- Pulse by Capital Stake

- Posts

- Markets 📈, Policy 📝, Expansion 🏗️

Markets 📈, Policy 📝, Expansion 🏗️

Another Week, Another Pulse.

The past week was nothing short of eventful. On the global stage, the headlines were dramatic: in an audacious operation, the United States captured Venezuelan President Nicolás Maduro, flew him to New York to face drug-trafficking charges, and temporarily took control of the country — a move that stunned the international community.

Back home, the New Year brought some relief at the pump as petrol prices were reduced by Rs 10.28 per litre for the next fortnight. Inflation data followed, showing a mixed picture for households. Overall consumer inflation slowed to 5.6% in December 2025, offering a little breathing room, though weekly price trends still rose 2.41% compared to last year, highlighting ongoing pressure on essentials like food and fuel.

Economic pressures were also visible on the trade front. Pakistan recorded a trade deficit of over $19 billion in the first half of the fiscal year, as exports fell while imports grew faster than expected following recent trade policy changes. The widening gap between what the country sells abroad and what it buys is keeping pressure on Pakistan’s external finances.

Growth signals were more encouraging. Pakistan’s economy expanded by 3.71% in the first quarter (July–September), up from 1.56% a year earlier. Urea sales hit a record 1.356 million tons in December 2025, while cement despatches grew modestly by 1.47%, reaching 4.347 million tons compared to 4.284 million tons in the same month last year.

Policy and structural developments also moved forward. The Prime Minister formed a committee to set the pricing framework for the upcoming 5G spectrum auction, while preparations for Pakistan’s first-ever Panda Bond in China’s capital market aim to diversify external funding and strengthen economic ties with China.

Finally, the shift toward digital finance continued at pace. During FY2024–25, digital payment channels processed 2.5 billion transactions, totaling over Rs 55 trillion — a clear sign of the country’s growing adoption of cashless payments.

Your 5-minute recap of all the key updates.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/drwn89x8

SoundCloud - https://tinyurl.com/mr3hyhyz

📅 Key Events This Week!

📌 7th January 2026

🏦 T-Bills Auction

📌 8th January 2026

💱 Foreign Exchange Reserves

📌 9th January 2026

📊 Weekly SPI (Sensitive Price Index)

💸 Worker’s Remittances

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

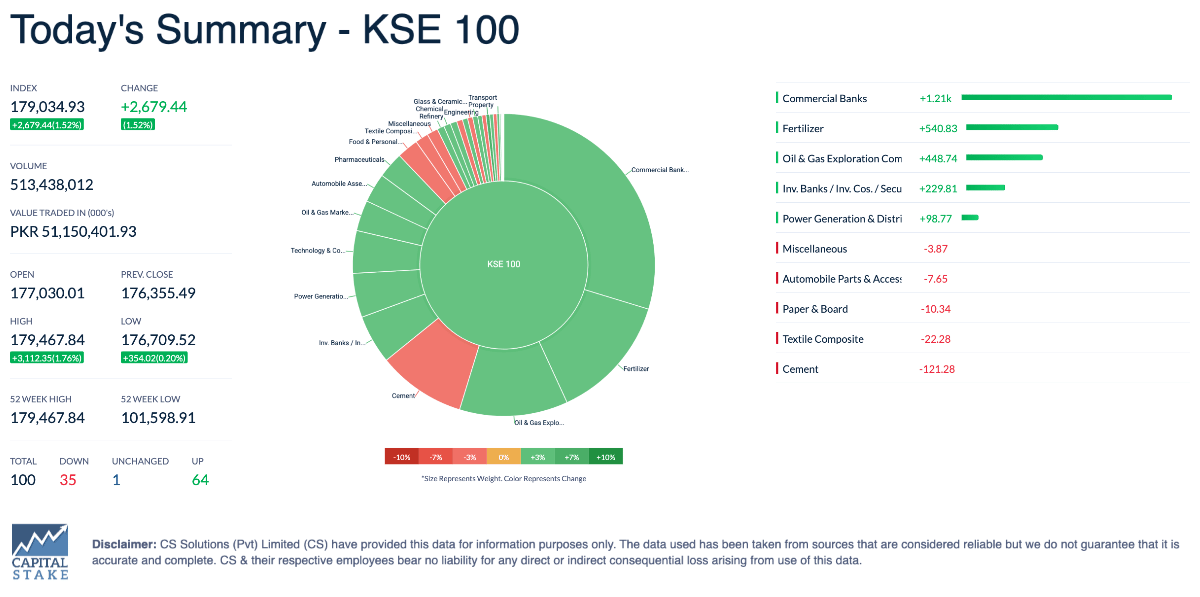

The KSE-100 Index soared by 6,634 points, gaining 3.8% week-on-week, and reached a new all-time high of 179,035 points by Friday. The rally was supported by typical New Year optimism and a softer-than-expected inflation print of 5.6% for December 2025.

PSX Invites Bids for Sale of ISE Towers REIT Shares

The Pakistan Stock Exchange (PSX) has invited bids from eligible institutions for 3.03 million shares of ISE Towers REIT Management Company, which were pledged by a defaulting member. The shares, valued at Rs 22.56 each as of June 2025, will be sold to recover approved claims, with bidders required to submit offers by January 8, 2026. This sale gives institutional investors a rare chance to acquire shares in a listed real estate trust, while the PSX uses the process to maintain market discipline and recover dues. The winning bidder will complete the payment within a week of selection, and the final price and competition among bidders will be closely watched by the market.

DG Khan Cement to Launch Pakistan’s Largest Clinker Line

DG Khan Cement (DGKC) has announced plans to set up Pakistan’s largest single clinker production line, with a capacity of 11,000 tons per day, at Mauza Khofli Sattai, Dera Ghazi Khan. Disclosed to the Pakistan Stock Exchange, the brownfield project marks a major expansion for the company, boosting production capacity to meet growing domestic cement demand and strengthening its position in the industry. DG Khan Cement already operates multiple factories across Dera Ghazi Khan, Chakwal, and Hub, Balochistan.

PTCL Completes Acquisition of Telenor Pakistan and Orion Towers

PTCL (PTC) has completed the acquisition of 100% of Telenor Pakistan and Orion Towers, following approval from the Pakistan Telecommunication Authority (PTA). Telenor will operate separately during the transition before eventually merging with PTCL’s Ufone 4G business, subject to regulatory approvals. The merger aims to expand reach, improve customer service, and accelerate innovation, while regulatory safeguards ensure fair competition and investment in future spectrum auctions.

IMF Recommends 18% Tax on Local Hybrid and Electric Vehicles

The International Monetary Fund (IMF) has recommended that Pakistan end the current sales tax exemption for locally manufactured hybrid and electric vehicles and bikes, proposing a standard 18% rate from the next fiscal year. Currently, hybrids up to 1,800cc face 8.5% tax, and those between 1,801–2,500cc are taxed at 12.75%, but the exemption under the Eighth Schedule is set to expire on June 30, 2026. If adopted, this move would remove preferential treatment for the local electric and hybrid vehicle industry, significantly altering the tax structure that has encouraged cleaner, energy-efficient transport in Pakistan.

SBP Injects Rs13 Trillion, Sets Rs4.5 Trillion Borrowing Target

The State Bank of Pakistan (SBP) injected Rs13 trillion into the economy through conventional and Shariah-compliant operations, aiming to ensure liquidity and smooth functioning of financial markets. Separately, the central bank announced plans to borrow Rs4.5 trillion from the market between January and March 2026 through government bonds and treasury bills to fund fiscal needs. The rupee remained largely stable, closing at Rs280.11 against the US dollar, while local gold prices rose sharply, with 24-karat gold gaining Rs5,700 per tola to reach Rs460,262.

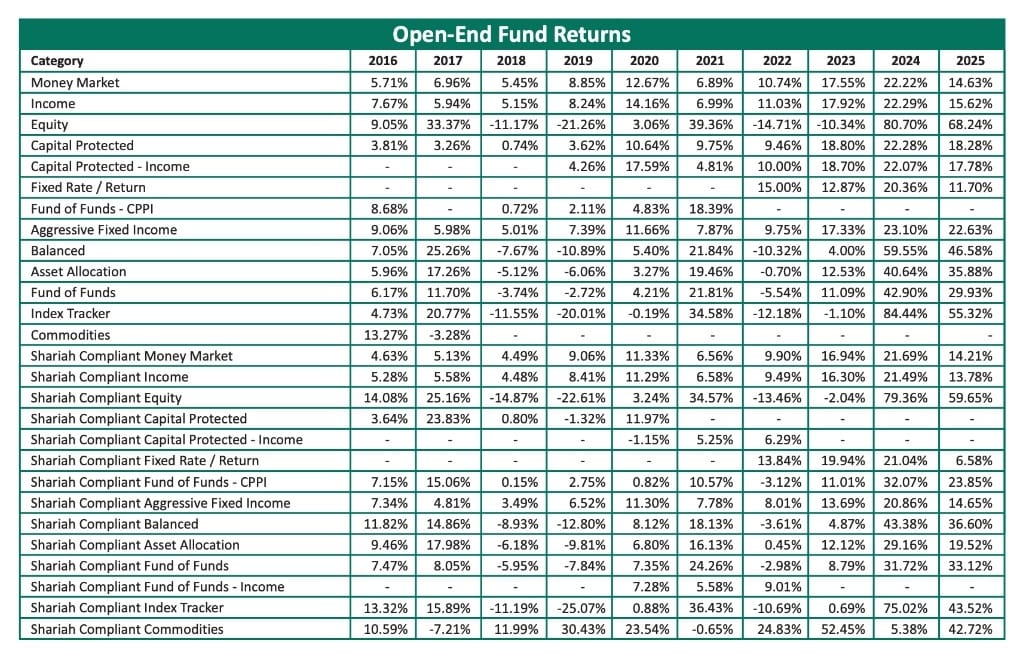

From the volatility of 2018–2019 to the historic highs of 2024, the open-end fund landscape has seen it all. As Commodities and Equity markets experienced significant shifts, Fixed Rate and Capital Protected funds offered a cushioned alternative for risk-averse investors. Explore the full 'Funds in View' breakdown below to see how your portfolio aligns with these long-term trends.

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan