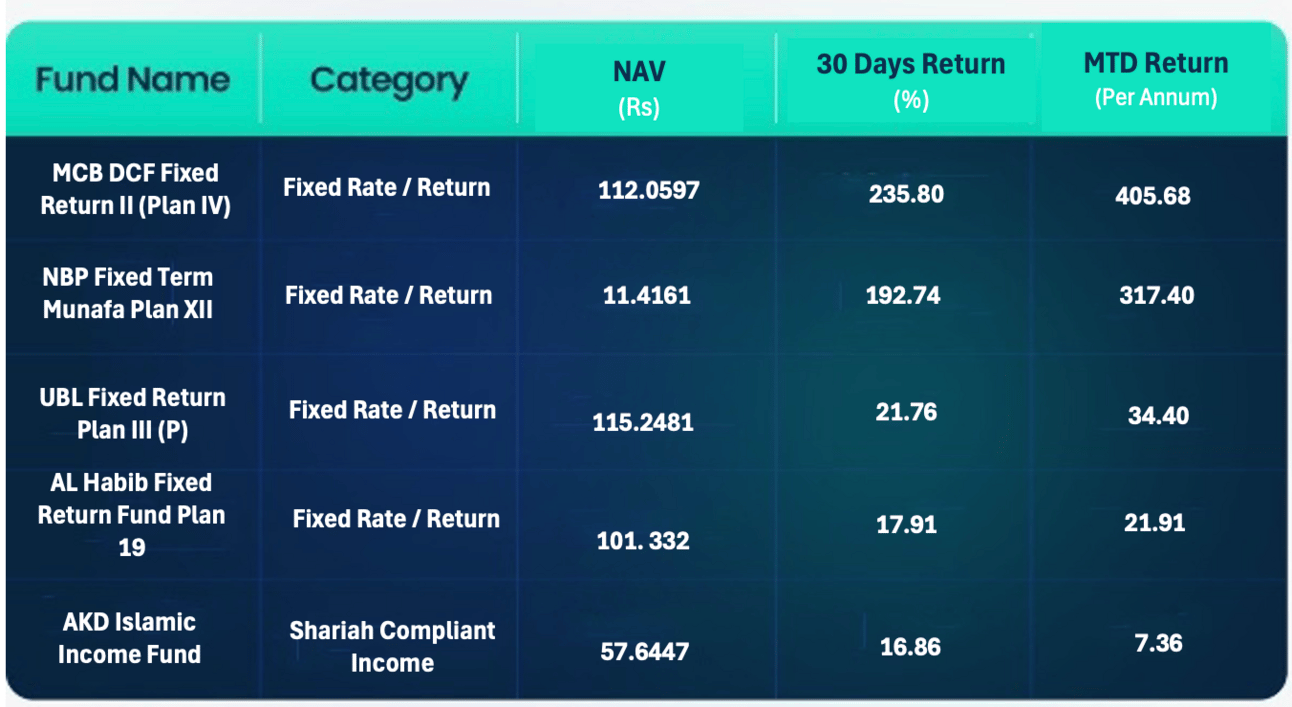

Islamic Income Funds That Outperformed the KSE-100 Index Last Month

Amid heightened equity market volatility and a sharp decline triggered by new trade tariffs, the benchmark KSE-100 index slipped by 0.56% over the past month. In contrast, several Islamic income funds continued to deliver positive and steady returns, offering investors a more stable alternative during uncertain times.

Here are the top-performing Islamic income funds that beat the KSE-100 in the last one month:

Credits: Behtari

Source: MUFAP

📱 Ready to explore these and other mutual funds?

🚀 Start your investment journey with the Behtari app — it’s simple, fast, and built for everyone.

📲 Download now:

🟢 Android: https://shorturl.at/HSNfm

🔵 iOS: https://shorturl.at/J0RUC

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan