- Pulse by Capital Stake

- Posts

- Markets ⚡, Money 💰 & Megawatts 📈

Markets ⚡, Money 💰 & Megawatts 📈

Another Week, Another Pulse!

Last week was nothing short of eventful, as chaos unfolded when Heathrow Airport, the world’s 4th busiest, shut down due to a fire at an electricity substation—potentially costing millions. Meanwhile, oil prices surged after new U.S. sanctions on Iran reignited Middle East tensions. Are we in for another price hike?

On the bright side, Starlink secured a temporary No Objection Certificate (NOC) to operate in Pakistan, promising faster internet—at least for now!

In other news, electricity updates have been giving shocks to solar users! The buyback rate is down to Rs10 per unit, and net billing is in—leaving many wondering if the savings still add up.

Here’s your five-minute rundown of the biggest stories in business, finance, and tech. Let’s dive in! 🚀

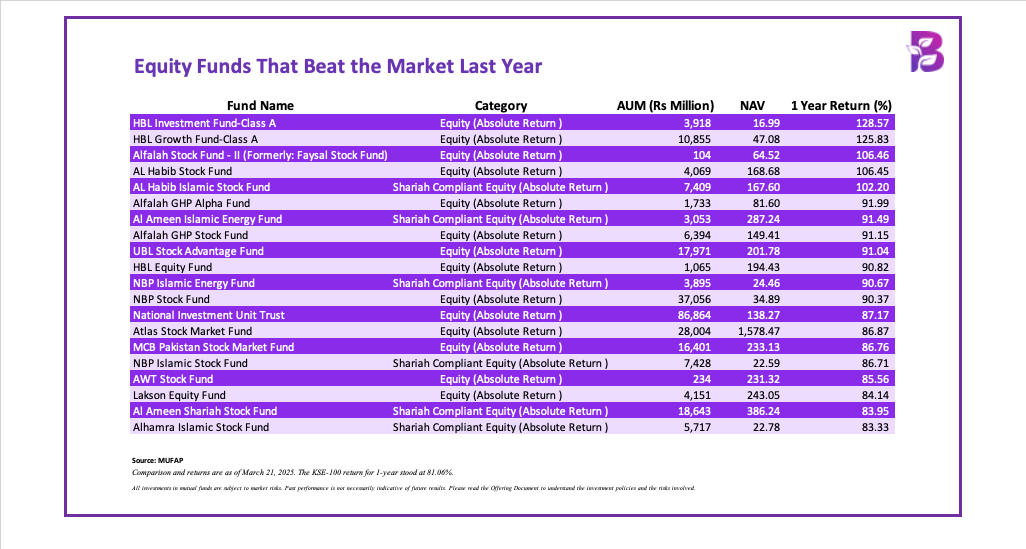

The State Bank of Pakistan has held interest rates steady at 12%, prompting many to rethink their portfolios. 📈 But what if you had invested in equity funds instead?

Behtari Capital’s latest analysis breaks down the potential returns—check it out now on X! 🔍

📅 Key Events to Watch This Week!

📌 China Development Forum 🇨🇳 📆 – March 23-24, 2025

📌 Large Scale Manufacturing Index (LSMI) 📊 📆 – March 24, 2025

📌 International Conference on AI and Machine Learning in Finance & Tech 🤖 📆 – March 24, 2025

📌 Instant Payments Summit ⚡ 📆 – March 24, 2025

📌 Data Analytics & AI for Financial Services Summit 📊 📆 – March 25-26, 2025

📌 Foreign Exchange Reserves Update 💰 📆 – March 27, 2025

📌 T-Bill Auction 🏦 📆 – March 27, 2025

📌 Weekly Sensitive Price Index (SPI) 📈 📆 – March 28, 2025

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

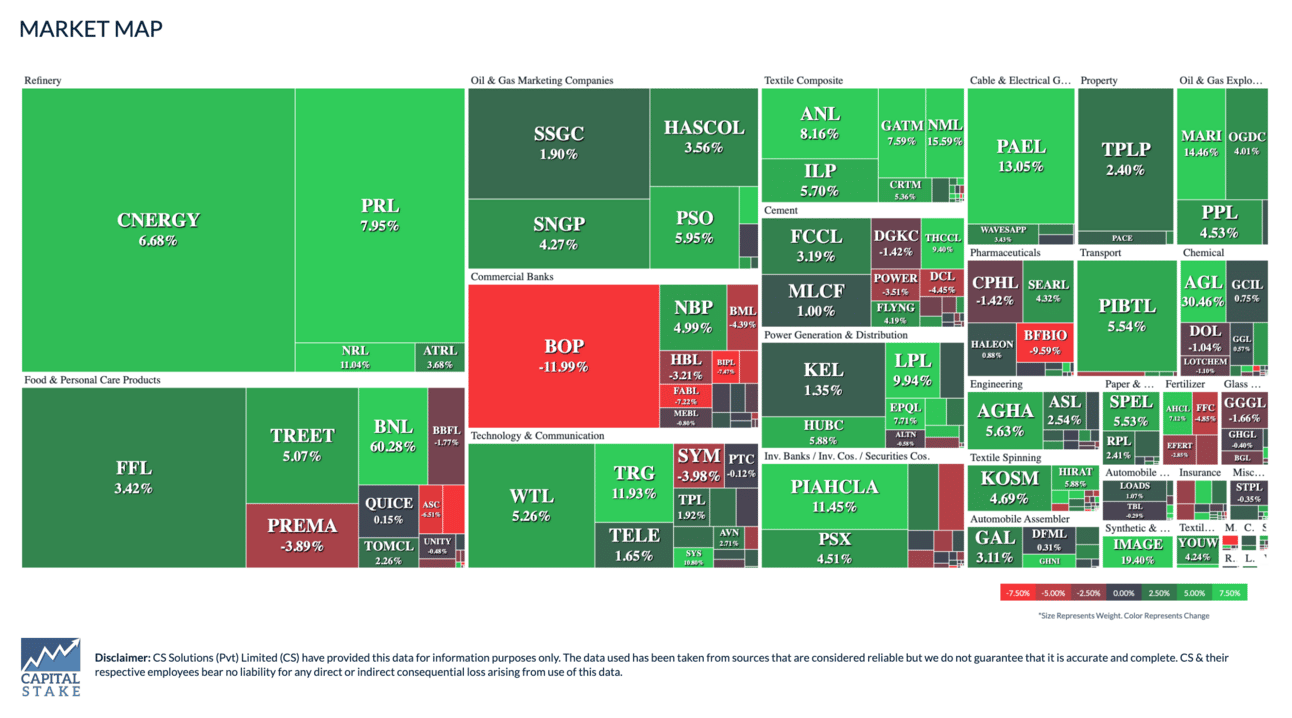

This Week at PSX: Record High! 📈

The Pakistan Stock Exchange hit an all-time high, gaining 2.52% WoW! Optimism surged with Moody’s upgrade of Pakistani banks and hopes for a circular debt resolution.

Enjoying your reading? We'd love to hear your thoughts! Take just 2 minutes to share your feedback by clicking the link: Pulse Feedback Form.

PIA workforce shrinks to 7,000 following job cuts

What Happened?

Pakistan International Airlines (PIA) has significantly reduced its workforce from 18,000 to 7,000 employees. This was part of a broader restructuring plan aimed at improving efficiency and reducing financial losses. The update was shared by Federal Parliamentary Secretary for Defense, Zaib Jafar, during a session in the National Assembly.

Why It Matters?

PIA has long struggled with financial losses and inefficiencies. Cutting jobs may reduce costs, but it affects thousands of families and raises service quality concerns. The airline’s reliance on government bailouts has strained public funds—if restructuring succeeds, it could ease this burden and free up resources for other sectors.

What’s Next?

The restructuring process is ongoing, and further changes may be introduced, including privatization. The government is exploring options to revive the airline, which could involve bringing in private investors or overhauling management practices. PIA’s ability to improve services, reduce losses, and regain passenger trust will determine its future.

Govt plans to use surplus electricity for crypto mining

What Happened?

The Pakistani government is considering using surplus electricity to support crypto mining and blockchain data centers. Officials are working on special electricity rates to attract businesses without offering subsidies.

Why It Matters

Crypto mining requires a lot of electricity, with miners spending up to 70% of their earnings on power costs. Since Pakistan has excess electricity, using it for mining could create jobs, bring investment, and reduce financial losses from unused power. However, ensuring a stable electricity supply and managing the risks of the crypto industry will be key challenges.

What’s Next?

The government is in discussions with stakeholders to finalize electricity tariffs. If successful, this could boost Pakistan’s digital economy, but clear policies and regulations will be needed to ensure long-term benefits.

IMF approves tax cut on property purchases in Pakistan

What Happened?

The IMF has agreed to reduce the withholding tax on property purchases in Pakistan by 2%, starting in April 2025. However, the tax on property sellers will remain the same. The IMF also approved a Rs60 billion reduction in Pakistan’s tax revenue target for March 2025.

Why It Matters

Lowering taxes on property purchases could make buying real estate more affordable and boost the market. However, keeping the tax on sellers unchanged means selling property won’t become any cheaper. The reduction in the tax revenue target could ease pressure on businesses and taxpayers.

What’s Next?

The new tax rate will take effect in April 2025. The government will now focus on balancing tax collection while keeping the real estate market attractive for buyers and investors.

Pakistan’s First PKR-denominated Green Bond Launched to Accelerate Climate Finance

What Happened?

Pakistan has taken two major financial steps to support economic resilience and climate action. The World Bank has approved $102 million to strengthen the microfinance sector, ensuring financial stability for small borrowers, particularly in climate-affected areas. At the same time, Pakistan’s first Green Bond has been launched to raise Rs. 1 billion for eco-friendly projects, helping to fund clean energy and sustainability initiatives. The Green Bond, issued by Parwaaz Financial Services Limited, is listed on the Pakistan Stock Exchange and aims to mobilize capital for environmental development.

Why It Matters?

Pakistan faces severe climate challenges, including floods, heatwaves, and air pollution. In the past, limited financial resources made it difficult to invest in solutions like clean energy and disaster preparedness. The Green Bond provides funding for environmental projects, while the microfinance support ensures that vulnerable communities, especially in rural areas, have financial stability.

What’s Next?

The funds will be used to support green projects and microfinance institutions. If successful, these initiatives could help Pakistan build a stronger, eco-friendly economy. However, proper fund management and regulatory oversight will be essential to ensure long-term impact.

Ogra and Oil Refineries Disagree Over Fuel Imports and Supply Issues

What Happened?

Pakistan’s oil regulator, Ogra, and the country’s five oil refineries are in a dispute over fuel imports and supply issues. Refineries claim they are not being fully utilized because excessive imports of refined oil are being allowed, while Ogra argues that refineries are not fulfilling their commitments. This conflict is leading to financial losses for the country.

Why It Matters

Pakistan is losing foreign exchange by importing refined petroleum instead of using locally refined products. If local refineries remain underutilized, it could harm the country’s energy security and increase reliance on imports. Both sides blaming each other creates uncertainty in the oil market, which can lead to supply disruptions and price fluctuations.

What’s Next?

Ogra has suggested new agreements between refineries and oil companies to resolve the issue, but refineries believe these agreements won’t help unless the regulator enforces proper policies. A resolution is needed to prevent further economic losses and ensure a stable fuel supply.

The KSE-100 index has surged to new highs, gaining 81.06% over the past year. Several equity funds have outperformed the index, with HBL Investment Fund – Class A leading the way. Stay updated on market trends and fund performance through the Behtari app.

🔹 Download for Android: https://shorturl.at/HSNfm

🔹 Download for iOS: https://shorturl.at/J0RUC

SBP Reserves Rise by $49 Million, but FY25 Target Remains Uncertain

The State Bank of Pakistan’s foreign exchange reserves increased to $11.146 billion, yet challenges persist in meeting the $13 billion target for FY25 due to recent declines.

Federal Cabinet Approves 188% Salary Hike for Ministers

Ministers and advisers will now receive up to Rs. 519,000 per month following an amendment to the 1975 Act, significantly increasing their salaries from previous levels.

Sugar Prices Surge to Rs. 180 Per KG Despite Government Intervention

Sugar prices continue to climb, reaching Rs. 180 per kg in major cities, despite official efforts to stabilize rates at Rs. 164 per kg nationwide.

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan