- Pulse by Capital Stake

- Posts

- Markets 📈, Strikes ✊, Surplus 💰

Markets 📈, Strikes ✊, Surplus 💰

Another Week, Another Pulse!

From flooded streets to flooded headlines, the week was packed with developments reshaping Pakistan’s economic and social landscape. Karachi and Lahore witnessed large-scale market closures as traders protested against new tax measures introduced in the Finance Act 2025. Meanwhile, the government is preparing to replace the current solar net metering system, hinting at major shifts in the country’s renewable energy future. In tech news, Pakistan assured Google that it won’t be impacted by the new 5% digital tax, clarifying that the law applies only to companies without a local office. An audit report revealed that the Senate bypassed procurement rules in spending over Rs. 28 million on food and beverages. On the revenue side, the FBR reported a record 7.27 million tax filers — a promising sign, though questions remain about whether this reflects meaningful progress on meeting collection targets. The government also launched Pakistan’s first Gender Pay Gap Report and National Action Plan, revealing stark income disparities and calling for reforms. In parallel, SECP introduced a draft Women EquiSmart Policy to push for greater gender inclusion in financial sectors. Pensioners received welcome news with a 15% increase in EOBI pensions, and Pakistan’s economic leadership engaged with Moody’s to outline the country's reform efforts and stability roadmap.

Here’s your quick 6-minute recap of all the news you need to know this week.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/3hphajab

SoundCloud - https://tinyurl.com/3t35vx4b

Spotify- https://tinyurl.com/u5smt2un

📅 Key Events to Watch This Week

📌 🏦 Roshan Digital Account Update – 22nd July 2025

📌 💵 T-Bills Auction – 23rd July 2025

📌 🌍 Foreign Exchange Reserves – 24th July 2025

📌 🛒 Weekly SPI Release – 25th July 2025

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

In other key developments this week, the Pakistan Bureau of Statistics has begun work on a long-awaited Producer Price Index (PPI), expected to be rolled out by the end of the fiscal year. Meanwhile, the federal government has proposed raising the transaction threshold for disallowing cash-based business expenses from Rs. 200,000 to Rs. 2.5 million, marking a major policy shift. On the investment front, Pakistan is set to receive up to $100 million from Madagascar, signaling stronger trade ties between the two nations.

However, not all proposals are finding favor. The IMF has turned down Pakistan’s plan to impose a one percent water storage cess on taxable goods and instead suggested increasing the general sales tax rate to raise funds for development. The IMF has also directed the Ministry of Finance and the State Bank to jointly create a sustainable funding model for the Pakistan Remittances Initiative (PRI).

On a positive note, the State Bank recognized top-performing banks for enabling over 64,000 digital transactions worth Rs. 4.65 billion in cattle markets this Eid. Meanwhile, fuel prices continue to climb, with petrol up by Rs. 5.36 and diesel by Rs. 11.37 per liter, putting more pressure on already stretched household budgets.

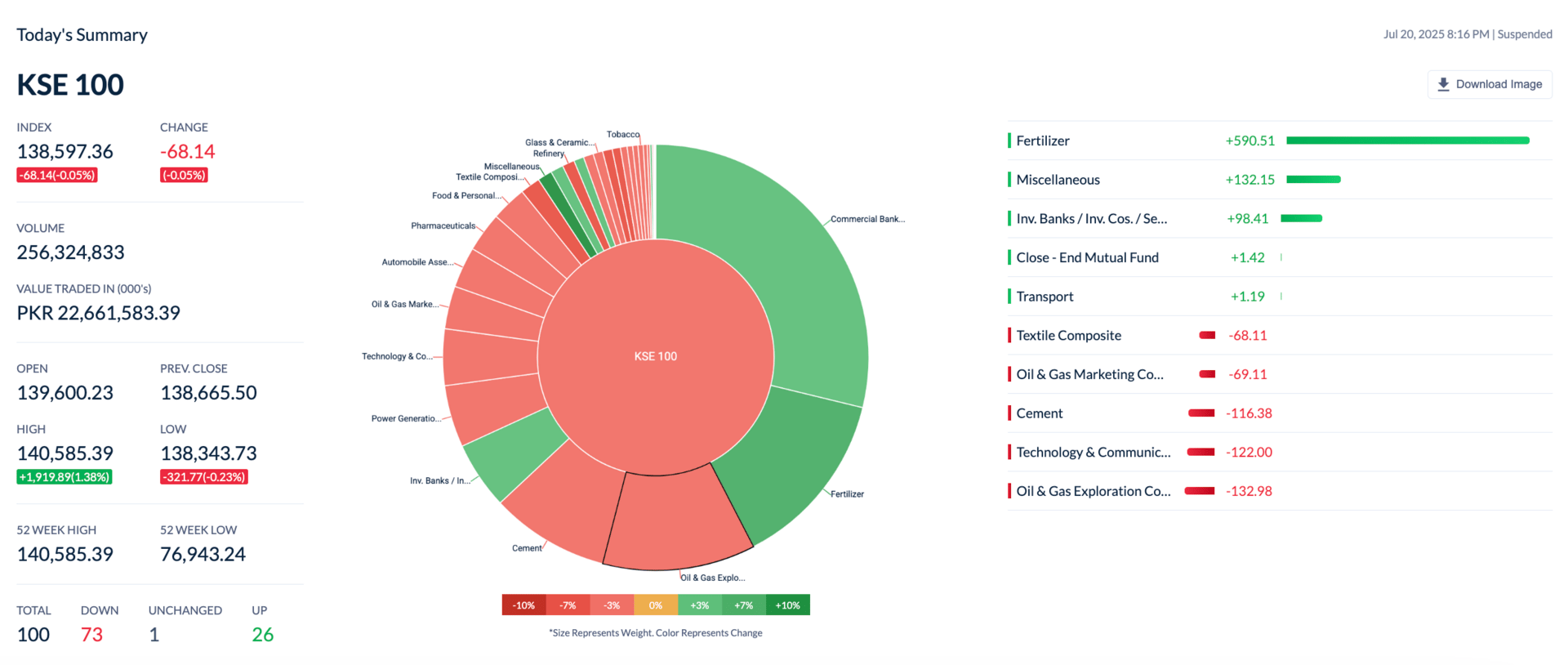

The Pakistan Stock Exchange (PSX) saw a strong rally this week, gaining 4,298 points (up 3.2% WoW basis) to close at 138,597. The surge was fueled by broad-based buying across sectors, supported by positive macroeconomic developments and improved investor sentiment.

Zarea Sets Up Subsidiary in UAE

Zarea Limited (ZAL) has set up a new company in Dubai called Zarea Commerce FZCO, which will serve as its regional headquarters. This move is a big step for the company as it looks to grow internationally, especially in technology-driven B2B trade. By establishing a presence in the UAE, Zarea aims to tap into global markets, boost exports, and digitize its operations. This could open up new opportunities for the company and signal its ambition to become a bigger player beyond Pakistan. Going forward, we can expect Zarea to focus more on expanding its reach and building international partnerships.

Fast Cables Becomes First Pakistani Manufacturer Certified by Abu Dhabi Energy Company

Fast Cables Limited (FCL) has made headlines by becoming the first Pakistani cable manufacturer to be certified as an approved vendor by the Abu Dhabi National Energy Company (TAQA). This certification is a significant achievement, as TAQA is a major global player in the energy sector, operating across 11 countries. The recognition highlights Fast Cables' commitment to quality, innovation, and meeting international standards. It also opens the door for the company to participate in large-scale regional and global energy projects, marking a big step forward in its journey toward international growth and recognition.

AKD Group Acquires 27.95% Stake in PC Hotels Operator

AKD Group Holding has acquired a 27.95% stake in Pakistan Services Limited (PSEL), the company that operates the well-known Pearl Continental Hotel chain. This move was formally disclosed through a filing at the Pakistan Stock Exchange, marking a significant development in the hospitality sector. The acquisition signals AKD Group’s growing interest in the tourism and real estate space, potentially bringing new investment and strategic direction to one of Pakistan’s most recognized hotel brands. With this stake, AKD now has a meaningful influence in the operations and future plans of the Pearl Continental group, which could lead to further expansion, upgrades, or shifts in the hospitality landscape.

Govt Forms Committee to Address Concerns Over New Tax Laws in Budget

The government has formed a special committee to address growing concerns from the business community over new tax measures introduced in the federal budget. This follows a split among business leaders over a planned nationwide strike on July 19, 2025. While most chambers have agreed to negotiate through the committee led by SAPM Haroon Akhtar, the Lahore Chamber of Commerce has announced it will go ahead with the strike. This matters because the proposed measures—such as taxing large cash transactions, deploying tax officers to business premises, and enforcing digital tracking systems—have sparked serious pushback from traders. In the next 30 days, the committee will hold consultations to propose a consensus-based solution to the Prime Minister, which could determine whether tensions ease or further escalate.

Govt Preparing Plan to Offer Easy Loans to Farmers

The government is working on a plan to offer easy loans to small and medium-scale farmers, as part of a broader push to boost agricultural growth. In a high-level meeting chaired by Prime Minister Shehbaz Sharif, officials were directed to prepare a detailed action plan by the end of the month. The focus will be on farmers with less than 12 acres of land, who will also receive support in accessing modern tools, quality seeds, and technologies like artificial intelligence. This matters because improving access to credit and technology could help increase productivity and income for millions of small farmers. What’s next is the rollout of this plan, which could play a key role in rural development and food security.

Pakistan Posts Current Account Surplus of $2.1 Billion in FY25

For the first time in 14 years, Pakistan has posted a current account surplus, closing FY25 with a $2.1 billion gain, according to fresh data from the State Bank of Pakistan. This marks the highest surplus since FY03 and a major turnaround from the $2 billion deficit recorded last year. In June 2025 alone, the surplus stood at $328 million, compared to a $500 million deficit in June 2024. While exports saw a modest increase, the real driver behind this improvement was a surge of over 25% in remittances from overseas Pakistanis. This matters because a current account surplus eases pressure on foreign exchange reserves and strengthens the country’s external position. The challenge now will be sustaining this momentum, especially as global and domestic economic conditions evolve.

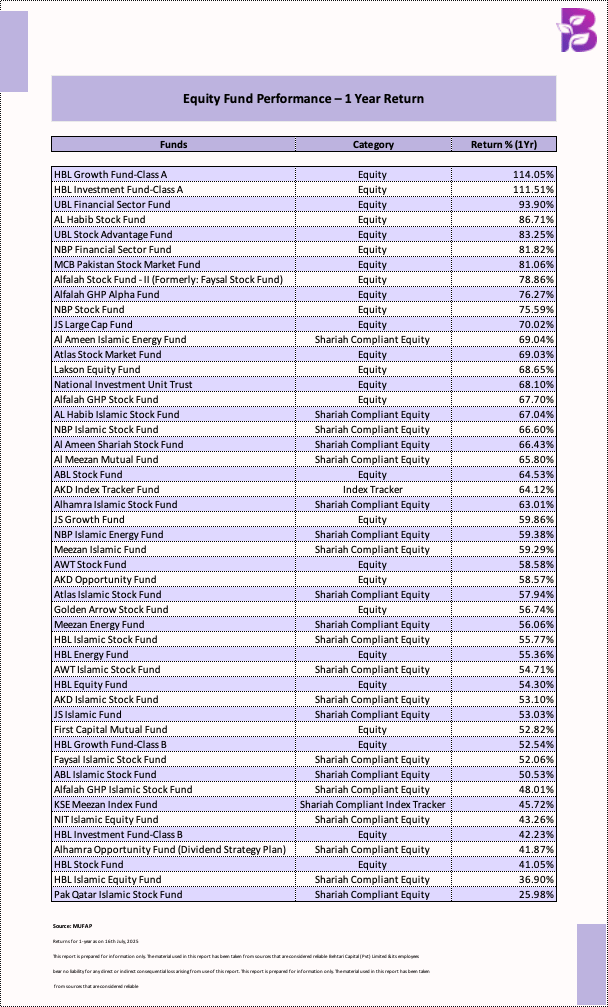

Did Your Fund Beat the Market?

The KSE-100 Index delivered an impressive 1-year return of +72.99% 📈 but not all mutual funds kept pace. While a few outperformed the market, many fell short. It’s a good time to check how your fund stacks up against the benchmark and whether it’s really working for you.

👉 Choose the right fund — download the Behtari app today!

📱 Android: https://lnkd.in/dhAe2dEz

📱 iOS: https://lnkd.in/dFQ2Jr3k

📊 Numbers in View

📈 KSE-100 Index: +3.20%

🛒 SPI Inflation: +0.38%

🌍 FDI: +1% MoM

💵 Current Account: $2.1B ✅ Surplus

🏭 LSMI (May ’25): -3.38% MoM

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan