- Pulse by Capital Stake

- Posts

- Investments 💰, Growth 📊, Insights 💡

Investments 💰, Growth 📊, Insights 💡

Another Week, Another Pulse!

As cold weather and dense fog spread across the country, the week brought a mix of surprises and steady developments. The State Bank of Pakistan (SBP) cut the policy rate by 0.50% to 10.5%, signaling confidence that inflation pressures are manageable while supporting economic activity. Petrol prices remained unchanged, while diesel fell by Rs14, even as weekly inflation rose 3.75%, mainly due to higher food prices.

Liquidity in the banking system remained tight, prompting the SBP to inject over Rs12.25 trillion, while a shortage of dollars in the open market highlighted ongoing pressure on foreign exchange. Pakistan is moving ahead with a USD 1 billion Panda Bond program and has asked ministries to explore possible IMF concessions to ease growth constraints. The World Bank approved a $700 million loan focused on tax fairness, budget transparency, and governance.

Foreign reserves rose to $21.09 billion boosted by IMF inflows, improving import cover to 2.62 months. Auto loans grew for the twelfth consecutive month, showing gradual recovery. In energy, Pakistan sought additional financing from the Asian Development Bank to address power sector debts and restructure costly loans, aiming to ease pressure and stabilize electricity supply. The current account posted a $100 million surplus in November, hinting at stabilizing external balances.

Emerging sectors made headlines as Fauji Foundation signed an LOI with Binance for blockchain, cryptocurrency, and payments, while the government announced the creation of Pakistan’s first Council of Digital Economy. Pakistan also committed to a Rs5 carbon levy on fuel under a 13-point reform plan tied to a $1.3 billion IMF-supported program.

The week reflected cautious optimism: easing monetary policy, improving reserves, and structural reforms across energy, finance, climate, and digital sectors, even as inflation and liquidity pressures remain.

Here’s everything you need to know to stay ahead this week.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/yc8t27b4

SoundCloud - https://tinyurl.com/2823jssa

Spotify- https://tinyurl.com/mweevkcn

📅 Key Events This Week!

📌 22nd December 2025

💱 Balance of Payment

💰 Repatriation of Profit

📌 25th December 2025

💱 Foreign Exchange Reserves

📌 26th December 2025

🛒 Weekly SPI (Sensitive Price Index)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

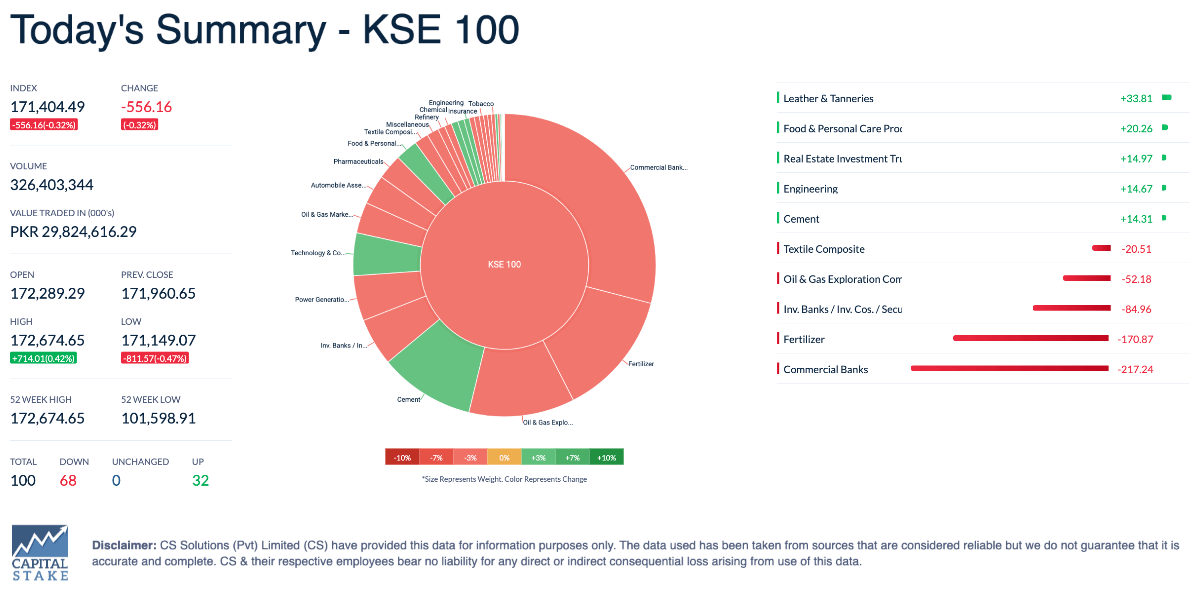

The KSE-100 index rose 1,540 points (0.91%) week-on-week to close at 171,404, supported by the State Bank of Pakistan’s surprise 50-basis-point rate cut to 10.5%. Investor sentiment was further boosted by a current account surplus of $100 million in November, reversing October’s deficit, and steady foreign direct investment of $180 million. Positive developments in government securities, including T-bill auctions exceeding targets and declining yields in the first Pakistan Investment Bond (PIB) auction, also contributed to the market’s upward momentum.

Pak Qatar Family Takaful IPO Public Portion Oversubscribed by 3.8x

Pak Qatar Family Takaful Limited’s IPO saw strong demand, with the public portion oversubscribed 3.8 times, as investors applied for 47.8 million shares against 12.5 million on offer. The earlier book-building portion was also oversubscribed and priced 29% above the floor, showing strong investor confidence in the company and the takaful sector. Shares will now be allotted according to rules, with small investors likely receiving full allocation and larger applications distributed pro-rata.

Govt to Sell Entire PIA Stake

The federal government has decided to sell its entire 100% stake in Pakistan International Airlines (PIA), with the initial auction on December 23 offering 75% of shares, while the remaining 25% can be acquired later at a 12% premium. Under the revised plan, only 7.5% of the bid will be paid in cash, with the rest injected directly into PIA as equity, making the process more flexible for investors. This move marks a significant step in the government’s privatization drive and could reshape the national carrier’s future once a buyer is finalized.

Pakistan’s REER Rises Above 10-Year Average

Pakistan’s Real Effective Exchange Rate (REER) rose to 104.8 in November 2025, surpassing its 10-year average of 103.2, indicating that the rupee has strengthened beyond historical norms. While a stronger REER reflects currency strength, economists caution that it may weaken export competitiveness and make imports cheaper, potentially impacting the trade balance. Analysts expect some correction ahead, with the rupee projected to average around Rs. 285 per US dollar in FY26.

Royalties, franchise fees capped at $250,000

The SBP has capped royalties, franchise, and technical service remittances at $250,000 for new companies, while existing businesses can remit up to 8% of local sales. The move, covering sectors like agriculture, infrastructure, and services, aims to simplify operations and align payments with market realities. Going forward, companies will need to manage foreign payments within these limits to stay compliant.

Pakistan, China advance talks on $2.2b industrial complex at Port Qasim

Pakistan and China’s Shandong Xinxu Group are progressing plans for an Integrated Maritime Industrial Complex (IMIC) at Port Qasim, valued up to $2.2 billion. The project will revive the steel jetty, add shipbuilding and shipbreaking facilities, and set up a modern steel mill, boosting local steel production and maritime capacity. The proposal, once submitted, will be reviewed by a joint committee, with a focus on employment, value addition, and environmentally responsible operations.

Pakistan’s interest rate is now 10.5% — the 7th highest in Asia 🌏 !

High rates may look attractive, but they often come with inflation and economic stress that can erode your savings.

What if your money could ride the waves instead of being tossed around?💡

Hybrid funds let you do just that — combining equities for growth and debt for stability, so you can benefit whether interest rates rise or fall.

Invest smart, stay flexible, and make your money work for you in any market. 📈

Ready to take control of your investments? Download Behtari today and start investing in mutual funds that adapt to changing markets! 🚀

Android: https://lnkd.in/dhAe2dEz

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan