- Pulse by Capital Stake

- Posts

- 📊 Rates, ⛽ Oil, 💸 Deficits

📊 Rates, ⛽ Oil, 💸 Deficits

Another Week, Another Pulse!

As raindrops begin to fall across the country, a flood of news has been making waves both locally and globally. The week kicked off with the State Bank maintaining the policy rate at 11%, while petrol prices rose to Rs. 253.63, reflecting global market trends. Geopolitical tensions remained high, with reports of a U.S. strike on Iran further unsettling global markets. On the domestic front, provincial governments unveiled their budgets for the upcoming fiscal year. However, one report raised concerns: while financial account ownership in Pakistan has grown by 28% over the past decade, women's financial inclusion remains significantly low. According to recent data, 56% of men have access to a bank or mobile wallet account, compared to only 14% of women, highlighting a persistent gender gap in financial access.

Your five-minute briefing to stay ahead this week.

Prefer listening instead?

Subscribe to our podcast for the latest business and economic news, anytime, anywhere.

🎧 Listen now on your favorite platform:

Youtube - https://short-link.me/11doF

SoundCloud - https://short-link.me/15mWt

Spotify- https://short-link.me/11do-

📅 Key Events to Watch This Week

📆 June 25, 2025

💸 T-bill Auction

📆 June 26, 2025

💵 Foreign Exchange Reserves Update

📆 June 27, 2025

📊 Weekly SPI (Inflation Tracker)

📆 June 30, 2025

🏦 Statistics Release: Scheduled Banks, Microfinance Banks & Development Finance Institutions (March 2025 Data)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

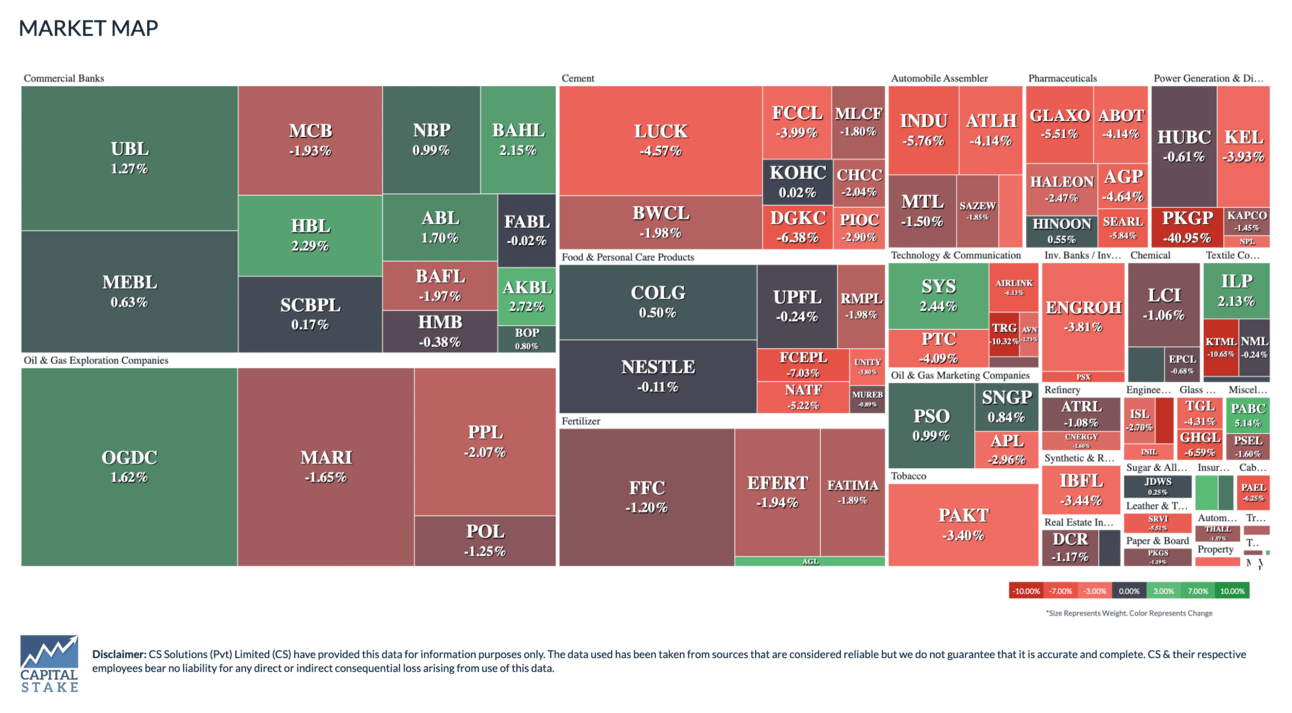

Market Wrap: KSE-100 Posts Fourth Consecutive Weekly Decline

The benchmark KSE-100 index recorded its fourth straight weekly decline, falling by 1.74% on a WoW basis. Investor sentiment remained subdued due to escalating geopolitical tensions following Israeli airstrikes on Iran, rising global commodity prices, and weakness across regional markets. However, the week ended on a slightly positive note, with the index gaining 20.65 points in the final trading session.

PACRA to list on PSX’s GEM board via offer for sale

PACRA is set to list on the PSX’s Growth Enterprise Market (GEM) Board by offering 7.45 million shares, which is 10 percent of its capital, through a Dutch auction. The price ranges from Rs. 10.75 to Rs. 15.05 per share. This move gives investors a chance to buy into a major credit rating agency and reflects growing momentum on the GEM Board, which supports high-growth businesses. The final share price will depend on investor demand during the bidding process.

PIA’s flight to privatization gains momentum with 8 qualified bidders

PIA’s journey toward privatization picked up pace as the Privatisation Commission received Expressions of Interest from eight parties looking to acquire 51 to 100 percent of the national airline along with management control. These included three individual firms: AKD Group, Air Blue, and Sardar Muhammad Ashraf D. Baloch Private Limited, and five consortia led by major business groups such as Lucky Cement, Arif Habib Corporation, and Fauji Fertilizer. By the final deadline, five of these parties submitted their Statements of Qualification, which will now be evaluated based on the commission’s prequalification criteria. This marks the government’s second serious push to privatize PIA in an effort to turn around the struggling national carrier.

Funfact: Only a Fraction of Pakistanis Invest in Stocks or Mutual Funds

There are only 333,065 investor accounts registered with the Central Depository Company, covering both the stock market and mutual funds. This represents just 0.14 percent of Pakistan’s population of over 240 million. In contrast, India has over 150 million demat accounts, reaching more than 10 percent of its population. Vietnam has over 7 percent and Malaysia nearly 20 percent. These figures reflect how limited public participation is in Pakistan’s formal investment ecosystem, underscoring the untapped potential for financial inclusion and capital market growth.

Ogra directs oil firms to maintain 20-day fuel reserves amid Iran-Israel conflict

As tensions rise between Iran and Israel, Pakistan’s oil regulator Ogra has directed oil companies to maintain at least 20 days of fuel reserves to ensure the country doesn’t face any shortages. It has also ordered the urgent import of 140 million litres of petrol and rescheduled the arrival of a fuel ship to June 26 instead of July 6. While officials say current fuel reserves are sufficient, these steps are being taken as a precaution to keep supply stable and avoid potential disruptions if the regional conflict escalates further.

GST hike feared to hit auto sales

The auto industry may face another setback as Pak Suzuki has raised concerns over the government’s proposal to increase the general sales tax to 18 percent in the upcoming budget. According to Managing Director Hiroshi Kawamura, the higher tax could lead to a sharp drop in vehicle sales, affecting not just manufacturers but also parts suppliers and thousands of workers linked to the sector. He noted that the industry has shown more stable growth under the current 12 percent GST, which supports around 2.5 million direct and indirect jobs. An increase, he warned, could slow down recovery and hurt job creation across the automotive value chain.

PM Orders Expansion of PNSC Fleet to Save $4 Billion in Maritime Trade Costs

Prime Minister Shehbaz Sharif has directed authorities to prepare a business plan within two weeks to expand the fleet of the Pakistan National Shipping Corporation (PNSC) and reduce the country’s $4 billion annual spending on maritime trade. Chairing a high-level meeting, he emphasized the need to acquire more ships on lease, as the current fleet of only 10 vessels with a combined capacity of 724,643 tons is insufficient to meet Pakistan’s trade needs. Expanding the fleet is seen as a strategic move to cut foreign shipping costs and strengthen the country’s maritime sector.

Govt secures $4.5bn loans from local banks to ease power sector debt

To ease the power sector’s mounting debt, the government has secured a Rs1.275 trillion ($4.5 billion) Islamic financing facility from 18 local banks. Power Minister Awais Leghari said the loan will be repaid over six years in 24 quarterly installments at a concessional rate of three-month KIBOR minus 0.9 percent, as agreed with the IMF. The move aims to address the growing circular debt that has disrupted power supply, deterred investment, and strained the economy.

Govt to Import Sugar After Exporting It Earlier

In a surprising reversal, the government has decided to import 750,000 metric tonnes of sugar despite having exported a similar quantity earlier this fiscal year. The initial exports helped push domestic sugar prices higher, benefiting millers but straining household budgets. Now facing rising prices and potential supply issues, the government plans to import 250,000 tonnes of raw sugar (pending cabinet approval) and 500,000 tonnes of refined sugar (already greenlit in principle). This policy flip has sparked criticism over planning and price control, with questions raised about the earlier export decision. The imports are aimed at stabilizing local markets, but may come at a higher fiscal and political cost.

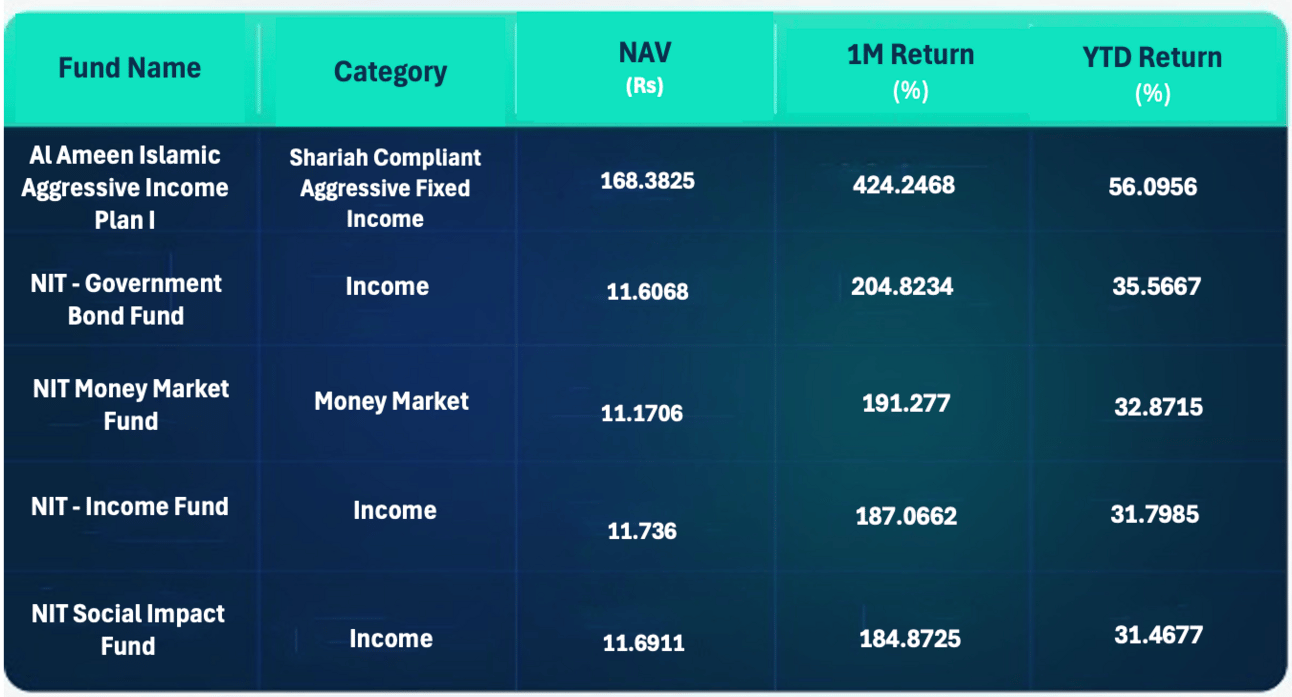

FUNDS IN VIEW:

Debt Funds Dominate as Investors Stay Cautious on Equities

Despite the policy rate remaining unchanged at 11%, the latest one-month mutual fund data shows that income and money market funds delivered the strongest returns. Leading the charts were Al Ameen Islamic Aggressive Income Plan I and NIT Government Bond Fund, both benefiting from favorable movements in fixed income instruments. Equity funds, however, did not feature in the top five performers this month. Their returns remained muted due to ongoing market volatility, lack of strong corporate triggers, and broader economic uncertainty, which limited short-term equity growth compared to debt-based instruments.

📊 Last Week in Numbers

📉 KSE-100 Index: down 1.74% WoW

📈 SPI (Inflation): up 0.27% WoW

💰 Foreign Exchange Reserves: increased by 0.77% WoW

📉 Current Account Deficit: recorded at $103 million in May

📉 Foreign Direct Investment: declined 7.6% MoM

Credits: Pulse by Capital Stake

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan