- Pulse by Capital Stake

- Posts

- 📉 Rankings, 💰 Revamps & ⚖️ Reforms

📉 Rankings, 💰 Revamps & ⚖️ Reforms

Good morning, people! The past week has been a whirlwind! The world celebrated Women’s Day in full spirit, while Ramadan continues to bring its energy to daily life. Amid the celebrations, a sobering reality made headlines—Pakistan ranked 145th out of 146 countries in the Global Gender Gap Report 2024. On the economic front, your morning glass of milk might cost more (or less) soon, as officials reconsider the 18% sales tax on packaged milk to ease industry pressures.

Meanwhile, the top ranks of bureaucracy might be getting a makeover. The government is considering adding new high-level positions to shake up salary structures and make room for promotions. Over in the financial world, all eyes are on today’s big policy meeting—what’s decided here could set the tone for the economy in the coming months.

And if that wasn’t enough, the Federal Board of Revenue (FBR) is brewing its own recipe for change. To stir up business activity, they’re looking to cut Federal Excise Duty (FED) on tobacco and beverages and lower withholding tax rates on real estate deals. The idea? More sales, more revenue, and maybe even a little breathing room for businesses.

But the real countdown is on for civil servants—tick-tock! They have until September 2025 to declare their assets, with a shiny new digital portal on the way to track it all.

Fasten your seatbelts—this week’s news is just getting started!

Barkat Frisian Agro Ltd’s debut trading session sparked a debate on X. The stock hit the upper lock in regular trading, a massive Rs. 1 billion changed hands off-market, raising questions on whether circuit breakers should apply in the first week of listing. Some argue they should only apply to the index, others suggest adjusting the limits—where do you stand?

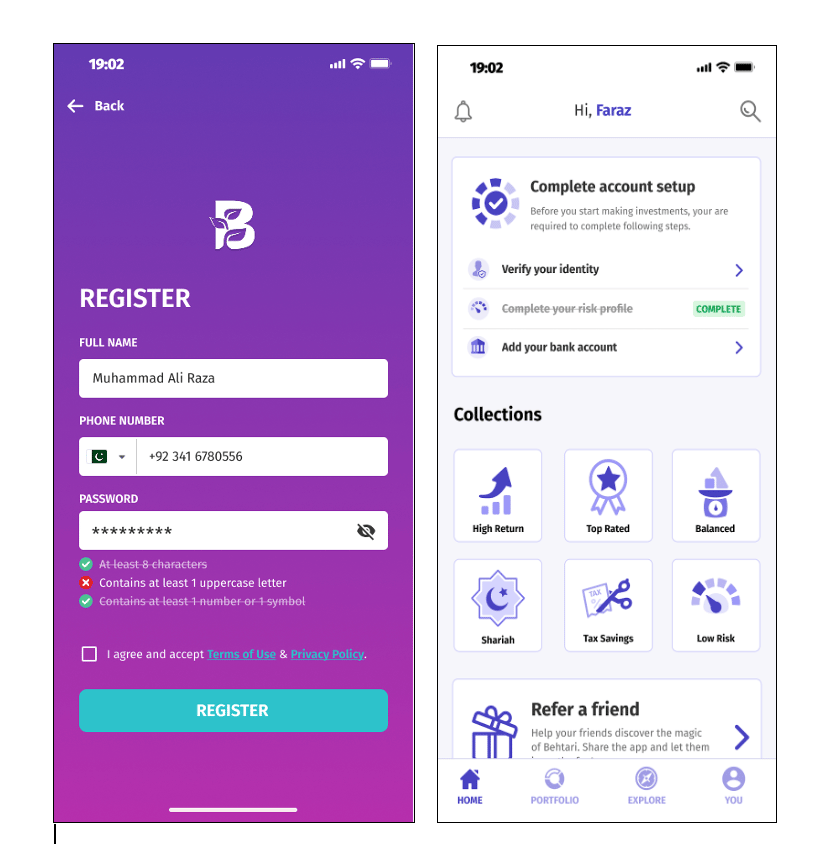

But as the government and markets are busy making moves, why is investing still so complicated for everyday people? Long forms, endless bank visits, confusing paperwork—just opening a mutual fund account can feel like a full-time job. It doesn’t have to be this way!

That’s where Behtari comes in. With a 10-minute onboarding process and a 30-second investment experience, we take the hassle out of mutual fund investing. No paperwork, no hidden steps—just simple, secure, and seamless investing at your fingertips. Download now on Google Play or Get it on the Apple Store and start investing today!

Key Events to Watch This Week!🔥

March 9, 2025

🏏 ICC Champions Trophy 2025 Final.

March 10, 2025

📉 Monetary Policy Announcement.

📈 Remittance Inflows: Overseas Pakistanis’ remittances for February 2025 (SBP report).

📉 Trade Balance: Import/export data for February 2025 (Ministry of Commerce).

March 13, 2025

💰 Foreign Exchange Reserves Update: State Bank of Pakistan (SBP) weekly update on reserves.

📉 Weekly Inflation (Sensitive Price Index): SPI data for essential goods price trends.

March 14, 2025

🏦 Total Deposits and Advances of Scheduled Banks (February 2025): Banking sector liquidity and credit trends (SBP data).

March 15, 2025

🏗️ Steel Sales: Monthly data reflecting construction sector activity.

🚗 Auto Sales: Vehicle sales figures from major manufacturers (PAMA report).

📊 Bank Lending Survey (Q2 FY25): Insights into lending conditions and credit demand across various sectors (SBP publication).

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

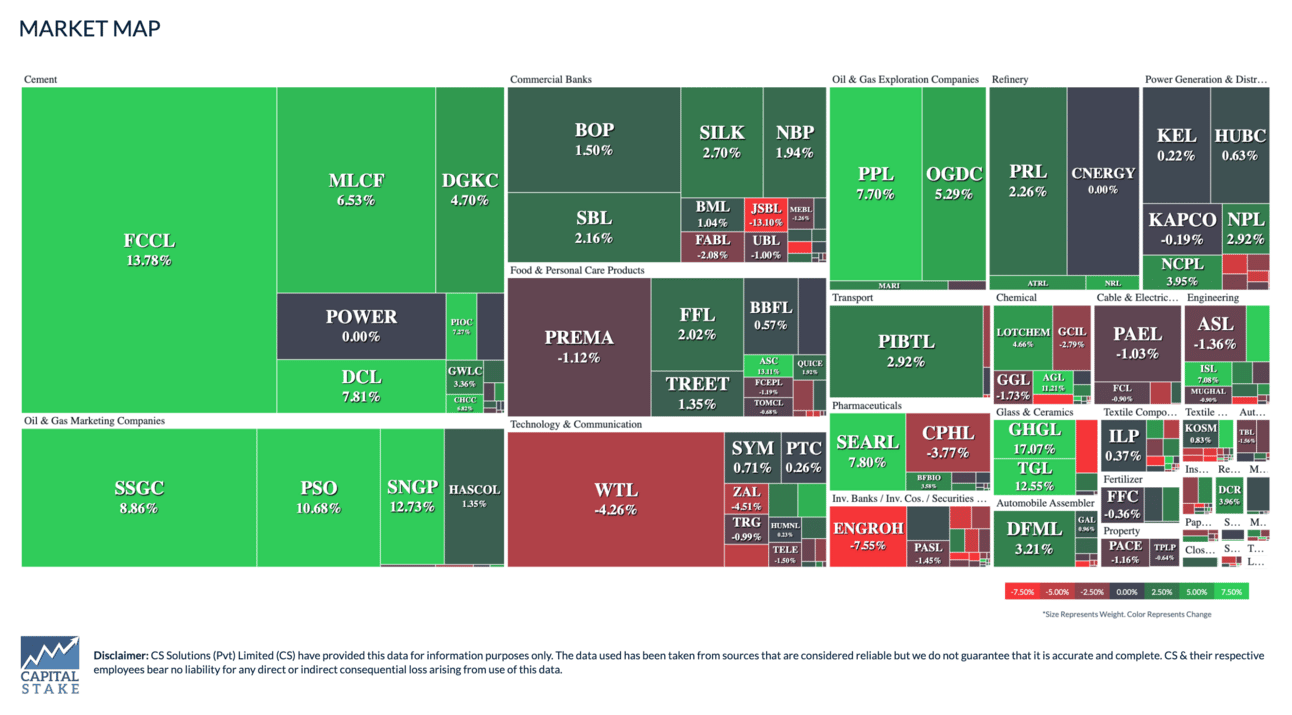

Week at PSX: How Did Stocks Perform?

The Pakistan Stock Exchange (PSX) closed the week on a positive note, with the KSE-100 Index gaining 1.01% on a week-over-week (WoW) basis.

What Happened?

Barkat Frisian Agro Limited (BFAGRO) made a strong debut on the Pakistan Stock Exchange (PSX) today (March 7). Its share price surged by 10% immediately after trading started, hitting the upper limit of Rs20.02 per share. This means investors who bought the stock during its Initial Public Offering (IPO) at Rs18.2 per share have already seen an increase in their investment.

Why It Matters:

This surge shows strong investor confidence in BFAGRO, a company backed by the Netherlands’ Frisian Egg Group and Pakistan’s Buksh Group. The company operates in the agriculture and food sector, which is essential for Pakistan’s economy. A successful IPO like this can encourage more companies to list on the stock exchange, boosting market activity and investment opportunities.

What’s Next?

Since the stock has hit its upper limit, it will be interesting to see if demand remains strong in the coming days. Investors will be watching how the company performs financially and whether it can deliver on its growth promises. If interest continues, the stock price may rise further, but like any investment, there are always risks.

China Extends $2 Billion Loan to Pakistan for One Year

What Happened?

China has rolled over a $2 billion loan to Pakistan for another year, the Ministry of Finance confirmed on Saturday. The loan was originally due for repayment on March 24, but China has extended the deadline, giving Pakistan much-needed financial relief.

Why It Matters:

Pakistan is facing economic challenges, including pressure on its foreign exchange reserves. This extension helps ease some of that burden and provides breathing room for the government to manage its financial commitments. China is one of Pakistan’s biggest lenders, and this move reflects strong economic ties between the two countries.

What’s Next?

While this extension is a temporary relief, Pakistan still has significant external debt obligations. The government will need to work on long-term solutions to improve its financial stability, such as increasing exports, attracting investments, and securing further financial support from international lenders.

Consumers Face Higher Bills as Govt Proposes New Power Surcharge

What Happened?

During technical discussions with the International Monetary Fund (IMF), Pakistan’s government decided against imposing new taxes but proposed alternative ways to generate revenue. One key measure is a new financial surcharge on electricity bills, meaning consumers may have to pay more for power.

Why It Matters:

Electricity prices are already a major concern for households and businesses, and an additional surcharge would increase the financial burden on consumers. At the same time, the government has asked the IMF to reduce or remove the general sales tax (GST) on electricity to ease costs, but the IMF has reportedly opposed this request.

What’s Next?

Formal policy-level discussions with the IMF will begin on March 10, where final decisions on electricity pricing and revenue measures will be made. If the surcharge is approved, consumers will likely see higher electricity bills in the coming months, adding to inflation concerns.

Govt, Banks in Talks for Rs1.25 Trillion Loan to Tackle Energy Debt

What Happened?

The government is negotiating a massive Rs1.25 trillion ($4.47 billion) loan with commercial banks to reduce Pakistan’s growing energy sector debt. The loan, which will be repaid over 5 to 7 years, is part of efforts to meet conditions under the ongoing $7 billion International Monetary Fund (IMF) bailout.

Why It Matters:

Pakistan’s power sector has long struggled with circular debt—unpaid bills that pile up due to inefficiencies, subsidies, and financial mismanagement. This debt puts pressure on the economy and leads to higher electricity costs for consumers. Resolving it is crucial for economic stability and to maintain IMF support, which has helped Pakistan recover from a financial crisis.

What’s Next?

While negotiations are ongoing, the final loan agreement is yet to be signed. The government will have to ensure that the repayment plan is sustainable, especially given its tight fiscal position. Consumers and businesses will be watching closely, as solutions to the energy sector’s financial issues often result in increased electricity prices.

Pakistan Resists IMF’s Carbon Levy on Fossil Fuels

What Happened?

Pakistan has pushed back against the International Monetary Fund’s (IMF) demand to impose a carbon levy on petroleum products, coal, and traditional fuel-powered cars. The IMF wants the government to gradually increase the petroleum levy from Rs60 to Rs70 per litre over three years, starting with an increase of Rs3 per litre in the first year.

Why It Matters

The proposed levy is aimed at discouraging fossil fuel use and generating funds for green energy projects. However, Pakistan is already dealing with high inflation and economic challenges, making any additional burden on fuel prices a sensitive issue. Higher fuel costs could drive up transportation expenses, impacting both consumers and businesses.

What’s Next?

The IMF and Pakistan are in ongoing discussions, and the final decision will depend on policy negotiations. If the government agrees to the levy, fuel prices could gradually increase, affecting daily expenses. However, if Pakistan successfully resists the IMF’s demand, alternative revenue or climate-friendly measures may be needed to meet global sustainability goals.

Trump to Visit Saudi Arabia Following $1 Trillion U.S. Investment Agreement

What Happened:

U.S. President Donald Trump has announced plans to visit Saudi Arabia this spring after securing a commitment from Riyadh to invest $1 trillion in American companies over the next four years.

Why It Matters:

This substantial investment underscores the strengthening economic ties between the U.S. and Saudi Arabia, potentially leading to significant job creation, technological advancements, and infrastructure development in the United States. For Saudi Arabia, diversifying investments aligns with its Vision 2030 plan to reduce oil dependency and bolster international economic partnerships.

What's Next:

Both nations are expected to outline specific sectors and projects that will benefit from this investment, potentially influencing global investment patterns and prompting other countries to enhance their economic engagement strategies to attract similar foreign investments.

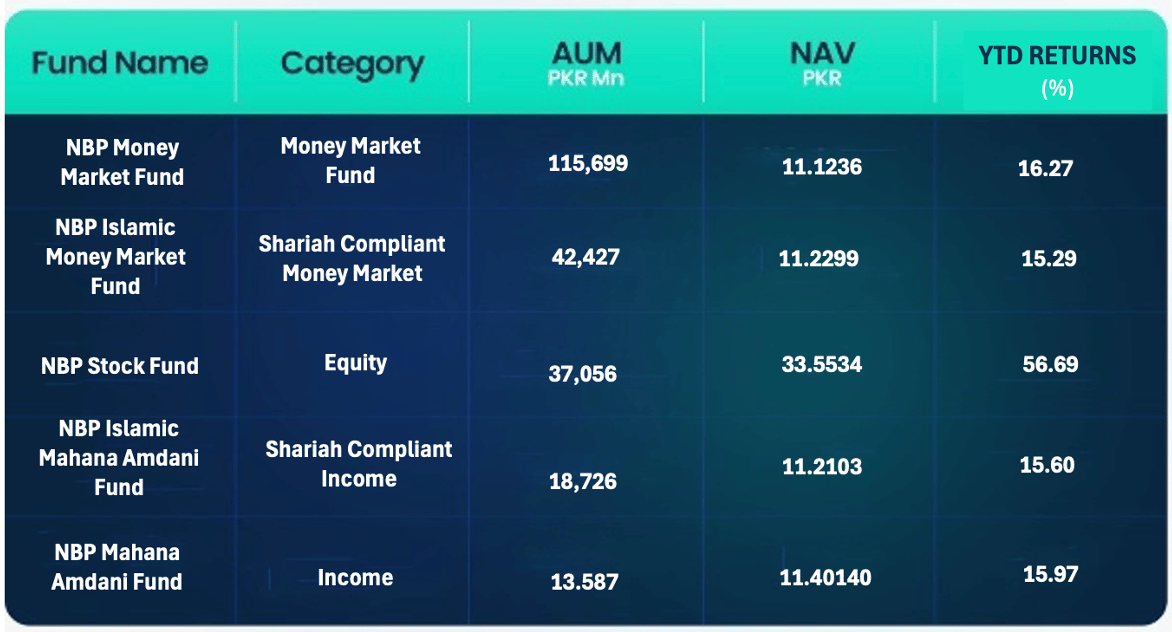

As part of our weekly strategy, we continue our deep dive into Pakistan’s leading Asset Management Companies (AMCs). This week, we spotlight NBP Fund Management Limited, one of the largest AMCs in the country. The following NBP funds, highlighted in the table below, have the highest Assets Under Management (AUM), reflecting investor confidence and market strength.

Answer to Last Week’s Riddle:

The answer is "Loan"! 💰

Riddle:

I have numbers but I’m not a phone.

I keep your money but I’m not a loan.

What am I?

Want to know the answer? Come back next week to find out!

In Other News

Weekly Inflation Falls for First Time in Seven Years

Pakistan’s weekly Sensitive Price Indicator (SPI) recorded a 0.9% year-on-year decline for the week ending March 6, 2025—the first drop in nearly seven years.

Gold Prices Rebound by Rs3,000 per Tola

After a previous decline, gold prices in Pakistan surged by Rs3,000 per tola on Friday, reaching Rs307,000, following an upward trend in global markets.

Pakistan’s Central Govt Debt Crosses Rs72 Trillion

The federal government’s total debt stock rose 11.2% year-on-year, reaching Rs72.123 trillion in January 2025, up from Rs64.842 trillion in January 2024, according to SBP data.

Get to Know More About Our Products

Behtari – Your one-stop shop for mutual fund investments.

StockIntel – Make the most knowledgeable investing decisions.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan