- Pulse by Capital Stake

- Posts

- Investments 📈, Trends 🔄, Opportunities 🌟

Investments 📈, Trends 🔄, Opportunities 🌟

Another Week, Another Pulse!

Flooded streets. Unkept promises. And a glimmer of hope on the economic front.

While much of the country is wading through urban flooding and climate chaos, another headline is raising eyebrows: Pakistan has received just $4.9 billion out of the $11 billion promised by global donors to help rebuild and prepare for future climate shocks. That’s less than half, and people are starting to ask where the rest went.

But there’s buzz in the air as we head into the first monetary policy of the new financial year, due on July 30. The State Bank just slashed treasury bill rates, and that’s often a hint. Could an interest rate cut finally be on the way?

Meanwhile, the IMF is keeping the pressure on. It rejected a three-year electricity plan for industries because the government couldn’t guarantee full payment collection. And with gas sector debt now exploding to Rs. 2,800 billion, the IMF wants a serious plan to fix it. The government's solution? A fuel levy of Rs. 3 to Rs. 10 per liter and possibly a new gas bill surcharge. That means higher prices for everyday Pakistanis.

In other headlines, the government is getting ready to sign a deal with the UAE to outsource Islamabad Airport. It’s a government-to-government agreement and a step toward attracting more foreign partners.

Still, it’s not all doom and gloom. The Asian Development Bank expects Pakistan’s economy to grow 3% in FY26, and S&P Global just gave us a ratings upgrade from CCC+ to B- saying our finances are stabilizing thanks to the IMF.

Here’s your five-minute recap, a quick look at the highs, lows, and everything in between.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/24xzcucr

SoundCloud - https://tinyurl.com/ycxt8w2z

Spotify- https://tinyurl.com/yc2y5u5b

📅 Key Events This Week!

📌 📅 30th July 2025

🏦 Monetary Policy Announcement

📌 📅 31st July 2025

💰 Foreign Exchange Reserves Update

📌 📅 1st August 2025

📊 Consumer Price Index (CPI) Release

⛽ Fuel Price Revision

🛒 Weekly Sensitive Price Index (SPI)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

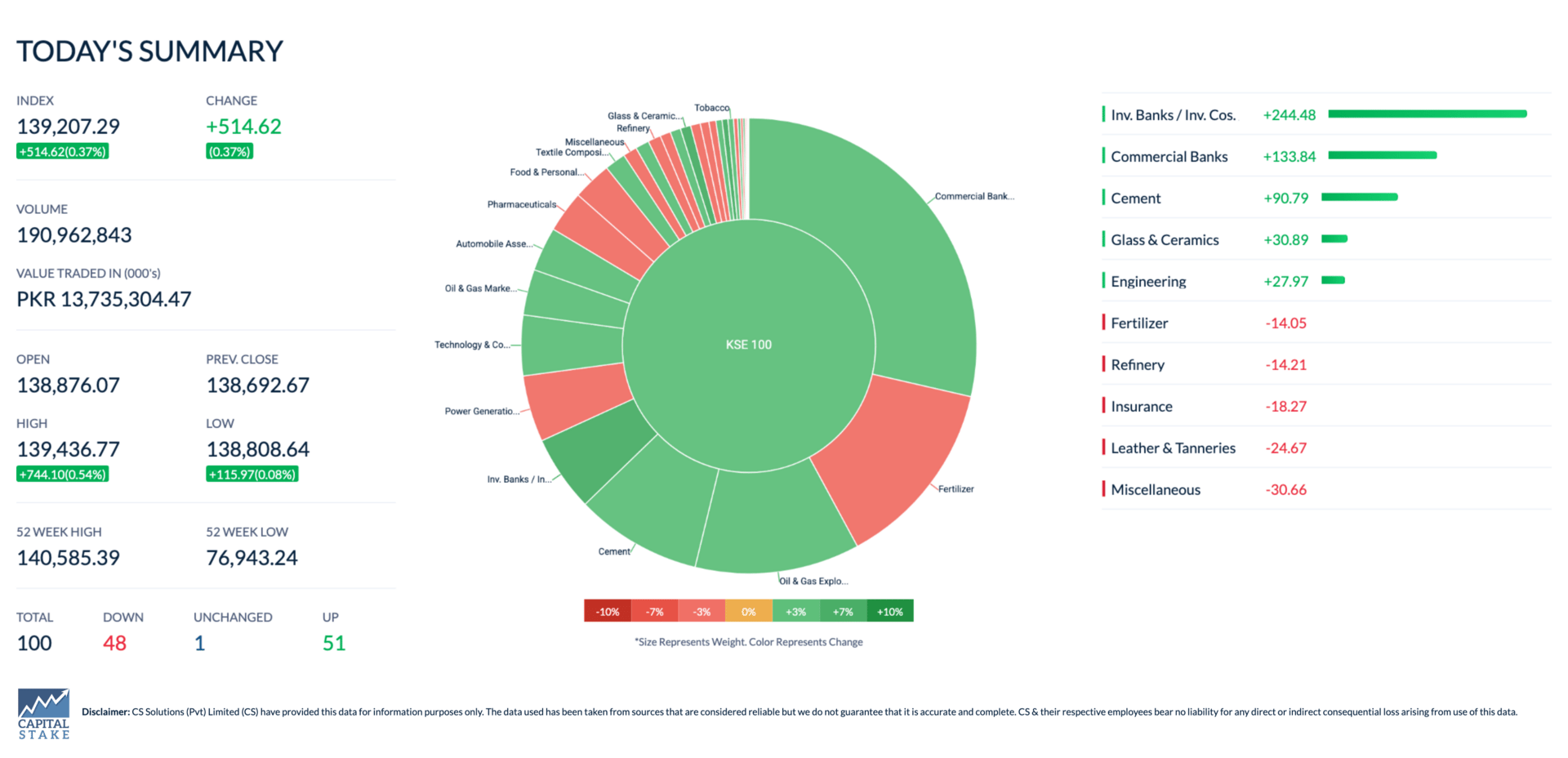

The Pakistan Stock Exchange ended the week on a high note. The KSE-100 index rose by 514.62 points, closing at 139,207.29 on Friday. On a week-on-week basis the index rose by +0.44%. What’s behind the cheer? Investors are feeling more confident, thanks to growing hopes of an interest rate cut and the recent upgrade in Pakistan’s credit rating, which signals stronger financial stability.

Bank Alfalah and Engro Fertilizers Partner to Launch PKR 250M Financing for Farmers Across Pakistan

Bank Alfalah (BAFL) and Engro Fertilizers (EFERT) have launched a PKR 250 million loan program to support farmers across Pakistan. Farmers will be able to access loans of up to PKR 1 million through Engro Markaz outlets and the UgAI platform, helping them invest in fertilizers and improve their crop output. The initiative aims to make financing more accessible for farmers, strengthen the agricultural value chain, and boost productivity. It will initially be available in Sahiwal, Sargodha, Bahawalpur, and Muridke, with plans to expand to more areas in the future.

Bilal Fibres to Launch New IT Business with Rs. 10 Million Investment

Bilal Fibres (BILF), a company known for making and selling yarn, is stepping into the tech world with plans to launch a new IT division. The company is investing Rs. 10 million to kickstart this initiative, focusing on software development, mobile apps, and IT support for small and medium businesses in Pakistan and the Middle East. With a five-member team to start, the goal is to break even within 12 to 18 months and become profitable in two years. This move marks a major shift from traditional manufacturing to digital services and could open new revenue streams for the company as it plans to go global in the long run.

Systems Limited Exploring Potential Acquisition in IT Sector

Systems Limited (SYS), one of Pakistan’s leading tech companies, has announced that it is exploring the possibility of acquiring another business in the IT and IT-enabled services sector. Talks are still in early stages and depend on final negotiations, legal checks, and regulatory approvals. This move could help Systems expand its capabilities, bring in new clients, and strengthen its position in both local and international markets. The company has said it will share updates as things progress.

PNSC Signs MoU with China’s Xinxu Group to Boost Maritime Investment in Pakistan

Pakistan National Shipping Corporation (PNSC) has signed an MoU with China’s Shandong Xinxu Group to boost investment in Pakistan’s maritime sector. The agreement sets the stage for both sides to work together on buying and operating cargo ships, including oil tankers, container ships, and dry bulk carriers. It also includes plans for ship chartering, management services, and financing support for future investments. This partnership could help modernize Pakistan’s shipping industry, increase trade capacity, and attract foreign investment into the country’s ports and shipping operations.

Govt Reverses Plan to End Solar Net Metering in Pakistan

The government has decided not to move forward with changes to the solar net-metering policy, after Prime Minister Shehbaz Sharif ordered a halt to the plan. This comes even before any formal proposal to lower the buyback rates for solar energy was submitted. It’s the third time such a move has been stopped, mainly due to public backlash. Net-metering allows households and businesses to sell excess solar power back to the grid, and changing the rates could have discouraged solar adoption. For now, the existing policy stays in place, which is a relief for current and future solar users.

China Backed Cable Project Eyes Multi-Billion Dollar Investment in Pakistan

China’s PeaceCable is considering a multi-billion dollar investment to help improve Pakistan’s digital connectivity through submarine and land-based fiber optic cables. In a meeting with the IT Minister in Shanghai, the company was briefed on Pakistan’s goals to connect 10 million homes and expand fiber access to 60 percent of mobile towers over the next three years. PeaceCable was invited to support this plan by investing in broadband networks and fiber infrastructure. If the partnership moves forward, it could play a major role in strengthening Pakistan’s digital future.

Gwadar Port Can Earn $850 Million Per Year from Fisheries, Dates: Maritime Minister

The Maritime Affairs Minister has said that Gwadar Port could earn over $850 million a year through exports of fish and dates, if supported by better infrastructure and investment. Balochistan has the potential to produce 300,000 tons of fish annually, but outdated technology and limited processing capacity are holding it back. Upgrading 34 fish processing units could unlock $645 million in exports. Similarly, Panjgur and Turbat produce over 225,000 tons of dates, which could bring in around $200 million with proper value addition. To boost connectivity, PIA will now operate three weekly flights to Gwadar, and a special charter flight service for investors is also being considered.

📊 Where Are Mutual Funds Moving Their Money?

A Look at the Last 3 Months of Sector Allocations

Mutual funds in Pakistan have made net investments of $35.4 million in the past 3 months — but where did that money actually go?

📈 Top Sectors Gaining Mutual Fund Flows:

Fertilizer: +$18.6 million

Oil & Gas Exploration: +$6.5 million

Debt Market: +$6.7 million

Power Generation & Distribution: +$4.8 million

Cement: +$0.4 million

📉 Sectors Seeing Outflows:

Oil Marketing Companies: –$4.8 million

Textile Composite: –$3 million

Commercial Banks: –$1.6 million

Technology & Communication: –$0.3 million

Food & Personal Care Products: –$0.3 million

💡 What Does This Mean for You as an Investor?

The allocations suggest mutual funds are shifting towards stable, dividend-yielding sectors and reducing exposure to sectors with global volatility or uncertain policy outlooks.

Curious about where your mutual fund is investing?

On the Behtari app, you can now:

✔️ Explore top equity funds

✔️ View sector exposures using Fund Manager Reports (FMRs)

✔️ Compare funds to make smarter decisions

📲 Download Behtari today

🔹 Android

🔹 iOS

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan