- Pulse by Capital Stake

- Posts

- Pulse by Capital Stake

Pulse by Capital Stake

Another week, Another Pulse!

Good morning! Even though Valentine’s Day has passed, the sweet vibes are still alive and kicking. Our news feed has been buzzing non-stop—from Turkey’s president gracing Pakistan with his presence to the electrifying action on the cricket field during the tri-series league, our nation has truly been center stage. The economic engines are revving up too: auto sales have surged by 73% as interest rates dip, remittances have jumped 25.2% year-on-year, and a new government loan scheme is offering up to Rs1 million for those securing jobs abroad. With two IMF missions on the horizon and top global money managers setting their sights on Pakistan’s sizzling $50 billion market, things are finally starting to move after the extended period of quiet in Pakistan!

Here’s your five-minute digest of the week’s most exciting news in business, finance, and tech.

Meanwhile, gold prices are soaring, putting a smile on investors’ faces, while Apple teases a new budget smartphone as iPhone SE stocks run low. But not all news is shiny—a fresh study warns that pesticides are throwing nature off balance, stunting growth and even altering animal behavior.

In other news, Trump recently made headlines by saying his advisers will set new tariffs based on what other countries charge, their taxes, and subsidies. This move could change how global trade with the U.S. works.

Starting 2025 with a bang, Zarea Limited raised Rs1.03 billion in the first IPO of the year on the Pakistan Stock Exchange. However, there is commentary on both sides of the aisle where potential conflict of interests have been common talk on X.

Key Events to Watch This Week! 🔥

IMF Missions Arrival – Feb 18-20, 2025 💼

SBP Buyback Auctions – Feb 17–21, 2025

Foreign Exchange Reserves Update – Feb 20, 2025 💹 (See history 📊)

Government Debt Auctions – Feb 19, 2025 💰

Lahore Literary Festival (LLF) 2025 – Feb 21-23, 2025 🎉

Weighted Average Lending & Deposit Rates for January 2025* – Feb 17, 2025 📊

Balance of Payments Report* – Feb 18, 2025 💹 (See history 📊)

Monthly Summary on Foreign Trade Statistics* – Feb 19, 2025 📈

Nominal/Real Effective Exchange Rates* – Feb 20, 2025 💱 (See history 📊)

* Tentative Dates

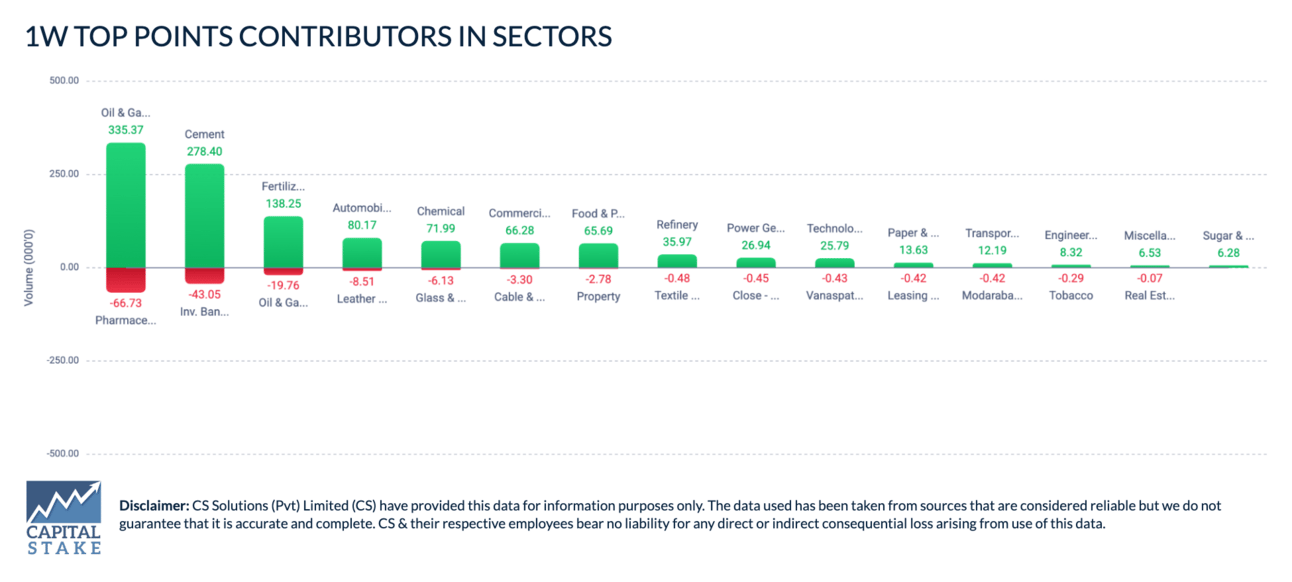

KSE All Sectors: Weekly Contribution Highlights

AsiaPak and Montage Oil Compete for Majority Stake in Lotte Chemical

What Happened:

Two companies—AsiaPak Investments, a private investment firm with assets in Pakistan and Hong Kong, and Montage Oil, a Middle Eastern oil and gas company—have submitted bids to acquire a 75.01% stake in Lotte Chemical Pakistan (LOTCHEM). This was officially disclosed in a notice filed with the Pakistan Stock Exchange.

Why It Matters:

LOTCHEM is a major player in the country’s chemical industry, and this potential acquisition could bring fresh investment, improved operations, and possibly expansion. If completed, the deal may impact Pakistan’s industrial sector, job market, and foreign investment climate.

What’s Next:

Regulatory approvals and negotiations will determine the final outcome of the deal. If one of the bidders secures the majority stake, it could lead to changes in management and business strategy. Investors and industry experts will be closely watching how this deal unfolds and its implications for Pakistan’s corporate landscape.

Remittances Surge 25.2% YoY to Reach $3 Billion in January

What Happened:

Pakistan received $3 billion in workers' remittances (📊View Trend) in January 2025, marking a 25.2% year-on-year (YoY) increase. This also contributed to the country's fourth consecutive current account surplus. From July 2024 to January 2025, total remittances reached $20.8 billion, up 31.7% compared to the same period last year, according to the State Bank of Pakistan (SBP).

Why It Matters:

Remittances are a major source of foreign exchange, helping to stabilize Pakistan’s economy. The surge supports currency reserves, strengthens the rupee, and reduces external financial pressure. The biggest contributors in January were:

Saudi Arabia: $728.3 million

UAE: $621.7 million

UK: $443.6 million

US: $298.5 million

What’s Next:

Experts anticipate that remittances will continue to grow, providing much-needed financial stability for Pakistan. If this trend sustains, it could further support the country’s external account and economic outlook in the coming months.

Two More IMF Missions Scheduled for Policy Talks in Pakistan

What Happened:

Pakistan is hosting a technical IMF mission on judicial and regulatory systems, with two additional policy-level missions on the way. These missions will discuss over $1 billion in extra financing for climate resilience and review the $7 billion Extended Fund Facility (EFF). Meanwhile, the IMF has urged Pakistan to adopt more effective public finance management methods—calling for modernized budget monitoring and live tracking of development funds.

Why It Matters:

These discussions and recommendations are designed to strengthen Pakistan’s economic stability, ensure efficient use of funds, and support key reforms in fiscal management and climate resilience.

What’s Next:

The upcoming IMF missions will assess Pakistan’s economic framework and policy reforms, including improvements in budget monitoring. Their findings could pave the way for further financial support and strategic adjustments to help Pakistan better navigate its economic challenges and climate change impacts.

Pakistan Car Sales Surge to 2.5-Year High in January 2025

What Happened:

Pakistan’s car sales soared by 61% YoY in January 2025, reaching 139,161 units—the highest in 2.5 years. Additionally, a 73% MoM increase was noted, with sales climbing to 17,010 units compared to December 2024.

Why It Matters:

This robust growth is fueled by lower interest rates, boosted consumer confidence, and the launch of new vehicle variants. The reduction in auto loan rates, following recent interest rate cuts by the State Bank of Pakistan, has made purchasing vehicles more affordable for consumers.

What’s Next:

If the current momentum persists, the automotive sector could continue to drive economic activity and consumer spending, further contributing to Pakistan’s economic recovery.

SBP Changes How It Buys Back Government Debt

What Happened:

The State Bank of Pakistan (SBP) has changed its method for buying back government debt. Instead of just buying short-term debt, it will now also purchase long-term bonds like Treasury Bills and Pakistan Investment Bonds, including different types like Zero Coupon, Fixed, and Floater bonds.

Why It Matters:

This move is designed to help reduce Pakistan’s overall debt and improve how the government manages its finances. By buying back more types of bonds, the government hopes to lower its debt burden and keep its finances in better shape.

What’s Next:

With this new strategy, Pakistan aims to make its debt more manageable, which could boost investor confidence and lead to more stable economic policies.

Global Oil Prices See Weekly Rise Amid Policy Shifts

What Happened:

This week, global oil prices have been on the rise as the U.S. moves to cut Iranian oil exports and tariff worries ease. Despite the weekly gains, oil prices have dropped over the month as traders react to daily policy changes and comments from President Trump that could impact both oil supply and demand.

Why It Matters:

Oil prices affect everyday costs like gas and the price of goods. When prices rise, consumers and businesses may face higher expenses, while falling prices can create uncertainty about market stability.

What’s Next:

The future direction of oil prices is uncertain. If efforts to resolve the Russia-Ukraine conflict move forward or if U.S. and OPEC+ boost production, prices might continue to drop. However, ongoing policy shifts and tariff issues could alter the current trend, keeping the market on edge.

FUNDS IN VIEW:

With interest rates declining further, this week we focus on equity funds boasting the highest assets under management (AUM). AUM represents the total value of assets that a fund manages, reflecting the cumulative investment by all its investors. A higher AUM is a strong indicator of investor confidence, showing that more capital is being entrusted to these funds.

Fund Name | Category | AUM (PKR Mn) | NAV (PKR) | Returns % (YTD) |

National Investment Unit Trust | Equity | 90,001 | 129.18 | 51.46 |

Meezan Islamic Fund | Shariah Compliant Equity | 40,559 | 114.743 | 40.5 |

NBP Stock Fund | Equity | 33,805 | 32.3533 | 51.08 |

Atlas Stock Market Fund | Equity | 25,497 | 1472.1129 | 45.19 |

Al Ameen Shariah Stock Fund | Shariah Compliant Equity | 16,576 | 350.95 | 43.94 |

Unveiling the Answer! 🎉

And the Answer for Last Week's Riddle is… Credit Card 💳! Did you get it right? Share your thoughts and challenge your friends with this week's brainteaser! 🚀

Riddle of the Week:

I show up every month, reminding you of your spending habits. I’m not a fee, but I reveal how well you manage your money. What am I? 🤔

Stay tuned for the full riddle and answer next week.

In Other News:

Roshan Digital Account attracts $9.5bn inflows

As of January 31, inflows through the Roshan Digital Account reached $9.564 billion. Out of this, $1.711 billion was repatriated, while $6.052 billion was utilized locally. Despite these inflows, the net repatriable liability remains at $1.8 billion. The RDA was launched in 2020 following significant outflows from treasury bills and investment bonds during the COVID-19 outbreak.

SBP reserves fall $500mn in less than a month:

The State Bank of Pakistan’s (SBP) foreign exchange reserves plunged by over half a billion dollars in less than a month. The central bank recorded an outflow of $252 million to $11.166 billion during the week that ended on Feb 7 (View data).

Biafo Industries Announces Partnership with Reko Diq Mining Company

Biafo Industries Limited (PSX: BIFO) has signed a contract for blasting services at the Reko Diq gold and copper mine.

Get to Know More About Our Products

Behtari – Your one-stop shop for mutual fund investments.

StockIntel – Make the most knowledgeable investing decisions.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan