- Pulse by Capital Stake

- Posts

- 💰 Loans, Investments & Returns

💰 Loans, Investments & Returns

Another Week, Another Pulse!

Good morning, everyone! Happy Monday! We hope you’re powering through Ramadan with strength and positivity. Speaking of strength, space travel just took another leap as a SpaceX capsule successfully docked at the ISS, bringing in a new crew and paving the way for astronauts who have been stationed there to finally return home.

Meanwhile, Japan is leading the charge in sustainability, introducing innovative methods to efficiently manage solar waste disposal—a crucial step toward a greener future. Over in the world of science, a fascinating breakthrough suggests aspirin could help fight cancer by breaking down the protective shield that cancer cells use to evade the immune system.

Closer to home, Pakistan has launched a Crypto Council to regulate blockchain and digital assets, signaling a significant move toward shaping the country’s digital finance landscape. However, not all is promising—looming water shortages in Sindh and Punjab threaten vital wheat and sugar crops, raising serious concerns about food security and agricultural sustainability.

Here’s your eight-minute rundown of the week’s biggest stories in business, finance, and tech. Let’s dive in! 🚀

🔹 Key Events to Watch This Week! 🔥

📌 Kabaddi World Cup (England) – 📅 March 17–23 🏆

📌 Roshan Digital Account Numbers Update – 📅 March 18 🌍

📌 Karachi Literature Festival – 📅 March 18–21 📖

📌 T-Bills Auction – 📅 March 19 💰

📌 Foreign Exchange Reserves Report – 📅 March 20 🏦

📌 Weekly SPI (Sensitive Price Index) – 📅 March 21 📊

📌 Current Account Balance Report – 📅 March 21 💼

📌 Pakistan Day Observance – 📅 March 23 🇵🇰

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

What’s the talk of the town? The Pakistan Stock Exchange (PSX) just saw two exciting new listings: Barkat Frisian Agro (BFAGRO) and Zarea Limited (ZAL). In its first five days of trading, BFAGRO surged by 63%, while ZAL had a slower start. This sparked a debate—should minimum margins be revised upward to prevent market manipulation, or is the true success of an IPO only measurable over a full business cycle? The discussion is heating up on X—join in!

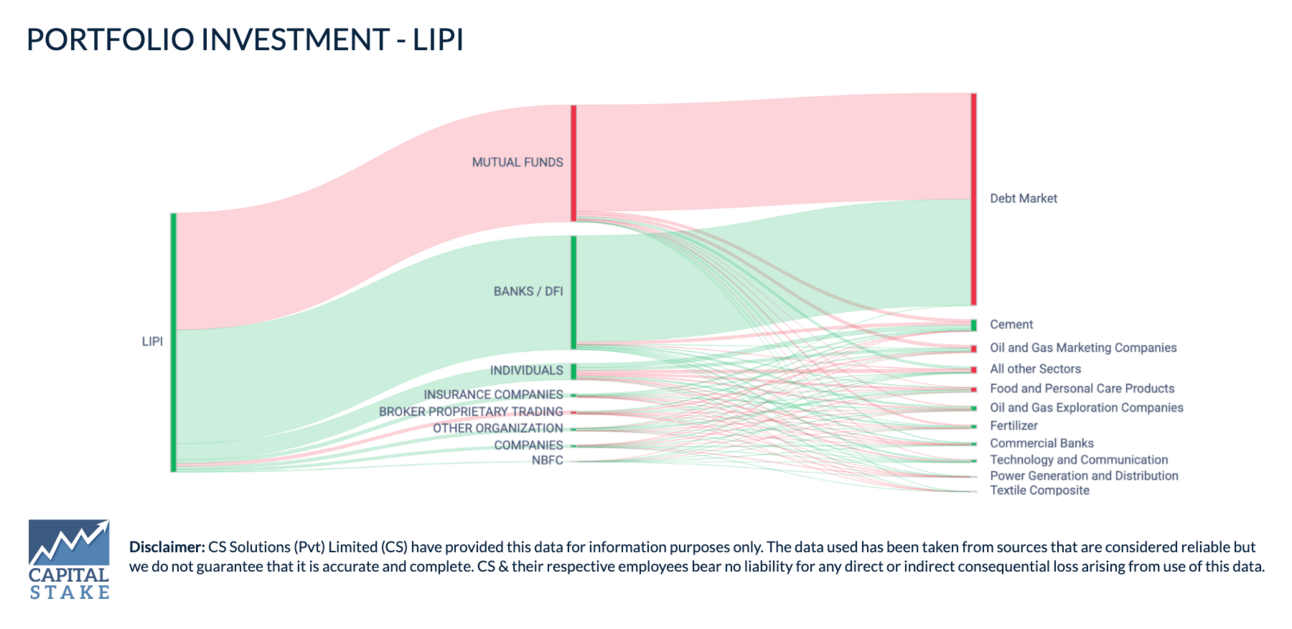

Another key question for investors: Who’s buying and selling? While new listings like BFAGRO and ZAL grab headlines, a look at institutional trading patterns can reveal deeper market trends. Over the last 10 days, mutual funds have been net sellers in the debt market, while Banks and DFIs have stepped in as major buyers. These shifts could signal changing risk appetites or portfolio rebalancing strategies. To stay informed on where the smart money is flowing, check out StockIntel’s portfolio page for real-time insights.

PSX Weekly Recap: How Did Stocks Perform?

Suzuki Discontinues WagonR & Ravi

What Happened?

Pak Suzuki Motor Company (PSMC) has decided to stop producing the Suzuki WagonR and Suzuki Ravi by mid-year. This follows the company’s earlier decision to halt bookings for the Suzuki Mehran and Bolan, signaling a shift in its vehicle lineup.

Why Does It Matter?

Despite strong demand for the Ravi, Suzuki has officially scheduled “nil production” beyond June. Similarly, Bolan, which was discontinued last year, remains in demand. However, Suzuki has not announced a replacement for WagonR, leaving buyers in limbo.

What’s Next?

While WagonR’s future remains uncertain, the Ravi will be replaced by the Every pick-up, which is already in production. Vendors supplying auto parts for Suzuki vehicles warn that small and mid-level dealers may struggle as customers take time to adapt to the new options.

Petrol Prices Unchanged, But Levy Increased

What Happened?

The government has kept petrol and diesel prices (See Trend 📊) unchanged for the next fortnight, starting March 16, 2025. However, to balance global oil price fluctuations, it has raised the petroleum levy by Rs. 10 per litre on both petrol and diesel, bringing the total levy to Rs. 70 per litre.

Current Petrol & Diesel Prices:

High-Speed Diesel (HSD): Rs. 258.64 per liter

Motor Spirit (MS-Petrol 92 RON): Rs. 255.63 per liter

Superior Kerosene Oil (SKO): Rs. 168.12 per liter

Light Diesel Oil (LDO): Rs. 153.34 per liter

Why It Matters

While fuel prices remain the same, the increased levy could impact inflation and transport costs in the long run. To offset this burden, the government has announced a reduction in electricity tariffs to provide some relief to consumers.

What’s Next?

If global oil prices rise, future price adjustments may be necessary. For now, consumers can expect stability at the pump but should keep an eye on upcoming government decisions regarding energy prices.

$1 billion IMF tranche talks conclude 'successfully'

What Happened?

Pakistan is moving closer to securing the next $1 billion tranche from the International Monetary Fund (IMF). Talks are also underway for a new climate-related loan, showing continued financial engagement between the country and the lender.

Why It Matters

IMF loans help stabilize Pakistan’s economy, ensuring the government can meet its financial obligations. However, they also come with strict conditions, such as higher taxes, reduced subsidies, and policy changes, which can affect everyday expenses, fuel, and electricity prices.

What’s Next?

If the deal goes through, short-term relief is expected for Pakistan’s economy, but citizens should prepare for potential cost-cutting measures imposed as part of the agreement. Further negotiations on the climate-related loan could also shape future policies.

SBP Holds Interest Rate at 12%

What Happened?

Contrary to market expectations, the State Bank of Pakistan (SBP) has kept the interest rate unchanged at 12% in its latest Monetary Policy Committee (MPC) meeting. The decision comes despite a decline in food and energy prices, which helped bring down inflation in February 2025.

Why It Matters:

Interest rates impact borrowing costs for businesses and individuals. A lower rate can boost economic growth, while a higher rate helps control inflation. The SBP’s decision signals concerns about inflation risks, especially if food and energy prices rise again. Meanwhile, economic activity continues to improve, as seen in recent indicators.

What’s Next?

If inflation remains under control, the SBP may consider a rate cut in future meetings. However, persistent core inflation and global price volatility mean interest rates could stay high for longer. Businesses and consumers should plan accordingly.

EU Seeks Unified Business Platform for European Companies in Pakistan

What Happened?

A discussion was held between the Finance Minister and the EU Ambassador to discuss the creation of a unified business platform for European companies. The goal is to strengthen trade and investment ties between Pakistan and the EU.

Why It Matters

The EU has already identified over 300 European companies operating in Pakistan, with the potential for many more to expand. A structured business platform could attract more foreign investment, improve trade relations, and create new economic opportunities in Pakistan.

What’s Next?

Discussions are expected to continue on how to improve Pakistan’s investment climate and make it easier for European businesses to operate. If successful, this initiative could lead to more foreign investment and job creation in key industries.

Moody’s Upgrades Outlook for Pakistani Banks

What Happened?

Moody’s Ratings has upgraded its outlook on Pakistan’s banking sector from stable to positive, citing strong financial performance and improving economic conditions. The decision aligns with Pakistan’s sovereign credit outlook, which has also improved.

Why It Matters

This marks a positive shift for Pakistan’s banks, which have significant exposure to government debt. An improved outlook can boost investor confidence, encourage foreign investment, and support economic stability.

What’s Next?

With the economy showing signs of recovery, banks may see stronger growth and improved credit conditions. However, continued economic reforms and stability will be key to sustaining this momentum.

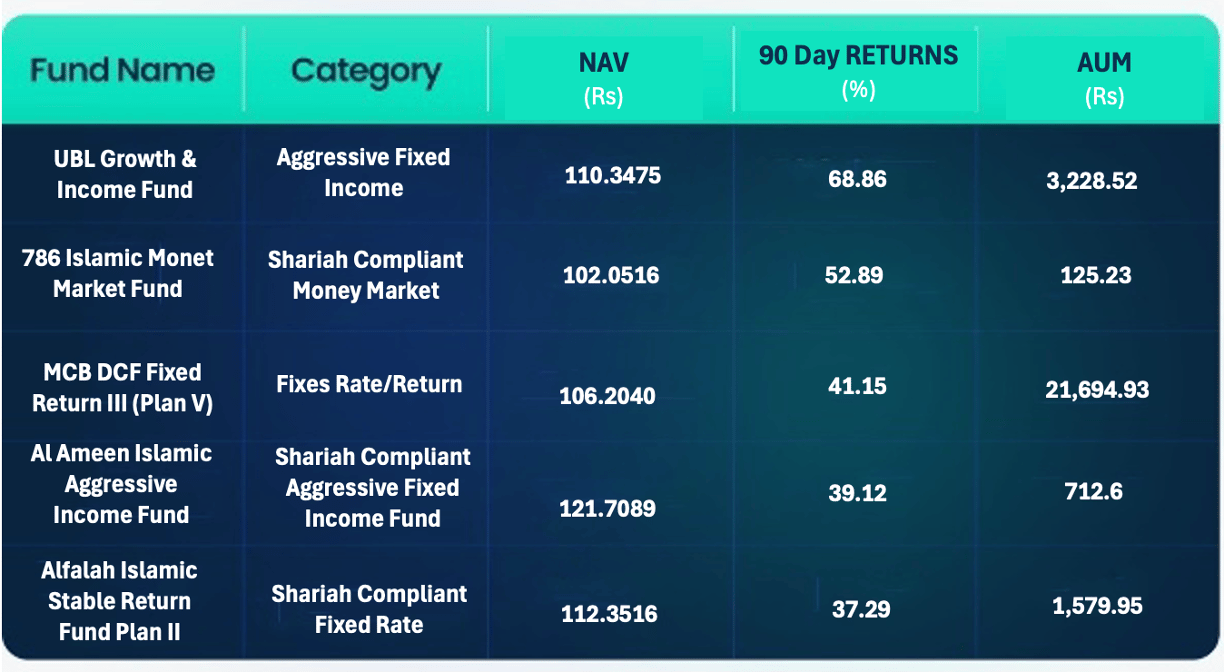

Despite a rate cut in January and a stable interest rate of 12% in March, income funds have continued to outperform equity funds in the last 90 days. Traditionally, equity funds thrive in bullish market conditions, but recent trends suggest that investors are favoring fixed-income options. With market volatility and economic uncertainty, fixed-income funds remain a preferred choice, offering steady returns while minimizing risk. Investors may consider these categories for consistent income generation in the current environment. 📈🔍 You can explore top-performing funds and investment opportunities by downloading the Behtari app today! 🚀📲

🔹 Download for Android: Google Play Store

🔹 Download for iOS: Apple App Store

LAST WEEK IN NUMBERS:

✅ Cricket Glory: India clinched the ICC Champions Trophy final! 🏆🏏

✅ Monetary Policy: The State Bank of Pakistan kept the policy rate unchanged. 🏦📉

✅ Remittance Boom: Inflows surged 38.6% YoY, boosting foreign exchange reserves. 💸📈

✅ Auto Sales Surge: A 50% YoY increase in the first 8 months of FY25. 🚗📊

✅ Forex Reserves Up: Total foreign exchange reserves rose 0.35% WoW. 💰📊

✅ Inflation Watch: The Weekly SPI edged up 0.22%. 📈📅/

Riddle Answer! 🥁

Here for the answer to last week's riddle?

Drum roll, please... 🥁 The answer to the riddle is "Loan"! 💰

New Riddle for the Week! 🤔

I grow with patience but disappear with haste. I can secure your future if properly placed. What am I?

Want to know the answer? Come back next week to find out!

Weekly SPI Inflation Rises by 0.22%

Inflation measured by the Sensitive Price Index (SPI) increased by 0.22% last week, driven by rising prices of tomatoes, chicken, bananas, sugar, and LPG, according to the Pakistan Bureau of Statistics.

Pakistan, IMF Lower Tax Collection Target by Rs. 620 Billion

Pakistan and the IMF have revised the country’s fiscal framework, reducing the Federal Board of Revenue’s annual tax target from Rs. 12.97 trillion to Rs. 12.35 trillion for the current fiscal year.

Gul Ahmed to Establish Four New Subsidiaries

Gul Ahmed Textile Mills Limited plans to set up four wholly-owned subsidiaries focused on specialized and sustainable textile operations, as per a notification to the Pakistan Stock Exchange.

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan