- Pulse by Capital Stake

- Posts

- Stocks 📊, Crypto ₿, Commodities ⛏️

Stocks 📊, Crypto ₿, Commodities ⛏️

Another Week, Another Pulse!

Basant is just around the corner, and the long weekend starting February 5th has everyone daydreaming about kites, sweets, and some much-needed downtime. But last week, while we were quietly preparing for colorful skies, the markets and economy didn’t take a holiday.

The State Bank of Pakistan surprised everyone by keeping interest rates at 10.5%. No cut, no drama — just a reminder that inflation still calls the shots. Investors hoping for relief were left blinking at their screens, while the Federal Constitutional Court quietly confirmed that the super tax is perfectly legal. A sigh of relief for the government, but a gentle nudge to businesses that the fiscal grind isn’t letting up.

The Pakistan Stock Exchange reminded everyone that it has a mind of its own. Over 6,000 points disappeared in a single day after Fauji Fertilizer Company’s earnings disappointed, and hopes for stock splits or bonuses evaporated like kites on a rainy day. Globally, oil prices spiked on fears of a US strike on Iran, silver officially entered bear territory, and Bitcoin tumbled to $84,300 as tech stocks and gold reversals triggered a risk-off mood.

Back home, inflation continued to nibble at household budgets. The Sensitive Price Index jumped 4.52% year-on-year, thanks to pricier tomatoes and pulses. Petrol stayed calm, but high-speed diesel shot up by Rs11.30 per litre, keeping transport and logistics costs on edge.

On the policy front, Pakistan’s public debt remains Rs17 trillion above the statutory limit, though refinancing risks eased with longer domestic loan tenors. S&P Global sees gradual growth ahead and easing inflation cautiously optimistic, just like investors after last week’s rollercoaster. Pakistan International Airlines is now officially privatized under Arif Habib Corporation, satellite internet edges closer with new cybersecurity rules, and Ali Farid Khawaja joins SECP as commissioner, keeping the regulatory wheels turning.

So as we get ready to fly kites this long weekend, last week is a reminder that markets, inflation, and policy surprises never take a break — even if we do.

Here’s your five-minute recap of everything you need to know.

🎧 Tune in to this week’s Pulse:

Youtube - https://tinyurl.com/ydrjcvfm

📅 Key Events This Week!

📌 2nd February 2026

📈 CPI Inflation

📌 3rd February 2026

🏭 Cement Sales

📌 4th February 2026

💵 T-Bills Auction Date

📌 5th February 2026

💱 Foreign Exchange Reserves

📌 6th February 2026

📊 Weekly SPI (Sensitive Price Index)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

Last week, the stock market took a cautious turn, with the KSE-100 ending lower at 184,175 points, down around 2.6% from the previous week. Investor confidence was tested by a mix of regional tensions, disappointing earnings from some major companies, and the State Bank’s decision to leave interest rates unchanged — a move that caught many by surprise.

Trading was slow for most of the week as rollover pressures kept participants on the sidelines. But in the final session, pockets of optimism emerged: government support for the industrial sector and reassuring signals from the central bank encouraged selective buying, giving the market a small lift. Even with this late rebound, caution prevailed, as investors weighed global uncertainties against local policy signals.

Fauji Cement, KAPCO Sign Agreement to Acquire Majority Stake in Attock Cement

Fauji Cement Company, together with Kot Addu Power Company, has signed an agreement to take a majority stake of over 84% in Attock Cement. The deal, announced last week, will give them joint control of the company once all approvals are in place, including regulatory clearances and a public takeover offer. If completed, this move will reshape Attock Cement’s ownership and strengthen Fauji Cement’s position in Pakistan’s cement industry, giving it more influence over the market and potential growth opportunities.

Haleon Pakistan to Invest £3.58 Million in Panadol Liquid Expansion

Haleon Pakistan is investing £3.58 million to expand and modernize its Panadol Liquid packaging line, aiming to meet rising demand and improve efficiency. The funds will go toward new machinery, upgraded infrastructure, and stronger quality controls, helping the company produce more while maintaining high standards. This move strengthens Haleon’s position in Pakistan’s consumer healthcare market and reflects its long-term focus on growth and innovation, ensuring popular products like Panadol Liquid can keep up with consumer needs.

Pakistan’s Zarea Limited signs $2mn strategic MoU with Chinese agri firm

Zarea Limited has signed a $2 million strategic MoU with Chinese agri-firm Wang Chuang Xi Jun Chang to explore growth opportunities in Pakistan’s agriculture sector. The partnership, announced at the Pak–China Investment Conference, will focus on bringing advanced seed technologies, tech-enabled farm services, and scalable production systems to Pakistan. The collaboration aims to boost productivity, modernize the agrivalue chain, improve supply chain efficiency, and open doors for exports, while also giving local farmers access to international know-how and markets.

World Bank to lend $379m for power transmission overhaul

The World Bank has approved a $379 million loan to modernize Pakistan’s power transmission system, with co-financing from AIIB and IsDB bringing total project funding to nearly $699 million. The project will upgrade transmission infrastructure, including reactive power devices to stabilize the grid, and support institutional reforms to improve governance. By tackling bottlenecks in key transmission corridors, the initiative aims to make electricity delivery more reliable, allow greater use of renewable energy, and strengthen the overall energy sector over the next decade.

IMF third review talks likely in Feb

Pakistan is gearing up for the IMF’s third review next month, which could unlock the next $1 billion tranche under the ongoing loan programme. The government is preparing economic and fiscal data, while also pushing for targeted relief measures for the salaried class and industries. Officials are working on a structured plan to ease operational pressures on businesses and support recovery, aiming to convince the IMF to approve measures that balance relief with the programme’s requirements.

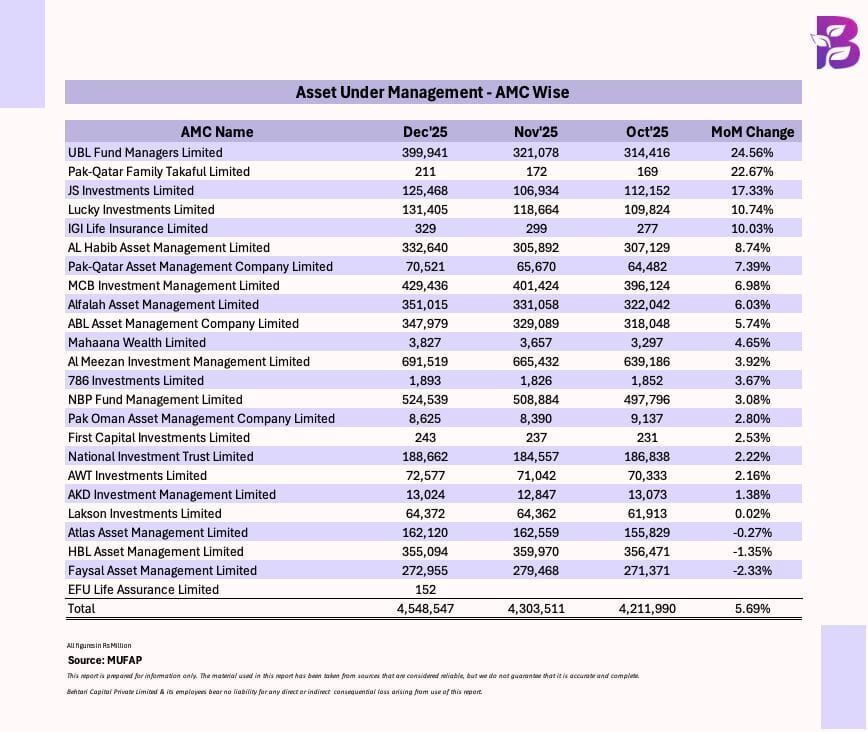

Pakistan’s Mutual Fund Industry Just Hit Rs. 4.5 Trillion AUM! 🇵🇰

While the “Big Three” – Al Meezan Investment Management Limited, NBP Fund Management Limited, and MCB Investment Management Limited – continue to anchor the market, December showed some incredible growth from other players:

🚀 UBL Fund Managers: +24.56%

🔥 Pak-Qatar Family Takaful Limited (PQFTL) : +22.67%

⚡ JS Investments: +17.33%

The numbers are rising, the market is evolving — and one question remains:

Where are you seeing the most value right now? Established giants or the fast-movers?

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan