- Pulse by Capital Stake

- Posts

- Markets 📊, Money 💰, Momentum ⚡

Markets 📊, Money 💰, Momentum ⚡

Another Week, Another Pulse!

While the country prepares for a renewed season of Basant next month, the last week was full of news. On the economic front, all eyes are on the State Bank of Pakistan, which is due to announce the Monetary Policy for the next two months on January 26th. This decision will set the tone for interest rates and your borrowing costs. Meanwhile, things got a little better on the regional political front as tensions eased between the US and Iran, causing global oil prices to fall more than 4 per cent on Thursday—a much-needed breather for the global energy market.

Closer to home, the federal government is already mapping out the future, with plans to approve the Budget Strategy Paper by May 10. There is a sense of optimism in the air as Pakistan’s Large Scale Manufacturing (LSM) Index increased by 10.4 per cent year-over-year in November 2025. This growth supports the government’s confidence that the economy will outperform international estimates this year, with specific relief planned for the salaried class and registered businesses in the upcoming federal budget.

In a move to stabilize our reserves, Pakistan has requested the United Arab Emirates to roll over $2.5 billion in debt for two years and reduce interest rates by nearly half. On the digital front, the State Bank has allowed exchange companies to connect with Raast, the country’s instant payment system. This means your home remittances can now be facilitated through a faster and safer channel. Additionally, a new look for our wallet is coming; the federal cabinet has given the go-ahead to print newly designed banknotes for the Rs. 100, 500, 1,000, and 5,000 denominations.

The tech world, however, is facing some friction. Telecom operators have warned the PTA that the 5G spectrum auction is currently "commercially unviable," as it would require an annual investment of about $150 million from each operator just for infrastructure. Despite this, digital finance is moving forward, with the Ministry of Finance signing a deal to explore using "stablecoins" like USD1 for easier cross-border transactions.

In other sectors, the search for a partner to revive PIA continues as the Arif Habib-led consortium begins due diligence with interested local and international parties. On the trade front, a major milestone was reached as bilateral trade with Canada crossed $1 billion. However, your weekly grocery bill might feel a bit heavier; short-term inflation (SPI) rose by 3.87 per cent this week, primarily driven by the rising cost of tomatoes and LPG cylinders. Interestingly, more Pakistanis are hitting the road through bank leasing, with auto financing jumping to Rs. 319 billion this December.

Adding to the week’s developments, the Economic Coordination Committee (ECC) approved over Rs. 7 billion for the Defence Division to boost capacity and cybersecurity. This aligns with a promising new report suggesting Pakistan’s defence export pipeline—featuring the JF-17 Thunder and Al-Khalid tanks—could become a major economic engine, with potential deals already reaching double-digit billions. On the health front, a new National Vaccine Policy has been drafted to offer 10-year tax breaks and incentives for local manufacturing, aiming to end our reliance on expensive imported vaccines. However, a note of caution comes from the World Bank, which predicts that while our growth is picking up, the current account deficit may widen in the 2026-27 fiscal year as we import more to fuel this expansion.

As you plan your next week, keep a close watch on the State Bank’s announcement on the 26th—it will be the biggest indicator of where the economy is headed for the rest of the quarter.

Here’s your recap of everything that you need to know to stay ahead.

🎧 Tune in to this week’s Pulse:

Youtube - https://tinyurl.com/mrsj2dkz

📅 Key Events This Week!

📌 19th January 2026

🌐 Roshan Digital Account

📌 20th January 2026

💰 Current Account Balance

📌 21st January 2026

📊 T-Bills Auction

📌 22nd January 2026

💱 Foreign Exchange Reserves

📌 23rd January 2026

📈 Weekly SPI (Sensitive Price Index)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

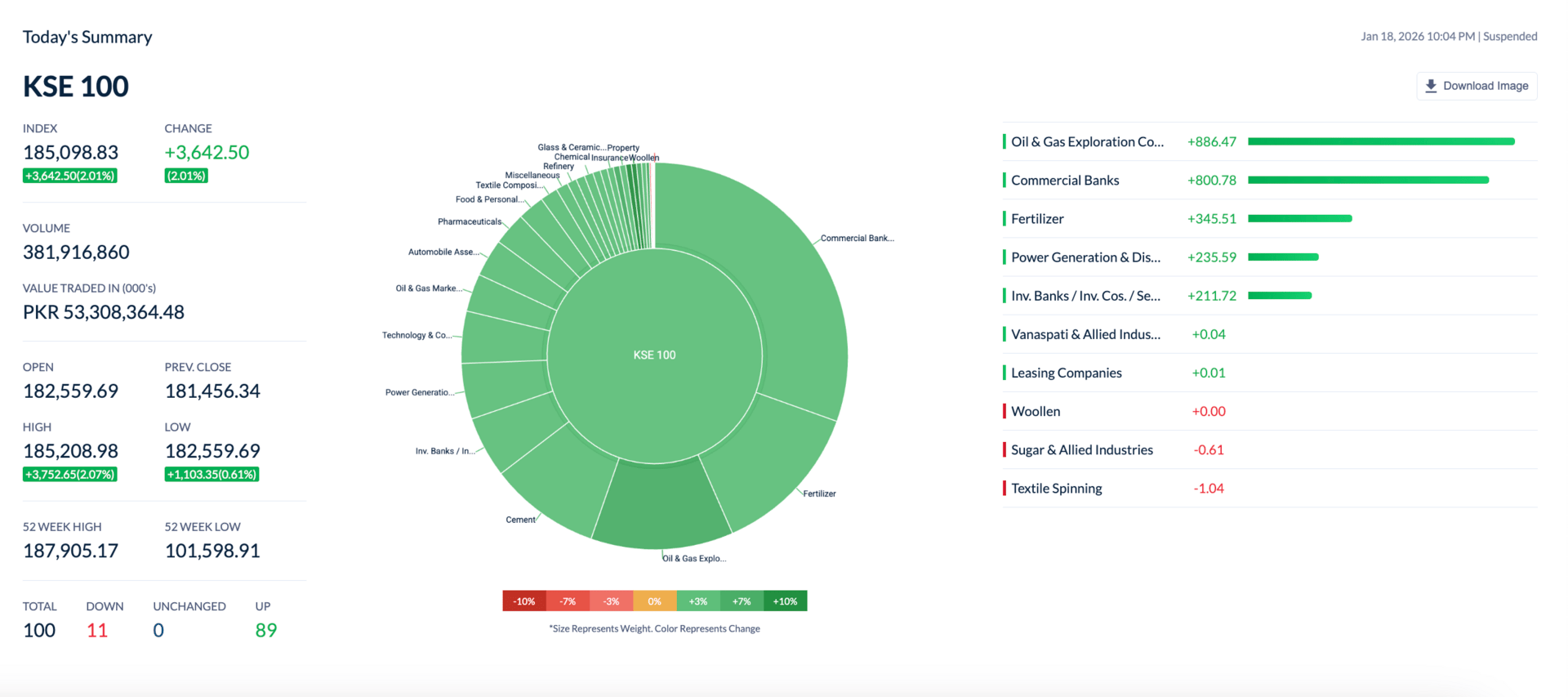

The Pakistan Stock Exchange ended the week on a slightly positive note, as a strong finish in the final session lifted the market out of an otherwise quiet trading spell. The benchmark KSE-100 index hovered within a narrow range for most of the week, reflecting investor caution amid ongoing geopolitical concerns. By week’s end, the index closed at 185,099 points, up 689 points or 0.4 percent. Sentiment improved noticeably on Friday as fresh liquidity entered the market, regional tensions showed signs of easing, and expectations grew around a possible policy rate cut, helping the bourse finish the week on firmer ground.

Capital markets will become faster as PSX transitions to T+1 settlement

The Pakistan Stock Exchange will move to a T+1 settlement cycle from February 9, 2026, so trades will now be completed within one business day instead of two. The change, introduced by the SECP, will speed up transactions, reduce risk, and make it easier for investors to manage their portfolios. By adopting the T+1 system, Pakistan joins major markets like the US and India, improving market efficiency and attracting both local and foreign investors.

Petrol, diesel unchanged, levy increased

The government has kept petrol and diesel prices unchanged for the fortnight starting January 16, but increased the petroleum levy. Petrol remains at Rs253.17 per litre and diesel at Rs257.08, while the levy rises by Rs4.65 on petrol and 80 paise on diesel, bringing total levies to Rs87 on petrol and Rs79 on diesel. The change affects fuel costs for transport and logistics, which could influence prices of goods and everyday expenses for consumers.

Govt cuts bond yields

The government raised Rs546 billion in a Pakistan Investment Bonds auction, cutting yields by up to 70 basis points. The largest amounts went to 10-year (Rs126bn) and 3-year (Rs125bn) tenors. Falling yields, along with slowing inflation, have raised expectations of a rate cut at the next monetary policy meeting on January 26.

SBP injects Rs12.8tr via OMOs

The State Bank of Pakistan injected Rs12.8 trillion into the banking system on Friday through conventional and Shariah-compliant Open Market Operations, with rates around 10.5%. The move eased pressure on banks and ensured liquidity remained available for lending, supporting financial stability. The rupee also inched up slightly to 279.95 against the US dollar.

Gap at the Top: Is the Market Becoming Too One-Sided? 📊

The December 2025 rankings just came out, and the "Big Three"—Al Meezan, NBP, and MCB—are in a league of their own. Together, they now control roughly 35% of all industry assets 💰.

To put that in perspective: out of the 21 AMCs on this list, just these three manage over PKR 1.4 trillion 💵. While the whole industry is growing toward the PKR 4 trillion mark 📈, the gap between these leaders and the rest is only getting wider.

But does being the biggest always mean being the best? The giants offer safety and trust 🛡️, but smaller and mid-sized companies can sometimes move faster to capture better profits 🚀.

What’s your strategy? 🤔 Are you sticking with the big names for peace of mind, or exploring other players for higher growth?

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan