- Pulse by Capital Stake

- Posts

- Market 📈, Fighters ✈️, Optimism ☀️

Market 📈, Fighters ✈️, Optimism ☀️

Another Week, Another Pulse!

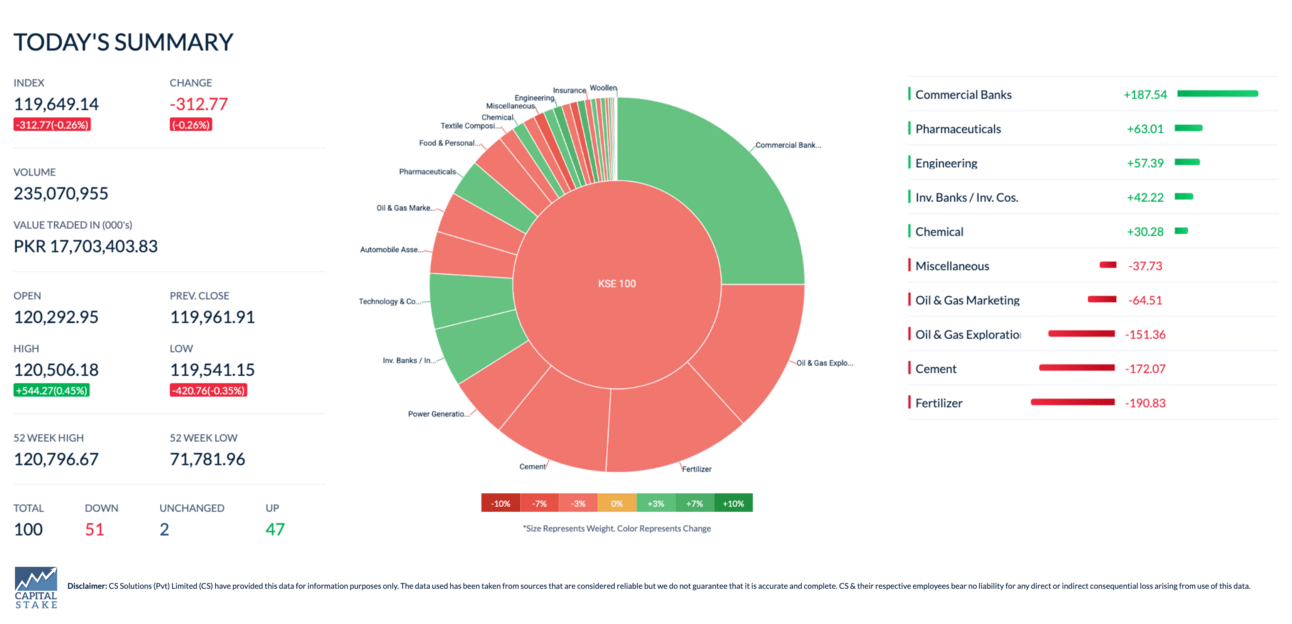

As the world slips back into its daily rhythm—and thermometers climb past 40 °C—optimism is heating up on every front. Pakistan’s KSE-100 blazed 10,000 points higher in a single session, energized by the post-ceasefire calm. Off the trading floor, the IMF applauded Islamabad’s “strong program implementation” for steadying finances and nudging the economy onto firmer ground.

Diplomatic temperatures warmed too: the U.S. President voiced eagerness to expand trade with Pakistan, while Goldman Sachs fanned the upbeat mood by lifting its 12-month outlook for Asian equities on expectations of stronger growth across the region. In other news, Deputy PM–FM Ishaq Dar leaves for China tomorrow as South Asian tensions evolve.

Amid recent Pakistan-India tensions, the spotlight turned to France’s Rafale and China’s J-10C fighter jets. Experts believe the J-10C’s advanced electronic warfare jammed Rafale’s systems, longer-range missiles secured key beyond-visual-range victories, and the Rafale wasn’t fully combat-ready. The market reacted sharply—Dassault’s shares fell 7% in a day, while China’s Chengdu Aircraft, maker of the J-10C, surged nearly 60%, reflecting growing confidence in its fighter.

📅 Key Events to Watch This Week!

📅 21st May 2025 – Large Scale Manufacturing Index 🏭

📅 22nd May 2025 – Foreign Exchange Reserves 💱

📅 23rd May 2025 – Weekly SPI 📈

📅 25th May 2025 – PSL Final 🏏

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

The benchmark KSE-100 index posted a strong weekly gain of 11.46%. However, in the final session, the index slipped by 312.77 points amid investor concerns over the upcoming budget and a cautious market sentiment.

Big Buyers Eye Rafhan Maize Products — Company Plans Major Capacity Expansion

Rafhan Maize Products Company Limited (RMPL), a top food company, has received offers from three big groups—Sapphire Fibres, Cherat Cement with Shirazi Investments, and Nishat Hotels—to buy about 75% of its shares. Earlier this year, on February 17th, the company announced plans to increase corn processing by 200 tons and glucose production by 100 tons. In the last trading session, Rafhan Maize Products’ share price rose by 0.71%, gaining Rs. 65.30 to close at Rs. 9,266.85.

Current Account Surplus shrinks to $12m in April

In April, Pakistan’s current account surplus dropped sharply to just $12 million from $1.2 billion in March (See Data📈), though the overall surplus for the past 10 months remains strong at $1.88 billion. The decline was mainly due to a large trade deficit caused by increased imports of raw materials to support exports. A shrinking surplus means less foreign currency inflow, which can put pressure on the economy. Going forward, Pakistan needs to grow exports and manage imports carefully to keep its financial balance healthy.

Govt Keeps Petrol Price Unchanged Despite Room for Relief

The federal government has decided to keep the price of petrol steady at Rs. 252.63 per liter for the next two weeks, despite some room for price relief. Meanwhile, high-speed diesel prices were reduced by Rs. 2 to Rs. 254.64 per liter, with kerosene and light diesel oil prices also seeing cuts. The decision to hold petrol prices unchanged may reflect concerns over fiscal pressures, subsidy burdens, or the need to maintain government revenue.

Pakistan Needs to Fulfill 11 More IMF Conditions or No More Funds

The IMF has tied the next slice of its $7 billion loan to 11 reforms: parliament must pass a Rs 17.6 trillion budget, raise power tariffs yearly and gas prices twice a year, impose agriculture income tax, scrap the Rs 3.21/unit surcharge cap, legislate a captive-power levy, lift curbs on used-car imports, and roll out governance, social-safety-net, and financial-sector plans; defence spending is pencilled in at Rs 2.4 trillion but could climb amid India-Pakistan tensions. For households this likely means steeper electricity and gas bills, wider taxation, and slimmer pay-packet relief—pinching disposable income—offset only partly by a promise to index cash transfers to inflation and the prospect of cheaper second-hand cars once import restrictions vanish.

Last Week in Numbers

🚗 Auto Sales decreased by 5% compared to last month.

💳 Roshan Digital Account Numbers dropped by 25% MoM.

🌐 The REER Index fell from 101.55 to 99.42.

🏦 Bank Advances went down by Rs 1.6 trillion (between January and April).

💰 Bank Deposits rose by Rs 32 trillion in April.

🌍 Foreign Direct Investment decreased by 3% YoY.

Credits: Pulse by Capital Stake

How Diversifying Your Investments Can Help You Grow Wealth

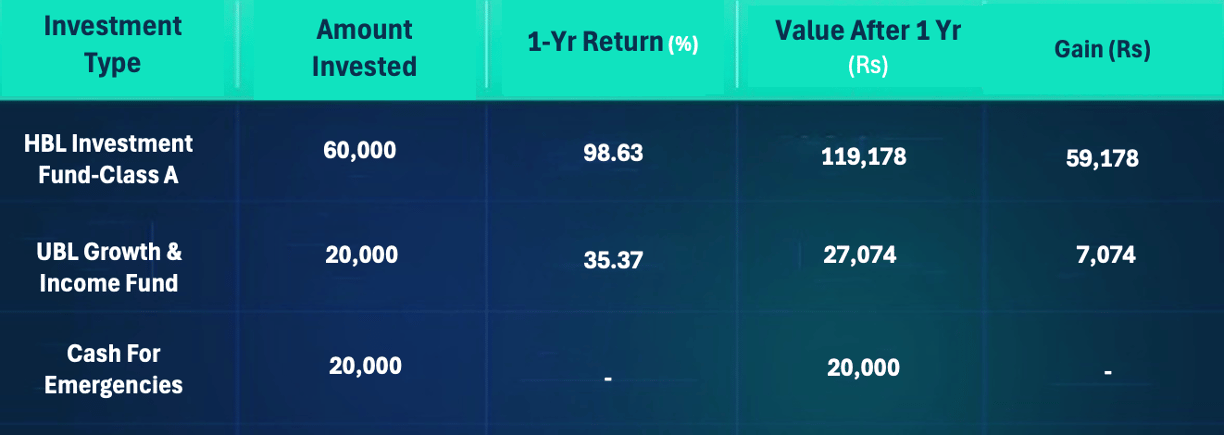

If you’re 25 and have PKR 100,000 to invest, putting all your money in one place might feel risky. Instead, imagine you invest:

60% (PKR 60,000) in a high-growth stock fund like HBL Investment Fund-Class A, which has a current 1-year return of 98.63%

20% (PKR 20,000) in a more stable income fund like UBL Growth & Income Fund, with a current 1-year return of 35.37%

20% (PKR 20,000) kept in cash for emergencies (earning no return but providing liquidity)

Here’s what your investment would look like after one year if these returns hold:

Diversifying across funds with different risk and return profiles helps balance growth and stability, while keeping some cash handy reduces the risk of forced selling during emergencies. With this kind of mix, your money could have grown by over 66% in a year, showing how mutual funds and diversification can help grow your wealth smartly.

If you want to explore such investments easily and track your progress on the go, platforms like Behtari make it simple to start, monitor, and manage your mutual fund portfolio anytime, anywhere.

Ready to start your investment journey?

📲 Download the Behtari app now:

🍏 IOS Download | 🤖 Android Download

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan