- Pulse by Capital Stake

- Posts

- 🏏Cricket, Debt & Deals

🏏Cricket, Debt & Deals

Another Week, Another Pulse!

This weekend was packed with action, from an electrifying Pakistan-India cricket showdown to major economic updates that stirred conversations across the country. While sports fans were glued to their screens, economic indicators painted a concerning picture, with Pakistan’s circular debt surging to Rs 2.384 trillion. Meanwhile, mixed price trends for essential commodities (See history 📊) during Ramadan brought both relief and uncertainty. On the financial front, Pakistan is gearing up for $1 billion climate financing talks with the IMF. At the same time, the World Bank’s private investment arm is looking to fund large-scale infrastructure projects that could inject $2 billion annually into the country over the next decade.

Here’s your quick five-minute roundup of the week’s biggest stories in business, finance, and tech.

Meanwhile, gold prices, which had recently provided some relief, have rebounded and are once again on an upward trend. On the bright side, Pakistan’s foreign exchange reserves (See Trend 📊) got a small boost! The State Bank added $35 million to its reserves last week, bringing the total to $11.20 billion as of February 14.

Amidst all the market buzz, a new debate has emerged on X over dividend-based investing. 📢Some argue that focusing on high-dividend stocks relies too much on past performance, and today’s top dividend payers may not be the best performers in the future. 📉 On the other hand, there is a belief that dividends play a crucial role in market valuations and long-term investment strategies. 📊Catch the heated discussion and see the latest opinions on X! 🗣️

🔥 Key Events to Watch This Week!

📌 IMF Delegation Visit – 📅 Feb 24-28, 2025 💼

📌 Pakistan Banking Summit 2025 – 📅 Feb 24-25, 2025 🏦

📌 Investment Conference 2025 – 📅 Feb 26-28, 2025 💰

📌 Government Debt Auctions – 📅 Feb 26, 2025 📈

📌 SBP Foreign Exchange Reserves Update – 📅 Feb 28, 2025 📊

📌 Prime Minister’s Visit to Azerbaijan – 📅 Feb 24-25, 2025 🤝

📌 Monetary Policy of Pakistan Announcement – 📅 Mar 10, 2025 📈(View Trend📊)

📌 Petrol Prices of Pakistan – 📅 Mar 01, 2025 ⛽ (View History📊)

KSE-100 Index: Weekly Review

Rollercoaster Week at Pakistan Stock Exchange! 🎢

It’s been a wild ride at the Pakistan Stock Exchange (PSX) as earnings season kicks into high gear! 🚀 50 financial results were announced last week, and the momentum isn’t slowing down—over 200 board meetings are scheduled for the coming week! 🏦📊

Stay ahead of the game by tracking live earnings announcements on StockIntel and never miss a market-moving update! 🔔

Lucky Cement Announces Stock Split – What It Means for Investors

What Happened:

Lucky Cement has decided to split its shares, changing the face value from Rs10 to Rs2 per share. This means for every one share currently held, investors will receive five new shares. However, the total value of their investment remains the same—the price of each share will be adjusted accordingly. The decision was made in a board meeting and will need approval from shareholders in an Extraordinary General Meeting (EoGM) on March 18.

Why It Matters:

A stock split does not change the overall value of the company, but it makes shares more affordable for smaller investors. By lowering the price per share, more people can buy and trade Lucky Cement stock, increasing liquidity and market participation. This move could make the stock more attractive, potentially boosting demand in the long run.

What’s Next:

If shareholders approve the split, the number of shares in circulation will increase from 293 million to 1,465 million. The price per share will adjust accordingly. Investors should keep an eye on Lucky Cement’s stock price and market reaction leading up to and after the split

Pakistan’s Cement Exports Jump Nearly 25%

What Happened?

Pakistan’s cement exports saw a significant increase of 24.85% in the first seven months of FY25, reaching $188.091 million, compared to $150.653 million during the same period last year. The volume of exports also grew by 35.34%, with shipments rising from 3.89 million metric tons to 5.27 million metric tons.

In January 2025, cement exports surged 40% year-on-year, hitting $20.619 million compared to $14.728 million in January 2024. However, on a month-on-month basis, exports dropped 35.36%, down from $31.898 million in December 2024.

Why It Matters:

The rise in cement exports highlights growing international demand for Pakistani cement, which is positive for the country's foreign exchange earnings and industrial growth. However, the monthly decline in January suggests seasonal factors or global market fluctuations might be impacting exports.

What’s Next?

Going forward, it will be important to monitor whether exports continue to grow or face further slowdowns. Factors such as global demand, raw material costs, and government policies will play a key role in shaping future trends in Pakistan’s cement sector.

Pakistan’s Current Account Swings Back to Deficit

What Happened?

Pakistan spent more on imports (See History📊) than it earned from exports in January 2025, leading to a $420 million deficit in its current account. This means more money left the country than came in. It’s a big shift from December 2024, when Pakistan had a $474 million surplus (meaning it earned more than it spent).

The main reason for this deficit was that imports increased by 11%, reaching $5.455 billion, while exports fell by 4%, bringing in $2.94 billion(See History📊). This caused the trade gap (the difference between imports and exports) to grow.

However, there was some good news—Pakistan received $3 billion in remittances (See Trend 📊) (money sent home by Pakistanis working abroad), a 25% increase from January 2024.

Why It Matters:

When Pakistan imports more than it exports, it loses foreign currency, which can put pressure on the country’s economy and its ability to pay for essential goods like fuel and machinery. A growing trade deficit can also impact the value of the rupee and make imported goods more expensive.

What’s Next?

To improve the situation, Pakistan needs to increase exports, control unnecessary imports, and keep remittances strong. If the trade gap continues to widen, it could make things tougher for the economy in the coming months.

IMF Team to Visit Pakistan in March for Loan Review

What Happened?

A team from the International Monetary Fund (IMF) will visit Pakistan in early to mid-March to review the country’s economic progress under the Extended Fund Facility (EFF) program. This review is important for securing future loan installments.

Before the main mission arrives, a technical team will visit in late February to discuss Pakistan’s request for additional support under the Resilience and Sustainability Facility (RSF), which helps countries address economic and environmental challenges.

Why It Matters:

Pakistan is currently relying on a $7 billion IMF bailout program to stabilize its economy. The IMF's review will determine whether Pakistan is meeting its financial targets and if it can receive further assistance. A successful review can boost investor confidence and help strengthen the economy.

What’s Next?

The IMF team will assess Pakistan’s economic policies, reforms, and financial stability. If the review goes well, Pakistan could receive further IMF funding, easing financial pressures. However, failure to meet IMF conditions might lead to delays in funding and more economic challenges.

Pakistan’s REER index clocks in at 104.05 in January 2025

What Happened?

Pakistan’s Real Effective Exchange Rate (REER) rose to 104.05 in January 2025, up from 103.67 in December 2024, according to the State Bank of Pakistan (SBP). This marks a 0.37% increase from the previous month and a 2.3% rise compared to January 2024, when the REER stood at 101.7 (See Trend 📊) .

Why It Matters:

A higher REER (above 100) means the Pakistani rupee is stronger, making imports cheaper but reducing export competitiveness. If the currency becomes too strong, Pakistani goods may become expensive in international markets, potentially affecting exports and trade balance.

What’s Next?

Pakistan needs to strike a balance—a very strong rupee can hurt exports, while a weaker rupee can increase import costs. The government and SBP will likely monitor the situation to ensure Pakistan's currency remains competitive without harming economic growth.

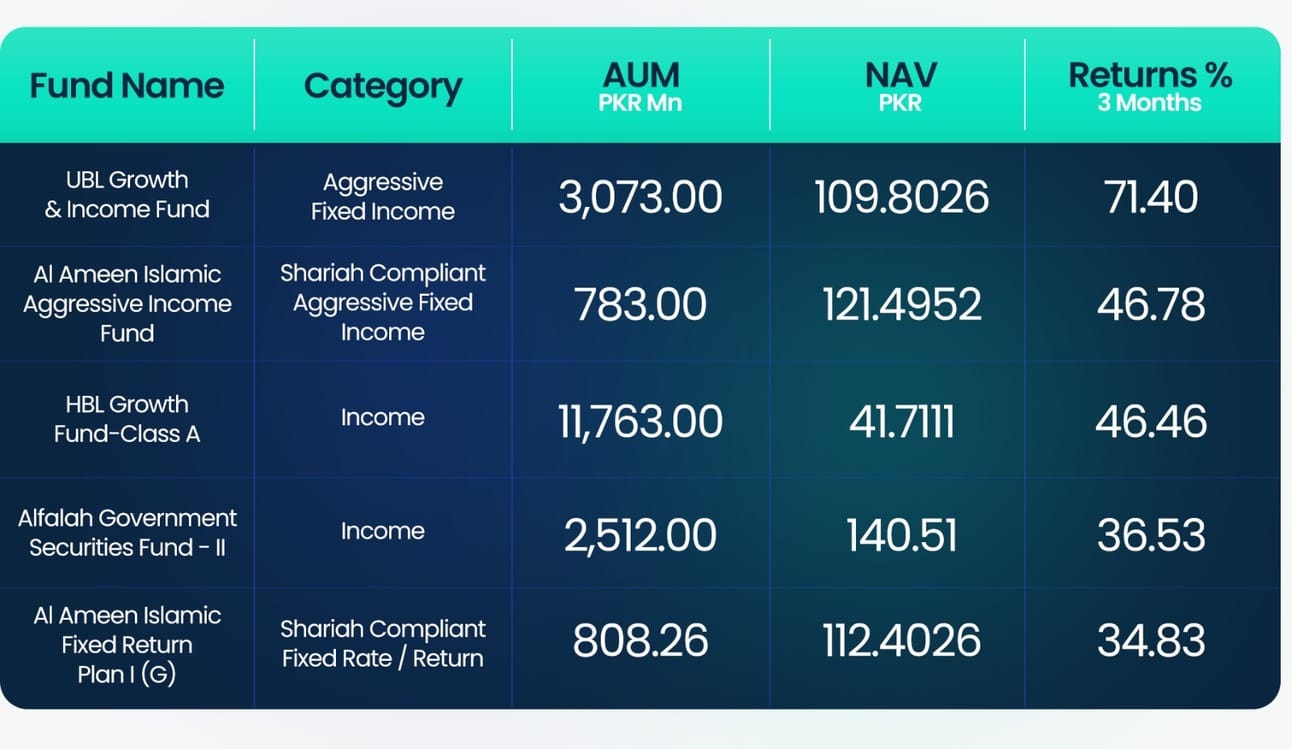

FUNDS IN VIEW:

Despite fluctuating interest rates, fixed income and aggressive fixed income funds have delivered strong returns over the past three months. Rather than benefiting solely from rising bond prices, these funds leveraged active portfolio management, strategic asset allocation, and credit spreads to optimize returns. The following funds recorded the highest gains during this period, reflecting effective investment strategies in a shifting rate environment.

Riddle Answer! 🥁

Here for the answer to last week's riddle?

Drum roll, please... 🥁The answer to the riddle is a credit card. 💳

Riddle of the Week!

I'm a plan to keep you on track, spend too much and you'll feel the lack. Set me right, and you'll be wise, what am I in finance eyes?

Want to know the answer? Come back next week to find out!

In Other News:

SECP Issues New Company Name Selection Guidelines

With the number of registered companies reaching 240,000, SECP has introduced new guidelines to address the rising rate of name rejections.

Govt Plans Digital Transformation with Data Park Initiative

Ahsan Iqbal chaired a meeting on Pakistan’s first Data Park, aimed at providing real-time socio-economic data through interactive screens and dashboards for students, researchers, and policymakers.

Trade Deficit with Middle East Widens

Pakistan’s trade deficit with the Middle East grew by 5.62% to $7.984 billion in the first seven months of FY25, driven by increased petroleum imports.

Get to Know More About Our Products

Behtari – Your one-stop shop for mutual fund investments.

StockIntel – Make the most knowledgeable investing decisions.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan