- Pulse by Capital Stake

- Posts

- Stocks 📈 Economy 💰 Digital 💻

Stocks 📈 Economy 💰 Digital 💻

Another Week, Another Pulse!

Even as the holiday season began to set in, the news cycle showed no signs of slowing down. Activity may have felt lighter, but the headlines kept rolling in without pause. This past week was packed with developments, big decisions, fresh funding, and signs of movement across multiple sectors.

The biggest buzz was around Pakistan International Airlines (PIAA). Nearly every news screen was locked onto the bidding process, which finally wrapped up with the Arif Habib consortium emerging as the highest bidder with an offer of Rs135 billion.

Away from the headlines, banks played a quiet but important role in the economy. Lending to the private sector crossed Rs1.5 trillion during the current financial year (FY26), giving a boost to large-scale manufacturing. This jump was largely driven by reduced government borrowing, allowing businesses better access to credit.

On the external front, Pakistan and the Asian Development Bank signed two major agreements worth a combined $730 million. These include a power transmission strengthening project and a programme aimed at improving the performance of state-owned enterprises, both expected to ease pressure on the power sector and improve efficiency.

Support from abroad also showed up in the numbers. Foreign loans and grants rose by 14% to $3.032 billion during the first five months of the fiscal year, compared to $2.667 billion last year, with IMF-linked funding playing a key role.

Global markets added their own flavour to the week. Gold, silver, and platinum touched fresh record highs, driven by expectations of further interest rate cuts in the United States, low year-end trading volumes, and rising geopolitical tensions.

Back home, progress continued on the technology and development front. Pakistan moved another step closer to launching 5G services after the federal cabinet approved recommendations for a spectrum auction planned for February 2026.

The government also introduced a new agricultural credit scheme, Zarkhez-E, aimed at providing financing to the 93% of small farmers who have traditionally remained outside the formal banking system.

In the mining sector, Reko Diq Mining Company awarded major equipment contracts worth approximately €70 million to Finland-based Metso for its copper-gold project in Pakistan.

Ending the week on a positive note, Pakistan also began exporting halal meat to Tajikistan, opening another door for trade and regional connectivity.

Here’s a recap of the week’s key developments to help you plan ahead.

🎧 Listen now on your favorite platform:

Youtube - https://tinyurl.com/yc8t27b4

SoundCloud - https://tinyurl.com/2823jssa

Spotify- https://h7.cl/1lR0I

📅 Key Events This Week!

📌 31st December 2025

🎉 New Year’s Eve

📌 1st January 2026

🛒 CPI Inflation

⛽ Petrol Price

💱 Foreign Exchange Reserves

📌 2nd January 2026

🛒 Weekly SPI (Sensitive Price Index)

Note: These dates are tentative and subject to change. Credits: Pulse by Capital Stake

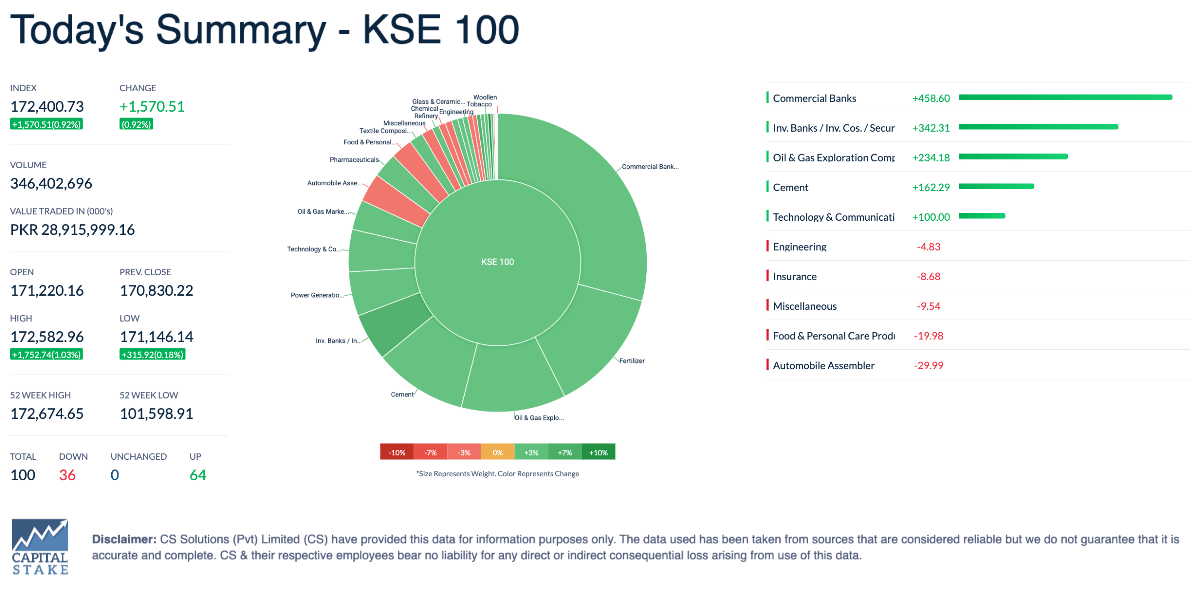

Pakistan’s equity market wrapped up the week ending December 26, 2025 on a positive note, with the KSE-100 index rising 0.58% week-on-week and continuing its record-setting momentum. Investor confidence was boosted by improving macro signals and the successful privatisation of PIA, which was sold to an AHCL-led consortium for Rs135 billion the country’s first major privatisation in almost 20 years and an important step under the IMF programme.

Blue-Ex Ltd Migrates from GEM Board to Main Board of PSX

Blue-Ex Limited (GEMBLUEX) has moved from the Growth Enterprise Market (GEM) Board to the Main Board of the Pakistan Stock Exchange, starting trading under the ticker “BLUEX” from December 29, 2025. This shift reflects the company’s growth and stronger financial position, allowing it to be part of the larger, more established Main Board and the PSX-KMI All Share Islamic Index as a Shariah-compliant company. Investors can now trade its shares in smaller lots of one share, with transactions settling two days after trading, opening at the GEM Board’s last closing price. This migration signals Blue-Ex’s readiness for greater visibility, liquidity, and participation in the broader market.

Crescent Star Insurance to Launch Digital and Virtual Assets Venture

Crescent Star Insurance (CSIL) is moving into the digital and virtual assets space by activating its subsidiary, Crescent Star Technologies, through a joint venture with SG Power Limited. Under the plan, SGPL would hold a 51% stake while CSIL retains 49%, pending regulatory approvals. The new venture will work on proposals to seek permission from the Pakistan Virtual Assets Regulatory Authority to operate in digital and virtual asset activities, signaling the company’s push to diversify into emerging technology-driven investments.

SECP Revises Share Issuance Rules to Protect Minority Shareholders

The SECP has revised share issuance rules to better protect minority shareholders, ensure fair dividends, limit extra voting rights, and maintain at least 75% of voting power for ordinary shares. The changes promote fair governance, prevent concentration of control, and align economic benefits with shareholder rights.

Govt Exits Wheat Procurement, Meets IMF Condition

The federal government will no longer procure wheat or set a support price, maintaining only emergency stocks capped at 6.2 million tons. A private company will handle purchases, financing, and storage for both federal and provincial governments, with the move expected to save Rs570 billion annually. Prices will now follow global market trends, in line with IMF requirements.

Textile Mills Association seeks temporary waiver of levy on Captive Power Plants

The All Pakistan Textile Mills Association has requested a temporary waiver on levies for gas-based captive power plants during December and January. Frequent power outages and voltage fluctuations in winter are disrupting operations, damaging machinery, and causing production losses, so the waiver would allow mills to rely on their own plants to maintain essential industrial activity.

IMF sees Public Sector Development Programme shrinking as defence outlay to rise

The IMF expects Pakistan’s Public Sector Development Programme to shrink while defence spending rises, with interest payments gradually stabilising and declining as a share of GDP through 2030. Interest payments, which rose to 7.8% of GDP in FY25, are projected to fall to 6.5% in the current year and continue dropping to 4.8% by FY30, reflecting lower policy rates, even as absolute debt servicing costs remain around Rs8–9 trillion in the coming years.

Thinking about investing in Alfalah Investments but not sure how to start? You don’t need to visit a branch or fill endless forms. In this short tutorial, we’ll show you step-by-step how to use the Behtari App to invest from the comfort of your home, making the process simple, fast, and hassle-free.

Download Behtari today and start investing in mutual funds!

Android: https://lnkd.in/dhAe2dEz

Get to Know More About Our Products

Behtari – Your all-in-one mutual funds investment App.

StockIntel – Your comprehensive PSX Trading and Analytics Platform.

Data Solutions – Unlock the power of data for smarter, more informed investing decisions.

Wealth Management – Smart wealth solutions for modern investors

Today’s Pulse by Capital Stake is brought to you by Hubab Irfan