- Pulse by Capital Stake

- Posts

- Loans 💸, Deals 🤝, Deficits 📉

Loans 💸, Deals 🤝, Deficits 📉

Another Week, Another Pulse!

If last week had a theme, it was simple: money on the move. From deposits being rolled over to fresh commitments landing on the table, Pakistan’s financial story stayed busy.

Saudi Arabia kicked things off by extending its $3 billion deposit with the State Bank for another year — a much-needed breather. Then came a boost from the Asian Development Bank, as Pakistan signed three financing deals worth $61.8 million to push major projects forward, including the massive $2 billion Karachi–Rohri ML-1 upgrade. And now everyone’s watching December 8, when the IMF Board sits down to approve the next $1.2 billion tranche.

Inflation cooled a touch in November, slipping to 6.1%. But not everything was calm — government debt climbed to Rs77 trillion in October, up 11.4% from last year, raising a few eyebrows.

There were some bright spots too. Forbes called Pakistan one of the region’s most aggressive adopters of fintech and digital assets — not bad company to be in. On the flip side, cement exports took a 26% hit, falling to 590,000 tons while the trade deficit widened at a faster pace of 37% to $15.5 billion in five months of the current fiscal year after exports plunged and imports grew in double digits.

In the global media world, Netflix dropped a bombshell by agreeing to buy Warner Bros Discovery for $83 billion — yes, the same house that made half the cartoons we grew up watching.

And closer to home, new rules now require VASPs to collect and verify details on virtual asset transfers above Rs1 million.

But the headline that deserves the biggest spotlight: women’s financial inclusion has jumped from 4% to 52%. A rare win worth celebrating.

On the regulatory side, things got a bit unusual. The SECP’s policy board cancelled all its agenda items, saying the new financial proposals they were given were poorly timed — a clear sign they weren’t happy. On a more positive note, the government announced plans to set up a modern Artificial Intelligence (AI) Centre to help upgrade Pakistan’s industries and bring in newer technology. In money matters, the country’s overall money supply dipped slightly this week but is still up by Rs4.38 trillion compared to last year. And outside the economy, tensions flared again at the Pakistan–Afghanistan border, with both sides accusing each other of breaking a fragile ceasefire — adding another layer of uncertainty to the week.

Here’s your recap of everything you should know about the last week.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/c4as5fc5

SoundCloud - https://tinyurl.com/4p9wcuvk

Spotify- https://tinyurl.com/3yt6pp63

📅 Key Events This Week!

📌 8th December 2025

🏦 IMF Meeting

📌 8th December 2025

🛒 Weekly SPI (Sensitive Price Index) Release

📌 9th December 2025

💸 Remittances Data

📌 11th December 2025

💱 Foreign Exchange Reserves

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

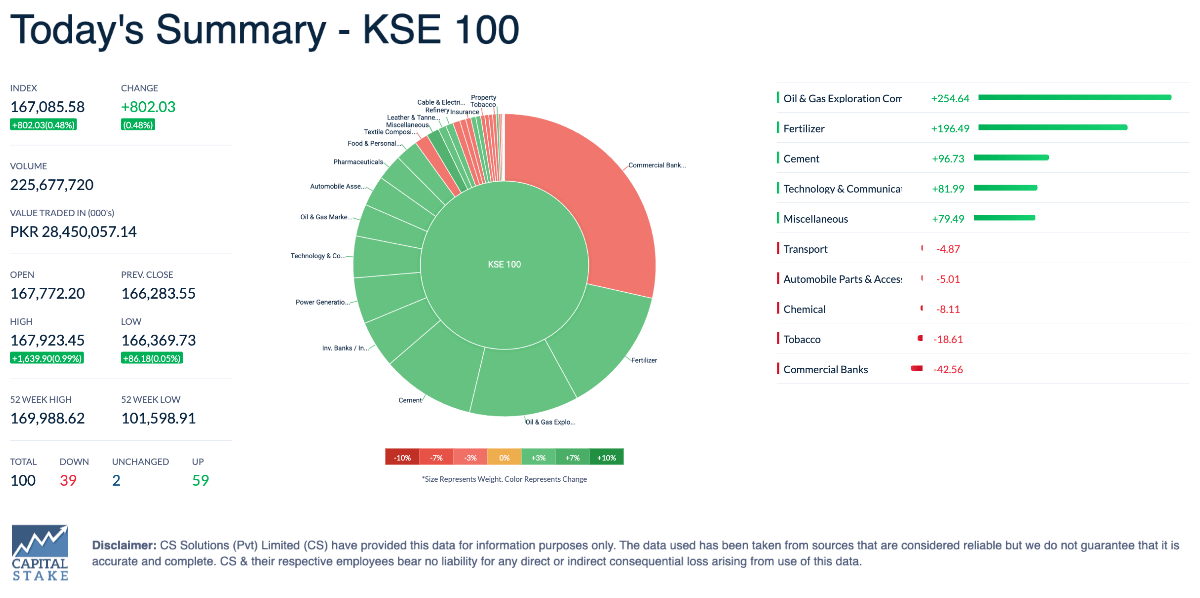

The Pakistan Stock Exchange had a relatively calm week, with the KSE-100 index showing modest gains. After a week of mixed economic news and updates on external financing, the index managed to close above the 167,000 mark at 167,086, up a total of 802 points, or 0.48%. Investors stayed cautious, keeping the market steady, as the exchange continued its consolidation phase without any major swings.

PTCL Gets Green Light to Acquire Telenor

The Pakistan Telecommunication Authority (PTA) has officially approved PTCL’s takeover of Telenor Pakistan, giving the company a No Objection Certificate after reviewing the deal to make sure it’s fair for consumers and the market. This means PTCL can now move ahead with the acquisition once all legal and commercial steps are completed. The deal is important because it could reshape Pakistan’s telecom sector, potentially improving service reach and efficiency, but both companies must maintain quality and meet all licence requirements during the transition.

Maple Leaf Cement Expands Stake in Pioneer Cement

The Competition Commission of Pakistan (CCP) has approved Maple Leaf Cement’s (MLCF) plan to buy more shares in Pioneer Cement (PIOC), ruling that the deal won’t hurt competition in the national cement market. The company can now complete the share purchases from sellers through the stock exchange, which could help streamline operations and support growth. Moving forward, both companies must follow all legal and regulatory requirements while keeping the market competitive.

Saudi National Bank Receives Offer to Sell Samba Bank Stake

Saudi National Bank (SNB), the majority owner of Samba Bank Pakistan, has received a non-binding offer from Najd Gateway Holding Company to buy its entire 84.5% stake in the bank. The move was announced on the Pakistan Stock Exchange, but any deal will require internal approvals, regulatory clearance, and completion of formal agreements. Last year, SNB had considered selling but eventually decided against it, making this latest offer a significant development to watch in Pakistan’s banking sector.

Pakistan Sets Up First Solar Panel Testing Lab

Pakistan has established its first laboratory for testing solar panels, thanks to support from the Korean government. The PAK-KOREA Testing Laboratory for PV Modules was set up by the Ministry of Science and Technology and KOICA, with $9.5 million in funding from Korea and Rs185.8 million from local development programs. Once fully accredited, the lab will test solar panels to international standards, helping boost sustainable energy, support industrial growth, and ensure quality for consumers as solar panels are set to become a mandatory item under Pakistan’s standards authority.

Government Urges SBP to Address SME Credit Crunch

The government has asked the State Bank of Pakistan to tackle the ongoing credit crisis for small and medium enterprises (SMEs), which struggle to secure financing to run and grow their businesses. SMEs are also pushing for a simpler, fixed-tax system, citing high taxes and rising energy costs as major hurdles. Experts warn that without support, small businesses—the backbone of any economy—risk being squeezed out by larger companies that have easier access to resources and influence.

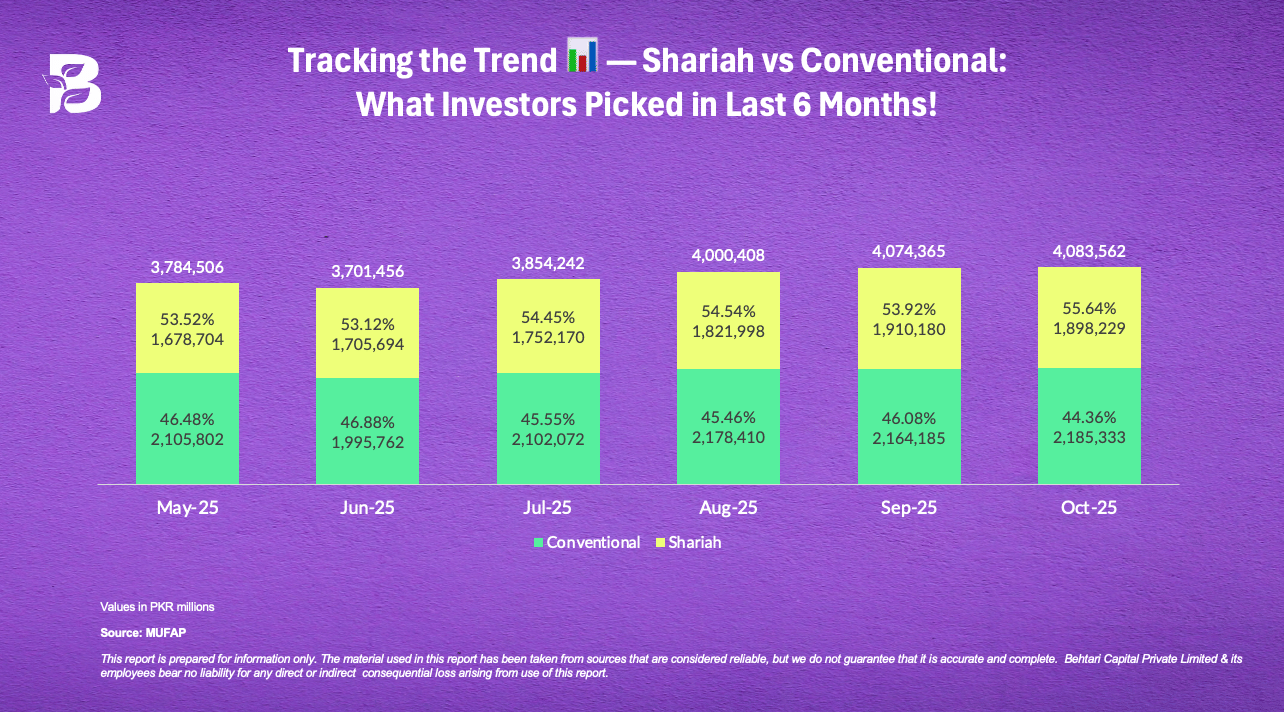

Tracking the Trend 📊 — Shariah vs. Conventional: What Investors Preferred in the Last 6 Months!

The mutual fund industry’s total AUM has surged to Rs. 4.08 trillion 🚀. While Conventional funds still hold a slight majority at 53–55%, Shariah-compliant funds are steadily gaining traction—rising from 45.5% in August to 46.5% in October 2025.

This upward shift suggests that investors are increasingly looking for options that deliver growth while aligning with their values. A powerful trend—and one worth paying attention to.

Ready to invest in funds that match both your goals and your values?

Download the Behtari app today to explore both Conventional and Shariah-compliant funds—simple, transparent, and at your fingertips.

📱 iOS: https://lnkd.in/dFQ2Jr3k

📱 Android: https://lnkd.in/dhAe2dEz

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan