- Pulse by Capital Stake

- Posts

- Stock Shocks 📉, Oil Dips 🛢️, Power Cuts ⚡

Stock Shocks 📉, Oil Dips 🛢️, Power Cuts ⚡

Another Week, Another Pulse

Good morning everyone — and welcome back after the long Eid holidays! While we were recharging, global markets were anything but calm. Here’s your five-minute rundown of the biggest stories in business, finance, and tech. Let’s dive in!

Enjoying what you’re reading so far? We’d love to hear your thoughts! Take just 2 minutes to share your feedback by clicking the link: Pulse Feedback Form.

The US stock market suffered its worst crash since the COVID era, plunging over 10%, and dragging oil prices down with it — now at lows we haven’t seen since the pandemic. The trigger? A fresh wave of trade tariffs from the US, which has rattled investors and forced global players to rethink their strategies. Even the IMF chief warned that these new tariffs pose a serious threat to the global economic outlook. Meanwhile, in a major geopolitical move, India and the UAE have agreed to set up an energy hub in Sri Lanka — a strategic step in India’s growing rivalry with China for dominance in the Indian Ocean region.

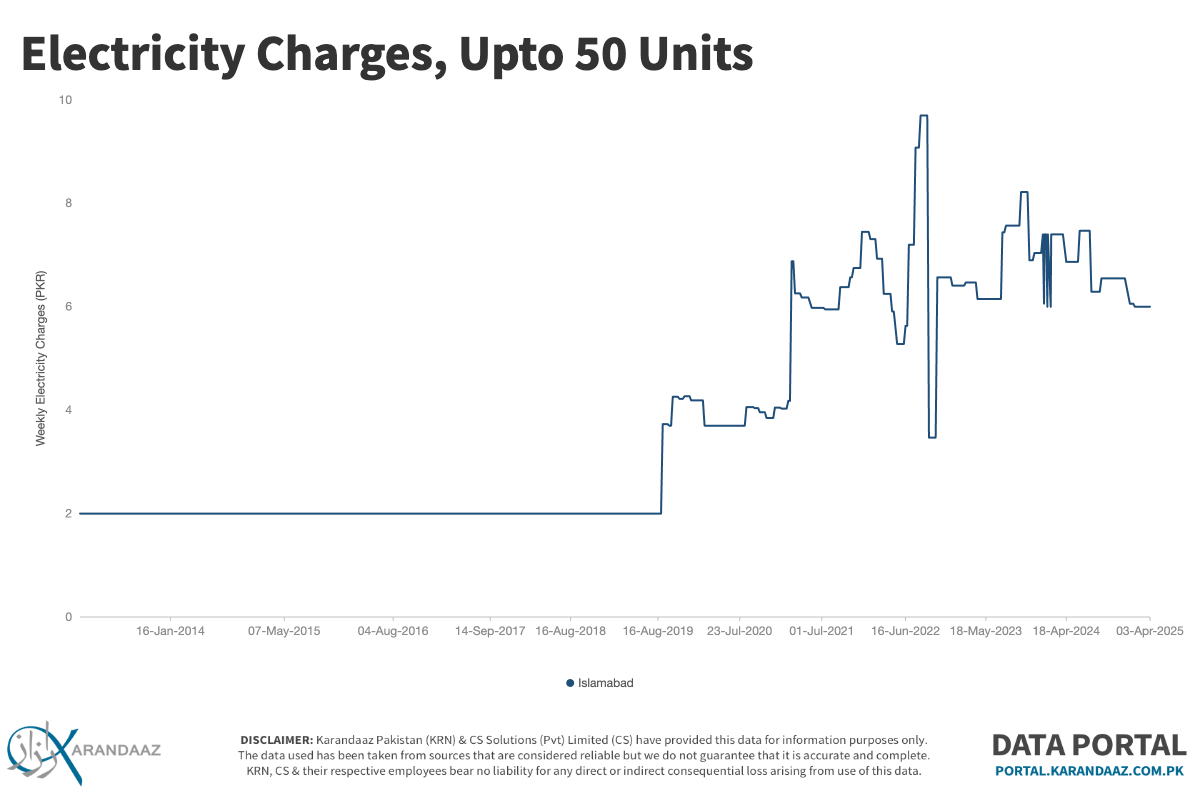

Closer to home, the PM announced a Rs7.41 per unit cut in electricity tariffs nationwide — a move that quickly became the talk of the town. While many celebrated on X, comparisons of regional electricity prices also began making the rounds.

While the debate continues, many were curious about how electricity prices have trended over time. We’ve got you covered — check out the historical electricity prices (up to 50 units). The data reveals a noticeable dip around 2022.

📅 Key Events to Watch This Week!

9th April, 2025 – 💱 Banks Floating Average Exchange Rates, 🌍 Workers Remittances

10th April, 2025 – 💰 Foreign Exchange Reserves

11th April, 2025 – 📊 Weekly SPI, 🚗 Auto Sales

11th April, 2025 – 🏭 Large-Scale Manufacturing (LSM) Index

15th April, 2025 – 🏦 Total Investments of Scheduled Banks, 💼 Total Deposits of Scheduled Banks, 📈 Total Advances of Scheduled Banks

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

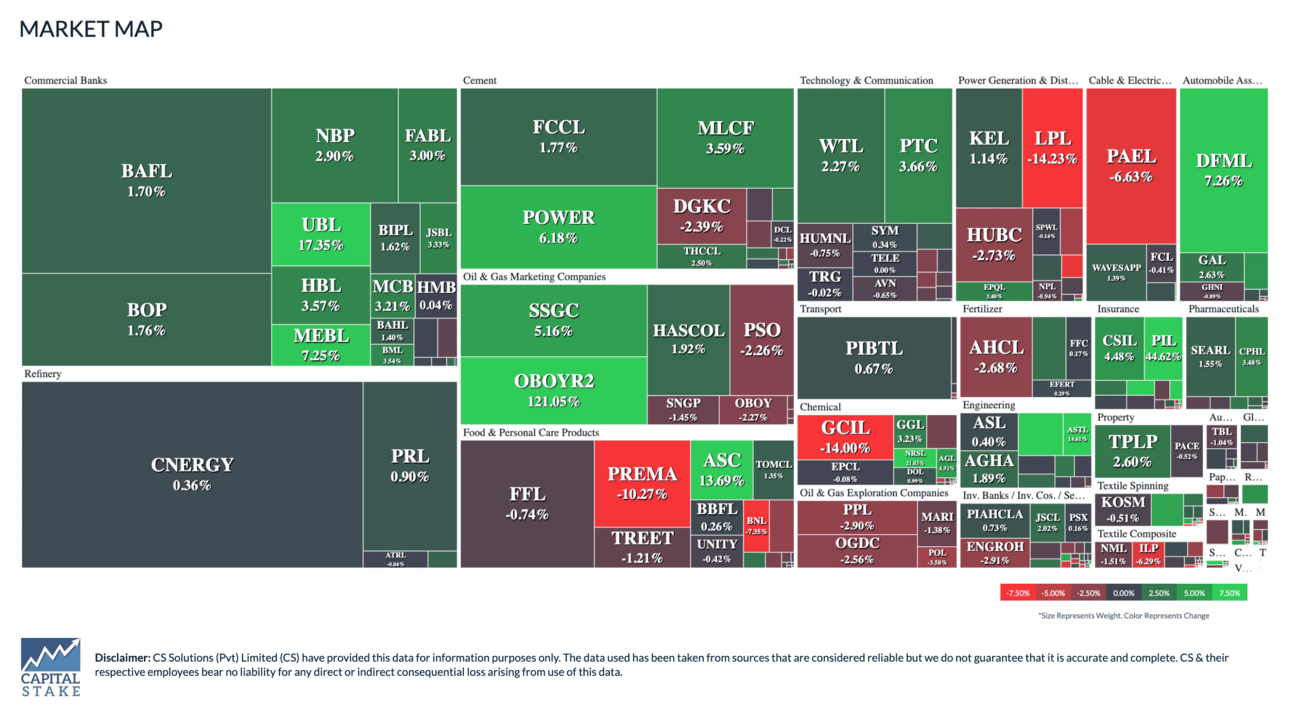

Week at Pakistan Stock Exchange

The KSE-100 index made headlines this week by crossing the 120,000 mark for the first time ever — a major milestone. However, despite the record high, the index closed the week with a slight 0.12% dip on a WoW basis. Want to explore how the index has performed over time? Sign up on StockIntel to track historical trends.

Did You Know? Wondering which company is currently the most valuable on the Pakistan Stock Exchange? That’s based on market capitalization — basically, what the market thinks a company is worth. Check out the StockIntel Screener to see who’s on top of the list today!

Silkbank to be delisted from PSX on April 7th

Silkbank is set to be delisted from the Pakistan Stock Exchange (PSX) on April 7, 2025, following its merger with United Bank Limited (UBL). This marks the end of Silkbank's independent market presence, after facing financial difficulties and a prolonged search for investors. The merger is significant as it reflects the ongoing consolidation in Pakistan's banking sector, allowing UBL to expand its retail banking operations while providing stability to Silkbank's customers. Going forward, Silkbank's operations will be integrated into UBL, strengthening the latter’s position in the market.

CPI - Numbers drop, pressure persists

Inflation in Pakistan has dropped to just 0.7% in March 2025, compared to 20.7% in the same month last year (See Trend 📊), which is the lowest it’s been since 1965. While this sounds like good news, it doesn't mean much for most people. Prices are still higher than last year, and the poor and middle class are still struggling because their money doesn’t go as far. With the economy growing slower than the population, it looks like the financial challenges will continue for a long time.

SBP pumps nearly Rs3 trillion into market

The State Bank of Pakistan (SBP) recently injected nearly Rs3 trillion into the banking system to ensure there is enough liquidity in the market. This is done to stabilize the currency and help manage the country's foreign exchange reserves. The SBP's move helps maintain the value of the Pakistani rupee by ensuring there are enough U.S. dollars available in the market. This action is particularly important when there’s a shortage of foreign currency, which can cause the rupee to weaken. After such injections, the aim is to prevent excessive drops in the rupee’s value and support businesses and consumers who need dollars for imports or international transactions.

Pakistan’s Trade Deficit Shrinks By 7.5% in March 2025

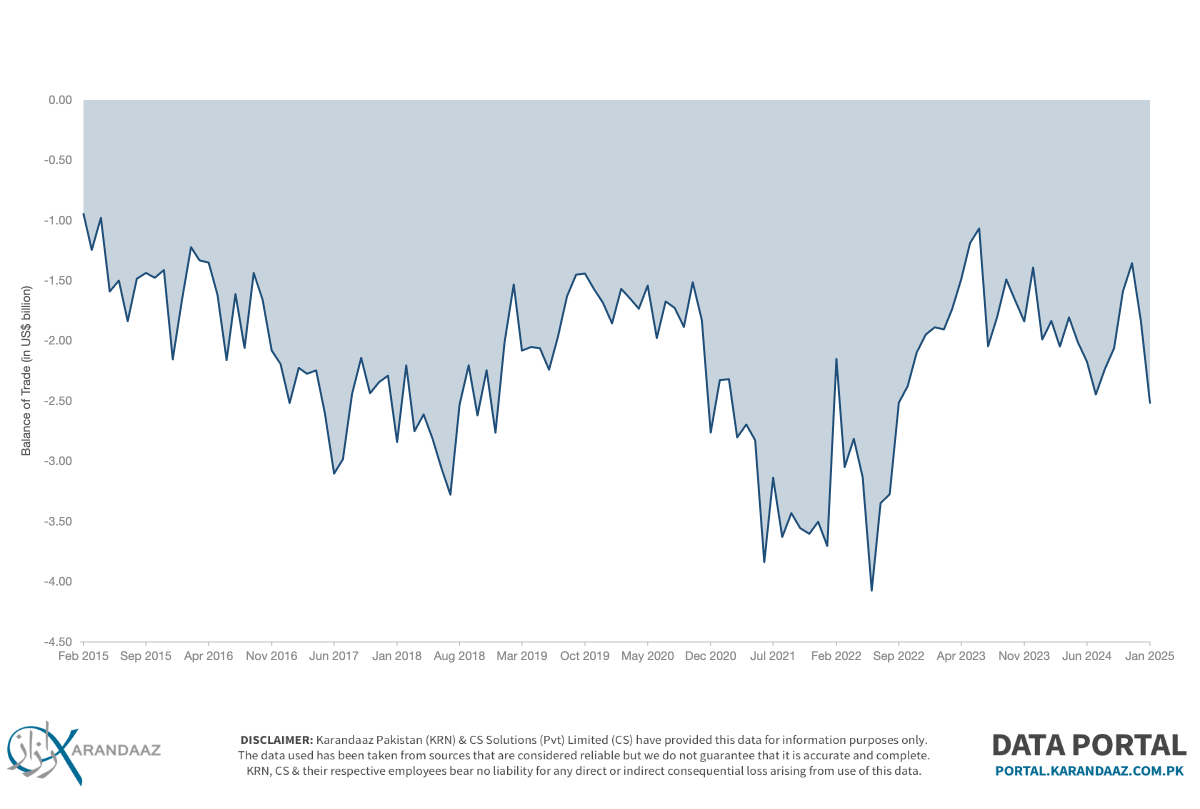

Pakistan's trade deficit, which is the gap between what the country imports and exports, decreased by 7.5% in March 2025. The trade deficit was $2.119 billion, down from $2.288 billion last year. Exports, or goods sold to other countries, went up by 1.9% compared to last year, reaching $2.6 billion. Imports, or goods bought from other countries, went down by 2.5%. However, over the first nine months of the year, the overall trade deficit increased by 4.5%, meaning Pakistan is still spending more on imports than it is earning from exports.

Historical analysis sheds a different light on the current situation. Although there was a temporary improvement from August 2024 to November 2024—with the trade deficit declining during that period—the deficit has now resumed its upward trajectory. Notably, increases in the trade deficit typically occur around June and July, driven by seasonal factors such as increased import demand for agricultural inputs and inventory restocking. For more details, check out the historical data.

IMF to Send Delegation to Pakistan for Governance Review

The International Monetary Fund (IMF) is sending a delegation to Pakistan to offer technical assistance on governance-related issues. This visit follows the IMF’s earlier review of governance and corruption in the country and aims to support improvements in these areas. However, the visit will not cover budget discussions, which are expected to take place virtually at a later stage.

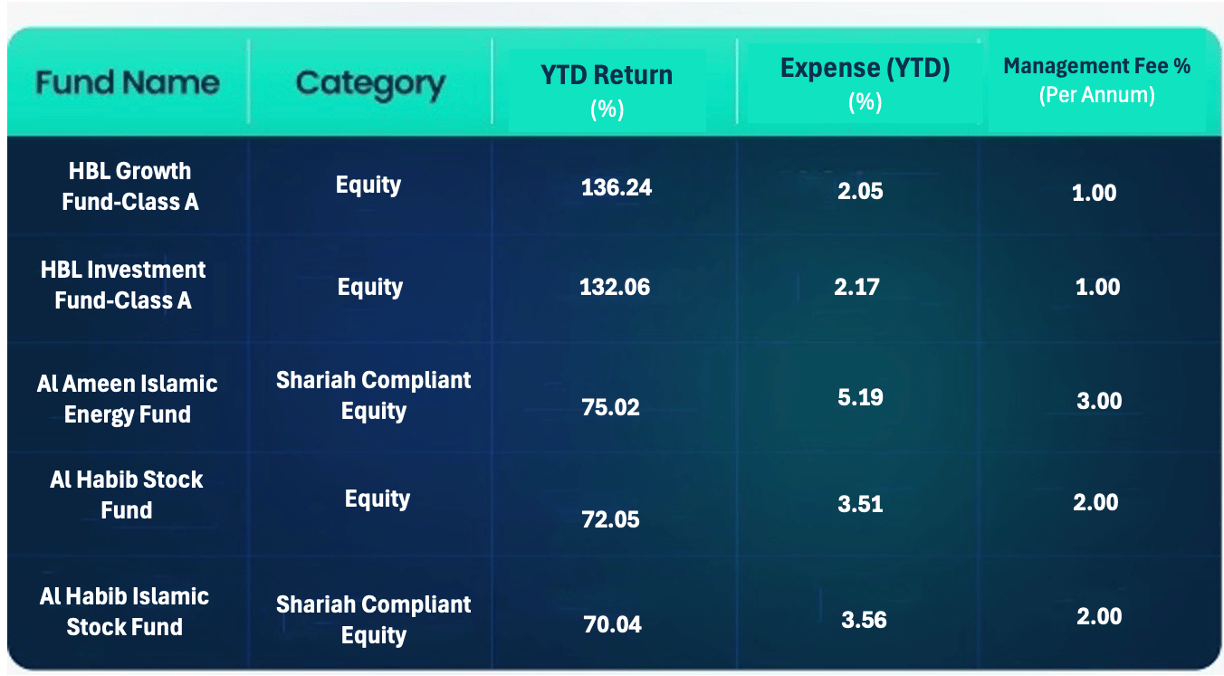

Wondering which mutual funds are performing well this year? Here are the top 5 equity mutual funds based on their Year-to-Date (YTD) returns — that’s how much they’ve grown in 2025 so far.

But running top-performing funds requires costs. These include the Management Fee, which is the amount charged for managing your investment, and the Total Expense Ratio (TER), which reflects the overall costs involved in running the fund. Understanding these costs is key, as they directly impact your returns.

🔍 Want to learn more about the costs associated with running top funds? Check out the top five funds by Year to date returns below:

📱 Ready to explore these and other mutual funds?

🚀 Start your investment journey with the Behtari app — it’s simple, fast, and built for everyone.

📲 Download now:

🟢 Android: https://shorturl.at/HSNfm

🔵 iOS: https://shorturl.at/J0RUC

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors.

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan