- Pulse by Capital Stake

- Posts

- Smog 🌫️ Surplus 💵 Strategy 🧭

Smog 🌫️ Surplus 💵 Strategy 🧭

Another Week, Another Pulse!

Smog season is back — and so is Lahore’s unfortunate claim as one of the world’s most polluted cities. While the air grows heavier, the economy is trying to find its balance. Pakistan posted a $110 million current account surplus in September 2025, offering a brief moment of relief, but the quarter still ended in the red with a $594 million deficit. Meanwhile, foreign direct investment slipped 34% year-on-year, showing that investor confidence remains fragile.

From October 25, millions of Pakistanis could wake up locked out of their digital bank accounts and wallets, as the State Bank of Pakistan’s new biometric verification rules come into effect. All financial institutions — from banks to e-money operators — must now make biometric verification the primary method of customer identification.

On the brighter side, Pakistan and Qatar signed a $3 billion investment protocol through the Qatar Investment Authority (QIA), signaling renewed investor interest from the Gulf. The IT Ministry also shared plans to improve digital infrastructure, announcing two new submarine cables expected to be connected within 15 months to strengthen internet capacity.

Still, challenges persist. The Global Investment Risk and Resilience Index ranked Pakistan among the least resilient economies — a sobering reflection of global investor sentiment. Yet, in a step forward, the State Bank of Pakistan partnered with the International Finance Corporation (IFC) to boost local currency financing and support private sector growth.

And in the week ahead, Prime Minister Shehbaz Sharif is set to visit Saudi Arabia (Oct 27–29) to attend the Future Investment Initiative (FII9) at the invitation of Crown Prince Mohammed bin Salman — a visit that could open new doors for investment diplomacy.

Here’s your weekly roundup in 5 minutes.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/ms99u7c4

SoundCloud - https://tinyurl.com/325ytka8

Spotify- https://tinyurl.com/d2nnc269

📅 Key Events This Week

📌 27th October 2025

🏦 Monetary Policy Announcement

📌 30th October 2025

💱 Foreign Exchange Reserves Update

📌 31st October 2025

🛒 Weekly SPI (Sensitive Price Index) Release

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

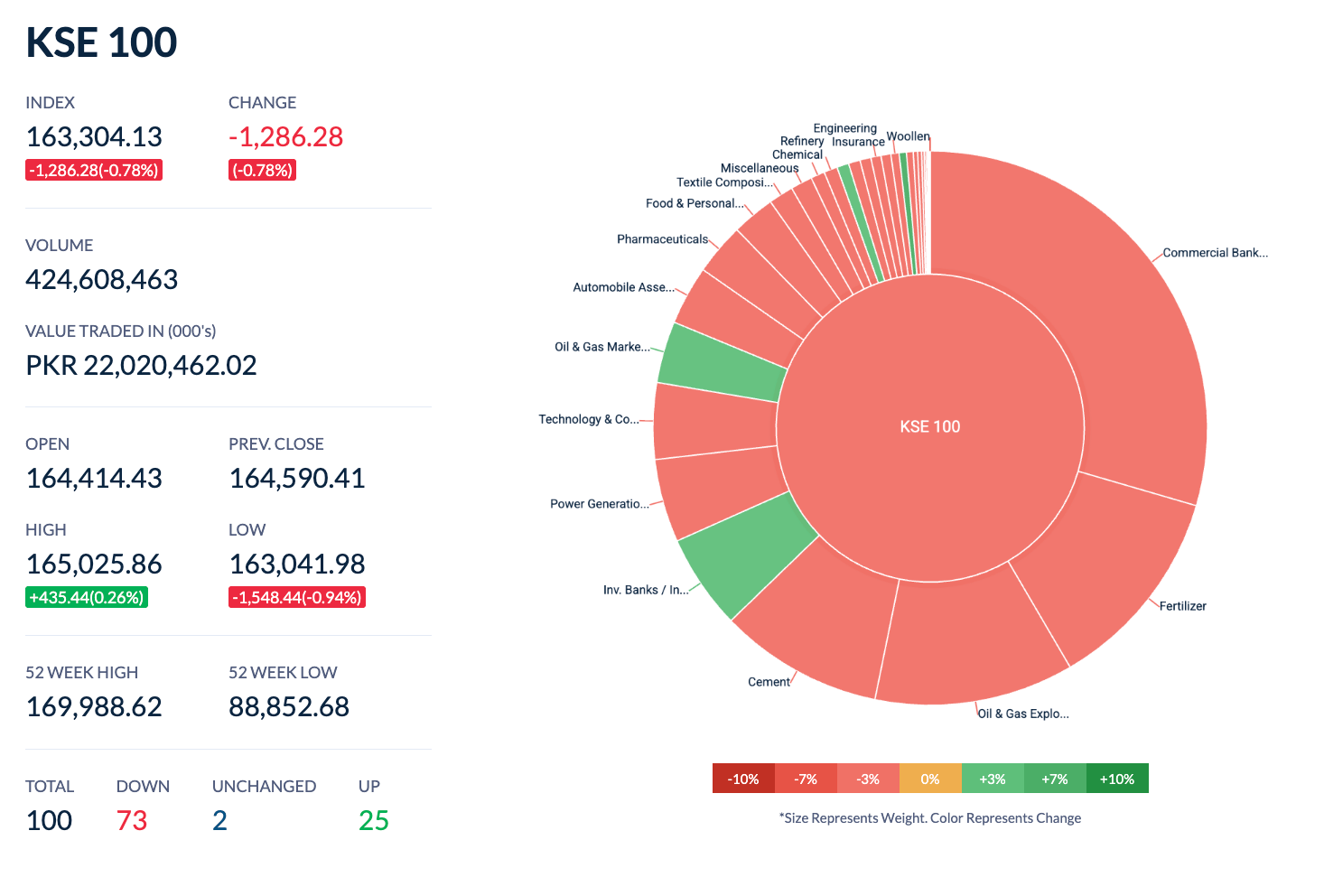

The Pakistan Stock Exchange (PSX) traded within a narrow range last week, as early optimism faded amid mixed investor sentiment and bouts of profit-taking. Initial gains — fueled by easing regional tensions and encouraging economic indicators such as the September 2025 current account surplus — were later tempered by cautious trading. The KSE-100 Index eventually settled at 163,304 points, marking a week-on-week decline of 502 points (0.31%).

PNSC Subsidiary Signs Deal to Acquire MR-II Tanker as Part of Fleet Expansion

The Pakistan National Shipping Corporation (PNSC), through its subsidiary Quetta Shipping Company, has signed an agreement to acquire the M.T. Stavanger Poseidon, a 50,000-ton MR-II class tanker that will be renamed M.T. Quetta. The purchase is part of PNSC’s $193 million fleet expansion plan, which includes three new vessels and aims to grow the national fleet to 30 ships by 2026. The acquisition reflects Pakistan’s broader effort to strengthen its maritime capacity, reduce dependence on foreign carriers, and enhance control over energy and cargo logistics, with procurement already underway for 12 additional vessels.

Pakistan is Getting First-Ever Official Apple Retail Store – Location and Opening Date Confirmed

Pakistan will get its first official Apple retail store by the end of 2025, with Airlink Communication confirming plans to open it at Dolmen Mall Lahore. The store follows Airlink’s appointment as a premium Apple partner by authorised distributor GNEXT Technologies, marking a major step toward formal Apple retail in the country. Customers will soon have official access to the full range of Apple products with local warranties, as Airlink also explores new ventures — including a pilot import of 10,000 Acer laptops and talks to bring another smartphone brand into local manufacturing.

Thatta Cement Subsidiary Signs Exclusive Deal to Produce Belarus Tractors in Pakistan

Thatta Cement Company Limited (THCCL) has announced that its subsidiary, Minsk Work Tractor & Assembling (Private) Limited, has signed an exclusive agreement with OJSC Minsk Tractor Works of Belarus to assemble and produce BELARUS tractors in Balochistan. The deal grants MWTA exclusive rights for local assembly in the province and aims to boost industrial activity, create jobs, and enable technology transfer through a new tractor assembly plant. Thatta Cement called the partnership a strategic step that will diversify its operations and support long-term growth.

Murree Brewery Begins Beer Exports After Decades

Murree Brewery (MUREB) has resumed beer exports to non-Muslim countries after decades, following government approval that applies exclusively to the company. While export volumes are still limited, Murree has set up a dedicated export department and expects gradual growth in global markets. The brewer also received approval for a 10–15% price increase and invested Rs. 1.5 billion in new equipment. Despite brief production disruptions, it reported a Q1 FY26 profit of Rs. 960 million, up from Rs. 914 million last year.

IMF Lifts Pakistan’s Growth Outlook, Eases Tax Collection Target by Rs. 150 Billion

The International Monetary Fund (IMF) has raised Pakistan’s growth forecast to 3.2% in 2025, up from 2.1% in 2024, citing lower energy prices, steady remittances, and a recovery in tourism. Growth is expected to reach 3.7% in 2026 and 4.5% over the next five years, supported by ongoing reforms and improved financial stability. Meanwhile, Pakistan and the IMF have agreed to cut the Federal Board of Revenue’s (FBR) tax target by Rs. 150 billion to Rs. 13.98 trillion for the current fiscal year, reflecting flood-related challenges. Despite the revision, the IMF has urged Pakistan to sustain 3.5% GDP growth and a tax-to-GDP ratio of 11% to stay on track with its recovery plan.

Women’s Bank Accounts in Pakistan Surge to 37 Million, But Gaps Persist

The number of active bank accounts held by women in Pakistan has jumped from 20 million to 37 million since the launch of the State Bank’s Banking on Equality policy in 2021, according to Governor Jameel Ahmad. Speaking at the World Bank’s Annual Meetings, he said the gender gap in financial inclusion has narrowed from 39% to 30%, reflecting progress in women’s access to finance.

However, while more women are entering the financial system, income and opportunity gaps remain. Female participation in higher-value sectors and access to credit still lag behind men, suggesting inclusion in numbers doesn’t yet translate to equality in impact.

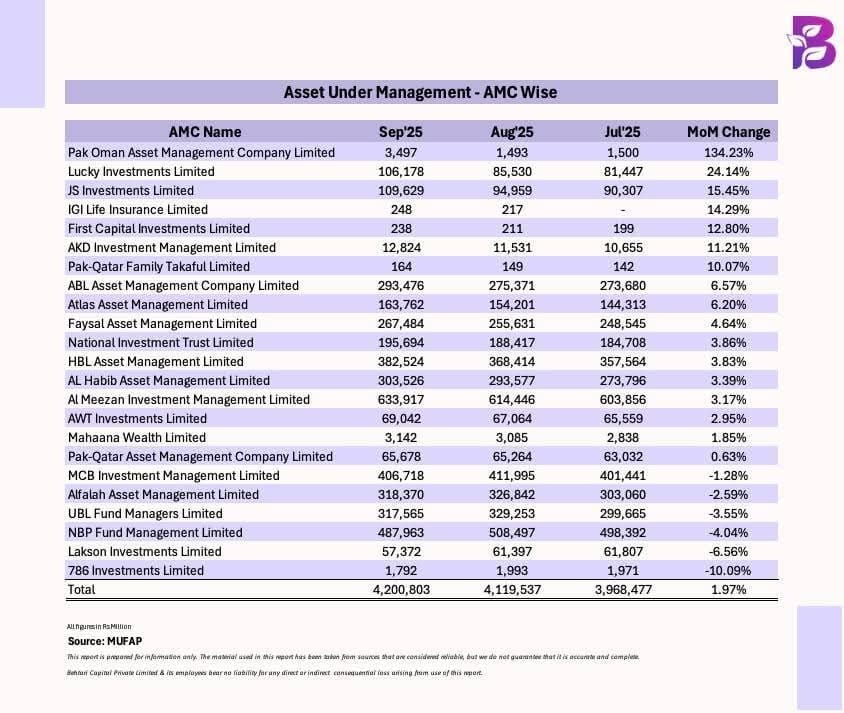

Who’s leading the pack this month? 🤔

Pak Oman Asset Management, Lucky Investments, and JS Investments recorded the strongest month-on-month AUM growth — reflecting solid investor confidence and market momentum.

💭 Which AMC do you think will top the charts next month?

Start your investment journey today with your favourite AMC on the Behtari App.

📱 Android: https://tinyurl.com/2f3fdbcc

🍎 iOS: https://tinyurl.com/4mxarrb2

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan